Each September, high school seniors return to the classroom, while parents begin the process of applying for financial aid. For many of the wealthier families in America, applying for aid will be a waste of time. For those that are financially-challenged, the process can be quite rewarding.

In this article, we're going to explain the types of student aid available from various institutions. That process will include running through examples that vary both household income levels as well as college costs. In all of these scenarios, we'll be using CollegeBoard's online calculator to provide an estimate of the Expected Family Contribution, or EFC.

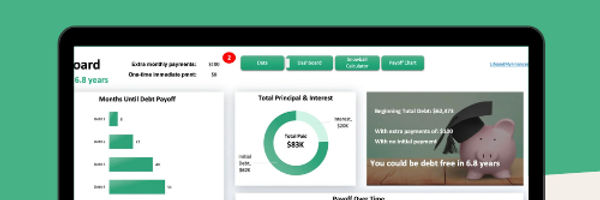

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

College Costs

As children approach that age of independence, when their sent off to college, friends and family members with older children will share their college cost stories. They may even discuss the financial aid packages they were offered or received. Families that received a lot of student aid will boast about the generous package their child was offered. Those families getting little, or no, financial help will complain about how expensive college costs are today.

When college is not very far off, this simple three-part equation becomes critical to understand:

College Cost - Financial Aid = College Funds Needed

It's not too difficult to figure out how much college might cost. In fact, this website has several online college cost calculators that can help to both project college expenses as well as figure out how much money to save each year.

Applying for Financial Aid

The process of applying for financial aid is both straightforward and well documented. The amount of aid received is based on a set of rather complex formulas, which consider the following variables:

Parent's Income

Parent's Assets

Student's Income

Student's Assets

From these four sets of inputs, the EFC formula will calculate both the parent's as well as the student's contribution. The sum of these two values is the Expected Family Contribution.

As the formula would suggest, the higher the family's income and the more assets owned by the family, the higher the expected family contribution. In the sections below, we're going to provide some practical examples of the EFC calculation to demonstrate how income and assets determine contributions.

Financial Aid Example 1

The first scenario we're going to examine involves the following:

Full Time Student Four People in Household Two Parents, One Child in College Annual Household Income of $50,000 No Significant Cash or Investment Assets

In this example, the EFC results would be:

Institutional Methodology (IM) = $3,500 Federal Methodology (FM) = $3,000

The expected family contribution would be around $3,250 per year.

Financial Aid Example 2

The second scenario we're going to examine involves the following:

Full Time Student Four People in Household Two Parents, One Child in College Annual Household Income of $100,000 No Significant Cash or Investment Assets

In this example, the EFC results would be:

Institutional Methodology (IM) = $17,500 Federal Methodology (FM) = $12,500

In this second example, the expected family contribution would be around $15,000 per year. At this level of household income, we've nearly reached the annual cost of a state college or university.

Financial Aid Example 3

The third scenario we're going to examine involves the following:

Full Time Student Four People in Household Two Parents, One Child in College Annual Household Income of $150,000 No Significant Cash or Investment Assets

In this example, the EFC results would be:

Institutional Methodology (IM) = $33,000 Federal Methodology (FM) = $25,500

In this third example, the expected family contribution would be around $29,000 per year. At this level of household income, we've nearly reached the annual cost of a private college or university (tuition and expenses).

Saving for College

We intentionally kept the above three examples simple. The reason we chose those three levels of income is that they demonstrate how quickly the EFC grows as household income grows. In addition, both the Institutional and Federal Methods consider savings when calculating contribution amounts. Even without any significant cash or investment savings, the EFC for individuals in higher income brackets grows rapidly.

Earlier we stated that we needed to examine three variables to understand the challenge of college costs:

College Cost - Financial Aid = College Funds Needed

Using the information we've examined so far, we can translate this formula into the following form:

The college savings we need is equal to the annual cost of the college or university minus our expected family contribution.

Let's revisit our second example above to see how this works.

State or Private Schools

With an annual household income of $100,000, the expected family contribution is around $15,000 per year. Furthermore, let's assume the student plans to attend a state university that costs $18,000 per year. From the above formula, we know:

$18,000 (Cost) - $15,000 (EFC) = $3,000 (Aid Received)

But what if that student decided they wanted to attend a private college or university that costs $28,000 per year? Our formula then tells us:

$28,000 (Cost) - $15,000 (EFC) = $13,000 (Aid Received)

The point we're demonstrating with these last two scenarios is that the EFC remains the same regardless of the cost of college. That is to say, once the cost of college exceeds the EFC, then each additional dollar of cost translates into a dollar of aid.

At the same time, families should recognize the EFC is equal to the maximum amount of money they'll need to spend each year on their child's education. Estimating the EFC allows families to develop a more accurate college savings plan.

College Savings Calculators

Once a family is ready to start a college savings plan, we have several online calculators that can help. Each of these tools allows the user to play "what-if" scenarios, so they're able to examine a full range of options:

Simple College Cost Calculator: allows users to project today's college costs into the future.

College Fund Calculator: not only projects costs into the future, but also helps users to figure out how much money they'll need to save each year to pay for school.