Mint is shutting down on January 1st 2024. Discover the best alternative budgeting apps.

Set the stage for a real showdown. It’s a YNAB vs. Mint comparison to find the best budget planner.

Both of these budget trackers have similar personal money management features, and a set of loyal users who swear by the tool.

Good for them. But you might be confused about which one to choose.

Don’t worry, though—we’ve got you covered.

This article will show you:

An in-depth comparison of YNAB and Mint.

The pros and cons of each app.

How to pick the better option for your needs.

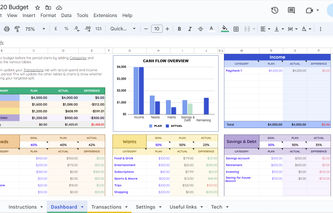

Check out our FREE budget templates:

What’s the Best Budgeting Software? YNAB vs. Mint At a Glance

We’ve done our homework by carefully researching these two tools.

But before we give you all the juicy details, let’s lay out a quick head-to-head comparison of these money trackers:

YNAB | MINT | |

|---|---|---|

How it works | YNAB helps you proactively manage your finances by encouraging you to allocate every dollar of your income to expenses or savings for that month. | Mint takes a simpler approach—it lets you keep an eye on all of your cash, credit, and investment accounts regularly. |

What you can do |

|

|

Reporting features | Reports on your spending, net worth, and income vs. expense ratio. | Reports on your spending, income, assets, debts, and net worth. |

Usability | Adding your accounts is simple, but getting used to YNAB’s budgeting philosophy and procedure requires some practice. | You can easily set it up by adding all of your budget and investment accounts. |

Compatibility | Compatible with iOS, Android, web browsers, Apple watches, and Alexa. | Compatible with iOS, Android, web browsers, Alexa, and Google Assistant (only for Android users). |

Pricing | Free trial period for 34 days, then $14.99/month or $98.99/year, with a money-back guarantee. | The app is free—it’s supported by ads and offers. |

Best for | Folks who want to try a hands-on approach to forward-thinking budgeting, including adopting a new method of “giving every dollar a job.” | Those who want to simply categorize their spending, create a single month’s budget, and see an overview of all of their financial accounts in one place. |

Customer service | Email and live chat support, a help center with articles and guides, video tutorials, and dedicated community forums. | Email and chat support, blog posts with financial tips, community forums, and a help center with FAQs. |

Customer reviews |

|

|

Main pros |

|

|

Main limitations |

|

|

And now for the rest of the details—

What is the YNAB Budgeting App?

YNAB or “You Need a Budget” is a personal budgeting software that was developed in 2004 by the husband-and-wife duo Julie and Jesse.

Regarded as the best personal finance app by millions of users, it follows a zero-based budgeting approach. Plus, it only lets you account for the money you already have, and not for what’s to come.

What does this look like in practice?

You link all your bank accounts to the YNAB app, let it pull out your financial information, and create budget categories. Next, you’ll assign a “job” or a budget type to every single dollar you have.

What about potential deal breakers?

YNAB has a complicated interface but its free educational resources can help you get a hang of it. Keep in mind that to track your cash, investments, mortgages, and other accounts, you’ll need to enter the transaction details manually.

Pros

- Can teach you a new way of thinking in advance about the money you’re saving and spending from your income.

- The hands-on approach may help you save more money than other systems can.

- Has a well-designed web interface.

- Enables you to budget for as many months in advance as you’d like.

- The interface is ad-free.

Cons

- Involves a bit of a learning curve and can be overwhelming when you’re first starting.

- You’ll need to establish a regular and disciplined interaction with the app to fully benefit from its philosophy.

- The app has no free version after the free trial, and can seem pricey.

What is the Mint Budgeting App?

Founded in 2007, and acquired by Intuit in 2009, the Mint budgeting app has over 20 million users.

Mint lets you track multiple savings and investment accounts on a single user-friendly platform.

Simply link your accounts to the app and it’ll automatically create budget categories and track transactions.

It’s like having a detailed snapshot of your financial health as and when you like.

The app also helps with bill notifications, usage alerts, free credit score checks—and shows you spending reports for each budget category over various periods.

Pros

- Very easy to set up and use.

- You can come back anytime and catch up on your financial situation.

- Connects with a large number of US and Canadian financial institutions.

- Free budget software.

Cons

- Can only set a budget for the current month.

- Might not prove effective in saving money in a bank or paying down debt.

- The web interface is less attractive and user-friendly.

- Web and mobile interface shows ads and offers.

YNAB vs. Mint: Which is the Best Budgeting App?

It’s time to weigh up these two contenders by digging deeper into—

How the apps work.

Reporting features.

Usability.

Device compatibility.

Pricing.

Who they’re best for.

Customer service and support.

Customer reviews.

How the apps work

YNAB | MINT |

|---|---|

YNAB helps you proactively manage your finances by encouraging you to allocate every dollar of your income to expenses or savings for that month. | Mint takes a simpler approach—it lets you keep an eye on all of your cash, credit, and investment accounts regularly. |

YNAB

YNAB claims its average user saves over $600 in two months, and over $6,000 in their first year.

Those are some staggering figures. The app attributes this success to its zero-based budgeting approach.

So, you tell YNAB how much of your money should go toward specific categories, such as costs, objectives, and savings, as soon as you get paid.

The idea is that you become more intentional with your money if you’re forced to actively figure out what to do with it.

This process is about as hands-on as you can get in terms of budgeting. This adds to the fact that YNAB has a relatively steep learning curve and can be very time-consuming.

But is the concept of zero-based budgeting worth all this effort?

Jack Prenter, founder and CEO of DollarWise, says, “Zero-based budgeting forces you to re-evaluate every single expense in your life. You’ll need to justify every dollar and have a good reason for why it’s being spent. In some ways, it’s very similar to the Marie Kondo method of ‘Does it bring you joy,’ but for your finances! Another key advantage is its capacity to combat budgetary inertia. Traditional budgeting methods involve making small adjustments to previous budgets, allowing you to continue wasting money. On the other hand, ZBB forces transparency and accountability, making it easier to pinpoint areas of waste.”

Mint

Arguably the most popular budgeting app, Mint is free to use, and tracks just about everything for you.

You can sync checking and savings accounts, credit cards, loans, investments, and bills to create personalized budget categories.

You can also choose to simply observe your spending habits or set limits for each budget category. (Mint will promptly notify you when you’re approaching your spending limit.)

Additionally, you can leverage Mint’s “Mintsights” feature to get customized insights into your financial trends over time. This feature can help pay down debt, save more cash, and track other financial goals.

Although the app lacks extensive educational resources, Mint does offer tons of FAQs on how to use the platform.

Reporting features

YNAB | MINT |

|---|---|

Reports on your spending, net worth, and income vs. expense ratio. | Reports on your spending, income, assets, debts, and net worth. |

YNAB

YNAB’s reporting features are designed to help you gain a deeper understanding of your financial situation and make informed decisions:

Generate spending reports to see how much you’ve spent in various categories over a specific period.

Access income vs. expense reports to keep excess spending in check. This report maps your income and expenses month by month along with the averages and totals for each category.

Track and calculate your net worth (the difference between your assets and liabilities) over a specific period.

Get accurate category balance reports and track different balances over time.

Get some much-needed motivation with customized debt payoff trackers (watch your progress towards paying off debt in real-time, including the total amount of debt you’ve paid and the remaining balance).

Splice and dice your finance data by dates using preset filters that show information that’s up to a year old.

Mint

Mint has similar reporting features to YNAB, with an addition of visual elements like graphs and charts:

Set up budgets for various spending categories and track your expenses against those limits.

Use visual graphs, and line and pie charts to understand where you can cut expenses.

Export the underlying data in CSV format for a more thorough analysis.

Access spending reports to know how much you’re spending across different categories like groceries, entertainment, and transportation.

Track your income over time and get a detailed breakdown of where your income is coming from.

View the change in your net worth over a specific period.

Closely monitor your credit score and get timely alerts when your score changes.

Usability

YNAB | MINT |

|---|---|

Adding your accounts is simple, but getting used to YNAB’s budgeting philosophy and procedure requires some practice. | You can easily set it up by adding all of your budget and investment accounts. |

YNAB

YNAB’s account setup is pretty straightforward, but learning the monthly budgeting process can be a task.

Instead of relying on your bank balance to figure out how much money you have left, YNAB encourages you to plan ahead of time by allocating each dollar of your income.

This shift in approach can take some getting used to, but that’s exactly the point—YNAB’s goal is to improve the way you think about money and establish spending plans.

It has plenty of informative videos and articles to help you along the way.

Mint

Using Mint is as easy as binging on a pizza. You link your accounts, the transactions populate, and you categorize them to analyze your spending and set budget limits.

As you use the app, you start building a set of “rules.” These rules will help Mint speed things up by automatically renaming and categorizing transactions it recognizes based on your past transactions.

Reviewing your budget, monitoring progress toward your savings objectives, or going over your reports are all intuitive tasks you can easily do on the app.

Mint’s desktop interface isn’t as straightforward, though. You’ll notice that the transaction register is small, especially when compared to the more user-friendly register on YNAB.

Device compatibility

YNAB | MINT |

|---|---|

Compatible with iOS, Android, web browsers, Apple watches, and Alexa. | Compatible with iOS, Android, web browsers, Alexa, and Google Assistant (only for Android users). |

YNAB

YNAB (You Need a Budget) works with a variety of devices:

Desktop: Both a web-based version and a downloadable desktop app that is compatible with Windows and Mac computers.

Mobile: Mobile apps for both iOS and Android devices. The app requires iOS 12 or later and Android 7.0 or later.

Tablet: An optimized tablet app for both iOS and Android devices.

Other devices: YNAB is also compatible with Apple watches and Alexa smart speakers.

Mint

You can use Mint on:

Desktop: A web-based version that can be accessed on any desktop or laptop with an internet connection.

Mobile: Mobile apps for both iOS and Android devices. The app requires iOS 12.0 or later and Android 8.0 or later.

Tablet: Mint also offers a money budget app for both iOS and Android devices, but they aren’t specifically optimized for tablet use.

Other devices: Mint is compatible with Alexa smart speakers but its Google Assistant integration only works for those who have the app installed on an Android phone.

Pricing

YNAB | MINT |

|---|---|

Free trial period for 34 days, then $14.99/month or $98.99/year, with a money-back guarantee. | The app is free—it’s supported by ads and offers. |

YNAB pricing

YNAB offers a 34-day free trial (rather than the more common 30-day trial) so that customers can access a month-end review.

If the trial convinces you to sign up for a premium subscription, it costs $14.99 a month or $98.99 per year.

Mint pricing

Mint, on the other hand, is a completely free budget software.

But as they say—if something is free, you’re most likely the product.

As a Mint member, you can expect a regular stream of email advertisements for various financial products such as credit cards, loans, and mortgages.

Mint also makes anonymized consumer data available to third parties, which can then use your information to target you with adverts that are relevant to your circumstances. (For instance, if you’re in debt, you may get debt consolidation offers.)

Who it’s best for

YNAB | MINT |

|---|---|

Folks who want to try a hands-on approach to forward-thinking budgeting, including adopting a new method of “giving every dollar a job.” | Those who want to simply categorize their spending, create a single month’s budget, and see an overview of all of their financial accounts in one place. |

YNAB

YNAB is designed for in-depth exploration. Budgeting isn’t just an option—it’s integral to the app’s design and philosophy.

This makes it a great option for anyone who wants to try something new and intentional.

Pick YNAB if you want to roll up your sleeves and get serious about goals like debt reduction or keeping more money in the bank.

Mint

Want to watch where your money goes, but prefer a less complex approach? Mint may be the right choice for you.

Unlike YNAB, Mint doesn’t need continuous and disciplined interaction. You can log in once in a while to check out the updated transactions on the app and get a feel for your financial situation.

You can choose to go deeper by creating budget categories for the upcoming month—but Mint is generally a more laid-back app that lets you skip this budgeting process.

Customer service and support

YNAB | MINT |

|---|---|

Email and live chat support, a help center with articles and guides, video tutorials, and dedicated community forums. | Email and chat support, blog posts with financial tips, community forums, and a help center with FAQs. |

YNAB

YNAB offers several customer support options:

Email support from the app and the website―you can expect to get responses within one to two business days.

Live chat support during regular business hours (Monday through Friday, 9 a.m. to 5 p.m. EST).

A help center with extensive articles, guides, and frequently asked questions to help you troubleshoot common issues.

Video tutorials on the website and YouTube channel to help you learn how to use the app effectively.

Community forums to help you connect with other YNAB users, ask questions, and share tips and advice.

Mint

Mint offers similar customer service options:

Email support directly from the app or the website―you can expect responses within 24-48 hours.

Chat support during regular business hours (Monday through Friday, 5 a.m. to 9 p.m. Pacific Time, and Saturday and Sunday, 5 a.m. to 5 p.m. Pacific Time).

A help center with detailed articles, guides, and frequently asked questions on how to leverage the app.

Mint resources for tips on budgeting, credit building, mortgage refinancing, financial planning, investing, and more.

Community forums to connect with other Mint users, ask questions, and share tips.

More on budgeting:

YNAB vs. Mint Review: What the Customers Think

YNAB | MINT |

|---|---|

|

|

Opinions are like noses—everyone’s got one.

Whether you’re “Team YNAB”, “Team Mint”, or still confused, user reviews can make or break your decision.

So buckle up and grab some popcorn, because we’ve gathered honest customer feedback for both of these tools—

YNAB vs. Mint Reddit reviews

We connected with seasoned YNAB and Mint users on Reddit to find out why they prefer one or the other.

A user who has dabbled with both budgeting tools says, “YNABing with my wife and getting a joint bank account made my life easier. It put our priorities in focus—paying down our debt, and learning what our actual means are, and how to live within them. We make decent money (an average of $5,500 per month) but we were wasteful and unorganized. YNAB helped us fix this situation.”

Another user who also recommends YNAB says, “I don’t think of YNAB as a ‘budgeting software’ (even though it is one). I think of it as determining where I’ll spend my money before I spend it. Everyone has had times where they think they’ve accounted for all their bills so they go on a shopping spree—only to later find out that the money was supposed to go to a phone bill. YNAB helps prevent these situations.”

Making a case for Mint, a user said, “It’s a free app, so you’re really not losing anything by using it. It’s also the best budgeting app I know of. I’ve been using it to track everything and refine my budget constantly for years.”

Another user echoes this sentiment, “Mint helps me check for fraud across multiple credit card accounts, and have a single view of my financial situation. I have four checking accounts, over 15 lines of credit, and two investment accounts—so you can imagine how useful it is for me to have a single view into all of it.”

YNAB vs. Mint: Which One Is the Best Budgeting Software?

Comparing YNAB vs. Mint is like sizing up an avocado toast and a classic PB&J sandwich.

YNAB (You Need A Budget) is like the trendy avocado toast.

It’s all about being mindful of your expenses and giving every dollar a job. The app is great if you want to take a hands-on attitude to your budget and enjoy tracking every penny.

On the other hand, Mint is like the classic but reliable PB&J.

It’s been around for a while, and it just works. It’s perfect for those who prefer a set-it-and-forget-it approach to their budget. And it’s one of the best apps to track spending without obsessing over every transaction.

So, which one do you think will be a good budget app for your personal preferences and budgeting style?

FAQ

We’re answering the most commonly asked questions on budgeting and money management tools.

.jpg)

.jpg)