There are several circumstances that allow current, and former, students to qualify for loan deferment. These options will vary depending on the types of loans outstanding as well as the borrower's financial and workplace status. A deferment means no payments need to be made on a student loan during the approved deferment period; the payments can be delayed until a later date. In the case of Subsidized Stafford Loans, interest charges will not accrue during this period which means the size of the loan will not grow due to financing charges.

Categories of Loan Deferments

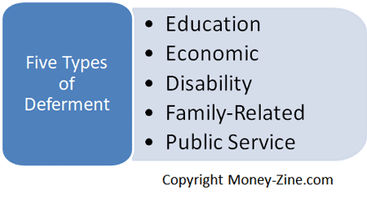

There are a total of five types, or categories, of student loan deferments. These apply to Federal Stafford Loans, Supplemental Loans, PLUS, and consolidated student loans. Each has its own set of rules, and will be explained in more detail in subsequent sections:

Education: has to do with a student's enrollment status, and is sometimes referred to as an in-school deferment.

Economic: generally dealing with specific types of economic hardships or unemployment.

Disability: a program that applies to disabled students.

Family-Related: applies to mothers re-entering the workforce, or those on parental leave from work.

Public Service: applies to students that are in the Armed Forces, Peace Corps, volunteers, or in public health service.

Education Deferments

As long as the student borrower is attending school at least half-time, as defined by the school, then payments on the loan can be deferred. In fact, most loan payments will resume six to nine months after half-time enrollment ceases. An in-school deferment form may be needed to verify enrollment. If the school is a member of the National Clearinghouse, then the enrollment data is kept electronically and may be sent to the lender through electronic transmission. To qualify, the student borrower:

Must have an outstanding Federal Stafford, Supplemental, PLUS, or consolidation loan.

The college or university must certify enrollment as a full-time or part-time student.

Economic Deferment

An economic deferment generally falls into one of two categories: hardships and unemployment. For the student borrower to qualify, the candidate must demonstrate need through a statement of annual earnings. This statement will indicate income is below certain wage guidelines established by the Bureau of Labor Statistics. To qualify for an economic hardship deferment, the student must meet one of the following criteria:

Receiving public assistance payments.

Working at least 30 hours per week, and have federal education loan payments that equal or exceed 20% of monthly income. Also, when subtracting federal student loan payments, monthly income must fall at, or below, 220% of the minimum wage or the poverty level, whichever is greater.

Working at least 30 hours per week, and earning no more than minimum wage or below the poverty level for a family of two, whichever is greater.

Working less than 30 hours per week, and earning no more than twice the minimum wage or the poverty level amount, whichever is greater. Also, when subtracting federal student loan payments, monthly income must fall below the minimum wage or poverty level.

Serving as a Peace Corps volunteer now, or sometime in the future.

Granted an economic hardship deferment under the Federal Direct or Federal Perkins Loan programs.

Unemployment Deferments

Students with outstanding loans may be eligible for an unemployment loan deferment for up to three years after they halt attendance at a school. Former students will likely be required to complete an application form every six months. To qualify for an unemployment deferment, the student borrower needs to:

Have an outstanding Federal Stafford, Supplemental, PLUS, or consolidation loan.

Conscientiously seek full-time employment in the United States.

Register with a private or public employment agency if there is one within 50 miles of the borrower's permanent or temporary address.

Confirm a job search for full-time employment during the preceding six months, when applying for a continuation of an unemployment deferment.

Disability / Rehabilitation Deferment

A student may qualify for a loan deferment if they are receiving rehabilitation training under an approved program, if they are unable to work due to an injury or illness, or if they are caring for a dependent or spouse that is disabled. To qualify for a disability deferment, there must be an outstanding Federal Stafford, Supplemental, PLUS, or consolidation loan. In the case of disability, the former student:

Must be unable to work, or attend school, for at least 60 days to recover from the illness or injury.

Developed the disability after obtaining student loans.

Must be pregnant, and with complications.

Must have a spouse, or dependent, that requires at least 90 days of nursing or similar care. This care must prevent the borrower from working full time.

To qualify for a rehabilitation deferment, the student:

Must be in a program that is licensed, or recognized, by a state agency as one that can provide rehabilitation training for drug / alcohol abuse and mental health services.

Must be in a program that provides written, individualized plans with specific end dates for services, and requires significant commitment to achieve rehabilitation.

Family Leave Deferments

A parental leave, or family leave, loan deferment is available to present and former students that are pregnant or caring for a newborn or a newly adopted child and cannot work or attend school. Parental leave deferments apply to an outstanding Federal Stafford or Supplemental Loan that was obtained before July 1, 1993. To qualify, the student or former student needs to be:

Pregnant, caring for a newborn, or a newly adopted child.

Unemployed, or unable to attend school.

At least a half-time student during the six months preceding the application.

This category of deferment can be obtained for a maximum time limit of six months for each occurrence. There is presently no limit on the number of occurrences.

Public Service Deferments

The rules as they apply to what is termed a public service deferment are quite generous. To qualify, there must be an outstanding Federal Stafford or Supplemental Loan obtained before July 1, 1993, or a Federal PLUS loan obtained before August 15, 1983. There are a total of five types of public service deferments:

Military: can be obtained while on active duty as a member of the Armed Forces, or when serving full time for a minimum of one year in the National Guard or Reserves.

Public Health: applies while serving as a full time officer in the Commissioned Corps of the United States Public Health Service.

NOAA: applies while serving actively in the National Oceanic & Atmospheric Administration (NOAA).

Peace Corps: applies while serving as a volunteer under the Peace Corps Act, or in an ACTION program.

Tax Exempt Organization / Volunteer: applies while serving as a volunteer for a tax exempt organization the U.S. Department of Education has determined to be comparable to a Peace Corps or ACTION program volunteer.

The qualifying rules, as they apply to each of the five program types, are as follows:

Military: documentation proving full-time active duty status in the U.S. Armed Forces.

Public Health: a statement from an authorized official of the U.S. Public Health Service that certifies the individual is serving as a full-time officer in the Commissioned Corps. This needs to include beginning and end dates of service.

NOAA: certification of active duty from an authorized official of the NOAA Corps.

Peace Corps: serving full-time in the Peace Corps for at least a one-year term.

Tax Exempt Organization / Volunteer: employed in an organization that is tax exempt Section 501 (c) (3) of the Internal Revenue Code that involves providing services to low income persons and their communities, assisting them in eliminating poverty and the related human, social and environmental conditions. Compensation received must not exceed the federal minimum wage.

Forms and Applications

Individuals that believe they qualify for one of the above programs should contact their lending agent, or loan servicing organization, for more information on the exact qualifying rules. These organizations should have the required form to apply for each program.