InvestEngine is a user-friendly, ETF-only buying and selling platform that is easily accessible and intuitive to navigate and use. The platform is only available in its home country of the UK, but its ETF offering is quite vast. Its biggest strength, however, is that it is free to use, with no fees, except for those who decide to use its Manage service and have experts manage their portfolio.

Who is it best for?

InvestEngine is an excellent platform for anyone interested in exchange-traded funds (ETFs), whether individuals or businesses, experts or first-time traders. It can be used by casual traders and those who approach trading more seriously.

This is not a full-trading platform, so it doesn't offer all the services of one. However, it does have multiple account types, with more expected to come in the future. It also offers automated trading, which is excellent for traders who cannot afford to spend all their time in front of their computers, monitoring the market and making manual moves. This feature will also be helpful to businesses with surplus funds, one of the groups the platform targets.

The platform does lack in several areas, such as customer service, which is only available via the ticket system. However, those who used it have reported positive experiences with the support team quickly and efficiently resolving their problems. Generally speaking, InvestEngine seems to focus intensely on the community, and it has received overwhelmingly positive reviews from its users.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 7.5 | Visitinvestengine.com |

- Very user-friendly

- Completely free to use, apart from managed portfolios

- Regulated by the FCA

- Over 590 available ETFs

- No live chat or phone service

- Only offers ETFs

- It only makes money by charging a 0.25% fee on managed portfolios, which might not be sustainable in the long term

Introducing InvestEngine

InvestEngine is an ETF trading platform headquartered in London, UK. The firm emerged in 2019, established by Simon Crookall and Andrey Dobrynin. At launch, its focus was on offering portfolio management services for individual investors.

However, since then, the platform has added a DIY investment option, allowing users to manage their investing and effectively trade for free manually. Apart from that, it now also offers business accounts, which brought numerous new clients and contributed to expanding the impression of a well-balanced ETF investment firm.

InvestEngine is strictly focused on providing access to Exchange-Traded Funds, offering very cost-effective and accessible investment solutions to its users. Its founders sought to democratise investing by using modern technologies to make it possible, easy, and affordable for anyone to invest in as many ETFs as possible, which can be seen from how the platform's features are organised.

For example, InvestEngine lets users invest as little as £1 into any ETF, which is made possible thanks to fractional investing. Furthermore, thanks to its DIY approach, you do not have to pay anything for portfolio management. Of course, that means that investors need to have experience to achieve the best user experience.

Investment Products

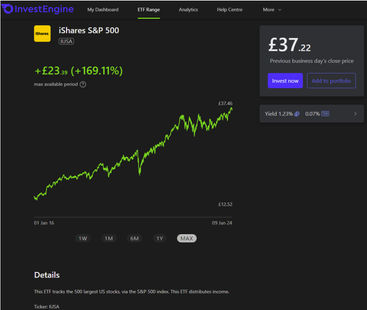

While InvestEngine is an excellent platform for accessing a rich selection of ETFs, it offers little other than that. The platform's offering is over 590 ETFs as of January 2024. While it lacks crucial instruments that are included by many of its competitors, it should be acknowledged that it acts as an excellent entry point for new investors.

Not only because of its ease of use but because it does not require significant capital. Apart from that, the types of accounts it offers are one of its considerable strengths, as will be explained shortly.

- Over 590 ETFs are available, including most major providers

- Both DIY and managed portfolios available

- Low or no-cost tax-advantaged accounts

- You can only invest in ETFs, not individual stocks

- No Junior or Lifetime ISA

- Only the London Stock Exchange is accessible

Assets Available

As far as available assets are concerned, InvestEngine only offers exchange-traded funds or ETFs. With that being the case, it is at a disadvantage compared to most of its competitors, such as FreeTrade (stocks, ETFs, and investment trusts), Vanguard (mutual funds, IRAs, ETFs, 401(k)s, and more), and others.

InvestEngine only features ETFs, but it has over 590 of them on offer, which allows it to offer instant diversification, easy access, and low cost. The platform believes that ETFs are an excellent choice for investors to build their portfolios and that InvestEngine can help its users make the most of the available ETFs.

The platform also explained its fascination with ETFs by listing their benefits, including that they are simple but still allow investors to invest in an entire market quickly and in a single transaction simply by tracking the performance of an index. There is also a large selection of them; they are diversified and easy to buy and sell.

Market Reach

InvestEngine’s market reach is very limited as the only exchange available through the platform is the London Stock Exchange. This is in stark contrast to competitors such as eToro and Trading212, which offer access to more than a dozen exchanges around the world.

The benefit of this limited reach is that all InvestEngine’s ETFs are priced in pounds, so there are no currency conversion of foreign investing fees to contend with.

Account Types

In terms of account types, InvestEngine has a fair selection of accounts specially tailored for individual and business clients. The offered account types are as follows:

General Accounts

General accounts are the most commonly used account across trading and investment platforms. They are tailored for individual investors and allow users to invest in a wide range of ETFs. InvestEngine's general accounts offer access to both DIY and managed portfolios and automated investing.

The platform also explains that they are not tax-free. Still, UK taxpayers may benefit from a £1,000 dividend allowance and £6,000 capital gains tax allowance in 2023/24 that can be set against returns to reduce tax liabilities.

ISA Accounts

ISA Accounts, or Individual Savings Accounts, allow users to invest in ETFs while potentially reducing their tax liability further. They come with tax benefits to UK investors, who can invest up to £20,000 into the account each year, and all the gains they make from this money will be tax-free.

InvestEngine ISA accounts come with no account fees, as long as you choose the DIY portfolio service. ISA accounts come with several benefits, including an opportunity for growth (as they’re Stocks & Shares ISAs), access to powerful investment tools, and the ability to transfer other existing ISAs into InvestEngine's service for free.

Business Accounts

InvestEngine's business accounts, on the other hand, were designed for companies, offering a platform for businesses to invest their surplus funds. With a business account, a corporate client receives help growing their funds through ETF investments.

The platform claims that using its business accounts for ETF investments is an opportunity to earn more on cash reserves. Once again, it offers managed portfolios and DIYs, as well as automated investing or manual investing, where companies can use Savings Plans to add to their portfolio weekly, biweekly, or monthly, depending on which schedule best suits them.

The platform also claims that it offers easy access and high security, as its Business Accounts are covered by the Financial Services Compensation Scheme (FSCS).

SIPP Accounts

As of the time of writing, InvestEngine does not yet have a Self-Invested Personal Pension (SIPP) account, but according to its platform, Personal Pensions will be "coming soon." It already lists the benefits, including ease of use, low fees, full transparency, tax efficiency, the ability to use DIY or managed portfolios, and the ability to register for exclusive early access to this type of account right now.

Features

InvestEngine offers several features that make its platform a good choice for novices, experts, and businesses. This includes DIY or Managed portfolios, fractional investing, automated investing, and regular rebalancing for managed portfolios. It should be noted that this is not a full-on trading platform, but the things it offers and does are of excellent quality. As such, it differs from its competitors in multiple ways.

- Easy, automated investing

- Fractional investing makes InvestEngine accessible

- Clear breakdowns and stats for your portfolio

- Basic charting tools are not useful for technical analysis

- Lacking in detailed market research or economic calendars

- Orders are executed once a day, which isn't useful for traders

Trading Tools

Here are the tools available on InvestEngine:

Managed portfolios

DIY portfolios

Fractional investing

Automated investing

Smart portfolios and rebalancing

Actionable insights

Managed Portfolios

Managed portfolios allow InvestEngine users to deposit their funds and make a few decisions that would guide the experts that the platform employs to choose an appropriate portfolio for their goals and risk tolerance. The feature comes with a 0.25% fee and ongoing management.

To set everything up, users will have to provide certain information, including their annual salary, investing timeframe, whether their goal is to minimise losses or maximise potential profit, decide on what to do if there is a downturn, the size of the loss that they can afford to suffer before it impacts their standard of living, whether they prefer a guaranteed rate of return or an uncertain one, whether they will have to withdraw their funds in the next five years, and the type of financial instruments they have invested in previously.

This is a perfect tool for new and inexperienced traders who lack the time to monitor their portfolios, the market changes, and the like. They would instead leave it to a professional to handle their investing.

DIY Portfolios

DIY portfolios are the exact opposite of managed portfolios. In this situation, you are the sole manager of your portfolio, meaning that you add and remove ETFs as you see fit based on your goals, desires, and expectations from the market. Naturally, that means that knowledge and experience are valuable for DIY investing.

But, if you have the working knowledge of the market, prefer to do your investing yourself, and have the time to do so, then this is a perfect way to engage with ETFs and to do it all for free since this approach comes with no fees. You can also simplify your trading experience with tools such as automated investing, smart portfolios, and one-click rebalancing.

Fractional Investing

Fractional investing gives you access to even the highest-priced ETFs simply by allowing you to pay only a fraction of the total ETF price. That way, the best-performing ETFs previously reserved for the wealthy and institutional clients become available to everyone. This helps users diversify their portfolios and means you can start investing with as little as £1.

Automated Investing

The AutoInvest feature automatically invests any cash in your account according to your chosen portfolio weighting. This is an excellent tool for someone who lacks the time or patience to do things personally.

AutoInvest can be combined with a Savings Plan, which will enable you to automatically deposit to InvestEngine every week, fortnight, or month.

Smart Portfolios and Rebalancing

You can set up your portfolio according to the proportion of each investment you want it to contain. If your portfolio drifts from your ideal weighting, you can use one-click rebalancing to trigger buy and sell orders that will realign your portfolio with your goals.

Portfolio Look-through

Actionable insights allow you to know which companies, sectors, and regions are a part of your portfolio. This is very important to investors, as it will enable them to understand the nuances of the market and understand how each of the available ETFs is likely to perform, depending on what company it is associated with, where the firm is based, the strengths and weaknesses of the region, the industry that the firm operates in, and other details.

Market research

Regarding market research, the platform has a blog section that publishes market commentary, news, and educational posts. The majority of the posts in question are written by InvestEngine itself, although there are some research articles, academic posts, and similar texts that the platform gets from other entities, such as WisdomTree Investments and Xtrackers — its featured partners.

However, since InvestEngine is not a complete investment platform, it does not offer access to asset-specific news, and it has no integrated economic calendar like some of the total investment platforms, such as eToro.

Educational materials

InvestEngine performs significantly better when it comes to educational materials. As mentioned, it has a blog that publishes various texts on all kinds of ETF-related topics. Still, apart from that, it also has its own Education Series that runs on YouTube, where various financial experts explain investment-related issues, terms, products, assets, and more.

The website also has a Help section where users can learn general information about the company, its accounts, portfolios, orders and trades, and ISAs.

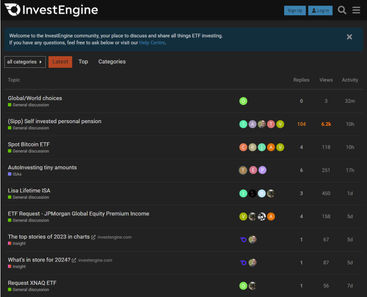

Lastly, the platform has a community forum where users can post and discuss various topics and "share all things ETF investing." The forum is split into four categories: InvestEngine news, General Discussion, Help & FAQ, and Investment ideas.

As such, it could be said that it has some essential elements of social trading in that users can share their plans, portfolios, news, strategies, and more. However, it does not feature any actual social trading mechanics or tools integrated into the platform for the trading community to use directly.

Fees

InvestEngine is very clear and direct in terms of fees and costs when it says that most activities within its platform are free of charge. It does not charge ISA fees; there is no fee per trade, account fee, or inactivity fee, unlike many other platforms.

The only fee that is ever paid is for Managed portfolios, which comes at a 0.25% fee, and that is it. Apart from that, the only other financial requirements include the £100 that users must deposit as a minimum to start using the platform.

This makes InvestEngine’s platform extremely cheap, which is one of its greatest strengths and why it tends to attract people despite its ETF-only offering.

- Commission-free trades

- No annual fee

- DIY portfolios are entirely free of charge

- Managed portfolios come with a 0.25% annual fee

- There is a £100 minimum deposit

- Such low fees could be unsustainable

InvestEngine makes money by charging fees on managed portfolios. As mentioned several times, this is the only thing the platform charges its users for, with no charges for having an operational account, deposits, withdrawals, or DIY portfolios.

While this might sound too good to be true, everything we have seen suggests it is true. The fact that the platform is regulated and audited confirms that it is not a fraudulent website. However, with that being the case, many have suggested that the platform will not be able to last, only charging for its Managed service.

For the time being, however, InvestEngine remains in business. As for how it performs, it has not yet reported a profit, so some remain skeptical, even among its user base. However, the platform continues to operate, seemingly with no issues.

Usability

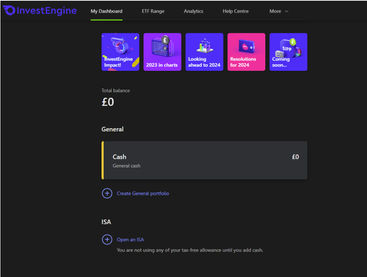

InvestEngine is a very user-friendly platform, meaning navigation is simple and intuitive. The platform’s dashboard provides an immediate overview of the user’s total balance, general cash, and portfolios and allows quick access to opening both a General portfolio and an ISA.

- Very easy to use

- The app has the same functionality as the web platform

- Navigation is clear

- Platform may be overly simplistic for some

- Lack of notifications for price changes

InvestEngine Web Trading Platform Review

InvestEngine’s web trading platform is highly user-centric, immediately noticeable from its design. It is pretty clean, with no distracting elements such as pop-ups, promotion of features, or other elements that confuse or overwhelm the new user.

Is InvestEngine beginner-friendly?

InvestEngine is very beginner-friendly, meaning that not only newcomers to this platform will easily find their way around, but also newcomers to the world of ETF trading and investment. Those who have never spent time on any trading or investment platform will easily navigate and use its web trading platform.

InvestEngine design and navigation

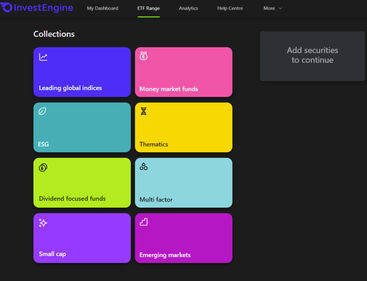

The design is straightforward, and at the top of the screen, users will find tabs, including My Dashboard, ETF Range, Analytics, Help Centre, and More, which includes Transactions and Reports.

The My Dashboard section will likely be where they will spend the most significant amount of time. It features platform news, the account balance, and buttons to open an ISA or general portfolio. You can also click on Cash in your dashboard to easily deposit, withdraw, or set up a Savings Plan.

In the ETF Range tab, all 590+ ETFs the platform offers are split into collections. If you have something specific in mind, you can search for a specific ETF, use several filters to list ETFs belonging to a particular asset class or provider or sort them by some other criteria, including relevance, Total Expense Ratio (TER), or yield.

The Analytics tab will provide more information about your portfolios, meaning this area will be empty until you build your portfolio and add some ETFs. The remaining tabs mostly contain helpful information, insight into past transactions, and the ability to create or review reports.

Login and Security Features

Logging in to InvestEngine is quick and simple, needing only an email and password that users set up during registration. Users can also go into settings to turn 2-factor authentication on or off, as it is turned off by default.

Alerts and notifications

The platform allows users to enable notifications, which currently only include InvestEngine news, with a maximum of one email or notification per week. Apart from that, the platform doesn’t provide any price alerts or trading notifications.

Earning reports & fees breakdowns

InvestEngine is transparent regarding the fees, immediately pointing out that its platform is mainly free. However, it is not as evident when it comes to its earnings. The platform has not released past earnings reports that would indicate its performance or success. If such reports exist, they are not easy for investors to find and understand how the firm performs.

InvestEngine App Review

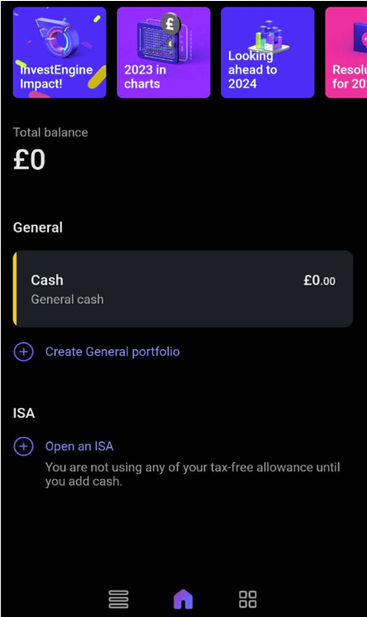

InvestEngine also offers a mobile app for Android and iOS devices. Immediately upon downloading and logging in for the first time, the app requires users to set up a 4-digit PIN. On devices that have it enabled, it automatically activates biometric protection that the device has set up, such as a fingerprint scanner or face ID.

Once this is done, the user is let into the app, and from there on, they face the same interface and features as on the platform’s web version. The only notable difference is that users can turn on or off push notifications for their mobile devices, which are turned on by default. This is done in the same area of the settings where users can turn on or off email notifications regarding InvestEngine news.

The app has three main pages; the first is the ETF range, where users can use a search feature to find a specific ETF or apply the same filters as on the web version to narrow their search. The second menu is the equivalent of the web version’s dashboard and acts as the app’s home page. The third and final page is the one that offers access to all other pages and functionalities, including Analytics, Transactions, Reports, Help Centre, and Settings.

Customer Satisfaction & Reputation

While InvestEngine is not nearly as big as the major players in the world of trading and investment platforms, it has developed its community, which seems to be rather pleased with the app and its services. Being an ETF-only platform, InvestEngine does not provide much. However, its service appears to be more than satisfactory regarding the area in which it specialises.

- Regulated by the FCA

- High Trustpilot score

- Covered by the FSCS

- The number of monthly visits is dropping

- FCA register claims that some activities by the firm may not be protected

Safety & Regulations

InvestEngine is a highly regulated and safe platform that adheres to strict rules and codes, including keeping clients’ funds and assets in segregated accounts.

Is InvestEngine regulated?

InvestEngine is fully authorised and regulated by the UK’s Financial Conduct Authority (FCA) [FRN 801128]. InvestEngine does not provide investment advice, but the FCA’s website says that InvestEngine is authorised to hold and control client money.

Given that the company is limited to the UK only, it is not registered by any overseas regulatory bodies. However, it is covered by the Financial Services Compensation Scheme (FSCS), which provides additional assurance for the users. This provides compensation coverage for any cash and value of assets held in user accounts, up to £85,000, in the event of the platform’s insolvency.

Is InvestEngine safe?

As a regulated ETF trading platform that follows the FCA’s rules and laws, InvestEngine is considered to be a safe platform. Some methods of securing its users and their funds include:

● The user funds are stored separately from the company’s corporate accounts

● The platform features 2FA

● Its app has several security layers to ensure that the account owner is the only one who can log in.

● InvestEngine is fully regulated by the FCA, one of the best-known regulatory bodies in the world.

● Users’ funds are insured thanks to the FSCS

InvestEngine background

InvestEngine was founded by Andrey Dobrynin, its current CEO, and Simon Crookall in 2019. The company is based in London, UK, focusing strongly on ETF trading, providing cost-effective, accessible investment solutions.

Since its launch, the firm has raised over £3.7 million in crowdfunding and claims to have £150 million in assets under management.

InvestEngine’s platform uses Two-Factor Authentication (2FA). Users must also go through the KYC procedure by providing private information, including their name, phone number, address, etc.

As the FCA dictates, the platform uses standard security measures to keep its users and their funds secure. To date, it has never suffered a known security breach or incident.

Customer Reviews

InvestEngine is available on both the Google Play and Apple App Store. It also has a more than solid rating on Trustpilot, one of the most trusted websites for rating various online services.

TRUSTPILOT | 4.6 / 900 reviews |

|---|---|

APPLE STORE | 4.7 / 1.6k reviews |

GOOGLE PLAY | 4.5 / 900 reviews |

InvestEngine reviews from Trustpilot

InvestEngine has overwhelmingly positive reviews on Trustpilot. Its score is 4.6/5, with 913 votes in total. According to Trustpilot, 79% of reviewers gave it a 5-star rating, while 10% gave it four stars.

In their reviews, the users shared that they had a very positive experience with the app, praising its user-friendliness and that they could easily invest without prior experience. They described InvestEngine as easy and efficient, with a well-laid-out website and excellent customer service.

InvestEngine Google Play reviews

InvestEngine has been downloaded over 10,000 times from the Google Play Store. Users appreciated the beginner-friendliness, low fees, and rebalancing tool. However, they were also critical of the bare bones UI, inability to compare ETFs on the same graph, and the lack of long-term historical data.

InvestEngine App Store reviews

Apple users praised InvestEngine's business account, the swift sign-up process, and the friendly and professional customer service. On the downside, though, users were critical of the platform's slow order execution, slow withdrawal process, and limited range of investments.

Customer Service

While InvestEngine has many strong points, customer service could improve. Currently, the platform only offers ticket support, which users can reach by clicking the help button on InvestEngine’s website. Apart from that, it also has a presence on multiple social media platforms.

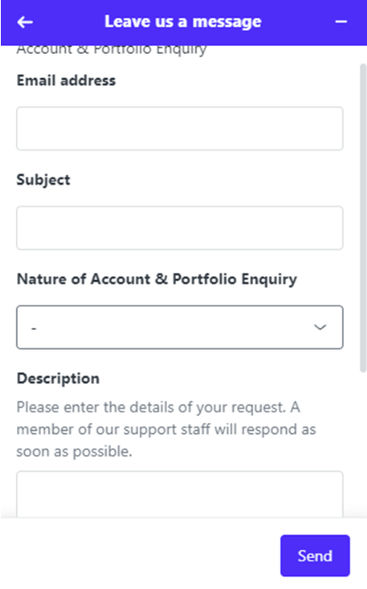

Customer support tickets

After clicking on the help button on the platform, users can select an issue from several offered options, including:

● Account & Portfolio Enquiry

● ISA Transfers & Cancellations

● Orders and Trades

● Report a Technical question/problem

● Please provide us with feedback

The user will be led to a new pop-up where they can enter their email address, subject, and nature of feedback. Below that, they can describe their issue and add attachments (up to 5 files) if they have something to report. After receiving and reviewing their questions and feedback, the support team will respond with a message sent to the user’s email address.

That said, customers have reported that the platform has been extremely quick with its responses and that it solved their issues using email communication in record time. While this is undoubtedly praise-worthy, users who reach out to customer support on trading platforms often require speed, so the lack of live chat and phone calls as options for reaching out could be seen as a negative.

Social Media

InvestEngine is maintaining a presence on several social platforms, including:

● X

Help Centre

Finally, the platform has its own Help Centre, where users can learn more about several categories, each of which concerns several topics. The categories in question include:

● General Information

● Account

● Portfolios

● Order and Trades

● ISAs

InvestEngine Alternatives to Consider

While InvestEngine has its strengths, its service can be found lacking if you are interested in anything other than its roughly 600 ETFs currently on offer. With that said, it is worth noting that there are numerous alternatives to this platform, including some of its largest competitors:

Vanguard

Vanguard is one of the best-known competitors to InvestEngine, with a long and rich list of features that give it its value. It offers:

More than 80 funds to choose from

More than half of its funds are not available through InvestEngine

It lets users invest in actively managed funds

It is a long-established leading investment manager

It has millions of users around the world

It offers its services globally, unlike InvestEngine, which is only available in the UK

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 6.0 | Visitinvestor.vanguard.com |

Trading 212

Trading212 is another excellent InvestEngine alternative with great benefits to using its platform. It offers the following:

Real-time trading around the clock

A rich selection of ETFs

No platform fees

Fractional investing

Website and app with the same functionality

The ability to create Pies, which can balance a portfolio automatically

The ability to borrow existing portfolio templates from other users

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.4 | Visittrading212.com | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Freetrade

Freetrade has several excellent features and benefits working in its favor, some of which give it an advantage over InvestEngine. For example, the platform offers:

A good, clean app

A variety of investment choices

Real-time trading

Zero platform fees

It is a significant player in the UK market

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 7.6 | Visitfreetrade.io | The value of your investments can go down as well as up and you may get back less than you invest. |

Should You Invest with InvestEngine?

InvestEngine is a trading platform that offers access only to exchange-traded funds. It has nearly 600 ETFs available, and its biggest strength lies in the fact that it is, for the most part, completely free to use. The platform only charges a 0.25% fee for managed portfolios, but if you choose to manage your portfolios yourself, you can avoid paying fees altogether.

The platform is regulated by the FCA. It has an app that looks and feels pretty much the same as its web version, and it has customer support that the users are pretty happy with, even though it only offers a ticket system.

Platform security is also up to the current regulatory standards, and there is a good amount of educational materials to help newcomers learn everything there is to learn about the platform itself, but also about ETF trading.

Overall, InvestEngine could be the ideal platform for anyone interested in ETFs who values fee-free investing and simplicity. In particular, it could be a good option for new investors who aren't confident with advanced trading tools and complex features.

However, those who want to place trades quickly, used advanced analysis, or access a diverse range of investments would likely be better suited to another platform such as eToro or Saxo Markets.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 7.5 | Visitinvestengine.com |