In today's fast-paced world, making money work harder for us is more important than ever. The allure of financial freedom, or even some extra cash for peace of mind, resonates deeply with nearly everyone.

Yet, many people overlook the potential of the small changes they can make in their daily spending habits. Finding extra cash in your budget doesn't always require significant sacrifices or drastic lifestyle changes; often, it's about recognizing and restructuring the little things that add up.

Here's a guide to uncovering these opportunities and setting your finances toward growth.

Start by Taking a Closer Look at Everyday Spending

One of the simplest ways to free up extra cash is to review everyday expenses. While certain essentials, like rent or groceries, are necessary, they often leave room for savings. Consider examining monthly transactions to identify patterns. It's not uncommon to find frequent, small purchases—like daily coffee runs or impulse buys—that don't add much value to your life in the long term. Adjusting these habits by opting for at-home coffee or limiting certain expenses to weekends, for instance, can lead to noticeable savings.

Moreover, subscriptions can be a quiet drain on your budget. With so many digital services available, it's easy to accumulate subscriptions that no longer serve you. From streaming platforms to premium apps, you may find that certain services need to be updated. Cutting back or downgrading your subscription tiers could free up extra cash without impacting your quality of life. This small act of decluttering saves money and creates a more intentional spending pattern.

Prioritize Needs Over Wants

Shifting focus from wants to needs is a foundational principle in smart budgeting. This doesn't mean cutting out everything you enjoy but putting financial priorities first. Many find it helpful to set a rule around purchases: if it's unnecessary, wait 24 hours before making a decision. Giving yourself that window often allows you to distinguish between something you genuinely need and something driven by impulse.

Additionally, defining what constitutes a "need" versus a "want" can vary greatly. A straightforward approach is to consider needs as items or services that directly support your well-being or essential responsibilities. Wants, on the other hand, are typically luxury or non-essential items. Establishing this mindset around spending can lead to healthier financial decisions and make it easier to stick to your budget.

Consider Interest as a Hidden Opportunity

Once you've found ways to curb expenses, it's essential to consider how to grow the extra cash you've freed up. This is where interest can become a valuable ally. Placing money in a high-yield savings account or other interest-bearing options can make your money work harder passively. Interest allows you to benefit from allowing funds to sit in certain accounts.

One tool to understand this benefit is an interest calculator. It estimates how much your money could grow over time if you leave it in an interest-earning account. While interest calculators are just one example of financial tools, they're instrumental in helping you visualize the power of compounding. This simple calculation could open your eyes to the potential your savings hold, even if they start small. Keeping funds in an account where they can grow independently instead of spending impulsively can be a gradual yet powerful way to improve financial security.

Making Adjustments as Your Financial Goals Evolve

Personal finance is never a one-size-fits-all process, and budgets may need adjusting as your needs change. When goals shift, revisiting your budget and aligning it with your new objectives is essential. Regularly reassessing your budget ensures that it serves your priorities, whether saving for a major purchase, planning for retirement, or building wealth.

Re-evaluating doesn't mean starting from scratch each time. Instead, it's about fine-tuning. For instance, if you've successfully paid off a debt, redirect those funds to other areas of your budget that could use strengthening, such as investments or additional savings. This approach maximizes every dollar and keeps your finances fluid to match your needs.

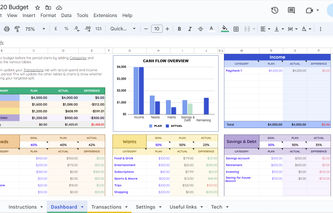

Leverage Budgeting Tools to Track and Analyze Spending

Budgeting tools have come a long way, providing visual breakdowns of where your money goes each month. Setting up a budgeting app or even a simple spreadsheet can simplify your financial landscape. These tools help track large and small expenses, offering insights that are only sometimes obvious when looking at a bank statement. By categorizing costs, you'll see where small adjustments could free up extra cash.

Along with tracking, analyzing your spending data is equally valuable. Reviewing where your money has gone over the past few months can help you spot trends that might hold you back financially. For example, you might discover that food delivery or online shopping expenses make up more of your budget than you expected. With this knowledge, you can consciously reduce these expenditures to save more each month.

Find Creative Alternatives for Big Expenses

Another way to make your money work harder is to re-evaluate large purchases or recurring expenses. Regarding big-ticket items, look for ways to get what you need at a lower cost. For example, if your transportation expenses are high, consider whether public transit, carpooling, or a mix of alternative options could provide savings. Even renting a vehicle on occasion might be more economical than owning one if you don't drive frequently.

Likewise, housing expenses are often the biggest in anyone's budget, but there are ways to save without sacrificing comfort. Roommates, for example, can significantly reduce rent costs. If renting isn't an option, smaller adjustments like negotiating utility bills, opting for energy-efficient appliances, or even making DIY repairs can all help save money on living expenses.

Automate Savings to Build a Financial Cushion

Once you've made the adjustments needed to find extra cash in your budget, putting those funds to work is crucial. Automating your savings is a reliable way to ensure every bit of extra money is set aside for future needs. Many banks allow you to set up automatic transfers from checking to savings on a specific day each month. This small step ensures that savings grow consistently without relying on willpower alone.

Building an emergency fund is a sensible first step for your savings. A solid financial cushion can reduce stress and provide a safety net in case of unforeseen expenses. Think of it as a way to turn your budgeting efforts into long-term security. This approach boosts your savings and makes it less likely that you'll need to dip into other funds if unexpected costs arise.

The Importance of Financial Awareness

Staying aware of your finances is the simplest way to avoid unnecessary expenses and keep your budget in check. Regularly reviewing your spending and savings habits helps maintain control over your money and keeps you informed about where adjustments may be needed. Financial awareness isn't just about numbers; it's about understanding the balance between what you earn, save, and spend.

When you're conscious of your financial state, your decisions tend to align better with your goals. This sense of control can be incredibly empowering, fostering a sense of financial independence from intentional, informed choices.

Concluding Thoughts

Finding extra cash in your budget isn't about deprivation—it's about making conscious decisions that align with your long-term goals. By examining your spending, leveraging available tools, and seeking creative ways to save, you can unlock potential within your budget that may go unnoticed. Making money work harder is rewarding, bringing clarity and security that ripple through all areas of life. Whether you're just starting or are already managing finances with intention, these practices create a foundation for a more secure future.

.jpg)

.jpg)