eToro is an accessible and navigable multi-asset investment platform with particular appeal to people who are just getting into investing. What I love about the platform are its impeccable social trading functionalities: personalised newsfeeds and CopyTrader. These let you approach investing from a new perspective, which is both a learning and a money-making opportunity.

Who is it best for?

eToro has been long touted as being an excellent choice for beginners and casual traders alike. With no-commission stock and ETF trading, the ability to buy fractional shares, low minimum deposit requirements, and no maintenance fees, it provides a low entry barrier for newbies. But what truly sets the broker apart is its impeccable social trading functionalities.

Social trading is very prevalent across the platform. Combined with its trademark CopyTrader feature, the broker is an excellent choice for those who wish to advance their knowledge through an interactive experience.

I appreciate that eToro is taking steps to expand its user base with the improvement of its charting package. Combined with eToro’s campaign to absorb all Stamp Duty charges, the charting update is likely to upscale eToro among other trading platforms geared towards active traders.

Introducing eToro

When it was first launched in 2007, eToro was largely focused on forex trading. The platform expanded its product portfolio to include stocks, ETFs, and commoditiesand quickly found traction globally. Today, its available in more than 140 countries and boasts over 20 million users, highlighting its appeal to a diverse range of traders.

In 2010, eToro created the first-ever social trading experience, OpenBook. It allowed traders to learn and copy from more experienced investors. Today, social trading and its flagship CopyTrade feature sit at the heart of eToro. Over the years, it evolved into one of the best social trading platforms available.

Innovation has driven eToro since day one. Besides an ever-expanding product lineup, it now offers smart portfolios, a cash management service eToro Money, and cryptocurrency trading.

While it is still lacking in its research, educational materials, calculators, and other trading tools, it continues to improve its services to expand its user base.

“Since its entry to the market, eToro has been what we can call a fan-favourite. With its incredibly easy-to-use platform and low trading costs, it has been a great starting point for new traders. It’s exciting to see the TradingView integration and where this new direction will take the platform in the future.”Jonathan Merry, the CEO of Moneyzine.comJonathan Merry

Investment Products – 6.5/10

eToro’s range of investment products and instruments is not far-reaching. It lacks some crucial instruments which are included by its competitors, such as bonds, mutual funds, futures or options (only available in the US).

As seen from the comparison table, eToro mainly maintains its edge in the competition by including cryptocurrencies within its offerings. While the selection of coins is not as extensive as you’d find from specialised cryptocurrency exchanges, it’s still respectable and makes the broker a good option for all-around traders.

- Cryptocurrencies available

- Fractional shares available

- Commodities trading

- Options trading

- No bonds and mutual funds

- No futures

- Limited account range: no tax-wrappers

- Limited stocks and shares range

Assets Available

Let’s look at eToro’s asset offer in more detail:

Stocks and shares: Over 3,000. Limited compared to competitors such as Freetrade (with 6,000+ on Plus and Standard) and Trading 212 (over 12,000).

Exchange-traded funds: Over 300 ETFs.

Fractional shares: Let you own fractions of expensive stocks, for example, Tesla or Apple.

Commodities: 32 commodities, including gold, silver, oil, platinum, wheat, and corn.

Indices: 20 indices that let you track the performance of an entire sector from a single position. Offer includes the UK100, NASDAQ100, GER40, FRA40, and more.

Cryptocurrencies: 80 coins available. eToro also has its own crypto wallet.

Forex: Stands for foreign exchange or currency trading. 52 currencies are available on eToro.

CFDs: Stands for contracts for difference. However, the FCA warns against them emphasising 80% of traders lose money on CFDs.

Options: Options are a complex instrument that lets you speculate on the future direction of an asset without the obligation to buy it. Options are high risk and can cause you to lose your investment very quickly.

It is important to note that 81% of retail investor accounts lose money when trading CFDs with this provider.

Trading CFDs involves a high level of risk and may not be suitable for all investors. The leveraged nature of CFDs means that you could potentially lose more than your initial investment. Before deciding to trade CFDs, you should carefully consider your investment objectives, level of experience, and risk appetite.

eToro against the competition: A comparison of assets available

eToro | Trading 212 | Interactive Investor | Degiro | |

|---|---|---|---|---|

Stocks and shares | ✔️ | ✔️ | ✔️ | ✔️ |

Exchange-traded funds | ✔️ | ✔️ | ✔️ | ✔️ |

Fractional shares | ✔️ | ✔️ | ✔️ | No |

Commodities | ✔️ | ✔️ | ✔️ | ✔️ |

Bonds | No | No | ✔️ | ✔️ |

Indices | ✔️ | ✔️ | No | ✔️ |

Mutual funds | No | No | ✔️ | ✔️ |

Cryptocurrencies | ✔️ | No | No | No |

Forex | ✔️ | ✔️ | No | No |

Options | No | No | No | ✔️ |

Futures | No | No | No | ✔️ |

CFDs | ✔️ | ✔️ | ✔️ | No |

Market Reach

eToro gives you access to the following 17 exchanges:

Amsterdam

Brussels

Copenhagen

Frankfurt

Helsinki

Hong Kong

Lisbon

London

Paris

Madrid

Milan

NYSE

NASDAQ

Oslo

Zurich

Stockholm

Saudi Arabia

In contrast, Freetrade has only 11 exchanges available and Trading 212 gives you access to 14. So when it comes to market reach, eToro has the edge compared to its fee-free trading competitors.

Account types

Currently, it’s only possible to set up a general investment account with eToro, you can’t yet sign up for other tax-advantaged accounts like stocks and shares ISAs or SIPPs. If you're investing large amounts of money, Trading 212 and Freetrade offer a low-cost ISA, and Freetrade even offers SIPP solutions.

However, in March 2023, eToro announced it was partnering with Moneyfarm to provide its users with an ISA.

eToro General Investment Account

The general investment account, also known as the eToro standard account, lets you invest and trade as much as you want but this could make you liable for Capital Gains Tax (CGT).

CGT applies to gains over the annual tax-free allowance of £6,000, while in the tax year of 24/25, it will decrease to £3,000. Alternatively, you can invest up to £20,000 in a Stocks and Shares ISA per tax year, and any profit you make will be protected from CGT.

eToro Professional account

The eToro Professional account caters to EEA-based traders, providing them with increased leverage levels. At the same time, it lets eToro engage with clients at a more sophisticated level. But while professional traders do get more features, they may be exposed to higher risks, and they are not as legally protected as retail clients.

eToro Corporate Account

The eToro corporate account is perfect for traders looking to trade via an established company. It's also great for signal providers and those who earn their main income from trading with eToro.

To open a corporate eToro account, you need a minimum deposit of $10,000 along with any required documentation.

eToro Islamic account

eToro’s Islamic account makes sure Let’s look at the basics of the account. First, no additional rollover commissions are charged for contracts lasting more than 24 hours. Second, the leverage is also interest-free, and finally, you can rest assured eToro doesn’t charge any account management fees.

All you need to do is contact customer service once you open your standard account and pay in the minimum $1,000.

Features – 8/10

For a zero-commission platform, eToro offers a decent amount of features, notably social trading, ready-made portfolios, and excellent educational materials.

However, some of the features, educational material, and research tools are only available to eToro club members. You automatically become a club member once you have a certain amount of money invested in the platform.

- Investment insurance

- Demo account up to $100k

- Interest on uninvested cash for higher tiers

- Limited educational materials

- Many market research tools reserved for Club members

- Screening functionalities are limited

Trading tools

Here are the tools available on eToro:

Demo account of $100,000

Multiple order types (standard offer)

Social and Copy Trading

Smart portfolios

Portfolio Analysis

One-click trading mode

Interest on cash

Demo Account

It’s worth noting eToro has something not all platforms offer: a virtual portfolio with which you can practise. While it’s not a real account, it lets you take your skills and eToro’s features for a test drive.

Moreover, it lets you use all the functionalities as if it was a real-money account, including CopyTrader.

Charting

eToro took a big leap to improve its charting package, which arguably took the platform miles ahead of its competitors of the same calibre. By integrating industry-grade TradingView into the platform, eToro is now comparable with some eminent platforms like Interactive Brokers – at least in terms of charting.

TradingView is commonly used among traders who rely heavily on technical analysis. There are loads of indicators you can use, along with over 50 drawing tools, and it’s extremely customisable.

The biggest downside is that only a handful of brokers provide access to it – in the UK, the major platforms include Pepperstone, Interactive Brokers, and now, eToro!

This is a serious move from a trading platform, long considered to be geared towards beginners and casual traders only.

Social Trading & CopyTrade

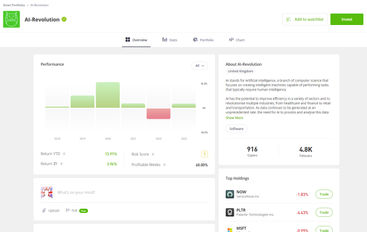

Social and copy trading functions are perhaps the biggest assets that eToro has. Each asset class, investor page, and market has a social feed where users can create posts and comment on others. Each investor’s profile provides a detailed breakdown of their performance, holdings, risk assessment, and more.

While the platform lacks tools to filter assets, there are plenty of criteria to screen traders. You can find traders that match your investment portfolio by setting parameters of risk score, preferred assets, number of trades, average order size, and more.

The statistics tab gives a thorough view of a trader's performance:

Their yearly performance, broken down by the month,

An average risk score of the past week,

How many copiers they have,

A breakdown of their portfolio by asset class,

And the frequency of their assets.

The minimum amount for copy trading is around £165, and it is possible to set an automatic closing trigger if the value of the investment drops a certain amount. This can either be an amount value or a percentage. It’s also optional to copy open trades.

In a way, eToro’s copy trading service and social trading features can make up for the lacking search functionalities. You can get loads of trading inspiration by following more experienced traders, or any trader for that matter. The ability to discuss ideas with them directly is the cherry on top.

SmartPortfolios

Besides copying top traders’ portfolios, you can also invest in Market Portfolios that revolve around a market, like Real Estate Trusts, or themes, like Ad-Tech stocks. eToro is creative in its use of smart portfolios (formerly known as CopyPortfolios), they cater to a variety of investment goals.

If you’d like to generate income, for example, you can go for a dividend-yielding stocks-focused portfolio. However, if you are an inspiring value investor, you can opt for the Berkshire Hathaway portfolio, which copies the investments done by legendary value investor Warren Buffet’s holding company.

It's also possible to view the breakdown of assets and risk exposure of each portfolio. I particularly like the level of detail that goes into assessing the risk exposure of each plan you opt for, which also specifies the portion of a portfolio used for CFD trading.

Portfolio Analysis

eToro allows a basic look into your portfolio – you can view things like your trading history, profit-to-loss ratio, average open, risk score, or any leverage used. The history tab details how much you paid in fees so far, the overall p/l ratio, and net cash flow.

The portfolio analysis tool is customisable to an extent. You can view up to eight parameters on the web platform and three on the mobile app. Moreover, it is also possible to replace these parameters with others as there are 16 in total. The catch is that it’s a bit click-hungry; you have to keep changing the parameters to get a holistic view of your portfolio.

One-click trading mode

In trading, time can earn or lose you money very quickly. eToro’s one-click mode lets investors trade without the usual confirmation screen. However, this mode can also be dangerous if anything goes awry, so it may be more suited to advanced investors.

Interest on cash

After your tier balance reaches $10,000, you start earning 2% interest on cash as a Gold member. This increases to 2.4% for Platinum users, 2.9% for Platinum+, and 5% for Diamond users.

Market research

eToro provides a standard economic calendar, an earnings report calendar, related news headlines, and daily market analysis series fully integrated into every asset page.

There are two main podcasts run by the eToro team – Market Bites and Digest & Invest, which go through individual stock analyses, market events, and the economy on a large basis. Podcasts in themselves are valuable additions, yet they are not integrated into the account. You can access them through eToro Academy instead.

The club members of the platform can also reach Trading Central, a highly celebrated hub for market research and analytics. The members can access eToro’s Analyst Weekly series, which includes insights on market events, penned by eToro’s in-house team of analysts. The series is largely based on fundamental analysis metrics and lacking in technical analysis commentary.

While the market research is not as extensive as offered by some more established firms like Interactive Brokers or Saxo Markets, it’s complete.

However, the addition of screeners that allow filtering the search for assets based on various criteria such as market cap, average return, profit margins, or revenue would have been excellent.

Currently, users are limited to brief lists of daily gainers and losers, analyst picks, and industry filters.

Educational Resources

eToro Academy provides an uneven approach to trading education. There are numerous courses covering the basics of trading, investing, and cryptocurrencies that can help beginners get up to speed. All of them are great to help novice traders.

The advanced topics are usually case-based rather than evaluating a subject in its totality, such as analysing Tesla stock’s latest price movements. In that sense, the podcasts that are advertised as “advanced courses” could add more value if they had been integrated into the trading platform itself rather than being hidden in the Academy.

eToro Academy

There are numerous courses covering the basics of trading, investing, and cryptocurrencies that can help beginners get up to speed. All of them are great to help novice traders.

Podcasts

There are two main podcasts run by the eToro team – Market Bites and Digest & Invest, which go through individual stock analyses, market events, and the economy on a large basis. Podcasts in themselves are valuable additions, yet they are not integrated into the account. You can access them through eToro Academy instead.

Content

The platform has extensive educational content:

eToroPlus: A blog that covers market analysis and events through easily-digestible content and investment ideas. It provides daily, weekly and quarterly summaries.

Retail Investor Beat: A quarterly survey analysing investment decisions, outlooks, and concerns of 10,000 retail investors across more than ten markets.

Club members can also access live webinars, third-party publications such as the Wall Street Journal, get a dedicated account manager, and exclusive market analysis.

Fees – 7/10

While trading stocks and ETFs are commission-free, non-trading fees are pretty high. These include a monthly inactivity fee of $10 (≈£8) once your account has remained dormant for a year, and a withdrawal fee of $5 (≈£4). A major problem is that all fees are paid in US dollars; thus, you also need to pay conversion fees each time.

However, as your balance increases, you automatically unlock eToro club features which give you discounts, perks, and even exemptions from some fees.

- Zero-commision trading for stocks and ETFs

- Fees decrease as your balance grows

- No FX fees with eToro Money

- High non-trading fees

- Pips make it more difficult to compare costs

- Minimum withdrawal amount $30

eToro Trading Fees

While there are zero fees for trading, currency conversion fees mean dealing with eToro comes with a charge if you’re not natively trading with USD.

To make matters more complicated, eToro uses pips to charge for currency conversion. The conversion fee varies by the currencies involved, and converting British pounds to US dollars is priced at 150 pips.

It’s not unusual to see low-cost brokerages charging high non-trading fees: Trading 212, for example, charges a whopping 0.5%, while Freetrade charges 0.99% on its Basic account. eToro’s spreads, however, are slightly high for industry standards.

In comparison, IG Markets spreads for commodities start from 0.1 pips and FX pairs from 0.6 pips, although it’s worth noting that IG users are hit by higher commissions and maintenance fees.

Pip is the unit of measurement to express the change in value between two currencies. It is usually the last decimal place of a price quote. For example, if GBP/USD moves from 1.1050 to 1.1051, that $0.0001 rise in value becomes one pip.

Now let’s break all of eToro’s fees by asset (but don’t forget that overnight and weekend fees may apply and affect what you pay).

Commission | 0% for stocks and ETFs1% for cryptocurrencies |

|---|---|

Currencies | spread and overnight fees |

Commodities | spread and overnight fees |

Indices | spread and overnight fees |

Stocks and & ETF CFDs | 0.15% for non-US instruments and US instruments above $3 |

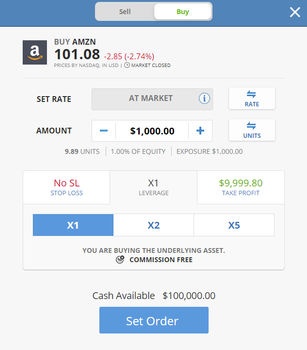

How much does eToro charge for a £1,000 trade?

Here’s how much would it cost to place a £1,000 trade to buy Amazon shares at the market price of $98.12 (£79):

Commission | Currency Conversion Fee | Total Cost in GBP | Total Amount Paid in USD | |

|---|---|---|---|---|

£1,000 | £0 | £15 | £1,015 | $1,248.45 |

And here’s how much would it cost to open a £1,000 CFD position for Amazon shares at the market price of $98.12 (£79):

Commission | Overnight Fee | Weekend Fee | Total Amount Paid in GBP | |

|---|---|---|---|---|

£1,000 | £1.5 | $1.53 (£1.24) | $4.59 (£3.73) | £1,006.49 |

Non-Trading Fees

eToro’s non-trading fees are relatively high for industry standards, although they can be justified by the platform's comprehensive educational content and some advanced features. On the other hand, the costs can be hard to track, especially as there is no tax-free account, making it even harder to budget around your investing activities.

For a greater degree of certainty, you may enjoy platforms with tax-free accounts and flat fees.

eToro against the competition: A comparison of non-trading fees

Withdrawal/deposit fees | Overnight/weekend fees | Inactivity fee | Minimum deposit | |

|---|---|---|---|---|

Freetrade | £0 | £0 | £0 | £1 |

Trading 212 | £0 | Vary by asset | £0 | £10 |

eToro | $5 to withdraw money | Vary by asset, often triple on positions opened on Fridays | 12 months free, $10 monthly after | $10, $50 first deposit, $500 for bank transfers |

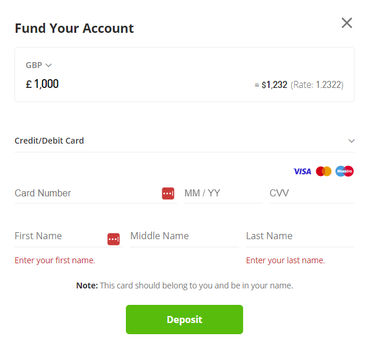

Deposit & Withdrawal Methods

eToro offers a variety of options for depositing and withdrawing funds, which are on par with many of its competitors. I particularly enjoy the fact that there isn’t a minimum deposit requirement for depositing funds for any of the methods listed, other than the initial deposit requirement of $50 (£40).

Similarly, there’s no upper limit on how much you can withdraw, although there are some charges applied for eToro Money withdrawals after a certain amount (covered in detail below).

Time | Maximum Depositing Amount | |

|---|---|---|

eToro Money | Instant | £250,000 max. Single deposit (unlimited for Black card owners) |

Credit/Debit Cards | Instant | $40,000 (£33,164) |

Bank Transfers | 4-7 days | Unlimited |

PayPal | Instant | $10,000 (£8,293) |

NETELLER | Instant | $10,000 (£8,293) |

Skrill | Instant | $10,000 (£8,293) |

Rapid Transfer | Instant | $5,500 (£4,561) |

eToro Money

eToro Money is a standalone payment application that allows transferring money to other users without any fee; it offers instant funding to eToro trading accounts. As I said before, you need to fund your account with at least $50 to be able to set up an eToro Money account.

As it stands now, eToro Money is free of charge – but it can change in the future. Benefits of eToro money:

Reduced Fees: You can deposit money to your eToro trading account with no additional currency conversion fees.

Instant Deposit: All deposits made through eToro Money are instantly available on your eToro trading account.

Visa Card: You can get a Visa card with no monthly costs or set-up fees. Only eToro club members can obtain a card.

However, non-club members in the UK can withdraw only £2,000 per month free, with a 1% fee applying thereafter.

eToro Club

eToro club is a tiered membership system that unlocks different perks with each tier. There’s no application process for the club – once you meet the eligibility criteria, which is the tier balance that comprises the account balance and the amount invested, you become a member automatically.

This club membership is applicable for clients with at least $5,000 in tier balance. This encourages high-volume trading and is appealing to high-profile investors. Considering that there aren’t additional costs associated with memberships, the perks that come with each tier add great value.

There are five tiers:

Silver members have over $5,000 in their account and gain access to a dedicated account manager, live webinars, a data-based Smart Portfolio, a Visa debit card, Customer Service Live Chat, 5% Discount on Tax Returns, and Delta PRO Investment Tracker.

Gold members have over $10,000 in their account and gain access to everything included in the Silver tier plus Weekly Market Analysis, and 2% Interest on their balance.

Platinum members have over $25,000 in their account and gain access to all perks included in lower tiers plus an exemption from withdrawal fees. Also, they get access to the Trading Central Research & Analysis platform, a 50% discount on FX, and complimentary access to major publications like the Wall Street Journal.

Platinum+ members have over $50,000 in their accounts. Perks include free Insurance up to 1 million EUR or AUD, and exclusive access to special sporting and cultural events on top of what’s included for lower tiers.

Diamond membership requires over $250,000 in tier balance. The members get everything included in lower tiers plus access to eToro's Diamond events and Crypto Cashback Program.

Here are the basic ways in which eToro makes money:

Charging withdrawal fees

Charging inactivity fees

Conversion fees

Cryptocurrency fees

Weekend and overnight fees

Spread (including when its customers lose money, frequent with CFDs).

Usability – 8.5/10

eToro is one of the platforms responsible for commercialising retail trading with an accessible mobile trading platform associated with low costs. It’s often rated among the best trading apps due to its easy-to-navigate interface and completely mobile-optimised UX.

- A separate eToroWallet app

- Clean interface

- Good security

- App and website not as balanced

- Notifications can be overwhelming

- Occassional crashes

eToro Web Trading Platform Review

eToro’s interface is a testament to its user-centric approach. Unlike legacy brokers who launched an online platform in later stages, eToro is a pioneer among the digital-first new-generation brokerages. It’s possible to see the amount of work that went into the development of digital products.

Design and navigation

There aren’t many special bells and whistles – yet, on the bright side, the lack of moving parts is making it incredibly easy to navigate. The search function is predictive and exhaustive. Overall, the interface offers great navigation throughout.

NewsFeed

eToro’s news feed is similar to regular social media platforms, offering you personalised and relevant content. It also lets you comment, like, and follow other investors who are essentially investing influencers.

Alerts and notifications

You can set price alerts on eToro, which can be very useful to avoid missing important trades. However, be prepared to hit the settings section and customise what you want and don’t want, as eToro notifications will also include marketing, social notifications, and market updates.

Portfolio management service

eToro uses Bullsheet’s portfolio management tools, which let you automatically import and track stocks before and after hours. You can also see your assets by sector, type, and dividend yield (among other things), and use Bullsheet’s stock screener. eToro purchased Bullsheet in 2022.

Earning reports & fees breakdowns

eToro has a Dividend calendar, IPO calendar, and regular earnings reports, setting it apart from many of its competitors. You can also see the fees that you paid in the app on the history tab.

Proxy voting

eToro introduced proxy voting in 2022, enabling investors to take part in meetings and vote on corporate matters.

eToro App Review

Much like Robinhood, eToro is also responsible for commercialising retail trading with an accessible mobile trading platform associated with low costs. It’s often rated among the best trading apps due to its easy-to-navigate interface and completely mobile-optimised UX.

The mobile version of eToro offers almost full functionality and allows traders to switch between devices seamlessly. You can access and make changes to your watchlist, place trades, and can copy other traders. The changes will be immediately reflected on the web version.

The charting capabilities on its mobile application are limited in comparison to the desktop view; the tools only include Bollinger bands, MACD, moving average, RSI, and stochastics. It's also not possible to compare assets on a single screen. So, if you’d like to conduct an extensive analysis, you have to use the web platform.

Achieving full functionality across mobile and web is a work in progress for many trading platforms. Saxo Markets' advanced platform SaxoTraderPro, for example, is simply not available on mobile. Further, IG Markets charts are also not fully mobile-optimised even though all the features are available on the app.

Although there are a few who do it better than others, like Trading 212 or Plus500, whose mobile apps are celebrated more than the web trading platforms.

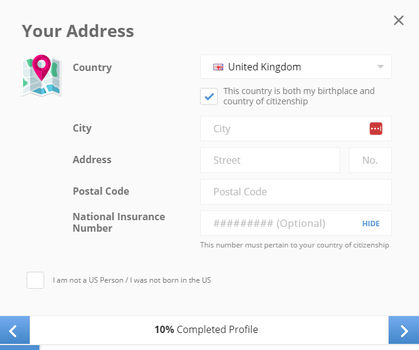

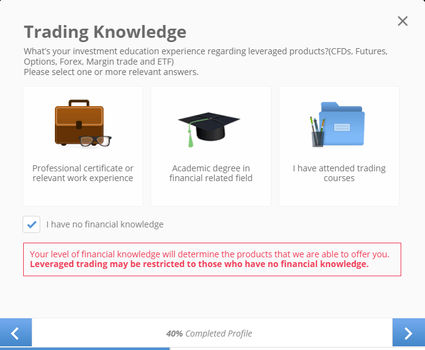

Setting Up an eToro Account

Step 1 – Sign Up for an eToro Account

Step 2 – Set Up Your Trader Profile

Step 3 – Deposit Funds

Step 4 – Start Trading

Customer Satisfaction & Reputation – 7.3/10

eToro is a well-established global platform which is safe and regulated in the UK, as well as other countries.

While customer reviews vary — as they do once you get to 30 million customers, eToro still has a good reputation for an investing platform.

- Established company

- Has all the necessary regulations

- Customer reviews overwhelmingly positive

- Customer service tiered

- Response times can be slow

Safety & Regulations

eToro is a safe investing platform, regulated, protected, and following KYC and AML standards. Clients’ funds and assets are kept in segregated accounts.

Is eToro regulated?

eToro is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. It is registered to offer cryptocurrency services under Money Laundering, Terrorist Financing, and Transfer of Funds.

The FCA regulation means that clients’ funds up to £85,000 are protected under Financial Services Compensation Scheme (FSCS). As per the regulations, the platform is also safeguarded under SSL encryption.

It’s also registered and regulated in other countries:

Cyprus: CySEC

Australia: ASIC

FSAS: Financial Services Authority Seychelles

SEC, FinCEN: US

The Italian Registry for providers of crypto/digital wallets services

French Financial Markets Authority

As a crypto service provider in Germany, but with no protections

Its digital platforms harness 2 Factor-Authentication and every investor needs to comply with KYC requirements by submitting a government-issued photo ID.

Employing industry-standard security measures and being fully regulated and authorised by the Financial Conduct Authority, eToro proves to be trustworthy and safe to use.

eToro Background

eToro is the biggest social investing and trading platform in the world, founded in 2007. Its founders are Yoni Assia, Ronin Assia and David Ring, while Yoni Assia is its current CEO, so it’s still founder-led. The platform’s headquarters are located in Tel Aviv, Israel, with offices in the UK, US, Australia, and Cyprus.

What vouches for eToro is its longevity and consistently increasing number of users, surpassing 30 million globally. It has also been the most downloaded trading app in the UK in recent years. Last but not least, it is heavily regulated. And although it is as safe as platforms get, your capital is still at risk.

Customer Reviews

On all three platforms, eToro has a great rating and a high number of reviews.

Trustpilot | 4.4 / 20,188 reviews |

|---|---|

Apple Store | 3.8 / 8,300 reviews |

Google Play | 4.0 / 132,690 votes |

eToro reviews on Trustpilot

The customer feedback is overwhelmingly positive regarding the account managers, who routinely contact their clients to make sure everything is on track and always reachable.

Many users left positive remarks about eToro’s user-friendly and stable platform along with the dedication of their account managers. While some look for more advanced research and portfolio analysis features, the general sentiment skews in the positive direction.

The majority of complaints revolve around issues with withdrawing money. There are numerous incidents where users had problems with their withdrawals even though their accounts are fully verified. Also, customers complained about untrustworthy CopyTrader accounts.

eToro takes the time to address customer queries with personalised messages and responds to 91% of negative comments.

eToro on Google Play

The reviews on Google Play show users appreciate eToro’s quick problem-solving and suitability for both beginners and experienced investors. They’re also satisfied with the app’s user-friendly interface and security measures.

Now for the most common sources of annoyance. Users complained about too many notifications, unexplained logouts, and the app feeling a bit outdated. There were also customer service complaints, mostly regarding response times.

eToro responded to most reviews, positive or negative.

eToro on App Store

How does eToro work for Apple customers? According to App Store reviews, the highlights for most customers include the app’s design, useful educational materials, and social trading features (compared to Twitter in some reviews).

On the other hand, users cited issues with withdrawal, some lagging problems, and poor customer service experiences (slow or no response) as the most common sources of frustration.

Again, eToro responds to reviews regularly.

Customer Service

Customer service has been a pain point for a fraction of eToro users, and the support ticket system, while common, is something I personally find robotic and unpleasant.

Call me old-fashioned, but a phone line where I can explain the issue and talk to a real person is unsurpassed. However, live options like having a dedicated manager contact you through WhatsApp or live chat are only available to eToro Club members.

eToro’s customer service comprises a live chatbot, an extensive FAQ section, and a ticket system. It’s possible to access the FAQ and ticket pages through the account, but the live chat is not readily available. I accessed it by running a Google search on ‘eToro Live Chat’.

eToro customer service channels

eToro replies to your support ticket to your registered email address | |

Live chat | Yes |

Support Portal | Yes |

Phone (WhatsApp) | Dedicated Account Manager for Club members |

FAQs | Yes |

Social media | |

eToro Community | Sometimes, you need to ask other users. |

For the scope of this review, I have tested the available services to assess the response time and assistance:

The customer support ticket I sent regarding issues with the payment methods was not answered within the two-business day window as eToro advertises.

The FAQ section is extensive and easy to navigate. It’s possible to find step-by-step instructions on setting up an account, depositing, withdrawing, using the Copytrader mechanism, and placing trades.

The live chat experience was largely swift and pleasant. A chatbot initially asks several automated questions to see whether it can help with your query or whether an agent is required. It took us three minutes to connect to a customer agent, and the response times varied between two to 10 minutes. The customer service agent was kind and knowledgeable and spent minimum time confirming the information I requested.

Support options increase for higher-tier club members, who ultimately gain access to a dedicated account manager.

Given that customers do complain about response times, I can recommend the same thing as eToro itself — reach out to the social media team on Twitter (or X?) and Facebook and the team will (should) help.

Alternatives to Consider

Although eToro is impressive in its offerings among other trading platforms of the same calibre, it has some major drawbacks. For starters, it's not possible to sign up for tax wrapper accounts ISA and SIPP – which hurts eToro's appeal to investors who wish to trade assets directly with tax advantages. The fact that it doesn't accept GBP payments as of yet is also a major problem. Although eToro Money offers a way to avoid currency conversion fees, it comes with its own limitations. And lastly, while the platform's product portfolio performs well in terms of versatility, the collections are not extensive. This may lead some traders to seek out alternatives that include more investment opportunities.

Freetrade: In terms of trading costs and usability, Freetrade is among eToro’s closest competitors. The key difference is that while eToro is a full-on trading platform, Freetrade is mainly a stockbroker. The investment options are limited to stocks and ETFs, but you can get an ISA or SIPP account and trade stocks without worrying about tax.

Trading 212: eToro is largely on par with Trading 212 in terms of products, fees, and product offerings. Trading 212 has a slight edge over eToro with its highly-celebrated trading app that carries full functionality, and the addition of ISA and SIPP accounts. Trading 212’s selection of stocks and ETFs is also larger than eToro’s, but it doesn’t include cryptocurrencies within its product offering.

Other Alternatives to Consider

| Name | Score | Visit | Support | Mobile | Security | Launched | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 7.6 | Visitfreetrade.io | Live Chat, Email | iOS, Android | 2FA, PIN, Biometrics | 2019 | The value of your investments can go down as well as up and you may get back less than you invest. | |

| 8.4 | Visittrading212.com | Email, Live Chat | Android, iOS, Web App | 2FA, Biometrics, PIN | 2013 | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | |

| 8.4 | Visitdegiro.com | Email, Phone | Android, iOS, Web App | 2FA, Biometrics | |||

| 9.8 | Visitplus500.com | Live Chat, Email, WhatsApp | Android, iOS | 2FA, Biometrics | 2008 | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Availability subject to regulations. FCA (FRN 509909). |

Plus500 disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.