It’s crazy to think that a subset of student loan borrowers has never faced a single bill, thanks to the continued pause on repayments since March 2020. But, as they say, all good things must come to an end—and so is the case with this temporary relief.

The Biden administration has alerted the 45 million Americans with student debt that they may have to start paying up sometime around August this year.

Does this decision affect you directly? It’s time to get your head in the game and figure out how to reduce your total student loan cost.

In this article, we’ll cover—

15 effective tips on how to pay student loans fast.

Top student debt resources you need to check out.

Key FAQs on understanding the basics of student loans.

Check out more articles on student loans:

Get out of student loan debt faster with our free tools:

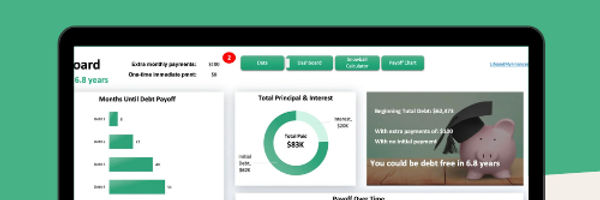

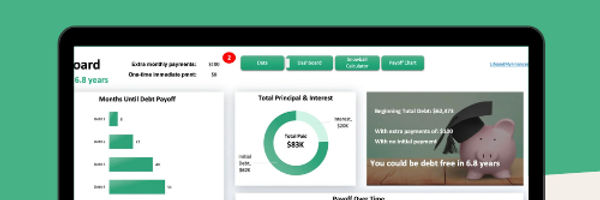

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

15 Top Tips for Paying Off Student Loans Faster

Here’s what’s wrong with the student debt narrative—

The conversation centers on interest rates and the total amount of debt—the factors that you (the borrower) can’t control.

Let’s change that and focus instead on the 15 steps you can take to pay off your student loans faster.

1. Increase your credit score

Keeping your credit in good shape can give you more loan options and a lower interest rate. Check your credit score before applying for a loan and figure out where you stand.

If your credit score needs improving, work on:

Reducing credit card balances.

Clearing any collection accounts and past-due accounts.

Making all future loan payments on time.

Examining your credit report for errors and disputing them if necessary.

2. Compare student loan offers

Are you the sort of person to try out ten shirts and buy the eleventh one? You want to do exactly that when choosing a student loan offer.

Lenders offer rates slightly different from one another. Most will let you check these rates by filling out quick online forms. It’s a win-win situation because checking rates this way won’t impact your credit score.

So don’t accept the first offer you qualify for. Look around for more options, stack them up against each other, and pick the cheapest plan.

Also, prioritize federal loans over private ones. Federal loans have relatively lower interest rates and can give you opportunities to seek loan forgiveness in the future.

3. Try the debt snowball method

The debt snowball method is one of the fastest ways to get out of debt.

Harvard Business Review’s research “The Best Strategy for Paying Off Credit Card Debt” says the technique works because—

It offers a clear plan of action.

It increases motivation by focusing on individual debts.

It allows for a series of small wins.

What’s the debt snowball method?

This incredible debt repayment strategy focuses on paying off your smallest debt first with minimum payments. You then use this momentum to eliminate the next smallest debt, and so on. Snowballing your student loans can effectively help you focus on a single debt at a time.

Curious to see if this method works for you? Check out our 👇

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

(Want something more? Want to get out of debt in a year or less? Check out our new Get Out of Debt course.)

4. Pay off student loans early

Since the Congress passed the CARES Act in March 2020, the pause on student loan repayments has been extended nine separate times. The repayments will likely resume in August 2023.

Should you continue enjoying this pause and plan for later this year? By all means. But if you’re in a situation where you can afford repayments, do it right away.

This is the fastest way to pay off student loans, as you can continue making loan repayments during this forbearance period without paying any new interest. Your monthly payments won’t be lower but this 0% interest rate will save you money in the long run.

5. Sign up for automatic payments

Most lenders offer automatic payments. Signing up for them will typically fetch you a 0.25% reduction in your student loan interest rate.

This is a simple yet effective way to reduce your total loan cost. Plus, automating payments will ensure you don’t miss monthly installments.

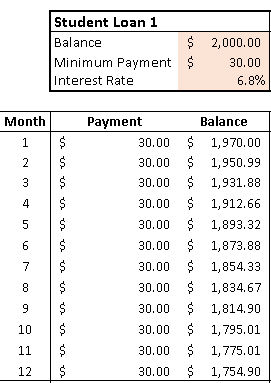

6. Pay more than your minimum payment

It’s simple—

Making extra payments will enable you to pay off your student loan principal and interest faster.

Most loan companies let you pick how extra funds are distributed. That is, you can ask your provider to redirect the extra payments to your loan’s principal amount rather than the interest.

Remember that the principal is the amount of debt you must repay, whereas the interest is the price you pay your lender for borrowing money. Paying off the principal will help you pay off your student loans significantly faster.

So, if you’re doing well financially, ignore your loan repayment plan and pay off more debt.

7. Choose a shorter repayment term

Choosing a shorter repayment term can help you save money on interest charges over time. Since you’ll make larger payments each month, you’ll pay off the loan faster and pay less in interest overall.

Plus, a shorter repayment term can help you achieve financial freedom faster. Paying off your loan sooner will let you allocate more money towards other goals, such as saving for a down payment on a house or building an emergency fund.

A shorter repayment term can also help you avoid defaulting on your loan. Choosing a longer repayment term may tempt you to make only the minimum payments each month, which can lead to accruing more interest and potentially defaulting on your loan.

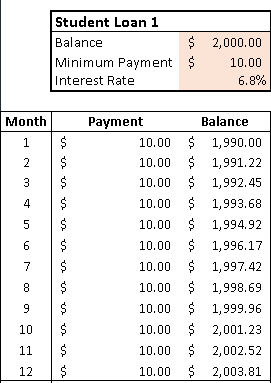

8. Make payments while you’re in school

If you’re still in school, it can be tempting to defer payments. We’re all for this pause but remember that your loan continues to accrue interest (that you have to pay later) even during this deferral period.

Once you graduate and your loan enters repayment, any unpaid interest is capitalized, meaning it’s added to your original loan balance. So, the new loan balance is the amount you’ll have to pay back.

So, how can you reduce your total loan cost while in school? Of course, making full monthly payments will result in the lowest overall loan balance. But this isn’t something most students can afford—and that’s completely fine. Even if you’re paying just $25 each month, you’ll save significantly throughout your loan repayment.

9. Work on a strict budget

Trust us when we say no one wants to spend their Sundays planning how they’ll pay their bills. But there’s no substitute for budgeting. It can help you prioritize your expenses, ultimately ensuring you don’t overspend.

This way, you can easily set aside some money to repay your debt in a shorter period. You might also be able to make extra payments, reducing your overall loan cost.

The whole thing can come off as an intimidating task. But we’ve got your back.

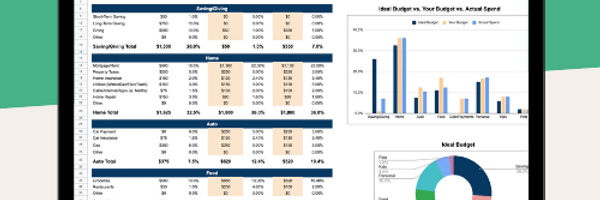

Start budgeting efficiently with our free and ready-to-use budget templates:

Simple, quick, and easy monthly budget template for Google Sheets and Excel.

With this template, you will get:

Pre-set expense categories

Simplified dashboard and day-by-day monthly tracker

Automated charts for comparison

Day-by-day views for budgets and actual spend

10. Use your tax refunds, bonuses, and gift money

This one is a cool money management method and a true test of your willpower.

Student loan interests are exempted from taxes, meaning you’ll receive tax refunds on your interest payments.

It may be tempting to use this money to sponsor a short vacation—but instead, consider redirecting the entire refund amount to pay off student debt further.

Try doing the same thing with any gift money or bonus you receive. Remember that even the littlest contribution can help in the long run.

11. Refinance your student loan

When you refinance your student loans, you take out a new loan with a private lender. The lender then pays off your existing debt and offers you new terms.

Refinancing student loans can lower your interest rate and monthly payments. If you play your cards right—you’ll end up paying thousands of dollars less.

This is especially beneficial if your credit situation has changed from the time you took out your loans. As you graduate and start working, you’ll most likely start building a more comprehensive credit history—resulting in a better credit score than when you were 18.

A better credit score will let you qualify for lower interest rates, so you’ll end up with lower monthly payments.

Keep in mind that if you refinance your federal student loan into a private one, you’ll lose certain benefits and repayment options.

12. Look for a loyalty discount

Lenders may offer you an additional discount for things, like having an existing relationship with the bank or credit union, paying on time, and more.

Make sure to check with your servicer or lender for details.

13. Consolidate your loans

If you have several federal student loans, each with its own interest rate, repayment periods, and minimum monthly payment, consider merging them all with a direct consolidation loan.

A direct consolidation loan involves taking out a new federal loan for the sum of all your previous ones. You’ll now only have to deal with one monthly payment and one due date.

Keep in mind that your interest rate will be the weighted average of the rates on previous loans, so you won’t always end up with lower rates.

14. Switch from fixed-rate to variable-rate loans

Variable rates change regularly over the life of your loan and typically begin cheaper than fixed-rate loans. While your loan rate may rise during its term, you may also benefit from a rate decrease.

How do you decide if you should switch to a variable-rate loan?

Robert R. Johnson, professor of finance at Creighton University, says, “The decision to switch from a fixed-rate loan to a variable-rate loan (or vice versa) depends upon two considerations. Firstly—consider the outlook for the interest rate environment.

If rates are expected to fall in the future, moving from a fixed rate to a variable rate loan may save you money. CME’s FedWatch tool currently suggests that the Fed will halt its rate hikes later this year and gradually begin lowering rates in 2024.

Secondly—check your degree of risk aversion. If you aren’t willing to bear the risk of even higher rates in the future, you may want to stick to a fixed-rate loan.”

15. Seek loan forgiveness and look for scholarships

Many organizations assist students who are unable to pay their debts. Graduates who work for non-profit organizations or in the public sector are typically eligible for this opportunity. However, some programs are geared toward those working in other fields.

These programs are frequently career-related, such as loan forgiveness programs for nurses. Keep in mind that the competition here is fierce, and you’ll need to prove that your financial situation is poor to repay the loan.

It also makes sense to apply for a loan only after exhausting all scholarship opportunities. Do a thorough search online and you’ll find scholarships for reasons you may have never considered.

List out your personal information, such as your culture, religion, and even your height. Then, make a list of all of your skills and interests. You’d be surprised to learn that there are awards for each of these attributes.

Useful Resources on How to Pay Off Student Loans Fast

Wondering how to pay off college debt?

There are tons of resources available to help you, including government programs, repayment strategies, and other useful tools.

Here are our top picks:

The United States Department of Education can help you understand college expenses and explore ways for minimizing them. Use the exit counseling tool to plan your education expenses for the year and estimate your projected student loan balance against your future monthly income.

StudentAid.gov gathers information from all of the loan servicers to provide you with a full picture of all of your federal student loans.

The U.S. Department of Education’s payment calculator can help estimate your monthly repayment amount for the student debt you currently have and any additional debt that you expect to borrow. Use it to help you estimate what your monthly payments will look like after school.

Use our free weekly and monthly budget calculators to manage your expenses while you're in school. Setting a budget will help you keep track of your income and expenses to make sure you’re not borrowing more than you can afford.

Use our free debt snowball spreadsheet to plan your repayment strategy and pay off your student debt faster.

Wrapping Up

Figuring out how to reduce student loan payments may seem daunting at first, but fear not—with some strategic planning and savvy financial decision-making, you can tackle that mountain of debt like a pro.

Start by taking a good hard look at your financial situation and creating a budget that works for you.

From there, explore options like refinancing or consolidating your loans to score better rates and terms.

And don’t forget to keep an eye out for easy ways to save money, like signing up for autopay or making extra payments whenever possible.

FAQ

We've put together a list of frequently asked questions to help demystify the basics of student loans and get you on the road to financial enlightenment.

.jpg)