Our Verdict

Plus500 can be a good choice for retail futures traders, particularly beginners who value access to the most commonly traded markets. It is a reliable platform, with a transparent fee structure and relatively affordable trading fees. The standout features for us are its free demo account and risk management tools.

What it can’t do is provide you with a diversified trading experience across global and emerging markets, or give you the sophisticated analytical tools to develop complex strategies.

Who is it best for?

Plus500 is best suited to futures traders with a focus on major markets looking for an easy-to-navigate platform, with minimal fees.

Pros

- Trusted, and 100% legit broker

- Beginner-friendly and easy to use

- Competitive trading fees

- Risk management tools

Cons

- Strong focus solely on the US market

- No variety of account types

- No portfolio management features

- No advanced analytical tools

Investment Products

In the US, Plus 500’s investment product offerings are limited to futures contracts. Let’s dive into what you can trade on this platform.

Pros

- Diverse variety of futures markets

- Micro and mini contracts

- Free demo account

Cons

- Small number of instruments, compared to some competitors

- The absence of certain markets, like individual stock futures

- Large focus on major markets

Assets Available

While limited to a single instrument type, Plus500’s offer for US users is still pretty diverse, providing access to more than 50 futures contracts, spanning various asset classes, including crypto, agriculture, metals, forex, interest rates, energy, and equity index assets.

Derivatives

To gain better insights into Plus500’s derivative products, we will have a closer look at each of its future contracts individually and discuss them in detail.

Crypto Futures

Plus500's offer of crypto futures is quite limited, focusing solely on Micro Bitcoin and Micro Ethereum futures. Traders who want to diversify their cryptocurrency portfolio beyond these two options might find this selection restrictive.

However, for beginner traders who haven’t dealt with cryptocurrency futures before, Plus500's limited selection can be advantageous. It simplifies the learning process by focusing on two of the most well-known and traded cryptocurrencies.

Agriculture Futures

Regarding its agriculture futures, Plus500’s offer is still a bit narrow compared to other platforms, but it is slightly wider than what it offers for crypto. Plus500’s traders can speculate on the prices of eight of the most popular agriculture commodities, including

Soybeans

Corn

Wheat

Soybean meal

Live cattle

Soybean oil

Feeder cattle

Lean hogs

If you are looking for a platform that will allow you to engage in a comprehensive commodities trading experience we suggest you look elsewhere. But if you are just looking to diversify your trading beyond traditional asset classes, Plus500’s offer should be enough.

Metal Futures

Plus500’s selection of metal futures includes the major metal commodities and allows speculating on the price of some of the most commonly traded metals in the commodities market, including:

Gold

Copper

Micro Gold

Micro Copper

Platinum

E-mini Gold

Silver

While far from the most extensive list, Plus500’s offerings in terms of metal futures will be good enough for most traders. But for traders who are looking for a broader array of metals, including lesser-traded and more specialized commodities like palladium, aluminum, or zinc, Plus500 will not meet the expectations.

Forex Futures

Like most of its offerings, Plus500’s selection of forex futures also focuses on the most traded currencies, rather than providing a huge variety of futures. Currently, the platform gives users access to 13 forex pairs, including major pairs like USD/EUR, USD/GBP, USD/CAD, and USD/AUD.

Beginner forex traders, as well as those who are experienced but prefer the major pairs would find the Plus500 offer sufficient. However, traders who specialize in trading minor and exotic pairs should avoid Plus500, as there are so many other platforms online that provide a significantly larger variety.

Interest Rate Futures

Plus500 provides users with access to only two interest rate futures contracts, the 30-Day FedFund, and the Micro 10-Year Yield. These futures may be enough to gain exposure to major interest rate movements, but compared to the competition, Plus500’s offer seems limited.

Several other trading platforms offer a broader range of interest rate derivatives, including a variety of government bond futures, short-term interest rate futures, and other related instruments, which can cater to more sophisticated and diverse trading strategies.

Energy Futures

Traders who use the Plus500 platform to trade energy commodity futures have access to a total of nine assets:

Micro WTI Crude Oil

Brent Crude Oil

Crude Oil

Heating Oil

Natural Gas

E-mini Natural Gas

RBOB Gasoline

E-mini Crude Oil

Micro Natural Gas

This selection is tailored towards the more mainstream and widely traded energy markets, meeting the criteria of most traders. Plus500 may not have the widest range of energy futures, but the platform still allows traders to speculate on the price movements of some of the most heavily traded and essential energy commodities in the market.

Equity Index Futures

In terms of equity index futures, Plus500’s offer provides users with access to 10 key global indices, including S&P 500, Nasdaq 100, and Dow Jones. These futures present a good opportunity for traders to engage with the broader stock market movements without investing in individual stocks.

That said, while Plus500's selection covers the most prominent and widely followed indices, it may be considered limited compared to other platforms. Some brokers offer a more extensive range of index futures, including regional indices, sector-specific indices, and other niche market indices that give traders a wider scope for diversification and strategy development.

Market Reach

Plus500's futures trading platform primarily focuses on the American market, which is evident in the range of futures products it offers, such as S&P500, NASDAQ100, Bitcoin, EUR/USD, Oil, and Gold.

While Plus500 is a global multi-asset fintech group with a presence in over 50 countries, the futures trading services for U.S. users are provided through Cunningham Commodities LLC, a registered futures commission merchant in the US.

In other words, while Plus500 has a broad global reach in other aspects of its operations, its futures trading services for U.S. users are more concentrated on major markets and instruments relevant to the US financial landscape.

Account Types

While the Plus500 platform has a range of account types available for users elsewhere, users from the US can only create a demo account, or a live trading account.

Plus500 Futures Demo Account

The Plus500 demo account is completely free to create and use. It allows traders to simulate real live trading without actually investing money and it is a great way for beginners to test out the platform without any risk.

What’s great about Plus500’s demo account is that the platform doesn’t place any limits on how much the user can practice trading, using the demo account. Other platforms impose certain time limits, or charge monthly fees for the usage of their demo accounts, which is not the case with Plus500.

This is a huge positive for the platform. We recommend anyone looking to learn the ropes, or test out a new strategy involving futures trading, should try out the demo account. It costs absolutely nothing, but can be a great experience.

Plus500 Futures Live Trading Account

Plus500’s live trading account is also free to create, but trading with it will come at costs that we will discuss more in detail further down the article. It is a one-for-all account, and it gives access to all the derivative products we discussed earlier. To open the account, traders need to deposit a minimum of $100 which is quite a low requirement, compared to the competition.

Overall, with its modest deposit requirement of $100 and the access to the diverse variety of markets it provides, the Plus500 live trading account presents an attractive opportunity for novice traders, facilitating a seamless and inexpensive entry to futures trading.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | Trading in futures and options carries substantial risk of loss and is not suitable for every investor. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments. NFA ID number 0001398. |

Features

The following section will dive deeper into Plus500’s trading tools and features, as well as the platform’s research and learning materials offerings.

Pros

- Great charting tools

- Multiple stop order types

- Unlimited demo account

Cons

- Scalping is not allowed

- Limited research offerings

- No real newsletter or trading recommendations

Trading Tools

Plus500 provides some useful trading tools to meet the needs of the average trader. Advanced traders may find the tools a bit lacking, as there is no social, copy, or algorithmic trading and no asset screeners.

The tools that are available are discussed below.

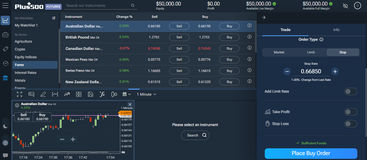

Charting

Plus500’s charting capabilities are a standout feature of the platform. Charts are available in a variety of time intervals from 1 week to 1 minute, as well as tick charts. You can personalize your charts with more than a dozen chart types and more than 20 drawing tools.

There are 98 different technical indicators available, which should meet the technical analysis needs of any trader. A really useful aspect is the multiple charts view, which lets you monitor up to 9 different charts on the same screen.

What’s more, you can save your chart layouts so you can easily return to them in your next trading session.

Order Types

Plus500 provides multiple order types, though not as many as you’ll find on some competitor platforms.

You can create a market order, limit order, or stop order. There are also options to add take profit and stop loss levels.

Plus500 may be missing some more advanced order types, such as trailing stop losses and Once Cancels the Other (OCO) orders, but what it does offer should suffice to meet the needs of most beginner and intermediate traders, as long as they don’t have more complex and specific strategies.

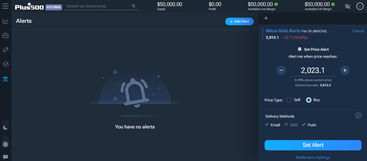

Watchlists and Alerts

If you want to keep an eye on certain instruments, Plus500 provides the tools you need. You can add your favorites to a watchlist so you’ll easily be able to view them as soon as you log in.

It’s simple to set up alerts as well—just click on the bell icon next to your chosen instrument. You can set alerts for certain prices, but unfortunately not for price changes or buyer sentiment.

If your alert is triggered, you’ll be notified by email, SMS, or push notification, depending on your settings.

Market Research

When it comes to research, Plus500’s offering is pretty non-existant compared to other trading platforms. You won’t even find an economic calendar on Plus500.

There’s no in-house market or fundamental analysis provided. Moreover, it doesn’t give its users access to third-party publications from reputable entities such as Morningstar, or the Wall Street Journal, which is the case with some other brokers.

Educational Materials

Like most other online brokers, Plus500 also provides its users with learning materials and resources where they can learn more about trading with the platform, as well as trading in general. While they are not the most comprehensive educational offerings out there, they can definitely be of help, particularly for beginners.

On Plus500’s website, users can navigate to the Trading Academy, a page dedicated to learning trading, where they can find the educational ebooks and videos. We were impressed by the videos as they were really well done – short, concise, and informative.

However, in our opinion, the best way to learn to trade on Plus500’s platform is to use the free demo account and practice. Unlike most other brokers, Plus500 doesn’t place limits on how long you can use the demo account, and beginners can try everything out before risking any capital.

Fees

Now, let’s have a look at Plus500’s fee structure, what its users are expected to pay for when trading, and whether or not it is an affordable broker.

Pros

- Competitive trading fees

- No inactivity fees

- No deposit or withdrawal fees

- No hidden fees

Cons

- Auto-liquidation fees

Plus500 Trading Fees

The Plus500 futures trading platform charges specific trading fees based on the type of contract. There is a commission of $0.49 per micro contract and $0.89 per standard contract (per side). Although these fees apply every time a trade is executed, they are still quite competitive compared to what other brokers charge.

Additionally, Plus500 charges an auto-liquidation fee of $10 per contract, which is applied if a trader has not offset or rolled their position before the contract expiration.

Overall, Plus500 has quite a simple and transparent fee structure that we appreciate greatly. We’re sure that traders will also appreciate the affordability and straightforwardness of the broker that doesn’t charge any hidden fees and let’s users know what they will pay, upfront.

Plus500 Non-Trading Fees

Plus500 is also quite affordable in terms of non-trading fees. The platform does not charge any inactivity fees, data fees, platform fees, or routing fees. Additionally, Plus500 users don’t get charged for deposits and withdrawals.

To sum it up, if you are concerned about the cumulative effect of various non-trading fees, you can rest assured that they are not an issue with Plus500.

How Does Plus500 Make Money?

Plus500 does not charge its users any subscription fees, and all the money the broker makes is through its transparent commissions.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | Trading in futures and options carries substantial risk of loss and is not suitable for every investor. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments. NFA ID number 0001398. |

Usability

In the next section, we will discuss the functionality of the Plus500 platform, its ease of use, availability, and other important information regarding its usability.

Pros

- Easy to use

- Simplistic and straightforward design

- Available on Android and iOS

Cons

- Lacks advanced functionality and customization options

- No real portfolio management features

Plus500 Web Trading Platform Review

The Plus500 web trading platform is very straightforward. It’s easy to get started with and use for both experienced and less-experienced traders. It focuses on providing you with the most important information, but lacks advanced features.

Is Plus500 beginner friendly?

Plus500 is as beginner-friendly as a futures trading platform can be. Futures trading is a complex and risky endeavor, but Plus500 tries to make things clear with its straightforward and simplistic interface and trading tools.

Additionally, the platform gives beginners access to its trading academy, where they can learn more about trading with Plus500. Combined with the demo account, Plus500 can be a beginner-friendly broker for novices willing to learn.

Plus500 design and navigation

As soon as you launch the Plus500 web trading platform, you will notice that the people who designed it were going for simplicity rather than aesthetics. It is not convoluted, brings out the most important information at the front, and navigating it is easy from the first try.

The platform provides essential trading tools and allows users to monitor trades, analyze charts, and create watchlists. Compared to the popular Meta Trader 4, Plus500’s platform offers significantly less functionality and customization options, making it much easier to use.

Login and security features

Logging into your Plus500 is easy and supports both two-factor authentication and biometric authentication on mobile devices. You can enable login through Facebook or Apple as well as with your email, if you prefer. You can also enable notifications of logins.

Search functionality

The Plus500 platform provides users with quick and easy access to any instrument they might be looking for through its search bar, located on the upper left side of the platform. Alternatively, you can select a watchlist, asset type, or category on the left to see a list of relevant instruments.

Alerts and notifications

Plus500 offers a free notifications service that sends alerts and notifications when a user opens or closes a position, their order expires, they’re auto-liquidated, they receive a margin call, or when an instrument reaches a certain rate.

Portfolio management

While Plus500 offers basic information in real time about the user’s account, transactions, balances, and profit/loss breakdowns, it doesn’t provide any noteworthy portfolio management tools or features.

Earning reports & fees breakdowns

Users can use the Plus500 platform to generate reports of their profits, losses, closed positions, and other account activity for the current year, or any other particular time frames, and receive them via email.

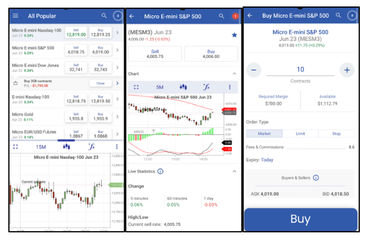

Plus500 App Review

The Plus500 platform is available on both Android and iOS devices through its native apps for both operating systems. Just like the web platform, the apps focus on making things easy and clear rather than providing tons of functionality.

That said, the apps do a great job. They can be used to open and close positions, set orders, monitor and analyze charts, set alerts, send notifications, and do essentially all the things that mobile traders need.

You’ll get pretty much all the same features in the app as you do on the web platform, so Plus500 is a good choice for users who want to trade on the move without sacrificing functionality.

Mobile Charts

This is an area where Plus500 excels. Many trading platforms don’t provide advanced charting tools to mobile users—you’re often lucky to get just a simple real-time line graph.

The Plus500 app, however, provides all the same chart styles, time intervals, drawing tools, and 98 indicators that you’ll find on the web platform. The only way in which the mobile charts fall short of the web charts is that the app doesn’t have a multi charts view for looking at instruments side-by-side—which is understandable on a small mobile screen.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | Trading in futures and options carries substantial risk of loss and is not suitable for every investor. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments. NFA ID number 0001398. |

Customer Satisfaction & Reputation

In this section, we will discuss the overall reliability of Plus500 as well as how happy its users are with the broker’s platforms on PC and on mobile.

Pros

- 100% legit and trustworthy broker

- Overwhelmingly positive reputation online

Cons

- No phone support

- Limited security settings

Safety & Regulations

Plus500 is a well-established and trusted broker, regulated by the proper authorities in every country it operates. It provides its users with a trustworthy trading environment and takes the necessary precautions to protect their funds in unfortunate scenarios.

Is Plus500 regulated?

In the United States, Plus500 is registered as a futures commodity merchant with the CFTC. The broker is also a member of the NFA, and the CBOT.

The broker’s subsidiaries are also authorized and regulated by many other regulatory authorities around the world. These include:

FCA (UK)

CySEC (Cyprus)

ASIC (Australia)

FMA (New Zealand)

FSCA (South Africa)

FSA (Seyshelles)

EFSA

MAS (Singapore)

FSA (Dubai)

Is Plus500 trustworthy?

Not only is it trustworthy, Plus500 is considered a leader among online trading platforms. The company holds client funds in segregated accounts and follows Anti-Money Laundering regulations. The broker also provides users with a range of risk management tools to help them protect themselves.

The company publishes its financial statements, annual reports, and transactions in its own shares. It is also committed to a range of ESG initiatives.

Plus500 may not offer as much in the way of security features as some competitors—for example, there’s no 2FA for opening/closing positions. But it does provide notifications and 2FA for logins, including fingerprint login for the app.

Plus500 Background

Plus500 is an international online trading platform, founded by six alumni of the Technion - Israel Institute of Technology in 2008. Today, it has subsidiaries in the USA, the UK, Japan, Australia, Israel, Singapore, Seychelles, Estonia, Cyprus, and Bulgaria.

The company went public on the London Stock Exchange in 2013, and it is currently a constituent of the FTSE 250 Index. Plus500’s current chairman is Jacob Frenkel, while David Zuria is the company’s CEO.

How Am I Protected With Plus500?

Plus500 doesn’t use its users' funds for investment purposes like hedging or any other business objectives. Instead, it keeps user funds in segregated accounts and administers them in accordance with the regulatory requirements.

The platform also uses SSL encryption to protect the data of its customers. Finally, Plus500 protects users from having negative balances through its margin call feature.

Customer Reviews

The online reputation of Plus500 is generally positive, with an overwhelming majority of users reporting they are happy with how the platform works on computer and mobile devices.

Plus500 reviews from Trustpilot

Plus500 has a great 4.1-star rating on Trustpilot. More than half, or 58%, of all 12,495 user reviews rate the broker as excellent, with five stars. However, we can’t overlook the large 15% portion of users who only give it one star.

Reviewers praised Plus500’s intuitive platform, prompt customer support, and demo account. However, some felt the platform could improve by providing more educational content and additional features such as Good Till Cancelled orders.

Plus500 App Store reviews

On the App Store, Plus500 has been rated 3.8 based on 38 ratings. Reviewers praised the easy account setup and navigation, as well as the low commissions.

Customer Service

The only way users can contact the Plus500 customer support and receive any sort of assistance is in writing. They can either use the live chat, or the contact form available on the Plus500 website’s Contact page, to contact the support team by email.

The lack of phone support is disappointing and means Plus500 lags behind full-service brokerages such as Hargreaves Lansdown or Saxo Markets in this respect. What’s more, Plus500’s agents aren’t available to answer the live chat 24/7.

Plus500 Alternatives to Consider

If you are not happy with a certain aspect of the Plus500 platform, some of the best alternatives to consider include:

NinjaTrader – Another broker that focuses on futures trading, NinjaTrader is an alternative for the more experienced traders looking for sophisticated analytical tools.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 0.0 | Visit |

eToro – For social trading and copytrading, eToro is not only an alternative better than Plus500, but easily the best platform for this particular purpose worldwide.

Interactive Brokers – In addition to futures, IBRK offers a broader range of tradable instruments, including stocks, options, and bonds, as well as advanced trading tools.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.1 | Visitinteractivebrokers.com |

Depending on your trading style and personal preferences, there is always the possibility that Plus500 may not be the ideal broker for you, and you should always research thoroughly before making a decision.

Should You Trade With Plus500?

Whether or not you should trade with Plus500 largely depends on your individual trading preferences and experience.

If you are new to trading, particularly futures contracts, and seek a straightforward, user-friendly platform with robust mobile support, Plus500 could be an excellent fit. Its simplicity, combined with a diverse range of the most popular futures contracts across various markets, appeals to beginners or those who prefer a no-frills trading experience.

However, seasoned traders and those looking for extensive research tools or a broad spectrum of tradable assets beyond futures contracts, might find Plus500 somewhat limiting. Weigh these aspects against your trading goals and conduct thorough comparisons with other platforms to find the best match for your investment needs.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | Trading in futures and options carries substantial risk of loss and is not suitable for every investor. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments. NFA ID number 0001398. |