Definition

The financial accounting term journalization is used to describe the process of recording transactions and events. Journal entries are usually chronological lists of debits and credits to accounts, along with a description of the transaction.

Explanation

Transactions are usually not entered directly into the company's general ledger because they involve both a debit and credit to accounts, which are found in two different sections, or pages, of the ledger. The journal allows a company to retain both the debit and credit involved with a transaction in one place.

An entry in a journal is comprised of four parts:

Date of the transaction or event

Account to be debited

Account to be credited

Brief explanation of the transaction or event

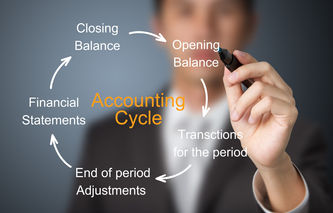

Journal entries are subsequently posted to the general ledger as part of the accounting cycle.

Example

On January 15th, 20XX, Company A purchases $500,000 in meters from its supplier Company XYZ, payable in 90 days. The following entry would be made in Company A's journal.

Date | Account Description | Account Number | Debit | Credit |

1/15/20XX | Meters | 380 | 500,000 | |

Accounts Payable | 232 | 500,000 | ||

Purchase of $500,000 in meters from Company XYZ, payable in 90 days. | ||||