The Canadian government has set up the National Student Loan Center (Centre) to ensure its students have access to all the information they need to apply for, and repay, their student loans. The center is conveniently housed in an online website that includes all of the tools, applications, and resources that Canadian students need to manage their loans.

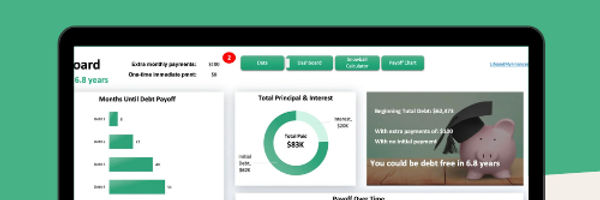

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

History of the National Student Loan Center

The goal of the Canada Student Loan Programs is similar to the goals of U.S. based programs; namely to ensure students that demonstrate the greatest financial need have access to a quality post-secondary education. The loan program was created back in 1964 as part of the Canada Student Loans Act.

From 1964 to 1995, independent financial institutions administered the loan process with guarantees of repayment granted to them from the Canadian Government. From 1995 until August 2000, the system was changed to one where there was a risk-sharing arrangement. Today, the Canadian government directly finances student loans, and administration of the program rests with the newly created National Student Loan Center (Centre).

This change introduced some complexities for students that received loans prior to August 2000. Loans established before this date need to be repaid to the original lending institution responsible for administering the loan, while student loans received after this date need to be repaid to the National Student Loan Center.

Student Loan Program

The Canada Student Loan Program (CSLP) provides Canadian students with access to money supplied by the federal government. Additional loans can also be obtained through the province in which a student resides. All government loans are interest-free; as long as the student remains enrolled in full time study.

Part time students will need to make interest payments on loans while still in school. Principal and interest payments are due once the student is no longer enrolled in school. Grants are used to supplement loans, but these are generally reserved for students with a permanent disability, or students from low income families.

Loans for Professional Students

Most of the charter banks of Canada offer programs geared towards professional students. These loans provide more funding than would be expected through a line of credit, as well as the potential to obtain lower interest rates.

Professional students obtaining loans from charter banks are also eligible for interest-free Canadian government loans. In fact, these private loans do not count against the student in terms of eligibility for government loans and / or grants.

The Loan Application Process

In Canada, there are local provincial or territorial offices that assist students in the loan application process. After completing an application, it takes from 4 to 6 weeks for the provincial office to process the document.

Grants and Loan Maximums

In general, Canadian students can expect to receive up to $210 per week for full time study or 60% of the assessed need, whichever amount is smaller. Loans provided by the local province will usually cover the remaining assessed student need.

Part time students are allowed to hold loans up to $10,000; however, they cannot carry more than $10,000 in total debt as long as they remain students. Finally, Canadian students may also be eligible for other grants such as the Canada Millennium Scholarship Foundation Bursary (CMS Grant).

As mentioned earlier, the repayment process starts after college enrollment ceases, and a Copy 22A form is used annually to confirm enrollment and maintain an interest-free loan.

Loan Repayment Calculator

The tools found at the National Student Loan Center website include repayment calculators, loan estimating tools, and links to outlets to make sure completed applications reach their destination.

The loan repayment calculator can help students figure out what their monthly payment obligations will be after graduation. The calculator accommodates fixed and variable rate loans as well as the number of monthly payments. This website offers additional student loan calculators.

The student loan estimator can be used by students to estimate their loan eligibility. Using a series of questions such as living arrangements, province of residence and study, the estimator walks the student through an "application" process. At the end of this questionnaire, the tool provides the student with an estimate of their financial need and eligibility.

College and University Search

A final tool worth mentioning involves an online college and university search. Students can use this tool to browse detailed information about Canadian universities and community colleges; helping them find an educational institution that suits their needs.