As tax time rolls past, parents may be wondering if the interest on a student loan is deductible on their federal income tax return. This article explains how to qualify, deduction rules, phase out limits, as well as providing links to the proper tax forms.

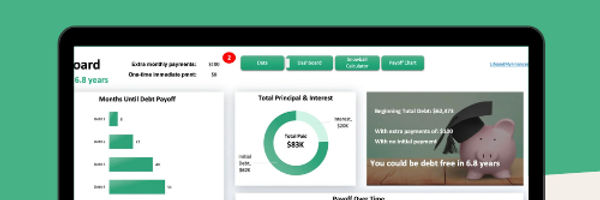

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

What Exactly is Student Loan Interest?

According to the IRS, student loan interest is defined as that paid during the calendar year on what are called qualified student loans. The interest can be both required by the terms of the loan, normal monthly payments, and any voluntary payments such as prepaid interest.

Qualified Student Loans

For the purpose of taking a student loan interest deduction on a federal income tax return, the loan must be associated with the expenses paid to an eligible educational institution. An eligible educational institution is defined as any college, university, vocational school, or any other type of postsecondary educational institution that is eligible to participate in a student aid program administered by the Department of Education.

A qualified student loan is one that was taken out to pay for the expenses associated with attending school. Expenses can include:

School tuition and fees

Room and board

Books, supplies, and equipment necessary to attend class

Other necessary expenses, including transportation costs such as student airfare

If the student is residing off campus, the allowance for room and board cannot be larger than the actual amount charged to live on campus, or any amount that was included as part of attending school. In other words, if the student lives in a luxury apartment that is twice the cost of campus living, a portion of the student loan would not be eligible for a deduction.

Student Loan Deduction Rules

We've read a lot of the IRS rules that apply to different programs, and it seems they attempt to balance simplifying the rules with fairness to taxpayers. Often this gets complicated by the real life scenarios that can take place. That being said, here is a summary of the most important tax deduction rules:

Maximum Deduction: qualifying taxpayers can take up to a maximum of $2,500 deduction on their tax return for student loan interest payments.

Qualifying Rules: to qualify for a deduction, the student loan must have been taken out for the sole reason of paying for qualified education expenses. In addition, the interest payment cannot be made from a related person or come from a qualified employer plan.

Qualifying Students: in order to take a deduction, the student loan must be for the taxpayer, their spouse, or a person they claim as a dependent. The student must also be enrolled at least half time in a qualifying program.

Double Tax Deductions

The second rule above is in place to prevent taxpayers from taking a double deduction on their taxes for student interest. For example, if they pay all, or some, of their student loan using tax-free distributions from a Coverdell Education Savings Account (ESA), then they need to reduce the deductible portion of the interest payment to account for the tax-free distribution.

In the same manner, taxpayers must reduce their qualified education expenses by the amounts paid for by employer grants, U.S. Savings Bonds, scholarships, student grants, or any other non-taxable payment or gift used, or received, to help repay the student loan.

The qualifying rules can also be translated in this way: Taxpayers cannot claim interest deductions for a student loan if they are claimed as a dependent by another taxpayer, or they are not legally obligated to make payments on the loan.

Phase-Outs and Limits of Student Loan Deductions

In 2020 / 2021, the limit or maximum a taxpayer can deduct on their return for a student loan is $2,500. Even if they qualify for a deduction, there is a phase-out schedule that is based on their modified adjusted gross income, or AGI. Generally, the phase out starts when AGI is over $65,000 ($130,000 married filing jointly) and the phase out ends when AGI is over $80,000 ($160,000 married filing jointly).

The exact phase out schedule for student loan deductions is shown in the table below:

Student Loan Tax Deduction Phase-Out

Tax Filing Status | AGI | Interest Deduction |

Single, head of household, qualifying widow(er) | Less than $65,000 | Full deduction |

More than $65,000 but less than $80,000 | Reduced deduction | |

More than $80,000 | No deduction | |

Married filing jointly | Less than $130,000 | Full deduction |

More than $130,000, but less than $160,000 | Reduced deduction | |

More than $160,000 | No deduction |

Tax Forms

If a taxpayer paid more than $600 on a qualified student loan, the lending institution (whether it be a financial institution, private lender, government agency, a college or university, or any other creditor) will send a Form 1098-E - Student Loan Interest Statement. Exact calculations for student loan interest deductions, and the associated income tax forms, can be found in the IRS Form 1040 instructions worksheet on the IRS website.