Service payback and loan forgiveness programs can help former students that are struggling to pay back their loans. These programs are designed to attract individuals to serve in certain jobs, or work in regions of the country, that are experiencing a shortage of talented workers.

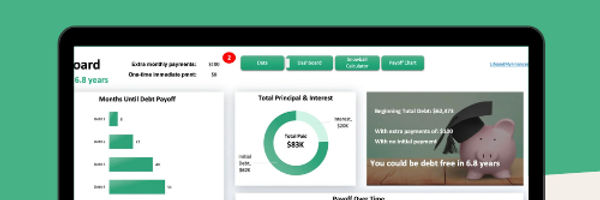

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

Loan Forgiveness Programs

The first program of this type dates back to the National Defense Student Loan Program of 1958. This program was aimed at increasing the enrollment of students willing to be public school teachers. Today, these programs have expanded into new categories of borrowers, and new ideas continue to be introduced into Congress.

Loan forgiveness and service payback programs are really just a variation of a work-contingent financial aid program. For example, service payback programs cover all, or a portion, of a student's costs if they agree to work for a specific period of time in a certain field or job after completing their education. These programs pay for a student's expenses while they are attending school.

Forgiveness versus Service Payback

A loan forgiveness program will repay a percentage of a former student's educational debt in exchange for work in a designated job. Unlike service payback, which pays for educational expenses while the student attends college, forgiveness programs payoff a loan after a student starts working full time.

DOE Programs

As part of the Higher Education Act (HEA) of 1965, and its amendments of 1998, both teachers and childcare providers were eligible for loan forgiveness through the Department of Education. These provisions applied to outstanding interest and principal for holders of unsubsidized Stafford Loans obtained through the Federal Family Education Loan (FFEL) Program as well as the William D. Ford Federal Direct Loan Program (Direct Loan).

Programs for Teachers

The teacher programs are offered through FFEL and Direct Loans. They provide up to $5,000 in forgiveness after five consecutive years of full time teaching. The teaching position must be in a low income, public or private non-profit school, which is district eligible for Elementary and Secondary Education Act (ESEA) funding.

A low income community is defined as one in which 70% of the population earns less than 85% of the state median household income. Only new borrowers as of October 1, 1998, with no outstanding loan balances, are eligible for this program. Former students must also have accrued at least five years of consecutive teaching before they are entitled to receive this money / award.

Childcare Providers

Eligible childcare providers must have a degree in early childhood education and work in a child care facility that meets state or local requirements, provides for children five or younger, and serves a low income community. After the second consecutive year of employment, forgiveness is provided at a rate that is 20% of the outstanding loan balance annually. After each of the forth and fifth years, 30% of the principal balance is forgiven.

As was the case with teachers, only ex-student borrowers as of October 7, 1998 are eligible for this program. If funding is not sufficient to forgive all of the eligible applicants, then awards will proceed on a first-come, first-served basis. Priority will be given to borrowers receiving funding under this program in prior years.

Campus-Based Programs

The following forgiveness programs are campus-based. This means the loans originated with colleges and universities, and were made to students based on demonstrated financial need.

Perkins Programs

In addition to the federal programs mentioned earlier, there are Perkins Loan programs for ex-student borrowers who work in specific public service jobs. These programs pay up to 100% of the outstanding balance for:

Full-time teachers serving elementary or secondary schools in low income areas

Head Start staff persons

Full-time special education teachers or qualified providers of early intervention services for the disabled

Members of the Armed Forces serving hostile areas

Peace Corps volunteers

Full-time law enforcement or corrections officers

Full-time teachers in shortage areas

Full-time nurse or medical technicians

Full-time employees of providers to high risk children and families in low income communities

Anyone planning to enter these, or similar fields, should review the details of these programs. It's a win-win situation, since the student's education is being paid for by the federal government, and the areas in-need get the attention they deserve.

Federal Programs

In addition to Department of Education and campus-based programs, there are some fairly large federally funded programs, which apply to specific groups of federal employees, or ex-students that are involved in specific occupations.

Military Employees

The military has several loan forgiveness programs that can help students pay for college in exchange for military service. This includes ROTC scholarships, as well as:

Army's College Loan Program: will forgive one-third of approved student loans for each year of full-time duty served, up to a maximum of $65,000.

Navy's Loan Repayment Program: offers students repayment for up to $65,000 for full-time duty soldiers who have no prior military service, a high school diploma, and a qualified loan.

Air Force College Loan Repayment Program: offers up to $10,000 in payments to eligible recruits.

Civilian Employees

Federal agencies can use incentives up to $10,000 per year for up to $60,000 in payments towards student debt. In return, the employee must usually agree to work at least three years for the agency, which may use these offers to recruit new employees.

Health Care Workers

Medical and Health Researchers and Professionals can apply for loan forgiveness through the National Institutes of Health, which runs several programs. The purpose of these programs is to attract research persons to the NIH. In exchange for repayment of up to $70,000 of education debt, the student commits to working at least 20 hours a week for two years.

The National Health Service Corps (NHSC) has both student loan forgiveness as well as a service payback program. The purpose of these programs is to encourage health professionals to work as primary health providers in certain areas of the country where health professionals are in short supply. Per sources, 233,320 Americans were eligible for student loan forgiveness under the PSLF program.

The NHSC will pay up to $50,000 in outstanding student loans in exchange for two years of service. Specifically, recipients need to sign a contract agreeing to provide two years of clinical service in one of the identified shortage areas.

The Nurse Reinvestment Act, which was signed into law on August 1, 2002, established a service payback program that provides a scholarship to nursing students. Under this program, nurses must agree to work in a nursing facility for a pre-determined period of time.

Volunteers

In addition to the Peace Corps volunteer program mentioned earlier, members of AmeriCorps, the National Civilian Corps, and Volunteers in Service to America (VISTA) are eligible for education awards that can be used to repay student loans.

One term of service is required to qualify for this award, which is $4,725 for a year of full-time service. Smaller awards are available for volunteers of part-time service. Members of VISTA can choose between an education award and a lump sum stipend that accrues at the rate of $100 for each month of service.

State-Funded Programs

Studies indicate a greater number of state run and funded programs. That research, conducted in 2001, indicated that nearly 90% of states (43) offered either service payback or loan forgiveness. As is the case with federal programs, teaching and healthcare professionals are benefiting the most from these initiatives.

Tax Implications of Loan Forgiveness or Awards

Under the current tax law, the amount forgiven represents taxable income for federal income tax purposes. Taxable income should be recognized in the year the student loan was written off.

There are some exceptions to this rule. For example, if a student loan was forgiven by a tax-exempt educational institution, then the award is excluded from gross income. This is true if the student is not employed by the educational institution or if the award was based on an agreement by the former student to work for a specific number of years in certain professions. Chapter 5 of IRS Publication 970 contains additional information on the tax implications of these programs.

Discover More: Student Loan Forbearance