Do you ever run out of money before the end of the month? Or stare in disbelief at your dwindling balance and wonder where it’s all gone?

These are signs that you need a budget. The 50/30/20 rule is one of the most popular budgeting methods. It promotes financial responsibility while being super easy to follow.

All you need to start managing your money with this method is a spreadsheet and a little bit of know-how. You’ll find both below.

Easily track your spending, see how much you have left, and discover which categories to cut back on. The colors and chart give you visual cues to manage your spending. Just order the 50/30/20 budget template for Google Sheets to start your budget now!

Breaking Down the 50/30/20 Budget Model

The 50/30/20 budgeting rule is popular for its simplicity. It’s sound financial advice that pretty much anyone can follow—you don’t need to be a math whizz to understand it.

To start with, you’ll need to know your monthly income after taxes and deductions. This constitutes 100% of your net income. All you do then is put 50% of that amount toward your needs, 30% toward your wants, and 20% toward your savings.

Wondering what goes in each of these spending categories? Let’s break each down further.

Monthly after-tax income

To budget, you’ll need to use your net after-tax income as opposed to your gross income. If your salary is $36,000 a year, this doesn’t mean you can budget for $3,000 a month, as some of your salary will be deducted for taxes.

If you get a paycheck each month, the simplest thing is just to look at your paycheck. This will tell you how much was deducted from your income and how much you have left to budget with.

If you need to work out net income yourself, you’ll need to deduct your federal and state taxes, social security, and Medicare. You can do this online using a salary calculator.

Spend 50% on What You Need

This category is for anything that you don’t have a choice in paying (like debt minimum payments and rent) and any other basics that you can’t reasonably live without (like food and internet).

Here are examples of needs:

Rent or mortgage payments

Utilities bills (gas, electric, water, etc)

Phone and internet bills

Minimum debt repayments

Groceries

Transport or commuting costs

Insurance payments (unless already deducted from your salary)

Medical costs

Maintenance and repairs

Childcare

TIP:

Make sure to distinguish between your basic needs and what would be more of a treat. Obviously, you need food. But this category is for grocery shopping, whereas eating out at restaurants is more of a luxury so should go in wants.

Spend 30% on What You Want

This bit of your budget is more fun. It’s for anything that you don’t need but makes you happy. Prioritize the wants that are most important to you. Here are some examples of what might be in this category for you.

Food & drink (eating out, takeout, alcohol)

Entertainment (movies, concerts, etc)

Subscriptions (magazines, streaming, etc)

Sports & leisure (gym memberships, books, hobbies, etc)

Small trips & outings

Non-essential shopping

Gifts

Put 20% Toward Your Savings

The rest is to help you meet your saving and investing goals. How you allocate this money will depend on your personal circumstances and aims.

If you have no savings, you might want to start by putting the full 20% toward building an emergency fund. Or if you’re struggling with debt you might want to use it to become debt-free as quickly as possible. For someone whose goals are to build long-term wealth and go on a big holiday in a couple of years, they might put some of this money into investments and some toward saving for their trip.

Here are some examples of what to put in the savings category.

Emergency fund

Specific/big savings goals (college, house deposit, etc)

Extra debt repayments

Retirement contributions (401k, IRA)

Investments (stocks, bonds, commodities, etc)

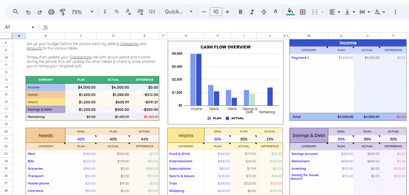

50/30/20 Budget Spreadsheet: A Sneak Peak

By far the easiest way to implement the 50/30/20 budgeting rule is to use a spreadsheet that is set up to manage your budget in this way.

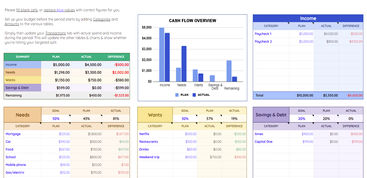

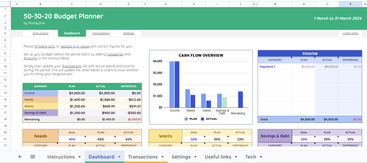

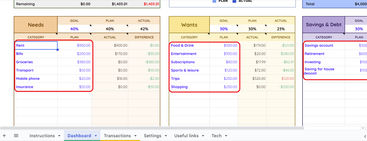

Our spreadsheet is a great tool for keeping your finances on track. Just fill out all your income, needs, wants, and savings to see what your percentages are.

You can play around with the figures in the ‘plan’ column. This will help you work out how much you can spend on each item to get closer to the 50/30/20 split. Or if 50/30/20 isn’t the right split for you, you can adjust the percentages under ‘goal’.

As you can see, the chart provides a great visual indication of the difference between your spending and your budget, as well as how much you have left to spend.

Example: The Spreadsheet in Action

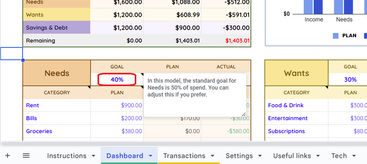

Here’s how things went when I tried out the spreadsheet for myself.

First I entered my monthly income. Seeing as my living expenses aren’t that high and my main goal is saving for retirement, I decided to adjust my split to 40% for needs, 30% for wants, and 30% for savings. To do this, I just changed the percentages under ‘goal’.

Then I entered all my spending categories in the appropriate section, along with how much I intended to spend on each. At first, the resulting percentages under ‘plan’ didn’t add up to the split I wanted, so I played around with the planned amounts until they did.

Here’s what my spreadsheet looked like at that point:

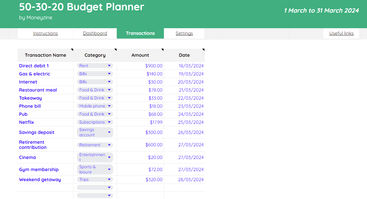

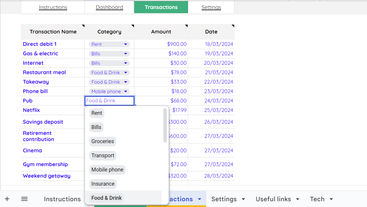

After that, I had to switch to the Transactions tab to enter all my transactions. This was easy enough by checking my bank statements and entering the amounts. I just had to select one of my chosen categories from the dropdown list for each transaction to make sure it was recorded in the right section of the budget.

The amounts I entered into the Transactions tab were automatically pulled through to the dashboard. This meant it updated in real time to show me how my actual spending compared to my budget and how much I had left to spend for the month.

As you can see, it’s super helpful. The red and green figures in the ‘difference’ column let me see whether I’m overspending or underspending in each category.

Where To Find the 50/30/20 Budget Spreadsheet Template

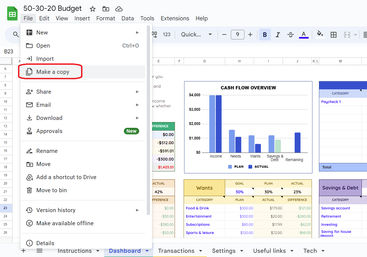

The spreadsheet is available on Etsy. Just head over to the store and get yours. You'll be given access to a Google Sheets link. Just make your own copy and start budgeting!

Benefits of the 50/30/20 Budget Rule (And the Catch)

The 50/30/20 rule has long been one of the most popular strategies for budgeting, and for good reason. Let’s take a look at why it has stood the test of time.

Why Is the 50/30/20 Rule Easy To Follow?

In a word: simplicity. Trying to figure out your own budget can be complicated. If you’re overspending, it isn’t always easy to see where or which spending categories you should be cutting back on.

The 50/30/20 rule is a basic blueprint that makes it easy to see how much money should go where and whether you can really afford that new pair of shoes this month. There are no complicated formulas here—anyone can do the calculations, even if math isn’t their strong suit.

It’s also pretty sound financial advice in most cases, so it’s especially useful to those who need a guiding hand on how much to spend.

TIP:

Unless you’re in financial difficulties, you can likely afford to get by on a 50/30/20 split. If you have a decent salary but spend more than half of it on needs, this could be a sign that you’re living beyond your means. Plus the rule is a good encouragement to invest in your future and have some fun along the way.

Where the 50/30/20 Rule Doesn't Work

That said, the 50/30/20 rule doesn’t work for everyone in every scenario. Here are situations when it might be better to use a different budgeting method.

Low income compared to your needs

Perhaps your income is particularly low or your basic expenses are high because you have a family to support or expensive medical needs. In these cases, it simply might not be possible to meet your basic needs with just 50% of your income.

You certainly shouldn’t feel pressured to stop buying what you really need just because the rule says to only spend 50%. You can always adjust the figures. Maybe a 70/25/5 split would work better for you.

High income

If your income is particularly high, you likely don’t need to spend half of it on your basic needs. Of course, you might still want to use this split. If living in a nice house with a nice car is important to you, it’s fine to spend 50% on those things, even if that’s more than you strictly need to spend.

But this comes down to your priorities. If you're happy to live a bit more modestly and want to pay for your kids’ college educations, maybe you’d prefer to spend a bit less on needs and more on savings.

Irregular income

Applying a blanket rule like the 50/30/20 split is harder when your income changes each month or each year. If you’re self-employed and experience big changes in your income, this budgeting model simply might not be possible.

In years where you do really well financially, you probably want to save more than 20% to make sure you have enough money to see you through any years when you struggle.

How to Adopt the 50/30/20 Budget Rule

Pretty much anyone can adopt the 50/30/20 budget rule without much difficulty. But if you really want to get the most out of this rule, here are some top tips.

Distinguish Between Wants and Needs

This isn’t always as easy as it sounds. It comes down to what’s essential vs non-essential, as well as the level of luxury involved. It’s the difference between buying groceries and buying food at a restaurant.

Take clothes, for example. They’re a necessary part of life, and if you don’t have enough to see you through the week then buying more is a need. But if you’re thinking of buying a new dress just because it looks cute, or buying designer clothes when cheaper alternatives would do, then this is a want.

Do you need a car? Well, if you don’t currently have one or your current car is too broken or expensive to run, then a new car is a need. But if you choose to make that new car a sports car, or there’s nothing physically wrong with your old car, then that’s a want.

TIP:

To work out which part of your budget to put items in, ask yourself two questions. Do I really need this? And do I need to spend this much on it or am I spending more because I want this particular one?

Track Your Spending With a Spreadsheet

Adopting the 50/30/20 budget rule is really difficult if you don’t track your spending. It’s a lot of hassle to manually add up how much you spend in each category without having somewhere to record it.

That’s why I recommend downloading the 50/30/20 budget spreadsheet template. It provides instructions to help you navigate it. Plus there are clear indications of whether you’re under or overspending in each category.

Use Savings Pots

If you struggle to manage your spending and saving to hit your budget targets, you could benefit from setting some of your income aside in different ‘pots’.

Saving for a holiday? Create a holiday savings pot so you won’t accidentally spend that money on other things. Trying to limit your spending on restaurants? Send a fixed amount of your income to a dedicated pot at the start of each month to make sure you don’t spend any more than that.

Challenger banks often make this super easy to do through an app. Use Wise ‘Jars’, Revolut ‘Pockets’, or Starling ‘Saving Spaces’ to keep funds separate. You can use these features to manage spending or save for short-term or long-term goals.

Short-Term Savings

This is money you put aside for goals in the near future, say less than 5 years away. Buying a new phone, going on holiday next year, getting married in a couple of years—these are all short-term savings goals.

You might just want to keep savings in your bank account or a savings pot if they’re for something inexpensive or needed in the coming months. If it’s going to be several months or more until your goal, you might want to look into high-yield savings accounts. Just make sure you’ll have access to the funds when you need them if the account has withdrawal restrictions.

Long-Term Savings

You should be saving for longer-term goals as well, like your retirement. Saving for college or a house could also fall into this category if they’re still some years away.

Seeing as you shouldn’t be touching these funds for a while, you can put them in tax-advantaged accounts with withdrawal restrictions, like a 401(k) or IRA for retirement or a 529 account for college savings.

You could also invest long-term savings. If you don’t care about short-term fluctuations or long maturity dates, you could hold long-term savings in investments like stocks and bonds.

Maintain Consistency

Have you ever started a budget and then just forgotten about it? I’ve been there, too. That’s why it’s so important to be consistent with your budgeting. Here are some tips to help you stay on track.

Automate payments: Setting up automatic payments in advance can help you stick to a budget. Automate your bills and savings deposits to make sure you never miss them.

Keep track of your spending: It’s hard to be consistent with your budget if you don’t have it recorded somewhere. The easiest option is to use a spreadsheet.

Keep your budget visible: As well as having a budget, it’s useful to keep it somewhere you’ll be reminded to use it. You could put a link to it on your browser homepage or a reminder on your fridge.

Organize regular budgeting sessions: Go through your bank statements and update your budget at the same time every week or month. Stick it in your calendar or set a reminder so you won’t forget.

Customize According to Your Situation

We’re all individual, and our budgets should be too. Make sure yours includes the spending categories that match your lifestyle. Does the 50/30/20 split not work for you? Adjust the percentages so they do.

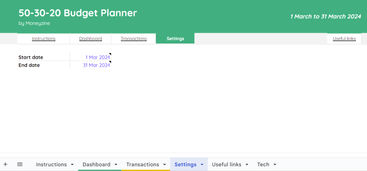

How To Use The 50/30/20 Budget Template (Google Sheets)

Wondering how to get started with the template? You’ll find detailed instructions on the first tab of the spreadsheet, but here’s the gist.

Step 1: Set up the dates for your budget

Step 2: Set your preferred budget split

Step 3: Set up your budget categories

Step 4: Add your transactions

Step 5: View the dashboard

Step 6: Start over

Alternatives to the 50/30/20 Rule

The 50/30/20 rule won’t be for everyone. If you’re looking for an alternative, here are some of your options.

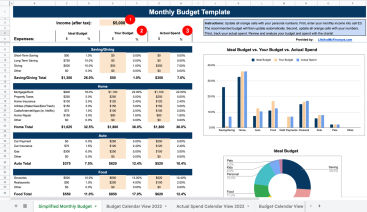

General Budget Template

If dividing into needs, wants and savings doesn’t work for you, you might want to use a budget that simply tracks all your spending categories. There’s a great example of this available in our shop.

As well as setting your own budget, the spreadsheet will show you the ideal budget based on your income. There are clear visualizations that show you which categories you ought to cut back on.

Envelope System

Nowadays, the kids are calling it “cash stuffing”, but the envelope method has been around for a long time. You simply withdraw the cash you need for the month and divide it into separate labeled envelopes for each of your spending categories.

This works in the same way as digital savings pots. The benefit is that some people find it easier to see and limit what they spend when they use physical cash.

The drawbacks? Holding large amounts of cash has its risks, and you won’t benefit from interest or the same level of consumer protection. Be warned that some insurance policies have limits on the amounts and circumstances that are covered if your cash gets stolen.

Zero-Based Budgeting

With a zero-based budgeting method, all your incomings and outgoings should add up to zero. You’ll have to allocate amounts to all your expenses so that the total amount matches your income. This doesn’t mean you should spend all your income each month—you should allocate some of it to savings.

So, Is the 50/30/20 Rule for You?

This is really a personal choice. As we’ve seen, it won’t work in some cases like low or irregular income. If this split doesn’t work for you, you could always pick percentages that do work.

In many cases though, the 50/30/20 budget can be a great rule of thumb for being financially responsible. It can also be a really easy method to follow with the right budgeting tool.

If you want to keep track of your spending and succeed with the 50/30/20 method, download the 50/30/20 rule spreadsheet from our shop.

.jpg)