In 2006, Congress slashed $12 billion in student lending funds in a desperate attempt to reduce the fiscal budget deficit. Recent studies have shown that student debt is getting out of control, and lawmakers on Capitol Hill have decided to take steps to help ease the burden for students with college loans.

In this article, we're going to discuss some of the measures elected officials are taking to help make college more affordable. Specifically we're going to discuss five programs that make getting a college diploma easier. We'll start by looking at two of the most popular ways to pay for college today: Stafford Loans, and Pell Grants.

According to Value Penguin, the average student loan debt in America (for those that borrow) is $32,731. So, we'll finish by discussing a couple of helpful student debt management tools that could see graduates become debt-free in no time.

Paying for College Costs

Additional Resources |

There are a number of ways to pay for college. It's possible to obtain a private student loan, or apply for two of the most popular federal programs that exist today:

Direct Loans, and

Pell Grants

It's important to understand how these programs can help because, later on, we're going to talk about some legislation that directly affects these two very important sources of college funding.

Direct Loans

Families can apply for a Direct Loan using the Free Application for Federal Student Aid form. These loans have variable interest rates, and are aimed at providing loans to both undergraduate and graduate college students. In general, there are two types of these loans:

Subsidized Direct Loans: which are awarded to students based on demonstrated financial need, and no interest accrues on the loan balance until repayment begins. They're called subsidized loans because the federal government is paying the interest due on the loan until the scheduled payments begin after graduation.

Unsubsidized Direct Loans: which are not awarded based on financial need. The interest due on the outstanding loan balance accumulates while the student attends school, and stops when the loan is repaid in-full.

According to statistics from the U.S. Department of Labor, approximately 43 million students borrow money to pay for college through Direct Loans, and the average loan amount is roughly $35,000.

Pell Grants

There are exceptions, but generally, Federal Pell Grants are awarded only to undergraduate students. These grants are paid out by universities or colleges at least once each term. The money can be paid directly to the student, to the school via a student account, or any combination of the two. Unlike a loan, a grant does not have to be repaid. The total amount owed on US student loans as of Q2 2022 was $1.75 trillion.

The average grant under this program is $4,031, and there are approximately $28.7 billion in Pell Grants awarded to 7.1 million students annually (2017 / 2018).

Reducing Student Debt

As mentioned earlier, there have been recent cuts to federal spending on student loans. Congress is reversing that trend, and is trying to reduce the total debt burden held by students using at least five different approaches:

Linking Loan Repayment to Income Levels

Increasing Competition Between Lenders

Reducing Student Loan Interest Rates

Increasing Pell Grant Maximums

Reducing Reliance on Private Lenders

We're going to finish this article by taking a closer look at each of these approaches, and explain how students may benefit from these changes in the near future.

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

Loan Repayment

The late Senator Edward Kennedy, former Chairman of the United States Senate Health, Education, Labor and Pensions (HELP) Committee, released a study on the student loan system entitled "Report on Marketing Practices in the Federal Family Education Loan Program." As part of his student loan reform stance, Senator Kennedy proposed a repayment plan that would place a cap on monthly loan payments.

Under this program, if a former student were to take a low paying job after graduation, their monthly payments would be capped at 15% of their monthly income. The federal government would then pay the remaining interest expense on the loan. For students entering such fields of work as law enforcement, social work, or teaching, there would be a loan forgiveness provision that starts after 10 years.

Lending Competition

Senator Kennedy also pushed for legislation that would encourage colleges and universities to borrow directly from the federal government. By bypassing large lenders such as Sallie Mae, which receives subsidies from the federal government on the loans they write, studies indicate the Department of Education would save taxpayer money.

To provide an added incentive to schools, the Department of Education is even willing to send half of their savings back to participating schools, so they can provide additional financial aid to students in lower income brackets.

Lowering Interest Rates

The House of Representatives has passed legislation that lowers the interest rate paid on student loans by half. This program would apply to Stafford Loans, and once again, target students coming from lower income families.

For students with $10,000 in loans outstanding, this can mean the difference between paying nearly $6,200 in interest over the course of a 15 year loan at 7.00%, and $2,200 in interest at 2.75% (2020 / 2021 rates). That translates into $4,000 in savings over the life of the loan.

Pell Grant Maximums

Former President Bush proposed to increase the maximum awards under the Pell Grant program from $4,050 to $4,600 in 2008 and to $6,345 in 2020 / 2021. The rationale behind this move is the feeling that Pell Grants have not kept pace with the rising cost of a college education. This program would cost taxpayers $15 billion over five years, but the prospects of it gaining legislative approval are high.

Private Lenders

Finally, most college students do not understand the financial relationship that exists between lenders and the schools they're attending. Many schools maintain a preferred list of private student loan lenders, in exchange for certain gifts made available to the schools themselves.

Prior to July 1, 2010, private lenders provided Stafford, PLUS, and Consolidation Loans under the Federal Family Education Loan Program. This program was eliminated by the Health Care and Education Reconciliation Act of 2010. New student loans are now available directly from the U.S. Department of Education's Direct Loan Program.

Managing Student Loans with the Debt Snowball Method

If you've taken out loans for your studies, you may find yourself in a significant amount of student debt. But don't worry; there are ways to manage this debt that could see you spend less money and time on repayments.

So what is the debt snowball? And how does snowballing student loans work? The debt snowball method is pretty simple.

Here's how it works:

List out your debts from smallest to largest

Pay the minimums on all the larger debts

Put as much money as you can toward the smallest debt until you pay it off, then tackle the next largest debt

Continue until all your debt is paid off!

Super simple, right? Anyone can do it! Grab it below 👇

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

How do you snowball student debt?

So how do you snowball student loans? It really isn't any different than we described above.

First, list out your student loans from smallest to largest

Pay the minimums on all of the larger student loans

Pay as much as possible on the smallest student loan debt until it's fully paid off

Then, move onto the next largest debt, pay that off, then the next one, etc. etc. until you've fully paid off your student loans!

Should you snowball student loans?

So now here's the big question...Should you snowball student loans?

If the interest rates on your student loans are all pretty similar, then snowballing your student loans absolutely makes sense. If, however, you have some student loans that are 20% and others that are 0%, you may want to check and see what the debt avalanche (ie. the high rate method) would do for you.

Why?

Because if your highest debt balance is a 20% interest, you really don't want to wait till the very end to pay it off. That would result in many months of high interest payments.

If, instead, you paid your debts by highest interest first, you could get rid of these high interest payments immediately and pay much less over the course of your debt payoff journey.

So should you snowball your student loans? That all depends on your situation. We'll go through this more in the sections below.

How do I calculate my snowball debt?

How can you calculate your snowball debt? Laying it out yourself is pretty easy. BUT, figuring out how long it would take you to pay off all your debts is actually pretty difficult.

This is where my FREE student loan debt snowball calculator comes in handy (download the snowball debt worksheet here!).

Just enter in the amounts, the percentage interest, and the minimum payments, and you will instantly see how long it will take you to pay off all your debts!

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

Snowball method for student loans

While the method to snowball student debt is pretty simple, it always helps to go through an example just to see how easy it really is! AND, you can see how powerful the student loan snowball really is!

Student loan snowball

Let's say you have $30,000 in student loan debt, and this is the breakdown of your current loans:

$15,000 student loan

12% interest

$200 monthly minimum payment

$10,000 student loan

9% interest

$122 monthly minimum payment

$3,000 student loan

6.8% interest

$45 monthly minimum payment

$2,000 student loan

6.8% interest

$30 monthly minimum payment

Setting up your student loan snowball in this case is pretty simple, right? You just line them up from smallest to largest, like this:

$2,000

$3,000

$10,000

$15,000

And, you start paying as much as you can toward the smallest debt, the one with the $2,000 balance.While doing this, you simply make the minimum payments on the others.

When you pay off the $2,000 debt, you start tackling the $3,000 student loan. And when you pay that off, you put as much money as you can toward the $10,000 student loan. Finally, you pay the $15,000 loan off and have a HUGE celebration!

But...like I said before... How long is that going to take you? 10 years? 15 years?

You really have no idea! It's not easy to calculate!

This is why I built the student loan snowball calculator.

There's a free version for up to 8 debts,

there's a larger version that can handle 16 debts (currently on Etsy for $3.99),

and there's a super-beefy version that can handle 32 debts (on Etsy for $9.99)!

I'm excited to show you how to snowball student loans with this calculator. Instead of taking 10 years to pay off your student loans, I bet you can use this tool to pay them all off in 4 years or less!

Wouldn't that be AMAZING?? Let's dive into it.

Student loan snowball calculator

I built a general debt snowball calculator quite a few years ago because I thought it might help my readers. Little did I know that the tool would be so powerful and prompt so many people to push their way out of debt and tell me about their success!

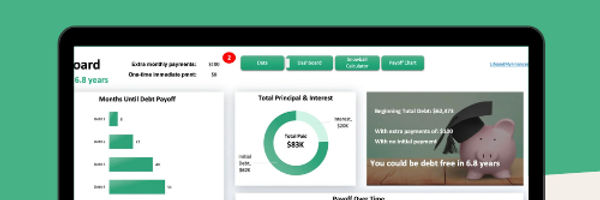

Because of this, I recently built the snowball student loan calculator! (If you missed it before, here's the student loan debt snowball download link) Here's how it works, and you'll soon see why it's so powerful!

(Also, if you have more than 8 loans, but you still want to buy this snowball tool, check us out on Etsy!Here are the links for the 16-loan version, and the 32-loan version!)

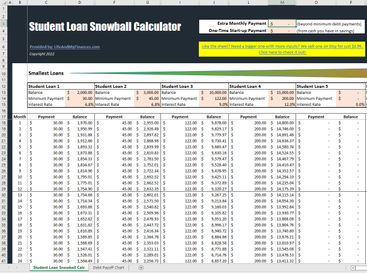

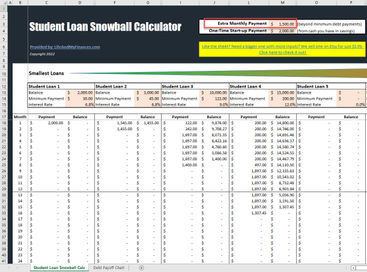

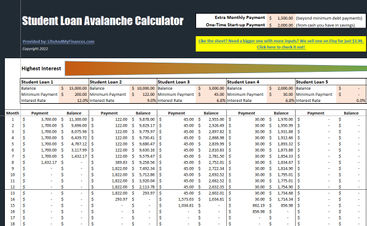

Enter the student loan debts into the student loan snowball calculator

First, we simply enter our debts into the tool from smallest to largest, and include the minimum payments along with the interest rates for each.

You can see we started with the $2,000 student loan on the left, and then added the other debts in sequence (with interest rates and minimum payments).

Immediately, the snowball Excel tool starts inputting the payment amounts and the rolling balance of each debt by month.

If you scroll down to the bottom, you can see how many months it would take you to pay off your student loans by making only the minimum payments.

In this example, it takes 120 months, or 10 years to pay off your student loans in their entirety. Personally, for me, that's just WAY too long to hang onto student loan debt!

How to snowball student loans with the student loan snowball tool

Want to know how to snowball your student loans with this free student loan snowball tool? I made it so simple, it's crazy. You're going to love this (and this is why people are willingly pay $3.99 or $9.99 for the expanded version of this tool!).

To pay off your student loans faster, you can do 1 of 2 things (or do both!):

You can dump a bunch of money toward your student loans up front (maybe you sell something, or have savings stashed away that you can use)

You can find a way to put more money toward your student loans each month (either by cutting costs or earning more!)

Or, like I said earlier, you can do both! Put some money toward your debts initially, and then pay extra along the way!

The impact of putting money toward your debts up front

Let's stick with our $30,000 student loan debt example from above. Let's say you sell some of your stuff and earn $2,000. You immediately put that toward your student loan snowball. What impact will that have?

We simply entered $2,000 into the "One-Time Start-up Payment" cell at the top of the tool, and you can immediately see the impact it has!

Obviously, that $2,000 student loan goes away immediately, and then that $30 minimum payment gets applied to the $3,000 student loan monthly payment!

This simple act will take down your student loan payoff journey from 10 years down to 9 years!

Not bad!

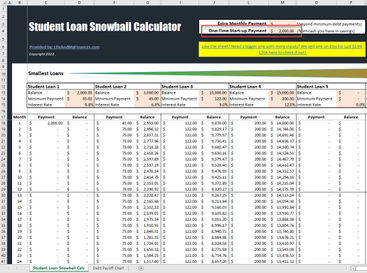

But...what if we put extra money toward the student loans every month? How quickly could we be out of debt then?

The impact of putting money toward your debts each month

Let's say in addition to that $2,000 initial payment, you're able to cut your costs and make an extra $1,000 a month on the side. All in all, you're able to put an extra $1,500 a month toward your student loans.

Now instead of 9 years to pay off all your student loans, what is your new timeframe for getting out of student loan debt?

Again, we simply head to the tool and put $1,500 into the cell marked, "Extra Monthly Payment", and then scroll down to see how quickly that final debt will pay off!

Whoa! As you can see, this made a HUGE difference! Instead of it taking 10 years or even 9 years, the extra monthly payments of $1,500 allow you to pay off your student loan debts in just 16 months!

That's just over 1 year! BOOM! Wouldn't that be awesome? The coolest thing is that it's absolutely possible!

You've got all the tools to make it happen. All you have to do now is make a plan and do it!

(Want something more? to get out of debt in a year or less? Check out our new Get Out of Debt course.)

High Rate Method For Paying Off Student Debt

Now that I've got you all excited...What if I told you that there was a way to get out of student loan debt even FASTER?

By using the debt avalanche method (ie. high rate method) to get out of student loan debt, you might actually be able to shave a couple more months off your get-out-of-debt timeframe!

Let's check it out. Then, we'll decide which method is actually best for paying off your student loan debt (Hint: It may not be the fastest way!).

Here's the freebie download: Student Loan Avalanche Free Excel Download

And here are the larger versions if you need them!

Debt avalanche method

So what is the debt avalanche method?

Instead of lining up your debts from smallest to largest like you would for the debt snowball method, you instead line them up from the largest interest payment to the smallest interest payment.

Makes sense, right?

The higher the interest, the more you're going to pay per month, so tackle that debt first to get rid of those higher payments!

And, just like the snowball method, while you're working to pay off that first debt with a vengeance, you're simply making the minimum payments on the other debts - in this case, the lower interest ones.

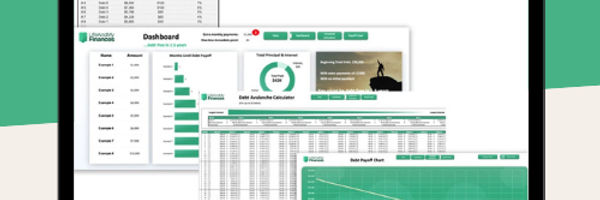

Want to get out of debt this year? This avalanche debt payoff spreadsheet is what you need!

A few top features of this template:

Fully customizable and easy to “play around” with

This tool is awesome for motivation!

Room for up to 32 debts!

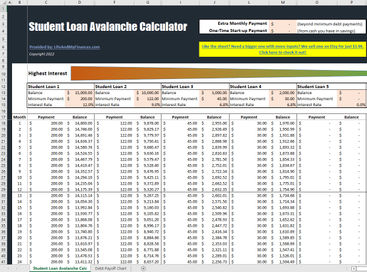

Avalanche student loans

So how do you avalanche student loans? How do you pay off your debts with the avalanche student loan method? Let's stick with our example numbers.

Let's say we have four student loan debts that total up to $30,000:

$15,000 student loan

12% interest

$200 monthly minimum payment

$10,000 student loan

9% interest

$122 monthly minimum payment

$3,000 student loan

6.8% interest

$45 monthly minimum payment

$2,000 student loan

6.8% interest

$30 monthly minimum payment

Which one has the highest interest payment?

The $15,000 student loan with 12% interest. So, we'll start paying that debt off first.

Next is the $10,000 debt with 9% interest.

Then it's a toss-up with the next two since they both have the same interest of 6.8%. But we'll list the highest dollar amount one first (since the interest will technically cost more money each month with the higher balance).

So, for the high rate method (ie. debt avalanche method), we'd pay off our student loans in this order:

$15,000

$10,000

$3,000

$2,000

...Which is actually the exactoppositeof how we would pay off the student loans with the debt snowball method! So which one will pay off first? Let's use the student loan avalanche calculator to figure it out.

Student loan avalanche calculator

If you pay off your debts using the student loan avalanche method, it actually doesn't save that much time or money. Without putting any extra dollars at your debts (ie. you just make the minimum payments), it will still take you 10 years to pay off your debts. And, you'll save only about $100 in the process as well.

The impact of putting money toward your debt avalanche up front

What if we follow the same example as the student loan snowball and put $2,000 toward your debts up front?

Only this time, you'd be applying the money to the $15,000 debt instead of the $2,000 debt.

Will this make a big impact toward paying off your student loans?

It actually does! Even I was surprised. By putting an extra $2,000 toward your debt with the debt avalanche method vs. the debt snowball method, you'll actually save yourself $1,700 AND you'll pay off your debts 4 months sooner.

That's pretty awesome!

The impact of putting money toward your debt avalanche each month

Alright. Let's take this one step further. What if you could put $2,000 toward your debt avalanche initially AND put an extra $1,500 a month toward your loans?

First off, how quickly would you pay your debt off? And second, how does this compare to snowballing the student loans?

Based on our student loan excel template, you'd pay off your $30,000 worth of student loans in just 16 months!

This is actually the same amount of time that it would take you if you chose to snowball student loans instead. BUT, itwould save you about $400 because you started with the highest interest rate loans.

Want to try the student loan avalanche tool yourself? Here's the free download in case you missed it earlier: FREE Student Loan Debt Avalanche Excel Tool Download

Is The Snowball or Avalanche Method Better for Paying Off Student Debt?

Based on the recent example above, the debt avalanche method seems like the clear winner for paying off your student loans. But is it really? Could there be other factors that would make the debt snowball the best option?

What is an advantage to using the debt snowball method?

Spoiler alert. Yes, there is an advantage to using the debt snowball method. In fact, Harvard actually touts that the debt snowball method is the BEST method for paying off debt!

Why?

Belief.

While the debt avalanche method might mathematically make the most sense in nearly every situation, it also might require you to pay off your biggest debt first...which can often take a LONG TIME.

You know what happens when tough things take a long time? People never make it.

People give up. They stay in debt. However, by using the student loan debt snowball method, you'd start with your smallest loan. Maybe it's only $500 and you pay it off in the first month.

That makes you feel GOOD! It makes you happy. It's progress.

Suddenly, you feel like you can do it. Then you pay off another loan, then another. BOOM! You're energized and you're trying to figure out how to go even faster!

The debt snowball creates momentum. With belief and momentum, way more people make it to the finish line.

What is an advantage to using the high rate method?

The advantage of the high rate method is that it saves you money in interest.

By paying the highest interest debt first, you pay on it less, and you therefore save more money.

So, if you followed the schedules exactly (with the debt snowball vs. the debt avalanche), the debt avalanche would pay off first every time and require you to shell out fewer dollars.

Snowball vs Avalanche

Now we come down to it.

What's better between the debt snowball vs avalanche? Both have their place honestly.

If you have a debt that has crazy-high interest, you might just want to tackle that first and use the debt avalanche method.

If, however, you have moderate interest rates and you're interested in quick wins and momentum, then use the debt snowball method.

.jpg)