One of the ways college graduates can ease their financial burden each month is by selecting the appropriate repayment option. This is especially true if the former student is struggling to find a job after graduation. In this article, we're going to be discussing the options available to former students responsible for repaying their loans. As part of that discussion, we'll first talk about repayment timelines and the counseling available before leaving school. Then we'll describe the variety of repayment options available for each loan type.

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

Repayment Timelines

For most federal student loans, the repayment timeline starts six to nine months after graduation, leaving school, or falling below half-time enrollment status. This is a grace period granted with all federal loan programs. Borrowers also have the ability to select from several repayment options too.

Loan Counseling

As students leave school, they should be offered the opportunity to receive some form of counseling. This will describe the process of repaying student loans as well as the timeline, or term, of repayment. Unlike a car loan or a mortgage, a student loan is unsecured. The government cannot take back the degree earned; however, they do have some recourse that is discussed later on.

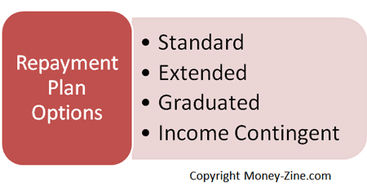

Direct Loans

The Direct student loan program provided by the Department of Education allows former students to choose from four different repayment plans including:

Standard Plan: fixed monthly payments of at least $50. Depending on the loan amount, the repayment term is up to 10 years.

Extended Plan: fixed monthly payments of at least $50. Depending on the loan amount, the repayment term is anywhere from 12 to 30 years.

Graduated Plan: payments start low, and then gradually increase over time. Depending on the loan amount, the repayment term is anywhere from 12 to 30 years. Monthly payments are "capped" at 1.5 times what the monthly payment would have been under the Standard plan.

Income Contingent Plan: payments are based on family size and the family's annual income. If income goes up, then so do the monthly loan payments. If the calculated monthly payments result in an outstanding balance after 25 years, the remainder of the money owed is forgiven.

This topic is discussed in more detail in our article: Direct Student Loans.

FFEL Loans

Student loans, such as Stafford loans, are repaid to a private lending institution. Each lending institution's plans can vary slightly from the information presented below:

Standard and Graduated Plan: the terms of these two plans are identical to those mentioned above for Direct student loans.

Income Sensitive Plan: payments are based on annual income under this plan. If income goes up, then so do monthly payments.

Extended Plan: only available to FFEL borrowers that received aid in excess of $30,000, and obtained their first loan before October 1998. Under this plan, the repayment schedule is increased up to 25 years.

Repayment Options

In addition to the traditional plans listed above, there are repayment options available to individuals that qualify:

Consolidation: if the borrower would like to manage just one loan, and perhaps even get a better rate of interest, they might want to consider consolidating the loan.

Discharge or Forgiveness Programs: in the event of a permanent disability or the passing of the borrower, it is likely the student loan will be discharged or forgiven. Teachers or childcare providers working in certain areas of the country may also be eligible for loan discharge or forgiveness.

Deferment: if faced with unemployment or another economic hardship, the borrower might be eligible for a loan deferment, which allows individuals to stop their monthly payments until the deferment period is over.

Failure to Repay

If the former student does not abide by the repayment schedule for their loan over a long enough period of time, they run the risk of being in default. Under these conditions, the lender and the federal government have a right to take action against the borrower to collect the money owed. The actions that can be taken include:

Financial Penalties: the lending institution can bring a lawsuit against the borrower demanding payment. The lender can also assess fines and late payment fees.

Forced Repayment: if the borrower is working, the government can take actions to have the money owed taken directly from a paycheck. This is sometimes referred to as garnishing wages. They also have a right to withhold income tax refunds, and apply that money towards an outstanding student loan.

Credit Reporting: notification can be sent to credit reporting agencies, which will affect the borrower's rating and / or credit score. A poor rating can make securing future loans, such as a mortgage, more difficult.

Ineligibility for Student Aid: former students that fail to repay their loans according to schedule may not be eligible for a loan if they desire to go back to school.

Additional information on the repayment of student loans can be obtained from private lending institutions or by visiting the Department of Education's website: Student Aid on the Web.