The loud budgeting trend went viral recently on TikTok, and after several years of rising costs and high inflation rates, thousands of social media users are flocking to the trend to embrace the concept of being vocal about your budgeting goals.

Here, our team has compiled a list of some of the best and most effective tips to really excel and crush your personal finance goals when committing to loud budgeting.

What Is Loud Budgeting?

Loud budgeting is more than a financial strategy; it's a declaration of your money priorities, making them known to your circle.

It's about embracing the power of choice over compulsion when it comes to spending. As TikToker Lukas Battle puts it, “it’s not ‘I don’t have enough’, it’s ‘I don’t want to spend”.

This approach not only fosters a sense of pride around financial discipline but also cultivates a supportive community around your financial goals. Here's how you can incorporate loud budgeting into your life, ensuring you navigate your financial journey with confidence and support from those around you.

1. Have A Clear, Targeted Budget Plan

Embarking on your loud budgeting journey should begin with establishing a clearly laid-out budget plan. This blueprint should outline your income, expenses, savings goals, and debt repayment strategies.

More than that, though, it should be a plan that you tailor specifically to you and your loud budgeting goals. Those could be building an emergency fund, paying off debt, or saving for a large purchase (we’ll cover all of these in the next sections).

By having a granular view of your financial landscape and a clear timeline of when you want to hit certain goals, you can make informed decisions about what expenses are necessary and which ones you can do without. Share this plan with your support network, whether that’s friends, family, or even posting on social media!

Remember, a budget isn't just a set of numbers; it's a reflection of your values and priorities, guiding you toward your financial aspirations with clear steps to break your goals down into tangible tasks.

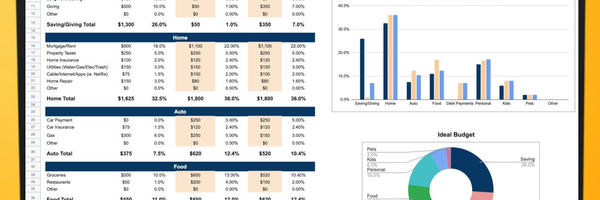

Start Your Budget Today!

Keep your finances on track with our monthly budget template. It will even show you the ideal budget for your salary! Keep track of all your spending categories and see where you can save.

2. Be Honest With Your Friends

Loud budgeting thrives on a policy of openness and honesty. By discussing your financial goals and challenges with friends and family, you’ll not only gain allies in your journey, but you will also help to normalize conversations about money.

This transparency can lead to shared experiences, advice, and encouragement, making the path to financial well-being a collective journey.

As another benefit, when your circle understands your financial mindset, they're more likely to support your choices, reducing the pressure to conform to spending norms that don't align with your goals.

3. Say “No” To Social Media Trends

In an era where social media often dictates trends and lifestyles, loud budgeting serves as a counter-movement. Ironically, loud budgeting is a trend in itself - but not all trends are inherently a negative thing!

Loud budgeting encourages you to critically assess the influence of social media on your spending habits. By consciously deciding to opt out of the latest must-haves, you assert control over your financial destiny.

The “de-influencing trend” has helped a lot with this movement, too. But loud budgeting enables you to look at countless influencers touting homeware, shoes, bags, or a myriad of other hot new commodities and simply say, “no thanks”.

4. Prioritize Your Emergency Fund

Creating and maintaining an emergency fund is a cornerstone of financial security and should be your first focus (unless you have more pressing debts to pay off first). Your fund acts as a buffer against unexpected expenses and is there for exactly that: emergencies.

It’s a safety net if you’re made redundant, have a large emergency purchase, or encounter a life situation where you know that you can rely on your fund to support you.

Aim for 3-6 months' salary in your fund before you move into other savings areas, such as investing. Ideally, you’ll open your emergency fund in a high-yield savings account that will give you a higher return on your savings, too. If you tap into your emergency fund, focus on replenishing it immediately.

5. Pay Off Your Debt

Loud budgeting extends to actively reducing and eliminating any debt that you may have accumulated. Being open about your debt repayment journey creates a sense of accountability for your goals and can provide you with added motivation through the support of your wider community.

Moving away from the concept that debt is shameful can be wildly liberating. There is something incredibly freeing and powerful about being able to say “here is my situation. Here is what I’m doing about it” - and more importantly, sticking to that statement.

Celebrating each victory, no matter how small, reinforces the positive impact of your choices, so shout those achievements loud and proud!

Become Debt-Free with the Debt Snowball Spreadsheet!

The Debt Snowball method helps you pay off debts faster and cheaper. See how it works and track your progress with our debt snowball spreadsheet for Excel and Google Sheets!

6. Take Part in the "Eating In" Challenge

Embrace the "Eating In" Challenge is a cornerstone of loud budgeting. By choosing to prepare meals at home rather than dining out, you can save money, eat healthier, and gain some extra cooking skills.

Many loud budgeters opt to meal prep their food to cut down on food waste and minimize the ingredients they use, too. You could go a step further by documenting this challenge on social media to inspire others to join in, creating a community of like-minded individuals focused on saving money through more thoughtful food choices.

Related: Top 10 Hacks for Healthy Eating on a Budget

7. Find Accountability

Building a network of accountability is crucial in loud budgeting. Whether it's through social media, a group of friends, your partner, or with a financial advisor, having people to share your progress with can significantly enhance your commitment to your financial goals.

Regular check-ins, sharing successes and setbacks, and seeking advice create a dynamic support system. This community not only keeps you on track but can also provide diverse perspectives and strategies that may uncover tips and elements of your budgeting goals you hadn’t yet considered.

8. Adjust Instead Of Missing Out

It's essential to find a balance between saving money and enjoying life. Instead of completely foregoing social activities, look for cost-effective alternatives. If going out is a significant part of your social life, find ways to participate without overspending. For example, you could decide to attend events but skip the expensive drinks.

Discuss these strategies with your friends; they may also appreciate saving money while still enjoying your company. You could all begin to host evenings in, instead of heading out, for example! This approach ensures you maintain your social connections and mental well-being while staying true to your financial goals.

What’s more, being open about these changes may have the positive knock-on effect of influencing your social circle to make some changes to their budget, too.

9. Find More Budget-Friendly Vacations

Travel doesn't have to be a luxury. Explore "destination dupes" - as they’re being referred to on TikTok - or more affordable travel alternatives that provide similar experiences to high-cost locations.

This article from NYT shares some frugal destinations around the US for budget travelers to consider.

10. Take Pride In The Hustle

Loud budgeting isn't just about saving; it's about growing your income too. Whether it's a side hustle, a new business venture, or upskilling for a better-paying job, be vocal about your efforts to increase your income.

Sharing your journey can inspire others to explore their own entrepreneurial or career advancement opportunities. Embrace the process, celebrate the small wins, and be transparent about the challenges.

Loud budgeting embraces the principle of being vocal about your goals - and if you want to increase your income with a side hustle or new entrepreneurial venture, embrace it.

Related: 40+ of the Best Side Hustle Ideas to Inspire You

11. Stand Your Ground

Being vocal about your budgeting can sometimes lead to a degree of criticism or misunderstanding from others around you. While loud budgeting is, of course, about being loud about your personal finance goals - it also means that you’ll need to justify your actions more than if you kept your cards close to your chest.

It's important to stay committed to your financial goals and the reasons behind them. That’s why having that clear, targeted plan that you truly believe in and know you can stick to is so vital.

.jpg)

.jpg)