Are you feeling the pinch of rising living costs? Now more than ever, it's crucial to stretch every pound. The key? Choosing the perfect savings account that aligns with your financial goals.

We've done the heavy lifting, analyzing the top savings accounts on the market to guide you towards a smarter decision.

Dive into our comprehensive review for insight into the best savings accounts in 2024. Plus, discover expert tips on maximizing your savings. Get ready to take control of your finances!

Saving Accounts – Our Top Picks

| Name | Score | Visit | Interest on Savings | Account Types | Key Features | Overseas Usage | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 8.5 | Visitrevolut.com | 4.75% AER | Standard, Plus, Premium, Metal | Investments, Budgeting Pots, Live Spending, Spending Analysis, freezeUnfreezeCard | £1,000 fee free spending, Plus and Metal accounts include insurance perks | ||

| 8.5 | Visitstarlingbank.com | 3.25% AER | Personal, Business, Kite Kids, Joint, Multi-currency | Budgeting Pots, freezeUnfreezeCard, Live Spending, Spending Analysis | Free ATM withdrawals, Mastercard exchange rate | ||

| 9.2 | Visitwise.com | 3.40% | Debit card, Money Transfers | Live Spending, freezeUnfreezeCard | Multiple currencies available |

The Best Savings Accounts for 2024 Reviewed

So, without further ado, let’s dive into the top-rated UK savings accounts. We added a section on each account’s advantages and disadvantages, helping you find the necessary info.

Best for investing – Revolut

Best for digital banking – Starling

Best for foreign currency savers – Wise

Best for credit products and loans – Chase

Best for customer service – Monzo

Best for high-yield saving – Virgin Money

Best for earning interest on your balance – Santander

Best for switching incentive – NatWest

Best for overseas use – First Direct

Best for individuals with no permanent address – Monese

Revolut stepped onto the scene in 2015 and developed an entirely digital banking ecosystem without having land-based branches. More than 28 million customers have faith in Revolut, with the numbers increasing despite the turbulent economic climate.

Most importantly, Revolut offers competitive interest rates and hassle-free access to its Saving Vaults, a feature launched in January 2022. The Vaults offer a 2.96% annual interest paid daily, with the option of using a savings boost, scheduled deposits, and a 4.25% annual percentage yield.

That being said, Revolut’s relatively short history can be a double-edged sword, given the volatile nature of modern fintech enterprises. In addition, the Financial Services Compensation Scheme (FSCS) does not cover the savings accounts in this digital bank. Additionally, although Revolut provides a state-of-the-art app, you can only choose between two categories of savings accounts. Many clients would benefit from a bit more variety and flexibility.

- Competitive interest rates

- Lightning-fast app

- No fees

- Limited account variety

- Limited protection

- Still lacks trust and reputation

Starling ranks among the best challenger banks in the UK for several reasons, primarily because of its feature-packed offering. For instance, Starling offers a feature called Saving Spaces, virtual change jars, for effortless and efficient savings. Likewise, this bank provides automatic round-ups, and one-year Fixed Saver accounts with a 3.25% AER/gross interest.

UK savers could also like the lack of minimum deposit requirements and variable overdraft interest rates (15%, 25%, or 35%).

Starling’s focus on modern technologies could present a problem for some UK savers and their in-person banking needs. But, of course, Starling is not the only neo-bank with no physical branches. Starling offers a 100% digital signup and no monthly fees, but the savings plans are a part of the interest-bearing current account.

- Interest on current account balance

- In-app overdrafts

- Round-the-clock support

- No physical branches

- Only available to UK residents

- Limited range of savings options

.svg)

Wise, formerly Transferwise, is another UK-based money transfer service offering savings accounts. Moreover, Wise operates in 175 countries, handling more than 50 currencies, so it’s no surprise it ranks as the best savings option for those who save in different currencies, including US dollars and euros.

Clients who put their money in Wise’s Asset funds could get a 3.81% variable rate return, and you could start with as little as £1. Of course, these government-backed assets don’t offer guaranteed returns, but you can continue to spend and send money while earning interest. As their motto says, you can “do more with Wise,” but we could hardly call their savings accounts perfect. After all, Wise charges a 0.29% annual fee on Asset savings.

- 3.40% gross AER

- Established reputation

- Multiple currencies available

- No overdrafts

- Low withdrawal limits

- No premium accounts

It’s almost impossible to ignore a bank with more than 56 million customers, even though Chase joined the UK banking ecosystem relatively recently (2021). This renowned American bank, owned by JP Morgan, offers FSCS protection, making it an attractive option for UK savers looking for top-level protection. Besides the competitive interest rates, such as the 3.1% AER on easy access accounts, Chase offers an attractive cashback scheme. Plus, the 5% rate on roundups is among the best in the game.

You should not that as we said, Chase only recently crossed the Atlantic, and some UK savers might not be familiar with the name. And although it has more than 4,600 branches worldwide, the bank operates only digitally in the UK. In other words, there’s no one to visit if something goes wrong with your savings.

- Established presence

- Wide range of savings plans

- Attractive interest rates

- Limited accessibility

- Requires a Chase bank account

- No overdraft available

Monzo entered the mobile-oriented banking market in 2015 as another app-based challenger bank. With a streamlined interface, Monzo has a lot going for it. UK savers can enjoy competitive interest rates, including a 1.30% AER for easy access saving plans.

In addition to its savings offerings, Monzo provides easy-to-use budgeting tools, automatic round-ups, and overdraft interest rates of 39%. Monzo's well-trained teams provide 24/7 assistance, making it an excellent option for UK savers seeking exceptional customer service.

Monzo links up with the likes of OakNorth, Charter, and Paragon to provide access to a flexible ISA, easy and instant access saving accounts, and fixed-term plans.

- 10-min account activation

- Overdrafts available

- Fraud protection

- App-only money management

- Spending and withdrawal limits

- Savings accounts from third-party providers

Virgin Money should be right up your alley if you want to save money with a UK banking heavyweight. After all, this well-established financial institution boasts more than 6.5 million UK clients, many of whom choose Virgin Money because of its various savings options.

Namely, Virgin Money provides an unrivalled array of plans, including fixed-rate bonds with up to 4.26% gross AER and easy access ISAs with a tax-free variable rate of 0.25%. Best of all, Virgin Money charges no fees for opening or maintaining a savings account. Can you have too much of a good thing? For instance, Virgin Money offers multiple savings plans, and many inexperienced UK savers might find the offer overwhelming. While we are at it, Virgin Money also doesn't offer a switching incentive, and some other UK savings accounts might get you £175 (First Direct) or even £200 (NatWest).

- Various interest-paying products

- Competitive interest rates

- No foreign transaction fees

- Lacklustre customer service

- No switching incentive

- Confusing savings options

Banco Santander entered the UK banking market in 2004, and the rest is history. Over the years, it acquired three building societies, establishing its presence among the best UK banks. In addition to a range of savings plans, Santander also offers a way to boost your savings by allowing you to earn interest on your current balance.

In exciting news, Santander has recently announced a significant increase in its in-credit interest rate for its 1I2I3, Select, and Private Current Accounts. The monthly interest rate will now stand at an impressive 2.00% AER/1.98% gross (variable) on balances up to £20,000. This new rate of interest will enable customers to earn up to £396.38 in interest on their account each year.

Furthermore, Santander remains the only bank in the UK to offer customers both cashback on household bills and interest on in-credit balances through a current account.

Overall, Santander could be an excellent choice for UK savers looking to grow their money because this bank offers the best high-interest savings accounts. However, the app needs an urgent update since it has no live chat, and the relatively low withdrawal limits could inconvenience some clients. Also, Santander offers no switching incentive for new savers.

- Comprehensive offering

- Plenty of physical branches

- An attractive cashback offer

- Generic app interface

- No groundbreaking features

- Low daily withdrawal limits

Natwest boasts 840,000 customers using its regular savings accounts (as of February 2023), but its offering doesn't end there. The bank provides several other savings plans, including the Flexible Saver (1.00% AER/Gross p.a.), Fixed Rate ISA (4.20% AER/Tax-free), Cash ISA (1.00% AER/Gross p.a.), and the First Saver (3.30% / 3.25% AER/Gross).

Natwest operates as part of the Royal Bank of Scotland, with over 24 million customers worldwide, and its attractive bank switching incentive continuously brings in new clients. Eligible users can claim a £200 Switch offer after joining NatWest.

However, it's worth noting that in December 2021, the FCA fined National Westminster Bank £264.8 million for anti-money laundering offences, which may raise concerns about the bank's practices. Other than that, it's not easy to find drawbacks with Natwest, except for above-average fees for payments and international transactions.

- £200 Switch offer

- Interest rates vary from 0.08% to 1.49%

- More than 3,000 ATMs

- Money-laundering scandals

- High transaction fees

- Mediocre customer support

First Direct offers a range of savings accounts with competitive rates, making it an attractive option for UK savers. Its cash ISAs offer a tax-free AER of 2.28%, while its 12-month fixed-term savings account offers an impressive 7.00% AER/gross rate. As a member of the HSBC group, First Direct provides top-grade protection for clients' funds and offers round-the-clock support.

However, it's worth noting that as a digital bank, First Direct has no physical branches in the UK, which may be a concern for some savers. Additionally, while the bank does offer a £175 switching offer and a £250 interest-free overdraft, it doesn't provide any interest on current account balances.

- Interest-free overdraft (up to £250)

- High withdrawal limits

- Excellent customer service

- No physical branches

- No interest on your account balance

- Limited range of savings plans

Monese stepped onto the UK banking scene in 2016, expanding its offering over the years. Today, Monese offers trademark online banking features, including the Pots feature that lets you earn interest on your balance and the round-up tool, which rounds your purchases to the nearest pound and saves every extra penny. You don't need to have a permanent address in the UK to be eligible for an account, making it ideal for those who just moved to the UK.

Monese offers a savings account marketplace in partnership with Raisin UK. Meaning that clients can browse UK savings accounts and claim extra savings boosts if they sign up via Monese. Plus, you’ll get full deposit protection because Monese has the FCA’s seal of approval. Nevertheless, it doesn't offer overdrafts, and much like other digital banks, its customer support primarily relies on chatbots instead of trained professionals.

- Effortless account setup

- No credit checks

- Referral rewards scheme

- Low limits on ATM withdrawals

- Chatbot-reliant customer support

- No overdrafts

How We Rate & Review the Best Savings Accounts

We apply a time-tested checklist of features when comparing the top savings accounts available in the UK. This includes:

The Product Offering

The most important part of our review process is the core product itself. We compare the key products offered by different banks and other financial institutions to recommend the best product for your needs.

While checking the features of your savings product, consider the following:

Account Term Length

Maximum Deposit Limit

Minimum Deposit Required

Withdrawal Restrictions

Frequency of Interest Payments

Tax Implications

Introductory Bonuses and Offers

Additional Features and Perks

Some financial institutions offer additional features and perks. We take these into account when comparing products, ensuring you can make the most of your savings.

Charges

High charges on an account can make it less suitable for your needs. However, the right bank for you may be able to offer a more comprehensive service because of the management fees it charges.

Customer Support

If you need to get in touch with your provider, good customer support is key. We consider customer reviews before recommending a product, to make sure your provider will be on hand if you need them.

Regulations

All the financial products and services recommended by Moneyzine are regulated by the Financial Conduct Authority in the UK. You can check the company on the Financial Services Register and find out exactly what they are authorised to offer, so you can trust them with your finances.

What Is a Savings Account?

A savings account is an account held with a financial institution that pays interest on deposited amounts. Different accounts will have different benefits and limitations, such as minimum deposits, interest rates, withdrawal limits, and durations.

How Do Savings Accounts Work?

Savings accounts have a simple purpose — they let people store and grow their money worry-free. Unlike stashing the cash in a shoebox under your bed, putting the surplus in a bank account is safe and convenient. On top of that, banks and financial institutions will pay you interest on your balance.

We’ll explain interest rates in more detail below, but the gist is that the bank pays you for using the money while it stays with them. Of course, the annual percentage yield (APY) varies depending on the institution and the amount of money in your savings account.

In most cases, clients can deposit additional funds at any moment. Yet, withdrawing the money can be tricky because some types of accounts have restrictions and penalties for early withdrawals. Nowadays, UK savers can transfer money in and out of their savings accounts via,

bank websites,

mobile apps,

physical branches,

ATMs.

Since UK banks offer mobile banking apps and online portals for monitoring your savings, money management is typically effortless and hassle-free. Linking your savings plan with a current account will let you transfer excess cash within seconds, allowing you to harvest interest on unneeded funds.

How Do Interest Rates Work?

Interest on a savings account refers to the amount of money a financial institution pays a depositor for keeping their savings in the bank. However, interest rates, expressed in percentage points, fluctuate since they depend on external economic factors.

The benchmark for interests across the UK, the Bank of England base rate, dictates the tempo. Savings providers use the base as a reference point, and an upward trajectory is good news for savers.

For example, the Bank of England base rate grew from 0.1% in December 2021 to 4.25% in March 2023. Consequently, the average interest rates increased significantly (even though most providers failed to reflect the dramatic increase in the Bank of England base rate).

Essentially, the longer you keep the money in the bank, the higher the interest rate. However, account providers might pay higher initial rates for some savings plans as a part of the switching incentive.

So, the key is to monitor the changes in interest rates and read the fine print before putting your name on the dotted line. Here's how average rates changed over the years:

Sep 2021 | Aug 2022 | Mar 2023 | |

|---|---|---|---|

Notice accounts | 0.47% | 1.17% | 2.66% |

Easy access | 0.17% | 0.69% | 1.85% |

(Source: Moneyfacts)

Accessibility Terms

Fund availability differs between savings accounts, so it’s vital to learn about accessibility terms before locking away your funds. The banks frown upon frequent transactions, but there are ways to access your money when needed.

For instance, instant-access savings accounts are flexible and will let you dip into the savings from time to time. This means that you’ll incur no penalties for withdrawals.

On the other hand, notice accounts and high-interest saving plans require contacting the bank before taking the money out. Early withdrawals can trigger penalties, or you could lose interest rates on the savings.

Common Charges Associated With Saving Accounts

Although most UK banks don’t charge for opening and maintaining a savings account, savers could expect some expenses while dealing with the bank.

For instance, cash withdrawals in a foreign currency will incur a fee, and NatWest will charge £1.38 for withdrawing £50 in the EU or the rest of the world.

In addition, savers could face overdraft fees if the bank offers this option. For example, Santander will charge £3.27 for £500 overdrawn for seven days.

The best UK savings providers frequently offer incentives for joining their ranks, and new customers can benefit significantly from these promotions.

For instance, NatWest offers a £200 switching bonus, while First Direct promises £175. So, even though these promotions typically don’t affect interest rates, they can boost your finances and inject free cash without much effort.

Yet, sign-up offers and similar incentives don’t come with exclusions and restrictions. Typically, current account holders cannot claim bonuses for switching.

Some UK banks offer cashback incentives, and Santander’s 1% cashback on phone and energy bills, council tax, and mortgage payments could earn you up to £10 cashback monthly.

How Much Should I Be Saving?

The amount of money you should be saving each month depends on your income and financial circumstances. The key thing to keep in mind is that a large portion of your income will be destined for essentials, such as housing, groceries, and bills.

The 50, 30, 20 Rule

The 50, 30, 20 rule lays the groundwork for approximately how much you should be saving based on your income. Based on this model, 50% of your income should be spent on essentials, and 30% should be spent on your lifestyle expenditure, leaving 20% for your savings.

Read our saving strategies article for more information on the 50, 30, 20 rule and other clever ways to save money.

What’s the Minimum Deposit?

The minimum deposit is defined as the minimum amount that must be paid into a savings account for it to be eligible under the Terms and Conditions. Usually, this amount will only be required to open the account and start saving.

However, some savings accounts require a regular direct debit payment to remain open. Make sure you check these requirements before making a decision.

What’s the Difference between Saving and Investing?

There are a few differences between saving and investing, even if the end goal may be the same. The main differences include risk, potential returns, recommended terms, and liquidity of assets.

What Is ‘Gross’ and ‘Net’ Interest?

Gross interest is the amount of interest you’ll receive on your savings before tax has been deducted. Net interest is the amount of interest you’ll receive after tax has been deducted.

Like any other income, interest received on your savings is normally taxable.

What Is the Personal Savings Allowance?

Personal Savings Allowance is termed as the total amount of interest that you earn across all of your bank accounts (except ISAs) each year, tax-free.

Basic rate taxpayers can receive up to £1,000 in interest tax-free over a given tax year.

Higher rate taxpayers have this amount reduced to £500, while additional rate taxpayers have no Personal Savings Allowance, so are taxed on all interest earned on their accounts. If your interest exceeds the amount permitted under the Personal Savings Allowance, you need to note this on your self-assessment tax return.

To put this into context, on an account with an interest rate of 5%, you’d need to save £20,000 into the account for the year to earn £1,000 in interest.

Why Compare Savings Accounts?

Comparing savings accounts carefully is vital to ensure you get the best deal. There are lots of different savings accounts available with different benefits and criteria.

Thus, it’s a good idea to properly research what each account offers such as interest rates, additional features and perks, charges and withdrawal limits, customer support, and rules & regulations to protect your savings.

Types of Savings Accounts

There are many different types of savings accounts such as easy-access accounts, fixed-term accounts, and products designed for specific purposes like ISAs and business savings accounts.

Cash ISAs

Individual Savings Accounts (ISAs) offer a tax-free alternative to savings. The Personal Savings Allowance permits you to earn up to £1,000 in interest tax-free, but ISAs allow you to save up to £20,000 a year without paying any tax on interest or dividends earned.

Read our full ISA guide.

Savings Accounts vs ISAs

The main difference between savings accounts and ISAs is that any interest earned on an ISA is tax-free, but the savings limit is also important, particularly if you’re a basic rate taxpayer.

The Personal Savings Allowance permits basic rate taxpayers to earn £1,000 in interest a year, tax-free. In order to earn above this amount in an ISA, the interest rate need to be higher than 5%.

ISAs are therefore most tax efficient if you’ve already reached your Personal Savings Allowance elsewhere, or you save the maximum amount in an account with an interest rate above 5%.

You should also consider withdrawals, as any withdrawals you make from an ISA still count towards your annual deposit limit. Frequently withdrawing from an ISA is therefore not ideal when compared with easy-access savings accounts.

Children’s Savings Accounts

Children’s savings accounts are useful for your child’s future and encourage them to do the same. With a children’s savings account, the child owns the funds, but the child's parent or guardian has exclusive control over the account, usually until the child turns 7.

Types of Children’s Savings Account

Children’s easy access savings

Children’s limited access savings

Children’s fixed term savings

Junior ISA

Joint Savings Accounts

Joint savings accounts are similar to savings accounts with the exception that two or more people have control over the account. This means both holders have the right to deposit and withdraw money from the account.

High-Interest Current Account-Linked Savings

A current account-linked savings product is a savings account directly linked to a current account with the same provider. These are often created as a means of rewarding loyalty to a financial institution by offering higher interest rates.

As the name suggests, these accounts can only be opened if you have a current account with the financial institution. There may also be additional conditions and caveats, such as maintenance of the minimum balance, a requirement to have had it open for a certain amount of time, or making it your ‘main’ account.

These savings accounts are beneficial if they’re offered by your current provider. However, if a rival company is offering a savings account with better rates, there could also be switching rewards for changing your current account.

Is Money Held in High Interest Savings Accounts Safe?

Your savings are shielded from market fluctuations as you’ve not invested anywhere in the stock market; your bank or financial institution is simply paying you to keep your money in their account.

In terms of financial security, most firms in the UK provide protection under the Financial Services Compensation Scheme (FSCS). The FSCS will compensate you for any funds lost if your financial institution goes into insolvency, up to the value of £85,000.

How Do You Open a High-Interest Savings Account?

You can open a high-interest savings account directly with the institution offering it, provided that you meet the criteria. A lot of banks offer high-interest online-only bank accounts, so these need to be set up via online or mobile banking rather than by phone or in the branch.

Specialist Savings Accounts

Specialist savings accounts offer specific ways of saving for those looking for something specific. Some of the best specialist savings accounts are listed below.

Ethical Savings Accounts

Ethical banks use business models, that leave no negative impact on the environment or society, while some ethical banks also attempt to actively have a positive impact on society.

Almost all ethical banks refuse to lend to industries like tobacco or weapons manufacturers, and some have a proactive attitude towards lending, such as investing in renewable energy.

Best Ethical Bank

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.5 | Visitstarlingbank.com |

Starling prides itself on avoiding the funding of fossil fuels, mining, arms, and military. Instead of these, it invests in government securities and other high-quality assets.

The bank is also a founder member of the TechZero taskforce, which is a small group of UK-based technology companies working towards climate crisis.

Savings Tracker Accounts

A savings tracker account is an account whose interest rate tracks the base rate of the Bank of England. The interest rates rise as the base rate increases and vice versa. These accounts will either offer the exact base rate of interest on your savings, or a fixed amount above or below the base rate.

Remember that some banks offer savings accounts at much higher interest rates than the base rate, so this doesn’t necessarily mean a savings tracker will give you the highest returns. However, it will give you an idea of how much interest you may earn if you follow the Bank of England’s base rate.

Best Savings Tracker Account

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 7.2 | Visitwww.utbank.co.uk/ |

180 Day Notice Base Rate Tracker

The UTB Base Rate Tracker account tracks the base rate of interest and matches it for your savings. It has a minimum opening deposit of £5,000 and a maximum deposit limit of £1m with interest paid annually.

Postal & Telephone Savings Accounts

If you like to manage your accounts by telephone or post, several banks offer postal and telephone banking services, including savings accounts.

Charity Savings Accounts

Charities need bank accounts to manage their funds. A charitable organisation can set up a savings account for any surplus donations to help earn additional money before it needs to be spent.

Crypto Savings Accounts

Investors in cryptocurrency can deposit their tokens into a specialist savings account and earn interest. Like other currencies, the tokens will earn interest as long as they remain in the crypto savings account.

Offshore Savings Accounts

As the name suggests, offshore savings accounts are held in countries other than the native place of residence. These are often offered as fixed rate, notice, or easy access accounts.

Opening an offshore account can be difficult but it offers tax advantages to saving in an offshore account. They typically require high initial deposits, and high fees, and aren’t protected by the FSCS.

Best Overseas Savings Account

The HSBC Fixed Rate Saver is a fixed-rate offshore account that pays monthly interest. The minimum starting deposit is on the low side for offshore accounts at only £2,000, and the maximum amount that can be deposited is £1m. A higher interest rate is offered at different deposit levels; £2,000, £50,000, and £250,000. This account is only available when you have an HSBC current account.

Can I Open a Savings Account For My Business?

Yes, you can open a savings account for your business. The three main types of business savings accounts available are:

Business easy access account

Business notice account

Business fixed rate bond

What Can a Savings Account Be Used For?

Everyone saves for different reasons, and savings accounts can help you achieve any of your savings goals.

Easy Access Account

Emergency funds

Unforeseen expenses

Saving for small purchases

Temporary savings to earn interest while finding the best long-term strategy

Family holiday

Regular Savings Account

Save regularly

Earn high interest on smaller amounts

Save without thinking about round-ups

Notice Savings Account

Family holiday

Large purchases

Fixed-Term Savings Account

Long-term savings

Earning interest on a financial windfall

Family holiday*

*You need to time this perfectly, so beware of not having the funds accessible when you need them.

Cash ISA

Tax-free saving

Lifetime ISA

Purchasing a house

Saving for retirement

Junior ISA

Saving for your children’s future

Encouraging your children to save for a long-term goal

Children’s Saver

Encouraging your children to save

Introducing financial discipline

Different Types of Savings Accounts Compared

The criteria for ranking and reviewing savings accounts help us separate the best from the rest. Yet, the abundance of options complicates matters and makes the process challenging.

The modern banking industry offers dozens of attractive instruments for saving money and earning interest. Here are the most-used types of savings accounts in the UK:

Advantages | Disadvantages | Tax advantages | Average Interest Rate | |

|---|---|---|---|---|

Regular savings account | Monthly deposits- Low initial deposits | Low yield- No tax savings | No tax benefits | 6.25% |

Cash ISAs | Easy access to funds | Withdrawn funds cannot be replenished | Tax-free interest up to £20,000 | 3.27% |

High-interest savings accounts | Attractive interests | High initial deposits | No tax benefits | 7% |

Lifetime ISA | 25% bonus from the state | 25% fee for early withdrawals | Tax-free interest up to £20,000 | 3.50% |

Easy Access Saving Accounts | Hassle-free withdrawals | Lower interest rates | Tax-free interest up to £20,000 | 3.55% |

Notice savings accounts | Generous interest rates | Penalties for early withdrawals | No tax benefits | 4.05% |

Is Saving the Best Use of Your Money?

This depends on how much you’d like to save, the returns you’d expect, how accessible you’d like your money to be, and your attitude to risk. Apart from saving, you may also look to build your wealth through investments.

Read our top investment guides.

Are You a UK Resident?

Usually, UK savings providers only create accounts for UK residents, but some online-only banks, like Starling and Revolut, accept non-UK residents as well. For this, you need to have been a UK resident for at least 3 years to be able to open a Cash ISA.

Best Accounts for Non-UK Residents, Expats, and International Students

Account name | Get Started | Best for | Minimum deposit requirement | Maximum account value | Accessibility terms |

|---|---|---|---|---|---|

Revolut | Non-UK residents | None | None | Managed via your Revolut current account through ‘Savings Vaults’. | |

Monese | Expats | None | £ 40,000 | Can be set up without a UK address. | |

Starling Fixed Saver | International students | £2,000 | £1m | Managed in-app. |

If you'd like more options, we also list the best basic bank accounts, bank accounts for the self-employed, and bank accounts for students in the UK.

Some banks offer sign-up rewards and bonuses for opening an account with them or transferring to them. This isn’t necessarily just limited to savings accounts, so check the benefits when you sign up.

What Are the Benefits and Risks of Savings Accounts?

Benefits

Opening a savings account is simple.

Savings accounts don’t carry the risk of losing money as investments do. You are guaranteed to get at least your original deposit when you withdraw.

Seeing your savings grow over time can encourage you to keep money saved for longer and reduce your spending.

All UK savings accounts are protected by the FSCS, so even if your chosen provider goes bust, you’re still guaranteed to get your money back, up to a total of £85,000.

Risks

Over time, savings accounts are likely to be outpaced by inflation, so your savings will have less spending power in the long term.

If you choose a fixed-term account, you may earn less than the market rate if interest rates rise.

Variable interest rates mean you won’t be able to guarantee how much interest you’ll receive on your account if market rates change.

Some financial institutions ask you to meet certain criteria to get benefit from the best interest rates.

How Does Inflation Affect My Savings?

Inflation can impact the overall spending power of your savings, as the money you’ve saved over time will have less spending power against the increase in prices.

How to Sign Up for a Savings Account?

Once you’re ready to start saving, it’s time to find a suitable bank and open a savings account. Luckily, the top-rated UK savings providers offer a streamlined sign-up process, regardless of how you apply.

Namely, there are several methods for applying, including

Via phone

Online

In-person

By mail.

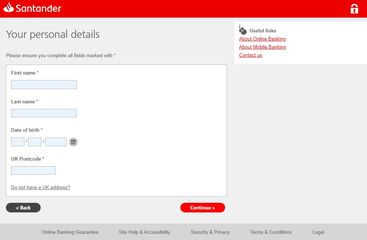

Nowadays, most UK savers opt for online applications. So, we’ll use Santander’s website to describe the process.

After visiting the bank’s portal, new savers should click “Savings and Investments” within the Personal tab.

.jpg)

As the name suggests, this tab will let you explore the various savings instruments. Once you find the ideal option, gather your ID because the next step will require entering personal details.

Besides your name and date of birth, the bank will require a UK postcode and a government-issued ID, such as a passport or a driver’s licence.

Once you pass those hurdles, the final step would be to accept the terms and conditions, including fees, interest rates, and accessibility terms.

Age – Although some UK banks will open savings accounts for people aged 16 and over, most financial institutions require you to be 18 or over.

Residency – As a rule of thumb, UK savings providers will only create accounts for UK residents. However, most online-only banks, like Starling or Revolut, accept non-residents. If this applies to you, take a look at our list of 10 best online-only banks in the UK.

Proof of Address – While traditional high-street banks might require proof of address to open a savings account, most digital banks like Monese or Monzo only need an address to send you your card.

Minimum Deposits – UK savers should check minimum deposit requirements before applying for a savings account, given that some plans require only £1 for the initial deposit, while others require up to £500 or more.

How to Boost Your Savings and Get the Most Interest on Your Savings

There are some tips to remember when maximising your savings.

Regularly Review Your Savings Account

New deals frequently come into the market, and variable interest rates change quickly. Keep an eye on your savings account and compare it with competitors’ offerings to make sure you’re getting the best deal, particularly during financial volatility.

Use a Cash Savings Platform

A cash savings platform is an online savings hub that gives you access to a wide range of savings accounts from different financial institutions in order to maximise the interest you earn. They allow you to diversify your savings accounts without searching each provider’s individual resources to find the best deal.

Save as You Spend

In this age of digital banking, a lot of banks provide both a current account and savings account that allow you to top up your savings with a feature commonly called ‘round-ups’.

Round-ups take any debit card payment from your current account and round it up to the nearest pound, saving the excess into your savings account. For example, if you purchase something for £1.20, £2 would be taken out of your current account, with the additional £0.80 being paid into your savings. This is a useful way of saving without consciously thinking about it.

Look for the Best Interest Rate

Variable interest rates can change frequently. Therefore, if you’re in an easy-access account with a variable interest rate, keep your eye open for any better deals along the way.

This is also an important consideration when looking at fixed-term savings accounts. While you may lock your money in with the best interest rate to begin with, if the base rate of interest rises, some variable interest rate accounts may provide a better deal by the time your fixed term is up.

Look Out for Any Limits or Restrictions

Limits and restrictions can make all the difference when it comes to the best deal for your circumstances. Low deposit limits can seriously limit the amount of interest you may earn over the lifetime of the account, and minimum deposits or direct debits could cause you to lose the benefits of the account if they’re not met.

Look for Perks and Bonuses

Different accounts offer different perks and bonuses, from cash back to rewards schemes with external suppliers. You may find an account with the right package to make a slightly lower interest rate in the long run.

Regularly review your savings account

Use a cash savings platform

Save as you spend

Look for the best interest rate

Look out for any limits or restrictions

Look for perks and bonuses

Could You Earn More Interest from a Current Account?

Not many current accounts offer interest rates at the moment, but some that do may earn you more interest if you make a large enough deposit.

High-interest savings accounts often have relatively low maximum deposit limits, which caps your total interest at a modest level. The highest-interest accounts also tend to come with additional requirements, such as opening a current account with the same bank, which makes it difficult to have more than one.

While current accounts are likely to offer lower interest rates than this, if you have a large amount of money to deposit, you may find the interest you earn is higher in the long term.

A regular savings account offers a 7% interest rate on its fixed-term account, with a maximum monthly deposit of £300. The account is fixed for a year, meaning the maximum total deposit limit for the year is £3,600. You must have a current account with this provider to open a regular savings account.

The interest earned on the maximum deposit would be 7% of £3,600, making the maximum interest earned for the year £252.

On the other hand, a current account is on the market, offering 4% interest on balances up to £85,000. If this account is also maxed out, you’ll earn a total of £3,400 interest for the year.

Despite the savings account offering a higher interest rate, the low deposit cap means you can earn more interest in the same time period elsewhere.

Is Your Money Safe in a Savings Account?

Savings accounts are among the safest places to keep your money, as there are no investments and you’re guaranteed to receive your original stake.

From a security point of view, UK savings accounts held with banks are protected by the Financial Services Compensation Scheme (FSCS), which offers protection if your chosen financial institution goes bankrupt.

The scheme offers compensation on all funds up to a total of £85,000. Therefore, if you have more than this to save, it may be a good idea to save it in accounts with different financial institutions.

Are Savings Accounts Worth It?

Savings accounts are an easy way to build up your savings, but there are other alternatives to protect you from inflation or earn you more in the long run.

Remember, money deposited in a zero-interest current account will also lose value over time, due to inflation. It may be a good idea to put some spare cash in a savings account, even if it’s earning a modest amount of interest in an easy-access account while you decide on a long-term plan.

Key Terms to Know

Here’s a glossary of some of the terms that may come up when you’re looking for a savings account.

AER

Annual Equivalent Rate (AER) is the actual interest rate an account may provide after interest earned has been compounded. This is essentially an interest earned on the interest you’ve already received and paid into your account.

Compounding can make a big difference to your savings total, so remember to keep an eye on the AER of a savings account.

BOE Base Rate

This is the Bank of England's base rate of interest. The BOE may change the interest rate for various reasons, and not all bank accounts will track it.

FCA

The FCA is the Financial Conduct Authority which regulates financial service firms and financial markets in the UK to raise standards, prevent harm, and ensure they are complying with financial law. All financial providers recommended at Moneyzine are FCA-regulated, and you can find them on the FCA register of regulated firms.

Fixed-Rate

A fixed-rate savings account requires you to keep your money locked for a set period of time in order to benefit from the interest rate. This allows you to calculate exactly how much money you should receive when you withdraw.

Gross Interest

Gross interest is the amount of interest you receive on your savings before tax has been deducted. Savings accounts pay your interest gross, so if you exceed your Personal Savings Allowance, you need to file these on your tax return.

Maturity

Maturity refers to the point when a fixed-term savings account has reached the end of its term and can be withdrawn. The length of the term depends on the account, and there may be other criteria with some accounts like the Junior Cash ISA and the Lifetime ISA.

Variable Rate

Variable rate refers to an interest rate that isn’t fixed. The financial institution sets the interest rate and is subject to change at any time. Some rates track the base rate of interest, while others do not.

Variable interest rates may rise or fall, depending on external factors. It’s worth keeping an eye on competitors’ rates to make sure you’re getting the best deal.

FAQ

Do I have to tie my money up to save?

Can I get a joint savings account?

What's better; an ISA or a savings account?

Should I open a fixed-rate or easy-access account?

How can I be sure my savings are safe?

I have debts, should I pay those off before I start saving?

What are introductory bonus rates?

Can I have more than one savings account?

Can I take my money out of a savings account whenever I want?

How can I save for my children's future?

What do you need to open a savings account?

How do I close a savings account?

How often should I review my savings account to see if it's still right for me?

Do I have to tie my money to the savings account to save?

What are savings pots?

What is Raisin?

More Bank Account Advice

Make Informed Bank Decisions

.jpg)

.jpg)

.jpg)

.jpg)