Student loans are like any other type of credit. They charge interest, but these interest rates are usually lesser than personal or credit card loans.

However, what sounds like cheap access to money for education is taking a toll on the nation.

According to the White House, over 45 million Americans currently carry more than$1.7 trillion in federal student loans. A Department of Education analysis states that a typical undergraduate student with loans now graduates with nearly $25,000 in debt.

This is because of the exorbitant cost of education and rising interest rates. Plus, the Biden administration is looking to resume federal student loan payments in late 2023.

Now is a great time to learn what increases your student loan balance and develop a debt repayment strategy.

This article will help you understand what increases your total loan balance and capitalized interest, and cover actionable tips to decrease your student loan balance.

This article will tell you:

What Increases Your Total Loan Balance: 6 Key Factors

Understanding the Basics of Student Loans

What is Interest?

What is Capitalized Interest?

When Does Interest Start on Student Loans?

Options for Student Loan Repayment

How to Reduce The Interest You Pay on Student Loans

5 Key Tips to Decrease Loan Balance

Want to dive deeper into student loans and debt payoff plans? Check out our popular posts below:

What Increases Your Total Loan Balance: 6 Key Factors

As a general rule of thumb, loan balances decrease over time as you make repayments. However, student loan balances can increase even if you repay the debt.

In fact, according to research by Moody’s, almost half of student loan borrowers are further in debt five years after they begin paying back their loans.

But why does this happen? Let’s look at six possible factors.

1. Paying Less Than the Requested Amount

You’ll have to pay a set amount of monthly payments to offset your student loan.

But what happens if you pay less than the requested amount? For starters, your monthly payments won’t cover the loan’s interest and principal amounts.

This is because a portion of every installment you make goes to clear interest and another towards the principal. Any unpaid interest and principal amounts will likely increase your loan balance.

We’ll use our student loan debt snowball calculator to understand how this affects your loan balance (follow the link and download the calculator if you want to follow along).

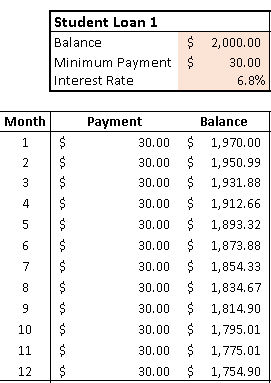

Let’s say you’re supposed to make a minimum payment of $30 on your $2,000 student loan. Here’s what happens to your balance over time:

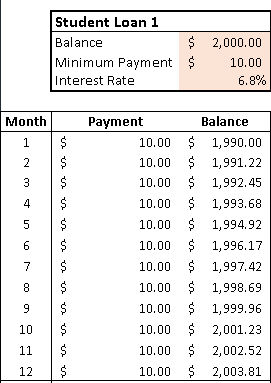

Now, let’s assume you make a partial payment of $10. This will lead to an increased loan balance that’s more than the initial $2,000 loan amount.

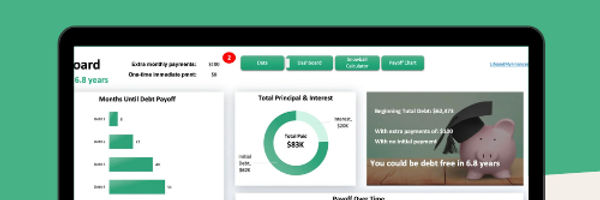

Want to set up your student loan snowball spreadsheet in just a few minutes? Grab yourself a copy 👇

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

Make a small investment, get your instant download, and create a plan to become debt-free.

Karen P. had this to say:

“Absolutely what I was looking for! Made debt repayment look so much more manageable than what I had put together myself! Thank you so much!!!!”

2. Delays in Loan Repayments

Delayed loan payments result in penalties and fees. These fees add to your initial loan amount, which increases your total loan balance.

Here’s what happens when you delay a federal student loan payment:

30-day delay: Your loan servicer can charge you up to 6% of your missed payment amount as a late fee. For example, every time you skip a $100 payment, you could be charged a $6 fee.

90-day delay: Your servicer can report your late payments to credit bureaus. This can lower your credit score significantly.

270-day delay: Your student loans will enter default. This can trigger new penalties, like collection costs and tax refund seizure. Note that you may be charged as much as 25%of principal and interest as collection fees, while the interest continues to accrue.

But what about private student loans?

Private loans aren’t standardized like federal loans.

For instance, a lender’s late fee could be a percentage of your payment or a flat fee.

Private lenders tend to report late payments after 30 days.

Plus, these loans default sooner than the federal ones.

A study byMeasureOne states that the early-stage (30–89 days delay) and late-stage (90 days or more) delinquency rates for private student loans are 2.73% and 1.75%, respectively.

While these numbers look positive, data analyst Lowell Ricketts notes that student loan delinquencies could increase to pre-pandemic levels once federal student loan payments restart.

3. Choosing an Extended Payment Plan

Extended payment plans are student loans that usually last for 20 years or more before being paid off.

These payment plans reduce the loan balance very slowly.

But don’t these plans let you make smaller monthly payments?

Sure, they do. But they can be expensive in the long run. After all, the longer the repayment period, the more interest you’ll likely pay. So, a 10-year loan will cost more than a 5-year one.

Additionally, the small payments you make on extended plans only cover the interest and some principal amount. So if you miss a payment, your loan balance will likely increase.

Looking to simplify your student loans or reduce your rate?

4. Missing or Deferring Payments

You can miss a payment on an agreement with your lender. However, that doesn’t mean your loan balance stops accruing interest. This interest can add to your principal amount and eventually increase your loan balance.

Here’s an example: Lenders may give you a grace period of six months after your studies to make payments. This can empower you to find a job and establish a source of income. However, yourstudent loan keeps accruing interestduring this time, resulting in an increased loan balance.

5. Income-Driven Payment Plans

Income-driven payment options usually give you the lowest monthly loan payment among all repayment plans.

Here, your monthly payment is calculated based on:

Your annual income.

The poverty guideline for your family size.

And your state of residence.

You may find yourself in a situation where you miss a payment or pay lesser than the specified monthly. And because the monthly payment is less to begin with, this can increase your loan balance.

6. Calculation Errors

Sometimes, bizarre calculation errors can increase your loan balance.

Wondering how to spot such errors?

If you’re making the correct loan repayment and still notice your loan balance shooting up, query it. Such errors can happen for many reasons, including algorithmic errors, wrong payment amounts, or mixing your account up with somebody else’s.

Understanding the Basics of Student Loans

We’ve looked at the key factors increasing loan balances. Now, for the 45 million individuals with student loans right now, let’s now take a step back and go through the basics.

What is Interest?

Interest is theadditional or monetary charge you pay a lenderin return for borrowing money. This expense is a percentage of a loan’s unpaid principal amount.

Interest can be considered simple interestif it’s based on the loan’s principal amount. It qualifies ascompound interestif it’s based on the principal and the loan’s previously earned interest.

How is Interest Rate Calculated?

Student loans are direct loans. These direct loansaccrue interest every day.

You can calculate the daily interest rate of your student loan by dividing the annual interest rate by 365 or 360,depending on the number your loan issuer uses.

Note

Federal student loans carry (usually lesser) fixed interest rates. Private loans have variable rates that can tick up after Federal interest hikes. According to Bankrate, federal interest rates range from 4.99% to 7.54% in 2022. Average private interest rates range from 3.22% to 14.96% fixed and 2.52% to 12.99% variable.

What is Capitalized Interest?

Interest capitalization is theaddition of unpaid interest to the principal loan balance.

Typically, when you make payments on federal student loans, it covers interest accrued between monthly payments and the actual loan balance. Factors like delayed payments, deferments, or forbearance, can increase the unpaid interest and loan balance.

For instance, the interest builds up if you pause monthly payments during a deferment period. Your lender can now capitalize on this unpaid interest. And capitalization will increase the outstanding loan balance.

When Does Interest Start on Student Loans?

Student loans start accruing interest as soon as they are disbursed. That means your loan balance is already increasing, even if you aren’t repaying debt until you graduate.

As you approach the start of your repayment period, your loan servicer will capitalize the previously accrued interest.

What does this look like in practice?

Let's say you borrow a $5,000 student loan for your final year. And your loan isn’t due until six months after you graduate. This means interest will accrue on your debt for 18 months.

If you have a 5% interest rate, you'll have roughly $25 in monthly interest. Over 18 months, an additional $432 will be added to your balance. Instead of the original $5,000, you’ll now owe $5,432 to your lender because of loan capitalization.

Is there any way to prevent this from happening?

Derek Sall, financial expert and founder of Life And My Finances, had this to say about student loans:

If you must get a loan, I would apply for a subsidized federal student loan. With these, the government pays the accrued interest amount while you're in school and during the grace period before repayment.

Be sure to check if you qualify for these loans as they’re reserved for students with financial needs.

Also, you could make interest-only payments on your student loans while in school and during periods when full payments aren't required.

Options for Student Loan Repayment

So, when do you have to start paying back student loans?

Federal loans and most private student loans come with a grace period, where payments are deferred until after you graduate. This period is usually six months long. While private and unsubsidized loans continue accruing interest during this time, you don’t have to make repayments yet.

Use this grace period to choose a student loan repayment plan works best for you.

Note that you can change your federal student loan repayment plan as often as you need to. Some private lenders also have alternate payment plans you can check out.

Here’s a look at some options for student loan repayment plans:

1. Standard Repayment Plans

The standard plan is the most common repayment plan. They feature scheduled payments and fixed monthly payment amounts. Federal loans usually have a repayment tenure of 10 to 30 years. This figure may vary for private loans.

2. Graduated Repayment Plans

Graduated payment plans are available for all federal student loan borrowers. Here, payments start low and increase gradually over time. However, the loan must be repaid within 10 years.

3. Income-Based Repayment Plans

You can qualify for an income-based repayment plan if you have a high debt relative to your income. Under this plan, monthly payments are either 10% or 15% of your discretionary income.

Payments are evaluated each year based on your family size and income. Note that income-based repayment plans are federal-only plans.

4. Extended Repayment Plans

Extended repayment plans are federal-only payment options for direct loan borrowers with over $30,000 in outstanding loans. Here the monthly payments are low, and the time frame for repayment is within 25 years.

How to Reduce The Interest You Pay on Student Loans

We’ve discussed all the factors that can add to your loan balance. But what if you already have an increased loan balance? Is there a way to reduce it?

Refinance Your Loan

Refinancing your student loans after graduation could help you get a lower interest rate and save on total interest charges.

Start by contacting multiple lenders and inquiring about the rates, qualifications, and fees. Be mindful of these two aspects:

Refinancing federal student loans can strip you of certain federal benefits, like interest subsidies.

Interest rates depend on credit scores and credit history. This is why you may need a co-signer to secure favourable terms.

Check with Credible to get the best student loan refi rates. They poll 10+ banks to get the best rate for you.

Automate Loan Payments

Want an instant reduction in the interest rate?

Here’s the easiest trick in the book: Sign up for automated payment or auto-debit to reduce your interest rate by 0.25%.

This is true for most federal and private student loans.

Plus, setting up automatic deductions is a great money habit that’ll help you make timely payments. Check if your loan is eligible for this benefit before signing up.

5 Key Tips to Decrease Loan Balance

We’re letting you in on five crucial steps you can take to reduce your loan balance today. Read on to find out how.

1. Try the Debt Snowball Method

The debt snowball method is one of the fastest ways to get out of debt!

This incredible debt repayment strategy focuses on paying off your smallest debt first with minimum payments. You use this momentum to eliminate the next smallest debt off the second, and so on.

Snowballing your student loans can effectively help you focus on a single debt at a time.

Curious to see if this method can work for you? Grab your copy 👇

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

2. Make Extra Repayments

It’s simple. Making extra payments will help you pay back your student loan’s principal balance and interest faster.

Most loan providers let you choose how extra funds are allocated. That means, you can ask your provider to use the extra payments to pay down your loan’s actual principal, instead of the interest.

Remember

The principal is the actual debt you need to pay off, whereas the interest is the fee you’re paying your lender for borrowing money.

Paying off your principal will help you get rid of the student loan debt much quicker!

So, don’t stick to the loan repayment schedule, and pay off more debt if you’re doing well financially.

3. Pay During the Forbearance Period

With Congress passing the CARES Act, student loan repayments have been paused since March 2020.

The Biden administration has announced that these loan repayments are set to resume in late 2023.

Shouldn’t you enjoy the pause and plan for 2023?

By all means, you can. However, if you’re in a situation where you can afford loan repayments, do it!

Borrowers, who continue to make loan repayments during this forbearance period, can do so without paying any new interest on their loans. While your monthly payments won’t be lower, this 0% interest rate will save you money in the long run.

4. Seek a Temporary Interest Rate Reduction

Autopay isn’t your only saviour. Lenders may offer you additional discount opportunities for things, like having an existing relationship with the bank or credit union, paying on time, and more. Make sure to check with your servicer or lender for details.

5. Pay Loans With Tax Refunds

This one is cool money management method. Student loan interests are exempted from taxes. This means that you’ll receive tax refunds on your interest payments. Consider redirecting the entire refund amount to pay off student debt further.

KEY TAKEAWAYS

Factors like delayed payments, missing payments, extended or income-driven repayment plans, and more, can increase your total student loan balance.

Student loans start accruing interest as soon as they are disbursed. That means, your loan balance is increasing even before you graduate school.

Try implementing the debt snowball strategy to repay your student debt faster.

Take measures, like refinancing your loan, making extra payments, seeking discounts, automating loan payments, and more to decrease your loan balance.

.jpg)