Definition

The financial accounting term general ledger refers to a physical or electronic document that contains a record of the company's financial accounts. Companies can have subsidiary ledgers in addition to their general ledger.

Explanation

In the past, general ledgers were physical books containing the transactions affecting the company's assets, liabilities, owner's equity, revenues and expenses. Today, most large companies use software applications such as Enterprise Resource Planning (ERP) tools to manage and store this information.

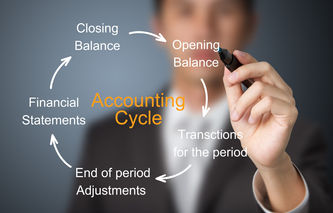

Subsidiary ledgers, also known as sub-ledgers, are frequently used to store information at a more granular level. For example, there may be a sub-ledger for accounts receivable or revenues. As part of the accounting cycle, transactions are posted to the general ledger using a double-entry approach; which involves both a debit and credit for each entry.

In practice, a journal is used to record and store transactions prior to posting in a ledger account. When a debit or credit is posted to the ledger, a reference number is recorded alongside, or assigned to, the corresponding journal entry. This process provides the accounting department with a tracking mechanism to ensure all journal entries are eventually posted to the company's general ledger.

The information contained in the general ledger is extracted to produce a trial balance. Once a series of adjustments have been made to these accounts, it's possible to produce the company's financial statements.

Example

On January 15th, 20XX, Company A purchases $500,000 in meters from its supplier Company XYZ, payable in 90 days. The following entry would be made in Company A's journal.

Date | Account Description | Account Number | Debit | Credit |

1/15/20XX | Meters | 380 | 500,000 | |

Accounts Payable | 232 | 500,000 | ||

Purchase of $500,000 in meters from Company XYZ, payable in 90 days. | ||||

The information from Company A's journal is then recorded in the appropriate ledger accounts using the double-entry method.

Date | Account Description | Account Number | Debit | Credit |

1/15/20XX | Meters | 380 | 500,000 | |

Purchase of $500,000 in meters from Company XYZ, payable in 90 days. | ||||

Purchase of $500,000 in meters from Company XYZ, payable in 90 days.

Date | Account Description | Account Number | Debit | Credit |

1/15/20XX | Accounts Payable | 232 | 500,000 | |

Purchase of $500,000 in meters from Company XYZ, payable in 90 days. | ||||