Everyone that's driven a car understands that insurance is a good way to protect their investment. In fact, leasing agencies and lending institutions will usually require the purchase of an insurance policy to protect their investment too. After all, until that lease is up, or the car loan is paid off, those companies are part owners of the vehicle.

Automobile Insurance Policies

Since insurance companies have been regulated for a number of years, there is a great deal of standardized terminology used in car insurance policies. That's good news for the consumer because it makes comparing quotes easier.

| Additional Resources |

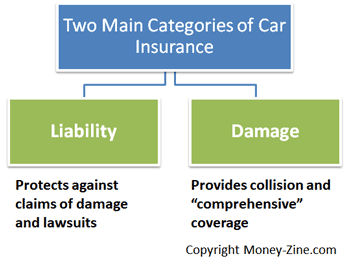

All automobile insurance carries offer consumers the opportunity to purchase two basic categories of coverage: liability insurance, and physical damage to property. In the sections below, we're going to take a closer look at how each type of coverage is structured.

Liability Insurance

Liability coverage provides for the reimbursement of damages the policyholder might have caused, and if they are found to be at fault. Within car insurance policies, there are two basic types of liability coverage:

- Bodily Injury: Protects the policyholder from claims and lawsuits by people who are hurt or are killed as the result of a car accident. This portion of the policy pays for the personal financial hardships the other party might be exposed to as a result of the injury.

- Property Damage: Drivers also need protection from claims and lawsuits brought by people that had property damaged by an accident.

Dollar Coverage

Each state has established a minimum value for the liability insurance drivers need to carry within a car insurance policy. This coverage is for the protection of other parties that are injured.

Minimum liability coverage generally starts around $50,000, and can be as high as $1,000,000 on most standard policies.

Personal Injury Protection

The personal injury protection, or PIP, pays for the policyholder's medical treatment as well as the treatment of others that are covered under the policy. This is a form of a no-fault insurance coverage. Personal injury protection is further divided into two types:

- Medical Expenses: Pays for the cost of providing medical care. Examples include hospital stays, doctor fees, and rehabilitation of injuries.

- Non-Medical Expenses: Pays for costs such as income continuation, paying someone to provide essential services such as cleaning a home, and even funeral expenses.

PIP insurance protection ranges from $25,000 to as much as $250,000 on a standard car insurance policy.

Physical Damage

There are basically two types of physical damage protection that a policy provides: collision, and comprehensive.

- Collision Coverage: Protects policyholders from damage that they cause to their car in the event of a collision. For example, if they were to hit a tree or found to be at fault in an accident. It's also possible to file a claim for damages caused by others. Under these circumstances, the policyholder's insurance carrier would then file a claim against the other party's carrier for the cost of the damages.

- Comprehensive Coverage: This component of the policy covers costs that occur when a car is stolen, vandalized, or otherwise damaged; except for those items covered under collision. It's termed comprehensive because that's what it is; it covers all the other insurance protection needed for a car.

Comprehensive and collision coverage are subject to deductibles, and the amount of insurance needed depends on the value of the car being insured. This brings us to our final topic: Figuring out how to compare insurance quotes.

Automobile Insurance Quotes

Unfortunately, not all car insurance policies are created equally. It takes careful study, and time, to make a fair comparison. On the positive side, it's easy for the insurance company to accurately determine the value of the car.

Vehicle Identification Numbers

For a new car or used car, an insurance company usually requires the car's VIN, or vehicle identification number. The VIN is a code consisting of numbers and letters that identify the car's make, model, engine option, assembly plant, and model year. Just by knowing a car's VIN, an insurance company can accurately place a value on the automobile.

Discounts and Factors Affecting Costs

When comparing quotes, make sure each company is providing the same level of coverage. This includes validating the deductibles paid are also consistent between policies.

Premium Discounts

In addition to the above, many car insurance companies offer discounts on premiums for the following:

- Safety Features: Companies may provide a discount for car safety features such as anti-lock brakes and air bags.

- Alarm Systems: Security features found in cars such as anti-theft devices reduce the likelihood of a car being stolen or increase the likelihood of it being found.

- Good Student Discounts: This is a reduction in the premium for students that rank in the upper 20 percent of their class, has at least a B (or 3.0) grade point average, or is on the Dean's list or honor roll.

Factors Affecting Cost

Finally, there are several factors that may affect the cost of insurance, including:

- Geography: Insurance companies use the applicant's address and match it against their statistics on car theft rates in the area.

- Use of Car: Will the car be used for commuting to work or pleasure-use only? The more miles driven each year, the higher the likelihood of an accident.

- Driving Records: This can include prior accidents, and the number of points on a driver's license that can be attributed to poor or dangerous habits.

- Credit Insurance Scores: Finally, the law allows insurance companies to develop what are called credit insurance scores. These scores can affect insurance premiums. The rationale behind this approach is simply this: Statistics show that individuals with poor credit are much more likely to file an insurance claim, which increases the carrier's cost to provide insurance.

About the Author - Automobile Insurance Basics

.jpg)

.jpg)