1. Set retirement goals as early as possible and have milestones to hit

Setting retirement goals is crucial: according to the Federal Reserve, retirees generally have high levels of financial well-being, especially those with diverse income sources beyond Social Security.

Here are some examples of retirement goals:

Save $25,000 for retirement by age 35.

Pay off your mortgage by age 50 and invest the rest of the money in retirement funds.

Have $100,000 in investments by age 60.

Planning for retirement is all about finding a balance between your current financial needs and your future aspirations, ensuring a comfortable and secure retirement.

Two key areas can help you with retirement planning:

1. Set clear and realistic goals: Define how you want your retirement to look like and estimate the funds you'll need. Take into account factors such as your desired retirement age, lifestyle, healthcare costs, and life expectancy. Use retirement calculators to estimate the amount you need to save and set yearly saving goals.

2. Start early and save consistently: The power of compounding interest means that money saved earlier grows significantly over time. Start saving for retirement as soon as possible, even if the amount seems small. Consistently contribute to your retirement account, such as a 401(k) or IRA, and over the years, it can grow into a substantial nest egg.

2. Regularly align your retirement goals to changing future needs

What you're planning today might not be the best choice for you a year or two down the road. Life can be unpredictable and circumstances change, so your retirement planning should be flexible enough to adapt.

Diversify your investments: Don't put all your eggs in one basket. Spreading out your investment portfolio can help manage risk and potentially increase returns in the long run. This could involve a mix of stocks, bonds, mutual funds, and other investment options, depending on your risk tolerance and time horizon.

Regularly review and adjust your plan: Life circumstances and economic conditions can change, so it's important to review your retirement plan on an annual basis. Make adjustments to your savings rate, investment choices, and retirement goals as needed. This also means keeping an eye on your asset allocation as you approach retirement, considering more conservative investments if necessary.

Maximize employer contributions and take advantage of tax benefits: If your employer offers a retirement plan with matching contributions, try to contribute enough to receive the full match – it's like getting free money. Also, make the most of the tax advantages associated with retirement accounts like 401(k)s and IRAs, which can include tax deductions or tax-free growth.

3. Keeping retirement savings on track through cost of living increases will be difficult – but you’re not alone

Retirement saving stats show that, among those who haven't retired yet, only a small number of people feel like their retirement savings are on track. And, in the last five years, even fewer are confident that their retirement planning is on track. This just goes to show the importance of effective planning and setting retirement goals based on your age.

Now, I know it's not the most exciting task, but making sure your retirement finances are keeping up with inflation will help you stay on track with your savings.

The key thing to remember is to look at the bigger picture and decide for yourself what being on track means.

4. Aiming for $100,000 will give you an above-average retirement savings pot

The data revealed that the typical American household had a retirement savings of around $87,000. However, this number can vary quite a bit depending on factors like age, education, and race. So, it's clear that there's no one-size-fits-all approach to retirement planning.

For example, households with a college degree had an average savings of about $141,700, while those with just a high school diploma had around $44,000.

In general, if you can save more than $100,000, your savings will grow even more with compound interest. This means you'd be in a pretty good position compared to other Americans when it comes to retirement.

Age group | Median retirement savings |

|---|---|

Younger than 35 | $18,880 |

35 to 44 | $45,000 |

45 to 54 | $115,000 |

55 to 64 | $185,000 |

65 to 74 | $200,000 |

Older than 74 | $130,000 |

Roth IRA or 401k? This template will answer your questions.

With this template, you will get:

All DFY, simply add your details

Charts for comparison and clear answer

Easily update for any year (2023, 2024, 2025, etc…)

5. Starting early is key to successful retirement savings

While it's pretty obvious that saving earlier will boost the value of your retirement fund, it's also worth noting that the rising cost of living, getting on the property ladder, and the general increase in financial pressure on people under 45 is making it difficult for them to save for retirement. This is also reflected in the average retirement savings across different age groups over the past 30 years.

Between 1989 and 2022, the under 35s saw a 104% increase in their retirement savings, while those between the ages of 35 and 44 saw a 95% increase.

When compared to other age groups, this indicates a significant slowdown in early retirement planning. Addressing this issue is crucial to avoid larger gaps in retirement income in the future.

One potential solution is to take advantage of employer benefits and tax breaks for retirement planning. While it may result in a lower bank balance in the short term, it should be viewed as a long-term bonus.

If your employer matches your pension contributions and you increase them, you'll essentially be getting a stealthy pay increase that goes directly into your retirement fund.

Of course, this won't solve all the problems and should be considered in light of personal circumstances, but it's a viable option for many.

6. Upping retirement savings instead of one night out a month can make a huge difference

It's concerning that more than a quarter of American households didn't have any savings in retirement accounts in 2022. But here's the thing: making just one small change every month can have a big impact on your retirement savings down the line. So, don't sweat it too much!

Age group | % with no retirement savings |

|---|---|

18-25 | 43% |

30-44 | 28% |

45 to 59 | 19% |

60+ | 12% |

This is all because of compound interest, which basically means earning interest on both the initial amount of money you put in and the interest you've already earned in previous periods.

Let's say you save $50 every month starting from the age of 25. Even without any interest added, that would still be an extra $24,000 by the time you retire.

But with a savings account that has an annual interest rate of 2.5%, thanks to compound interest, that $50 a month would grow to $40,900 by the time you reach 65.

And if the annual interest rate is 7%, that same $50 a month would turn into a whopping $140,000 with compound interest when you retire.

Explore Compound Interest

Results

| Initial Amount | $1,000 |

|---|---|

| Total Additional Contributions | $0 |

| Total Interest | $0 |

| Final Amount | $0 |

This harsh reality (and possible benefit) shows how important it is to set retirement goals that are actually attainable. Whether you start with small goals, diversify your sources of income, or consider how inflation will affect your retirement savings, each step is crucial for building a stable financial future.

7. Knowing what you need for average retirement income is crucial

The average retirement income in the United States can vary a lot depending on which state you're in, but on a nationwide average, it's around $25,545 per household. This number is really important when it comes to managing your income during retirement.

It's worth noting that the average monthly retirement income can differ based on a few different things, like whether you're single or part of a married couple.

If you're a single retiree, managing your retirement income often means being really careful with your budget so you can cover all your living expenses, healthcare costs, and other things you need. The average retirement income for a single person might be lower than for a whole household, so you may need to do some extra planning with your finances.

On the other hand, if you're married, you might have the advantage of combining your resources. The average retirement income for married couples could be higher, giving you more flexibility with your money. But of course, this also means you need to think about the long-term needs of both of you.

Estimate your retirement income

Regardless of your situation, it's always a good idea to use a retirement calculator to figure out how long your savings will last. This can help you plan for the future and make sure you're on track for a comfortable retirement.

Inputs

Result

| Monthly Income from Retirement Funds | $3,533 |

|---|---|

| Monthly Income from Pension / Social Security | $2,100 |

| Monthly Income in Retirement | $5,633 |

| Annual Income in Retirement | $67,592 |

Data Insight: Retirement income by state, top 5 ranked

State | Retirement income |

|---|---|

District of Columbia | $43,080 |

Alaska | $36,023 |

Maryland | $35,732 |

Virginia | $35,306 |

California | $34,737 |

Roth IRA or 401k? This template will answer your questions.

With this template, you will get:

All DFY, simply add your details

Charts for comparison and clear answer

Easily update for any year (2023, 2024, 2025, etc…)

8. Your job could impact the needs of your retirement pot

In the past three years, the average retirement age in the USA was around 65. This means that in 2020 it was 66, in 2021 it dropped to 64, and it went back up to 66 in 2022 (according to the latest figures).

But, did you know that life expectancy after retirement can actually vary depending on the kind of job you have? It means that you might have to plan your retirement savings differently based on your profession. Different jobs and roles have different average retirement ages.

For example, non-skilled general, technical, and transport jobs have a life expectancy that's up to 3.5 years shorter compared to academic professions. This difference is partly due to the physical toll these jobs take on the body.

The numbers also vary depending on whether you're a male or a female:

Data Insight: Life expectancy after retirement by profession

Sector | Men* | Women* |

|---|---|---|

Transport | 15 | 20 |

General | 15.5 | 20.5 |

Technical | 15.5 | 20.5 |

Administrative | 16 | 21.5 |

Care | 17 | 22 |

Agriculture | 17.5 | 23 |

Teaching | 18 | 23 |

*years life expectancy from age 65.

9. Investments and work are supplementing retirement income

A lot of retirees, about 79%, had some kind of private income, with 56% getting money from pensions and 42% benefiting from interest, dividends, or rental income.

Also, 32% of retirees had income from work, which shows that more retirees are working after retirement or have a spouse who is working. Social Security was still the main source of income for 78% of retirees, and it was even more common (92%) among those who were 65 or older.

10. Explore different investment opportunities

For folks who aren't retired yet, there are lots of ways to save and invest your money. The most common ones are things like 401(k)s or 403(b)s, which about 54% of non-retired adults have.

These are way more popular than traditional pension plans, which only about 27% of non-retirees have. Plus, about 47% of non-retirees have savings for retirement that aren't in official retirement accounts.

Some people are even getting into alternative investments, like investing in art. But just like with any investment, you need to think about your own goals and maybe have a higher net worth to start with, like $100,000.

11. How are retirement investment opportunities managed?

The focus on investment can take different forms – either self-managed or with an advisor.

Financial Advisor Managed: A financial advisor manages investments by giving personalized advice and handling transactions based on an individual's financial goals and risk tolerance. They offer expertise in diversifying portfolios, tax strategies, and long-term financial planning.

Self-Directed: In self-directed investments, individuals handle their investment decisions personally without external guidance. They research, buy, and sell assets using online platforms or brokerages. This approach requires a good understanding of the market and investment strategies but offers more control and potentially lower fees.

Robo-Advisor Managed: Robo-advisors use algorithms to manage investments based on the user's risk tolerance and goals. After an initial questionnaire, the robo-advisor automatically allocates assets in diversified portfolios, often using ETFs. This method offers a hands-off, low-cost investment strategy, suitable for those who prefer automated, data-driven decision-making. Generally, ETFs aren't as popular in 401k (or other pension plans) as they can limit the diversity of a portfolio.

Make sure to (honestly) consider your financial knowledge and experience, as well as the time you can dedicate to manage your retirement pot. Based on this, select the best way to deal with it.

12. Working in retirement isn’t always a benefit

In the US, about 30% of retirees still earn money from work, which suggests that more retirees are choosing to work after retiring or have a spouse who is still working.

While this may seem like a sensible choice, there are potential downsides to consider. We spoke with Dustin Rinaldi from rwmadvisor.com, who pointed out some of the possible issues:

If the retiree's employer offers a 401(k), it may be used to avoid Required Minimum Distributions. The retiree can execute an inverse rollover, strategically moving their Traditional IRA to the 401k.

Retirees receiving Social Security benefits before full retirement age that exceed the IRS limit may face an unexpected reduction in their Social Security benefits. Social Security benefits taken before full retirement age will be reduced $1 for each $2 above the current limit of $22,320.Dustin Rinaldi, rwmadvisor

13. Being financially confident can help

Taking the time to research financial products and retirement investment options can make a big difference in how people choose to manage their retirement planning. To feel more confident about your finances, we recommend keeping track of markets, using resources like this one, talking to experts, and staying informed about economic announcements and changes.

Generally, the more confident savers in the US are about their finances, the more likely they are to take control of their own finances. This means they have more influence and involvement in their retirement savings.

According to a survey conducted by the Federal Reserve, people's level of financial literacy is connected to how confident they feel about managing their investments.

For individuals who have self-managed retirement accounts, those who feel comfortable handling their investments tend to answer more financial literacy questions correctly, with an average score of 77%.

On the other hand, those who are less comfortable with investment management tend to score lower, with an average of 63% correct answers.

Interestingly, non-retirees who have self-directed retirement accounts generally perform better on financial literacy questions compared to non-retirees without such accounts and those who are already retired.

Presence of retirement savings and level of investing comfort | % Correct Score in Financial Literacy |

|---|---|

Has self-directed retirement savings | 68 |

Mostly or very comfortable investing | 77 |

Not or slightly comfortable investing | 63 |

No self-directed retirement savings | 37 |

14. Build an emergency fund ahead of retirement

While it's great to know how much income you want or need, as you approach retirement, you'll need to start thinking about your budget, managing emergency funds, and how an unstable economy can affect your finances.

Retirement savings and emergency funds have different purposes. Retirement savings are long-term investments, often in accounts like 401(k)s or IRAs, that aim to build wealth over many years to provide financial security during your retirement. These funds are typically not touched until retirement age and often come with tax advantages.

On the other hand, an emergency fund is a readily accessible cash reserve meant to cover unexpected short-term expenses, such as medical emergencies or sudden job loss. It is usually kept in a savings account and should hold enough to cover 3-6 months of living expenses, providing a safety net for immediate needs.

In 2024, only 44% of U.S. adults reported being able to cover an emergency expense of $1,000 or more using their savings, a slight increase from 43% in 2023. Despite improvements in the economy, a significant 35% would need to borrow money for such expenses, with 21% relying on credit cards and 10% borrowing from family or friends.

63% of Americans are saving less due to inflation, and 45% attribute this to rising interest rates. Alarmingly, 66% expressed concern about not having enough emergency savings to cover a month's worth of living expenses if they lost their primary source of income.

Additionally, 57% feel uneasy about their current level of emergency savings, and 22% have no emergency savings at all.

Roth IRA or 401k? This template will answer your questions.

With this template, you will get:

All DFY, simply add your details

Charts for comparison and clear answer

Easily update for any year (2023, 2024, 2025, etc…)

15. Payoff all debt ahead of retirement to improve quality of life after work

The cost of debt in retirement is becoming a bigger worry for lots of Americans.

Recent studies have shown that the amount of debt people have when they retire is going up. In 2016, the GAO found that the median debt for older households was $55,300, which is a big increase compared to $18,900 in 1989.

Percentage of people with debt in retirement

Year | % 55-64 (age) | % 65-74 (age) | %75+ (age) |

|---|---|---|---|

1989 | 70.8% | 49.7% | 21.0% |

1992 | 70.2% | 51.4% | 31.6% |

1995 | 73.7% | 53.4% | 28.4% |

1998 | 76.2% | 51.4% | 24.6% |

2001 | 75.6% | 56.8% | 29.2% |

2004 | 76.3% | 58.8% | 40.3% |

2007 | 81.8% | 65.5% | 31.4% |

2010 | 77.7% | 65.2% | 38.5% |

2013 | 78.7% | 66.4% | 41.4% |

2016 | 77.1% | 70.1% | 49.8% |

2019 | 77.3% | 70.0% | 51.4% |

2022 | 77.2% | 64.8% | 53.4% |

This increase in debt includes different types, like home, credit card, and student loan debt. The effects of this growing debt are complicated.

For retirees, dealing with and paying off debt becomes a crucial part of financial planning.

Having to pay off debt during retirement, such as credit card balances with high interest rates, can eat into retirement savings and affect the overall quality of life, resulting in a hidden reduction in your retirement income.

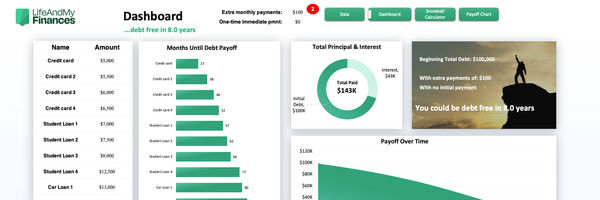

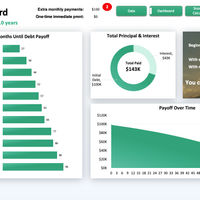

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!

16. Using a debt snowball ahead of retirement can have a huge impact

The debt snowball method is a cool strategy for paying off debt. You basically start by tackling the smallest debt while still making the minimum payments on the others.

Once you pay off the smallest debt, you move on to the next smallest, and so on, until you finally conquer the biggest debt.

What's great about this method is that it gives you a sense of accomplishment and keeps you motivated as you knock out each debt. Plus, when it comes to retirement planning, using the debt snowball method is super helpful. It helps you systematically reduce your debt, which means you'll have more money to save and invest for retirement. And that's a big boost to your financial security in your golden years.

Scenario: Emily's Debt Snowball Plan

Emily, who's 45 years old, is getting ready to retire and wants to get rid of her debts using the debt snowball method. Here's what she owes:

Credit Card A: $2,000 at 18% interest, Minimum Payment: $60

Credit Card B: $5,000 at 15% interest, Minimum Payment: $125

Car Loan: $9,000 at 5% interest, Minimum Payment: $170

Student Loan: $15,000 at 4% interest, Minimum Payment: $150

Emily's strategy:

She lists her debts in order of amount, not interest rate.

Credit Card A: $2,000

Credit Card B: $5,000

Car Loan: $9,000

Student Loan: $15,000

Minimum Payments on All but Smallest Debt: Emily pays the minimum on her car loan, Credit Card B, and student loan. She focuses an extra $100 per month on Credit Card A.

Pay Off Credit Card A: With determination, Emily pays off Credit Card A first.

Roll Over Payments to Next Debt: After Credit Card A is paid off, she adds the money she was paying to the minimum payment on Credit Card B.

Repeat the Process: She continues this process, rolling over payments to the next smallest debt until all debts are paid off.

At an extra $100 per month, Emily reduces total interest from $7,000 to $5,000 and pays off her debt in 5.8 years.

At an extra $200 per month, Emily reduces total interest from $7,000 to $4,000 and pays her debt in 4.8 years.

By the time Emily's ready to retire, she's paid off all her debts and can start putting more money into her retirement savings. This will really boost her financial stability for the future.

Explore the debt snowball method

Find out in more detail how to take control of your financial future! Charts and graphs will help you visualize your progress and keep you motivated!

17. HSAs could reduce the burden of healthcare costs in retirement

Planning for healthcare in retirement is super important because retirees typically face high healthcare costs.

According to Fidelity Investments' 2022 Retiree Healthcare Cost Estimate, the average 65-year-old couple can expect to spend around $315,000 on healthcare throughout retirement. That's a lot more than what most couples estimate, which is only around $41,000. This shows that there's a big gap in people's awareness of how much healthcare actually costs in retirement.

To plan for these expenses properly, it's a good idea to use a healthcare costs in retirement calculator. These tools can help you estimate your expenses, including those before and after you become eligible for Medicare, as well as any potential long-term care costs.

For example, before you're eligible for Medicare, options like COBRA or marketplace insurance can be super expensive. And once you turn 65, you'll have to take into account Medicare premiums, which vary based on your income, as well as any additional costs for Medicare supplement plans.

According to RBC Wealth Management, a healthy 65-year-old can expect to spend around $404,253 on healthcare throughout their lifetime, not including long-term care which can cost up to $100,000 per year.

Figuring out how much money to set aside for medical expenses in retirement is really important. If you don't plan properly, it can seriously impact your retirement savings. On the other hand, if you plan effectively and budget for healthcare costs, you can better manage these expenses.

Using savings tools like HSAs or Roth 401(k)s can be helpful too. HSAs, in particular, offer tax benefits and can help you accumulate a good amount of money for future healthcare needs.

18. Determine how social security benefits will impact your planning

Social Security payments in retirement are basically money you get from the government when you're old enough, usually starting at 62.

These payments are all about how much you've earned and when you want to start getting your benefits. They figure out how much you'll get by looking at your highest 35 years of earnings and using a special formula.

The age when you can start getting full benefits depends on when you were born. Most people can start getting them between 66 and 67 years old.

If you decide to retire early, your benefits will be smaller. But if you wait past the full retirement age, you'll get more money each month. Social Security is really important for lots of retirees because it adds to their savings and pensions.

Jane’s Social Security benefits and approach

Imagine Jane, born in 1960, reaching her retirement age of 67 as per Social Security Administration guidelines. Throughout her career, Jane consistently earned an above-average income. The Social Security Administration calculates her benefit amount based on her 35 highest-earning years, adjusted for inflation.

Retiring Early at 62: If Jane decides to retire at 62, she'll get her Social Security benefits earlier. However, this means her monthly benefit will be about 30% lower compared to waiting until her full retirement age of 67. This reduction is permanent.

Retiring at Full Retirement Age (67): If Jane waits until she's 67, she'll receive her full calculated benefit. This amount is considered her standard benefit based on her earnings record.

Delaying Retirement until 70: On the other hand, if Jane decides to delay her retirement beyond her full retirement age, her benefit will increase by 8% per year until she turns 70. There won't be any additional benefit increase after age 70, so this is the maximum benefit she can receive. By waiting until 70, Jane maximizes her monthly Social Security payment.

19. 401k and traditional plans will offer different benefits depending on your needs

According to the U.S. Bureau of Labor Statistics, as of March 2020, only 15% of private industry workers had access to a defined benefit plan, while 67% had access to a defined contribution plan.

Furthermore, for 2021, the IRS set the 401(k) contribution limit at $19,500, with an additional $6,500 catch-up contribution for individuals aged 50 and over.

The average annual return on a 401(k) is typically between 5-8%, based on market conditions. However, thanks to compound interest, this can result in a significant return on pensions.

Pension Plans (Defined Benefit Plans)

- Guaranteed Benefits: Offers a stable and predictable income in retirement. According to the Pension Rights Center, about 35% of private sector workers were covered by a pension plan in the early 1990s.

- Death Benefit: Can often be passed on to beneficiaries, providing financial security for loved ones.

- Strict Withdrawals and Transfers: Limited flexibility in accessing funds before retirement age.

- No Employee Control in Fund Management: Investment decisions are made by the employer or fund manager.

401(k) Plans (Defined Contribution Plans)

- Tax-Deferred Contributions: Contributions are made pre-tax, which can lower taxable income. As of 2021, the IRS reports that there are more than 600,000 401(k) plans in the U.S.

- Employee Control in Fund Management: Employees can choose their investment options.

- Employer Match: Many employers offer a match, which is essentially free money. A 2020 Vanguard study found that the average employer match is about 4.3%.

- Portability: The plan can be rolled over into a new employer's plan or an IRA.

- Investment and Management Risks: The employee bears the risk of investment performance.

- No Guaranteed Payout Amounts: Retirement income depends on the amount saved and investment performance.

Comparison and Suitability

Pension plans are actually better for people who want a guaranteed income when they retire and don't really want to be hands-on with managing their retirement money. But, they aren't as popular anymore. There's been a big drop in the number of private-sector pension plans in recent years.

On the other hand, 401(k) plans are great for folks who want to be in control of their investments and are fine with taking some risks in the market. They offer more flexibility and are widely available in today's job market.

Roth IRA or 401k? This template will answer your questions.

With this template, you will get:

All DFY, simply add your details

Charts for comparison and clear answer

Easily update for any year (2023, 2024, 2025, etc…)

Wrapping Up

Retirement planning is a multifaceted process that requires careful consideration and proactive steps towards financial security. By summarizing the core aspects, we highlight the crucial steps to ensure a stable and comfortable retirement:

Here’s a summary of the core aspects of retirement planning with crucial steps to take:

Set Clear Goals:

Key Takeaway: Define realistic retirement objectives, such as saving a certain amount by specific ages (e.g., $25,000 by age 35, $100,000 by age 60).

Setting these milestones as early as possible pays off – a lot: If you have saved $50 every month starting from the age of 25, you’d have $24,000 by the time you retire without any interest. With an annual interest rate of 2.5%, thanks to compound interest, it would grow to $40,900 by the time you are 65.

Create Additional Income Streams:

Key Takeaway: Don’t just rely on your work pension contributions and get into investing for your retirement. Diversify investments to manage risks and potentially increase returns. Consider a mix of stocks, bonds, and other assets.

79% of retirees benefit from private income sources, enhancing their financial stability.

Clear Any Debt:

Key Takeaway: Make use of strategies like the debt snowball method to eliminate debts efficiently (and as soon as possible), freeing up more resources for savings.

More than half of the retirees over the age of 75 (53.4%) were in debt in 2022 – by systematically eroding your debt, you could be one of the luckier ones.

Review Healthcare and Benefit Plans:

Key Takeaway: Anticipate rising healthcare costs and choose appropriate coverage to mitigate unexpected expenses.

For perspective, an average 65-year-old couple might spend around $315,000 on healthcare throughout retirement.

Choose Pension Plans Wisely:

Key Takeaway: Opt for pension plans that align with your retirement goals, considering the pros and cons of defined benefit and contribution plans.

Consider limits and average returns: 401(k) contribution limits are set at $19,500, qand has an annual return of between 5-8%.

By focusing on these pillars, you can navigate the complexities of retirement planning with confidence, ensuring your golden years are secure and fulfilling.

.jpg)

.jpg)

.jpg)