In November 2023, Intuit Inc. announced that they will be shutting down Mint, a popular budgeting app, on January 1, 2024. If you are a long-time user of Mint, this news might come as a shock, and you might be wondering what to do next.

Mint, which started in 2009, has gained loyal users because it offers many helpful tools. These tools include spending reviews, tracking net worth, and personalised budgeting categories.

Intuit plans to merge Mint with Credit Karma, another app owned by the company. Unfortunately, the combined app will no longer have features such as monthly budgets and custom categories.

No need to worry. You have enough time to gather your financial information and find a different budgeting tool.

Before you start looking for a Mint replacement, remember to save any important data from the app. Save your transaction data as an Excel file and capture screenshots of important charts or insights. If you don't know how to do it, you can follow this process.

Summary

How to Find the Right Alternative to Mint

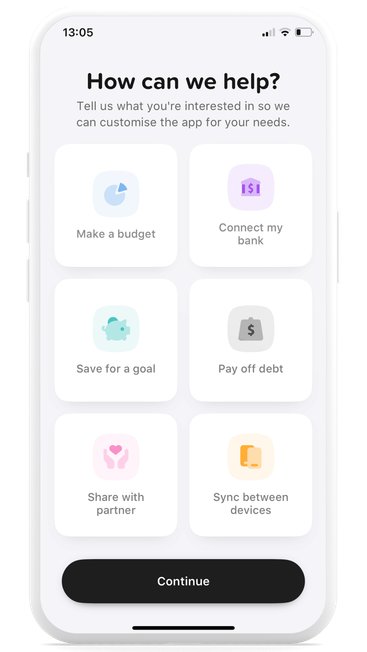

The best way to pick your next budgeting app is to make a list of the Mint features that were most valuable to you.

Use this list to assess potential replacement apps based on their offerings. You can find lots of different budget apps. Some of them offer a free trial before you have to pay.

Some apps, like YNAB (You Need a Budget), allow new users to import data files manually from their banks or other personal finance apps. This way, you don't have to start from scratch when migrating from a new service like Mint. Search for apps that can sync with your financial accounts and pull several years of transaction history.

Also, pay attention to reviews on app stores when selecting a new budgeting app. These can give you helpful information about how easy it is to use the apps, what they can do, and how good their customer service is.

Follow these steps, and you will find a suitable replacement for Mint in time for its closure.

Similar articles:

Top Alternatives to Mint

When you look for options other than Mint, you will discover many apps for budgeting and personal finance that meet your different needs.

Mint is a popular app that helps people track expenses, set budgets, and monitor investments. But everyone has different financial goals, so it's important to explore other options that suit your needs.

In the next sections, we will look at different options you can use instead of Mint. Each one has its own advantages and can help you with your money.

We have done thorough research on the top choices, so you can feel sure when deciding. In the end, you choose the app that fits your goals and preferences. This will make it easier to manage your money and have a smooth experience.

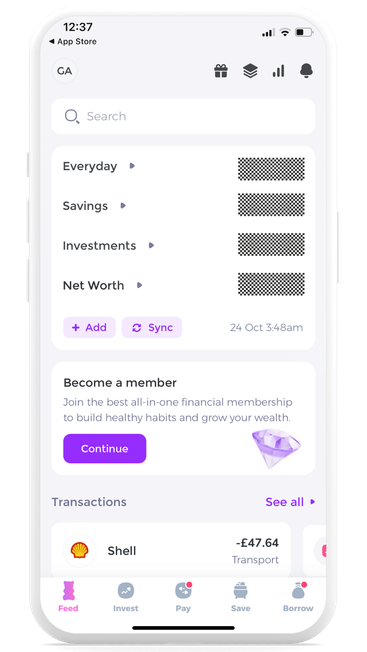

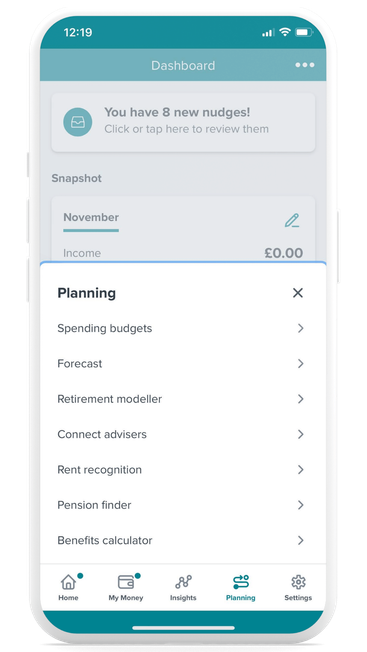

Emma

Emma is a money management app designed to help you seamlessly track, invest, send, and save money. The app started in 2018 and uses open banking technology. It combines information from your bank accounts, savings accounts, credit cards, and investments.

Emma aims to make overseeing your personal finances easier and more efficient with its many features.

Connecting all of your financial accounts to Emma is simple. You can easily see your account info and track spending by linking your bank or credit card in the app.

Emma supports most major banks, including app-only banks like Revolut, Starling Bank, and Monzo. If you want, you can link various investment and crypto accounts to the app.

Emma considers your payday and lets you set a monthly budget based on your spending habits. The app then provides notifications to keep you updated on whether you are above or below your budget. In addition, Emma arranges your spending into basic groups and displays spending analytics to show you a detailed breakdown of your expenses.

One useful feature of Emma is its ability to track subscriptions. The app helps you find duplicate or unnecessary subscriptions that waste money. Using its network of partners, Emma also suggests ways to save money on your bills, such as cutting costs on insurance, credit cards, or broadband.

With the introduction of Emma Invest, you can use this service to invest with as little as £1. The app offers a free investment account to all users but requires additional fees for investment activities.

Emma users can open an 'Easy Access Pot' to earn up to 4.34% AER on their savings. The money in this account is protected by the FSCS (Financial Services Compensation Scheme). If you decide to do so, don't forget to check out our guide on how to trade penny stocks and this list of cheap stocks to buy now to find some interesting suggestions.

You can download and use the Emma app for free. But if you upgrade to Emma Plus, Emma Pro, or Emma Ultimate, you'll get access to many other useful features.

The subscription plans cost £4.99, £9.99, or £14.99 per month and offer a 7-day free trial. These plans have advanced features like cashback, rent reporting to boost credit score, faster bank updates, and premium in-app support.

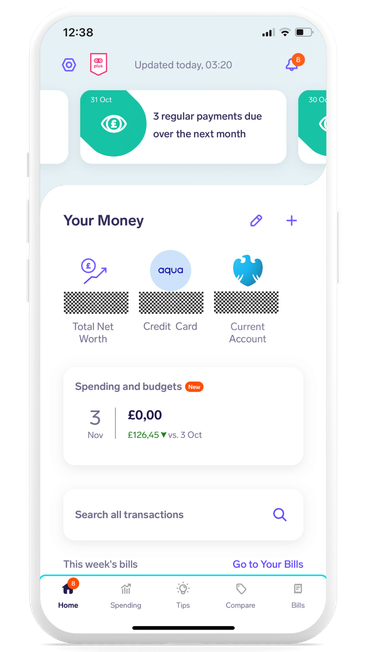

Snoop

Snoop is a money-saving app designed to help you manage your finances effectively. Founded in 2019 by former Virgin CEO Jane-Anne Gadhia and ex-Managing Director John Natalizia, it was launched in April 2020.

Snoop links to your bank accounts and credit cards through open banking. It studies your spending habits and offers money-saving tips. When you put all your accounts together, it's easy to see how much you spend on different cards. Snoop is available for both iOS and Android users.

Snoop offers a free version as well as a subscription-based version, Snoop Plus, which costs £4.99 per month or £31.99 a year. Snoop Plus offers more features like unlimited custom spending categories and tracking your net worth. You can also create unlimited custom spending reports.

Setting up a Snoop account is simple. To get started, download the free app from the Apple or Google Play store. Then, enter your name and mobile number. Once you confirm who you are, you will enter your email, create a secure pin, and connect your bank accounts using open banking.

One of the key features of Snoop is its personalised experience. The app continuously updates and uses Artificial Intelligence (AI) to learn from each user's actions. Some of its most notable features include:

Viewing all your accounts in one place

Tracking your bills and getting reminders to switch and save money

Creating budgets for monthly spending and category budgets

Receiving a list of the best deals to save money

Saving on household bills with tips within the app

Monitoring bill payments and notifying about price hikes or better deals

Seeing a summary of paid and upcoming bills for the month

Weekly and monthly spending summaries

Spending categorisation and daily balance alerts

Snoop currently supports most of the best high street banks in the UK, such as Barclays, First Direct, Halifax and NatWest. It also connects to app-only banks like Monzo, Revolut, and Starling Bank.

Snoop prioritises safety by using open banking to connect to your accounts. This means it can access your spending data without needing your login information. The app is not able to move money for you. It is registered and regulated by the FCA.

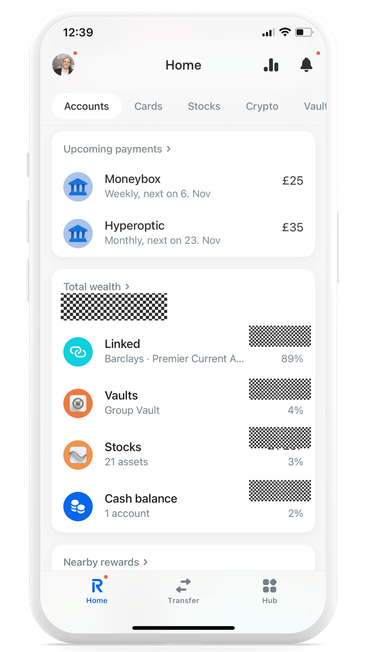

Revolut

Revolut is a popular digital banking app that offers a wide range of financial services to help you manage your money effectively.

Revolut allows you to open a multi-currency account, which is great for frequent travellers or people who work with different currencies. You can also benefit from free ATM withdrawals, currency exchange, and budgeting features.

Revolut's crypto trading capabilities are a standout feature, as the app makes it easy to buy, sell, and hold digital currencies. Revolut also gives you real-time money exchange rates, so you can keep track of currency value changes.

When it comes to budgeting, Revolut helps you set spending limits and track your expenses by category. You can use this to understand your spending habits and find ways to save money.

Using the app’s Vault, you can also create separate pots to help you give your savings a boost. When you use your Revolut card, the 'spare change round-ups feature' rounds up your purchases to the nearest whole number. The extra money is saved in your chosen Vault.

Because Revolut is primarily an online bank, it has fewer budgeting features than most other options on this list. However, if you're looking for one of the best banks for traveling abroad or you are seeking a way to earn more money each month and need a service to manage your finances, we recommend it.

For more information about Revolut and how it can help you save, read our detailed analysis on the Revolut app review.

Buddy

Buddy is an easy-to-use app. It helps you create a simple budget and track expenses with your loved ones. This app helps you save money by preventing overspending and meeting your financial needs.

In 2017, CEO Olle Lind launched Buddy to make budgeting easier. Buddy gives you a clear view of your expenses, income, bills, savings goals, and debt.

You can use the app to see your financial situation with clear and helpful charts and graphs.

Buddy's key features are distributed in three different sections:

Budgeting - this helps you organise your money by dividing it into categories like housing, food, and transportation. You can add custom categories and even select emojis to represent each category.

Transactions - Here, you can track your expenses in real time, by entering each purchase or expense as soon as you make it. This way, you can check your budget and make necessary adjustments.

Tools - In this section, you can find tools to help you with budgeting. You can manage different types of accounts, like checking, savings, credit cards, and cash. You can input the balances of each account, and the app calculates your net worth. You can also set reminders, export data, and use the recurring expense feature.

The main downside of the Buddy budgeting app is that the free version is limited and you will need to pay £43.99/year to access features like connecting your bank accounts and insights.

MoneyHub

MoneyHub is an app that helps you manage your money by organising all your financial accounts in one place. Moneyhub Enterprise created this financial management solution in 2013 for individuals and financial professionals.

One of the main features of MoneyHub is the ability to see all your financial accounts in a single location. The app looks at how you spend money, organises your expenses, and compares them to past months.

This spending overview can help you gain better control over your finances and budgets.

MoneyHub has a tool called the 'emergency cash builder'. It helps you save money in a dedicated account for emergencies. You can choose your own spending categories, split transactions, and receive reminders and tips.

MoneyHub also provides a unique feature that allows you to connect with a financial adviser directly within the app. The app also helps you forecast future expenses and see how they'll affect your finances.

Like the other apps on this list, MoneyHub uses open banking technology to connect with your financial accounts securely. Upon signing up, you receive an initial six-month free trial. After the trial period, the monthly subscription fee is £1.49 or £14.99 per year, depending on which option you choose.

YNAB - You Need a Budget

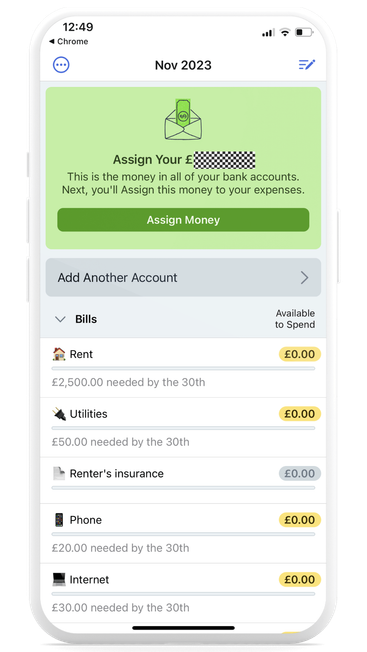

YNAB, short for You Need a Budget, is a money management app that uses the zero-based budgeting system and the envelope method.

YNAB, established in 2004, has four important rules: assign each pound a purpose, accept your actual expenses, adapt to changes, and save money over time. According to the app, users who follow these principles can save £600 in two months and £6,000 in a year.

Start using YNAB by making an account. Set your budget with different expenses and savings goals. The app uses a zero-based budgeting strategy, which requires allocating your entire income across different expense categories.

Through this approach, you gain a clear understanding of your expenses. YNAB offers a budget planning workbook that you can use on your own. It helps make the process easier. It also has an auto-assign feature that helps with categorization.

To effectively use YNAB's proactive budgeting, you need to actively set goals, add expenses, and adjust your budget. You can use default budget categories or make your own based on your needs. You can connect your bank account to YNAB for automatic transaction importing. You can also manually enter transactions if you prefer.

As a paid app, YNAB offers two pricing options: £14.99 per month or £99 per year. To test it, you can sign up for a 34-day free trial without providing credit card information.

YNAB can help you track financial accounts, but this feature isn't as streamlined as in other budgeting apps. If you care about keeping track of your investments, try using a budgeting app made for that.

YNAB takes longer to learn than other budgeting apps, but it offers plenty of resources for support. When you have an account, you can access live workshops, articles, guides, and an online forum.

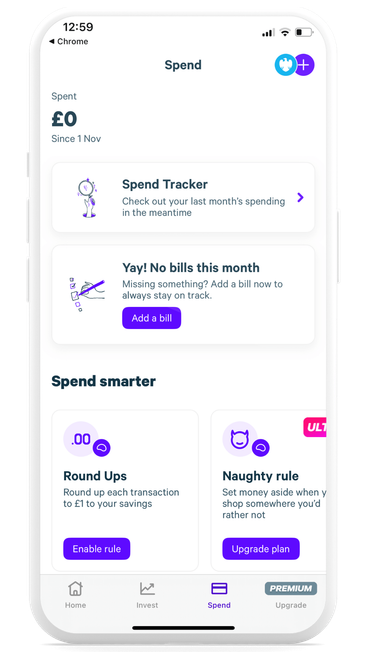

Plum

Plum is a UK-based app but is available in 9 EU countries too: France, Spain, Ireland, Italy, the Netherlands, Belgium, Cyprus and Greece. The app helps you manage your money and budget effectively.

With this Mint alternative, you can connect your bank and credit card accounts to oversee your finances in one place. Plum offers tools like spending categories, bill reminders, automated deposits, and competitive savings pockets. They also have an investing platform.

This app uses artificial intelligence to study your spending habits. Rather than suggesting how much money to set aside, Plum actually does it for you automatically, finding the perfect amount to stash based on your income and outgoings.

The app organises your spending, tells you about upcoming bills, and gives insights on cheaper utility providers. It also offers interest savings up to 4.21% AER.

Plum offers four subscription plans: 'Basic', 'Pro', 'Ultra', and 'Premium'. The Basic plan is free, while the Pro plan starts at £2.99 per month, Ultra at £4.99 per month, and Premium at £9.99 per month.

Each level gives you more benefits, higher interest rates for saving, and better investment options.

Why Use Budgeting Tools

Budgeting tools are essential for managing your finances effectively. They provide a clear picture of your income, expenses, and overall financial health. With a good budgeting app, you can set financial goals, track your spending, and create a plan to save for your future.

When you use a budgeting tool, you can make informed decisions about your personal finance. You can categorise your expenses to find areas where you spend too much and reduce costs. You can use this to reach your financial goals, like paying off debt or saving for a home.

As we have seen, there are several Mint app alternatives available, each with its unique features and capabilities. You can choose Emma, which has tools for budgeting, cash flow, and investment tracking. Or Buddy, a paid app that uses AI to give helpful advice on improving your finances.

Budgeting tools can also help you stay disciplined and motivated in your financial journey. You can develop good money habits by reviewing your progress and making changes. These habits will help you for a long time. Some apps give personalised spending insights and saving tips. This can help you stay on track more easily.

Free vs Premium Mint Alternatives

When looking for the best Mint app alternatives, you should consider the pricing models and the features offered by each option.

Free trials are an invaluable aspect when selecting a personal finance app. You can try the app's features, test its interface, and make sure it meets your needs before buying.

While some apps are free to use, others may offer a limited-time free trial before requiring a subscription. Either way, it's important to take advantage of these trials to make an informed decision. Remember that an app that works for someone else might not be the best fit for your unique financial situation.

Understanding Premium Services

Some personal finance apps provide a basic version with limited features for free, with additional premium services available for a fee. Premium services usually have extra features like better budgeting tools, investment tracking, and personalised advice.

When evaluating a premium version of an app, pay close attention to the costs involved. Monthly subscriptions can range from £4 to £14.99, depending on the app and the features it offers.

Ultimately, whether you choose a free app or a paid premium app will depend on what you like and need. Before deciding, think about whether the extra features are worth the price.

When looking for an app, keep your financial goals and budget in mind. Consider the costs of different pricing models and premium services. This will help ensure that you make the most of your chosen personal finance app.

.jpg)

.jpg)