Budgeting is like a Chinese massage—scream-out-loud painful while you’re doing it, but oh-so-satisfying once it’s over.

Truthfully, budgeting isn't that bad, especially once you get the hang of it (the same may be true for Chinese massages—but I’m not going back!). But the benefits of budgeting far outweigh the dread of sitting down and planning out your spending. To make it even less painful, we’ve created one of the best budget calculators out there.

Our spend calculator will help you—

Understand your monthly income.

Calculate your ideal spending based on a percentage of your salary.

Lay out your budget into various spending categories.

Budget by day, week, month, or year.

Track your spending vs. your budget.

Click the “Start Now” button below if you absolutely can’t wait to get started with your own fully-featured monthly budgeting calculator. (The link will take you to our store. With a small investment, you can start working on your budget immediately.)

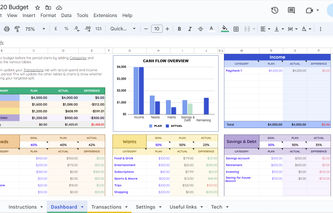

Simple, quick, and easy monthly budget template for Google Sheets and Excel.

With this template, you will get:

Pre-set expense categories

Simplified dashboard and day-by-day monthly tracker

Automated charts for comparison

Day-by-day views for budgets and actual spend

This tool has already been impressing readers—Kaitlin purchased this budget sheet, and gave it a 5 out of 5 review. This is what she had to say: “Awesome! So excited! Thank you!”

Get your budget calculator now—or continue reading to explore more about what this tool can do for you.

And be sure to check out our articles below to further guide you with your budgeting and saving:

What Are The Top Budgeting Methods?

What are the best budgeting methods out there? (And which does our household budget calculator use?)

50/30/20 budget rule

The 50/30/20 budget method is becoming the most popular these days. It’s simple, easy to remember, and to follow. With this method—

Spend 50% of your money on essentials (housing, transportation, clothes, and utilities).

Put 30% of your money toward your wants (entertainment, restaurants, toys, and so on).

Save the remaining 20% for the future (both short- and long-term).

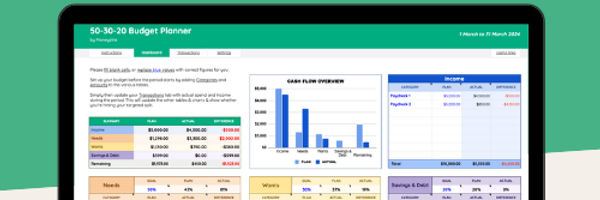

50/30/20 budget template perfect for beginners!

A few key features of this template:

Only includes the things you need – no unnecessary tabs

Included clear instructions

Pre-filled with sample data

Fully customizable to your needs

Zero-based budgeting

Too many people plan out how to meet their essentials, and have absolutely no plan for the rest of their money.

Inevitably, the additional money gets spent on food, nick-knacks, parties, and a novelty T-shirt for your wife that says, “I’m not bossy. I’m aggressively helpful.” (This didn't go over well, by the way.) The point is—if you don’t plan out every dollar, your money will fizzle away.

Instead, with zero-based budgeting, you divvy out your remaining income into categories like savings, retirement, or even “blow money” (so you have a fund that you can spend on whatever). This way every dollar gets planned out.

Read more:

What about our budgeting calculator? What method do we use?

How is our calculator set up—and with what methodology? We combined the above rules.

With our Excel budget calculator, you’ll plan out every dollar—and the recommended spending categories are modelled after the 50/30/20 principle.

Look at our preview images, and see for yourself.

Why Is Budgeting Important?

What’s the point? Why budget? (Will it help you that much?) As a man that has paid off over $100,000 of debt before turning 30, let me tell you—while budgeting isn’t sexy, fancy, or even all that fun—it flat-out works.

It puts you in control of your money

If you don’t budget, you get to the end of the year, look at your annual pay stub, and wonder, “Where did all that money go?” If you put together a budget at the beginning of the year, you’ll be telling your money exactly what it’s going to do for you (rather than leave you scratching your head, wondering where it all went).

Want to save money for your kids’ college?

Want to fulfil one of your bucket list ideas and take that vacation to Hawaii?

Want to put money into retirement?

—then put it in your budget!

Ever heard of “Where there’s a will, there’s a way”? Whoever said that wasn’t totally correct. I’d update it to say, “Where there’s a will and a plan, there’s a way.”

It gets couples on the same page financially

Some people have called into the Dave Ramsey show, telling Dave he saved their marriage. No, Mr. Ramsey isn’t a marriage counsellor—but he does push people to get on the same page with their money. This simple thing has calmed down many rocky marriages.

Make a budget with your partner and agree on it—you’ll be amazed how much life can improve when the money side is figured out.

It makes you aware of your spending habits

Stand up and walk over to the nearest wall. Jump up—and touch the highest spot you can. Nice job. Was it any good? Seemed like it. But you have no idea—because there’s nothing to compare it to.

But what if you’ve done this exercise before? And what if you estimated how high you could jump before taking that leap today? Then you’d have a better idea of how good that jump was. The same is true for budgeting.

First, make an estimate—then see what you can do. Most people come up short of their expectations, but that’s totally fine! At least now you know—and you can improve on your performance. Without creating a budget, you’ll just continue spending and wondering if you’ll have enough.

It leads to unexpected savings

This was my biggest surprise when I physically wrote my budget and spending on paper—

“I spend what on my phone bill? When did that happen?”

“Does my car insurance really need to be $150 a month? I wonder how I can get that down.”

“I didn’t realize food was costing me so much. Maybe I can cut back on something.”

With that simple reflection exercise, I reduced my budget to just $460 a month (not counting annual expenses like home insurance and property tax). It was absolute insanity—but it was all possible because of budgeting.

Our Budget Calculator Tools

We currently have two budgeting calculators available:

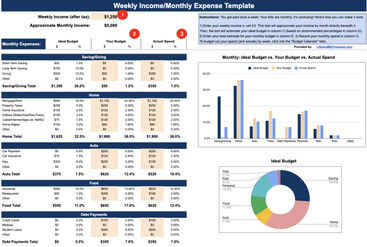

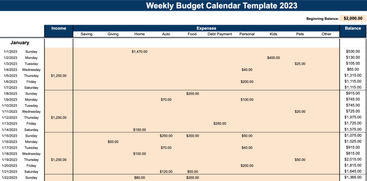

Weekly budget calculator

This spreadsheet is best for those that get paid weekly.

Simply enter your weekly paycheck into the tool, and it automatically translates it into a monthly income. From there, you can plan out your expenses by month in the main tab, or—if you want to get more detailed—you can plan out your spending by day, week, month, or year with the 2023 calendar tab.

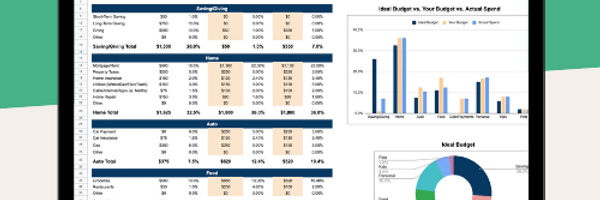

Weekly budget main page:

Weekly budget calendar view:

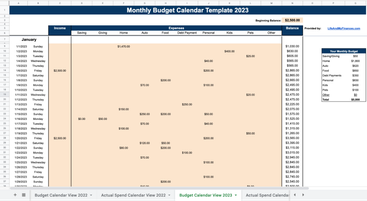

Monthly budget calculator

If you’d rather have a monthly budget calculator, we supply that for you as well. The look and feel are very similar to the weekly tool above—but the inputs are simpler since you’ll be supplying your income and expenses with a monthly lens.

On the main page, you’ll input your income and immediately get a look at your ideal budget. Then you’ll enter your personal budget into the middle column—so that you can track your actuals against them as you spend for the month! Use the calendar view to detail out and track your budget by day.

Monthly budget main page:

Monthly budget calendar view:

Free Budget Calculators

We also offer a stripped-down version of both the weekly and monthly spending calculator. Basically, they’re spreadsheets that allow you to enter your estimates and spending by hand. They could still be helpful for those that aren’t comfortable with Excel, or don’t want to spend the $5 (even though most believe it’s well worth it!).

Free monthly budget calculator

Below you can see what the simplified budget template looks like. And here’s the link to the free monthly budget calculator download. (Again, nothing will fill in automatically—but at least this can get you started.)

Free weekly budget calculator

If you’re looking for the free weekly budget calculator download, we’ve got you covered there too. Once you click the link, the download will appear on the lower-left corner of your screen.

How to Determine and Estimate Your Income

Do you know how much you take home each month?

You might know how much you earn per hour—or your salary per year—but you likely don’t know exactly how much money you make each month. To find this is relatively simple, though—so there’s no need to worry.

If you earn a weekly paycheck:

Look at your bank statement, and multiply that amount by four to get your monthly income.

If you get paid bi-weekly:

Multiply that bank statement figure by two to get your monthly income.

(There will be a couple of months out of the year where you earn more per month—but it’s best to assume the minimum earnings per month when you’re first getting started.)

How to Estimate Your Budget Based on Your Income

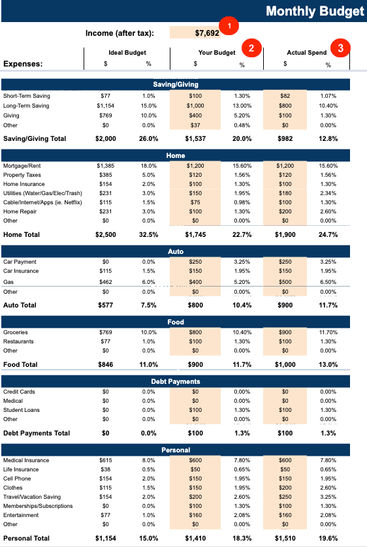

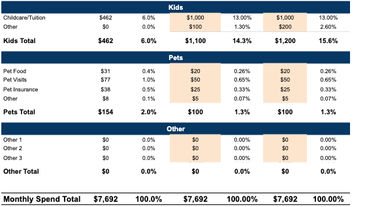

Wondering how to calculate each budget item? Now that you have your monthly income figured out, we can generate an ideal budget with our built-in budget creator. (Essentially, it’s a “budget percentages calculator.”)

To get your automatic budget breakdown, all you have to do is type in your income. Look again at the main page of the monthly expense calculator.

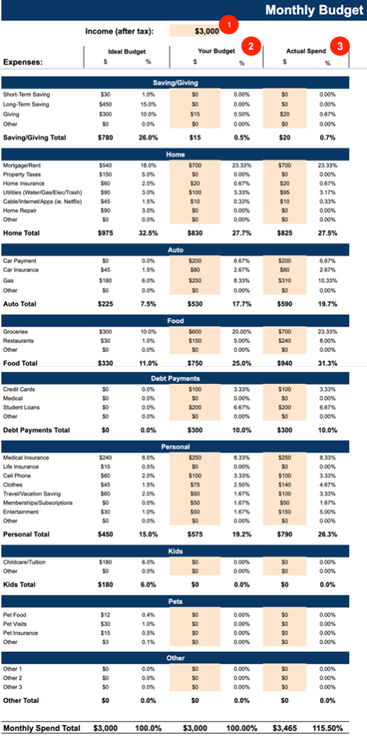

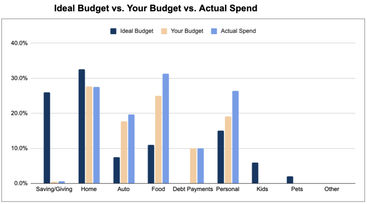

See theleft two columns that say “Ideal Budget”? This is your budget estimate.

The ideal budget is immediately generated when you enter your income—it’s based on a percentage of your income.

For instance, we recommend spending approximately 32.5% of your after-tax pay on your home (including the mortgage, property tax, insurance, utilities, cable, and any necessary repairs). So—we multiply your total income by 32.5% to get the “Home Total” line of your ideal budget.

Neat, right? Once you see your recommended budget, it’ll be so much easier to piece together your actual budget. Check it out!

How much should I save per pay check?

There are people out there that are literally searching, “How much should I be saving each month calculator?” This tool will do this for you automatically as well. (In fact, it’s the very first category of our online budget planner.)

Almost every financial expert recommends saving no less than 15% of your income for retirement. (On top of that, we recommend saving for the short term and giving some of your money away.)

In total, we recommend that 26% of your monthly income get stashed away or spread to those less fortunate. Before you freak out and say you can’t do that, try out the tool—we think you’ll be surprised.

How to Complete Your Budget Including Monthly Savings and Investing

So, how do you put all of this together? If you’ve already downloaded the tool, you’ve probably discovered that it’s actually pretty easy.

How to adjust the budget estimate to make it your own

As we already covered, you first enter your income—and your ideal budget will generate. From there, you’ll need to enter the budget that suits you best. How do you do this? Again, it’s not hard.

How to calculate your monthly expenses

To properly estimate your budget, you’ll first need to know what you typically spend from month to month. (Thankfully, your bank and credit card companies already track this for you.)

Log into your accounts, find your detailed transactions, and filter by the last year (if possible, extract the last few months).

Download the transactions as a .csv file—which can be opened into an Excel spreadsheet.

Put all your past spending into one sheet, and sort it by the date.

Boom—now you’ve got all your spending in one place. From here, go through the list and categorize each spend item (such as “cell phone,” “insurance,” “restaurant,” and the like). Now you can see what you’ve spent each month and in what category. Finally, look at each expense and category, and ask yourself:

“Do I really need to spend this?

Am I happy with this spending?”

If not—do what you can to cut that spend (or—at the very least—reduce it). Put the reduced amount into your future monthly and yearly budget. You can take this exercise anywhere you like—to budget monthly, weekly, yearly, or by paycheck.

Sample Budgets Based on Income

Need some more clarity? Examples always help.

Let’s review a few sample budgets—we’ll put together a family budget calculator and a budget breakdown of a25-year-old.

Family budget estimator

We’re going to put together a budget for a family of four making 100k.

First, let's be clear that the $100,000 is this family's salary after tax. To get four weeks' worth of income (the typical month), we'd divide $100,000 by 52 (to get the pay per week)—then multiply by four.

This family's monthly income is $7,692. Now we download the online budget calculator and enter $7,692 into the upper cell labelled "Income (after tax)."

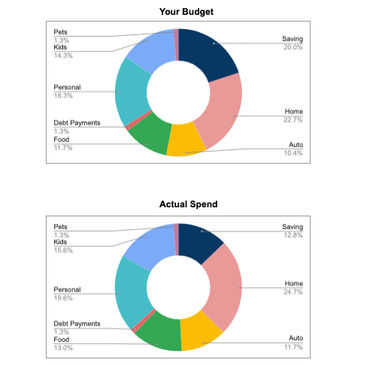

From there, the family budget is automatically calculated based on their income. We then took the liberty of putting some mock numbers into the "Your Budget" and the "Actual Spend" line—so you can see what it all looks like together.

As you can see, the ideal budget totalled $7,692, as expected. The personalized budget had fewer home expenses but a higher ratio of spending on auto, food, personal, and kids—this caused the saving/giving line to be less than the recommended 26%.

Finally, the actuals were higher than they thought (which is usually the case)—meaning they saved even less than they budgeted (and far less than the ideal budget).

Monthly budget for a single person

How about the budget breakdown for the 25-year-old? What would that look like? The process is the same—but the income would likely be less (say, $3,000 a month). Below is a sample of a monthly budget for a single income—

Read more:

How to Stick to Your New Budget

By now, you know precisely how these spending calculators work— Your bigger question is around how to actually stick to your budget.

This is quite astute of you—as this is the most challenging part of the budgeting process.

Anyone can use our tools and plunk some dollars into a cell—but how do you spend according to your plan? Understand that, at first, you won’t.

If you assume you’ll spend $5,000 a month—you’ll spend $5,800.

If you think you only spend $3,000 a month—you probably spend closer to $3,500 (or more).

The point is no one knows exactly what they're spending until they track it—so plan on your first few months being a little rocky. (That's okay—the important part is you're paying attention.)

Have a B-HAG: A big, hairy audacious goal

In other words, have a big reason for budgeting.

Do you want to retire with dignity?

Do you want to send your kiddo to college?

Or, maybe you’ve always been terrible with money—and this is a last-ditch effort to save your marriage.

All are noble aspirations. Whatever your reason, keep it at your forefront—and you’ll be more likely to stick with your budget.

(Is your B-HAG to save up money to send your kid to college? Check out our Free College Investment Calculator.)

Practice PDCA: Plan, Do, Check, Adjust

If you want to start killing it with your monthly budget sessions, you need to:

Plan out the month.

Do your best to stay within budget.

Check how you did at the end of the month.

Adjust your budget for the next month.

If you keep working it, and keep your eye on the prize, you’ll see some crazy success. (I can almost promise you that.)

Find a budget buddy

Ever get a gym membership and go for four days in January? (And then never again?) It’s easy to do the same with budgeting. That’s why—just like many of us need a buddy at the gym that encourages us to keep coming back—it would help if you have someone cheering you on with your finances too.

Find someone close to you that you trust. Tell them what you’re trying to do—and ask if they’ll do it with you. Who knows, it could be fun!

How to Increase Your Income or Decrease Your Expenses

When you budget for the first time, you’ll quickly realize that you don’t earn as much as you think—and you spend more than you think. Sometimes, the best way to work everything into your budget is by boosting your income and cutting some other expenses.

How to increase your income

Here are the top ways to earn more money:

If you believe you deserve a raise, ask for one.

Work toward a promotion.

Find a high-paying summer or part-time job.

How to decrease your spending

While it’s not as easy, it can often be more beneficial to reduce your spending instead of raising your income—because your savings aren’t taxed. (In other words, if you earn an extra $1,000 a month, it’s really only worth $700 after taxes—but if you save $1,000, you’re saving that full amount).

So, where can you save some big money? How can you make a real impact on your budget?

Downsize your house.

Sell your car if you’ve got car payments.

Cut out restaurant spending completely.

Sell anything you don’t need.

Cut your cable.

.jpg)

.jpg)