“I just can’t figure it out!—”

That was Greg a few years back. He was frustrated—almost angry—about his finances.

Each month, he thought he was finally getting ahead, but his hopes were typically crushed by a late surge of bills.

Fast forward two months.

Greg had scheduled another budgeting meeting with me. I was prepared to talk him down off the metaphorical ledge again, but I was immediately caught off guard by Greg’s ear-to-ear smile. He was over the moon about his finances.

So what changed? How on earth did Greg pull off this rapid transformation?

You might have figured it out from the title (or have searched about a “weekly budget template” to get here). It was, of course, the weekly budgeting method.

This method seriously changed his life. And this is exactly what this weekly budgeting template could do for you, too.

Similar articles on budgeting:

The Weekly Budget Template—What Is It Really?

So what is this weekly budget tool?

First, we’ll intro the sneak-peek preview. Then, we’ll dive into what this budget template really is and how it could help you.

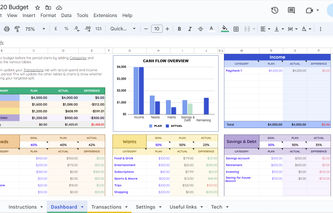

Weekly Budget Template for Excel and Google Sheets

By popular demand, I recently put the weekly budget method into an interactive, downloadable weekly budget spreadsheet so everyone can experience the same success as Greg.

Just click the “Start Your Budget” button below. The link will take you to Etsy. For a small investment, you’ll soon be on your way to transforming your financial life in 2023.

Just follow the directions on the sheet, and read through the rest of this post. You’ll be surprised by what this budget calendar system can do for you. Frankly, I’m excited for you—and I don’t even know you!

Still wondering if this tool is any good? While writing this post, I put the tool on Etsy (where nobody knew it even existed yet)—and it has already started selling. Check it out. Get the full version. You won’t regret it.

Free Printable Weekly Budget Template

Not tech-savvy? More in love with the friction of a #2 pencil on a piece of paper? Here’s the free budget template option for you. It’s not simple. It’s not interactive. And it will take you more time. But I don’t want to exclude you. Here’s the free printable weekly budget download, equipped with all the non-function-driven blanks you need.

Why Should You Use This Weekly Budget Sheet?

This simple weekly budget sheet will likely help you in a variety of ways:

It will help you make sense of weekly budgeting.

It will force you to think about the long term.

The tool will show you what your budget should look like.

You can map out your personalized budget.

And finally, you can actually grade yourself on how you’re doing with your actual spending.

It helps you make sense of weekly budgeting

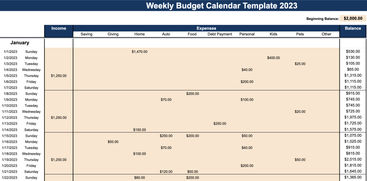

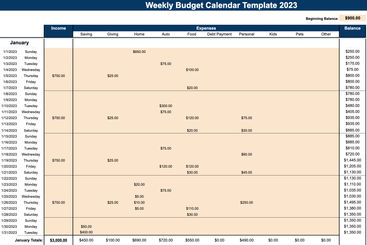

You saw the main budget tab already. It’s certainly a helpful overview, but the eye-opening moment often happens with the calendar. Take a look below.

Going into January, this individual has $2,000 in her account. Looks great, right? But guess what hits on the 1st—the mortgage payment. Suddenly, that two thousand bucks turns into $500. Then the daycare bill is due on the 2nd. Suddenly, she only has about a hundred bucks. Yikes. Maybe she wasn’t sitting so great after all.

The beauty of this tool is that now you’ll know this before time! You’ll lay out your budget like this and think, “Errrr, I’d better spend absolutely nothing this week because next week is going to hurt.” Whereas before, you’d probably head out for a fun night on the town, celebrating your financial success. Suddenly, budgeting makes sense and is easier than ever.

It forces you to think about the long-term

People tend to think hours into the future—days at best. With weekly budgeting, we train our mind to think weeks, months, and even years ahead. It’s the common differentiator to succeeding financially.

Take the career of a teacher for instance. The pay is meager, but I have met quite a few that have retired as millionaires. How did they do it? It started with budgeting and thinking decades into their future. You’ve found this template for budgeting, and you’re ready to tell your money where to go. Congrats! Put your long-term hat on and let’s shoot for the moon.

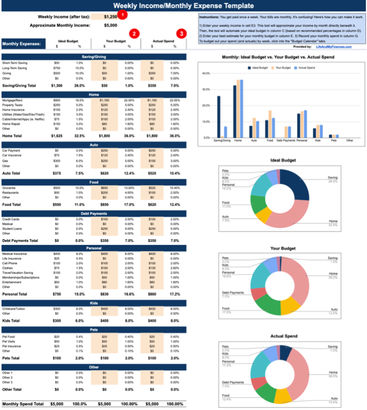

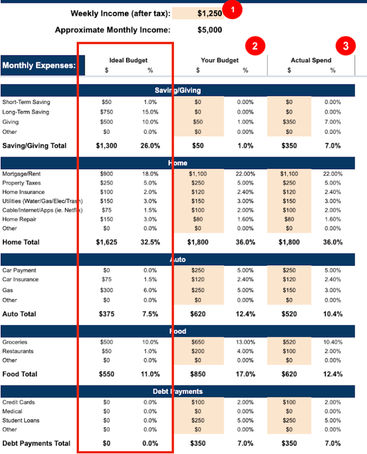

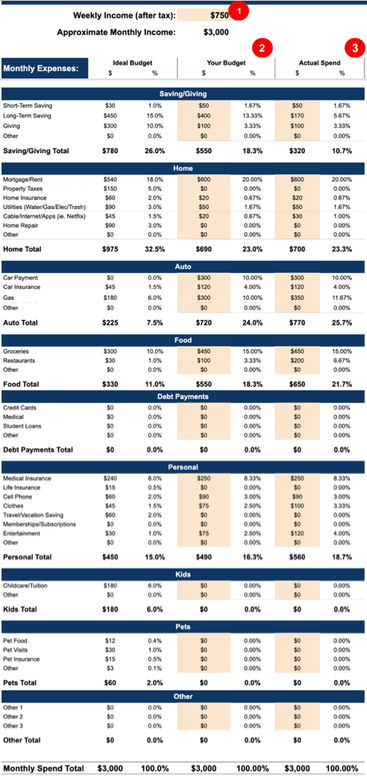

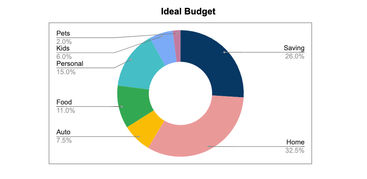

You can see what your budget should look like

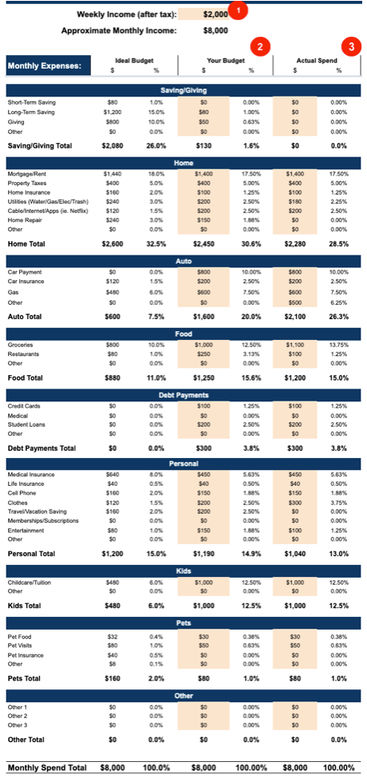

When you enter your income into the weekly budget tracker, it will automatically turn that weekly paycheck into an approximate monthly income. Then, based on that income, the tool will put your dollars into an “Ideal budget” column. (In case you missed it, I highlighted it in the image below.)

Is your rent payment in line with the ideal budget? How about the costs of your car? Food? With a suggested budget, you’ll be more equipped to put your budget together—and to put it together well.

You can easily map out your personal budget

Right next to the “Ideal budget” column is “Your budget”. All the categories are laid out for you. All you need to do is fill them in. This is waaay easier than sitting in front of a blank screen, trying to conjure up all the little things you spend on every week.

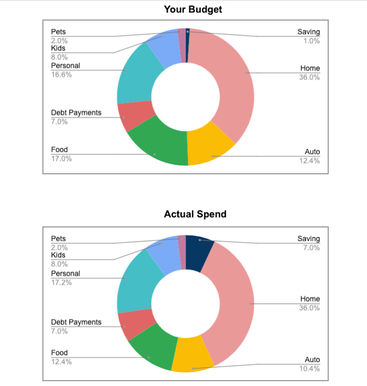

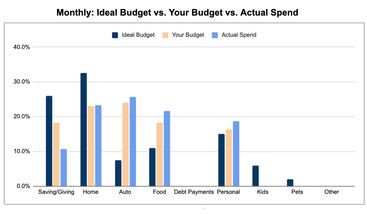

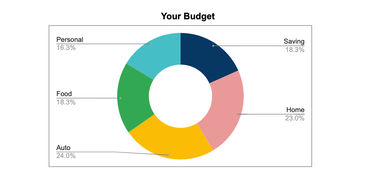

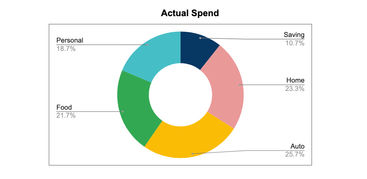

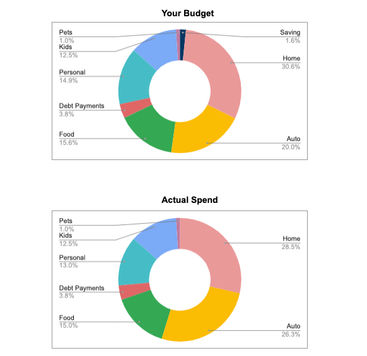

You can track your actual spending vs. your budget plan

And finally, with the “Ideal budget” and ”Your budget” in place, you’ll be ready to start tracking your actual spending to see how you’re measuring up! When you enter what you actually spend, the charts will automatically update, and you’ll be able to see and analyze your spending vs. your budget immediately!

Here’s a sample image of those charts. We’ll walk through these more when we discuss how to use the tool.

Weekly Budgeting Samples

Sometimes the best way to get a handle on something is with examples, so we’ll cover two budget samples here—one from a single male and another from a family budget with multiple incomes.

Weekly budget example #1: The single male

Let’s take a look at Ethan’s budget. He earns $750 a week after tax. He rents a room, has no kids or pets, and has a $300/month payment on his car. What does his ideal budget, actual budget, and actual spending look like?

Weekly Budget Planner: Main Tab

The ideal budget shows that Ethan should save $480 a month and give $300 away to causes of his choice. He has an obvious problem, though. His car costs nearly $500 more than it should each month, which makes saving and giving difficult.

And he doesn’t think he can spend just $330 on food each month, so his food budget is over $200 more than the ideal budget. Thankfully, his housing costs are low, and he doesn’t have child or pet costs. So, according to his initial budget, he’ll have $550 left at the end of the month for saving and giving. That’s not too bad!

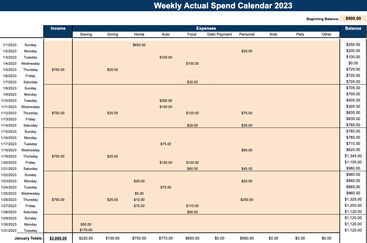

How did his actual spending pan out?

Ethan didn’t have anything major issues pop up during the month. His paychecks came in as expected, and most of his bills hit when they were supposed to, but he just had a few overspends: in gas, restaurants, and entertainment. With the additional expenses, he only had $320 for saving and giving at the end of the month. Again, not bad, but something he can improve on in the next month.

Weekly Budget Template: Budget Calendar Tab

Want to see how this spend looks in the calendar view? The first image was Ethan’s plan for January 2023. The second image is what actually happened. (Note the first few days—before Ethan got his paycheck. His budget said he’d only have $75 on Wednesday. With gas and a little extra entertainment, he nearly took himself into the negative! Good thing he knew where he stood with the weekly expense sheet, calendar view.)

Weekly budget example #2: The family budget

Okay, the single male budget was interesting—but what if you’ve got a family, including kids and pets? That gets way more complex, right? Perhaps. There are more chances for unexpected expenses, but the weekly paycheck budget template still works the same.

Our sample couple is Kyle and Jamie. Between the two of them, they earn $2,000 a week. They have two kids—one in school and one in daycare. They own a house and have two car payments. Let’s have a look at their main budget tab with their ideal budget, their actual budget, and their monthly spending—

By looking at the table or the budget charts, you can see their house payment is in line, but their car costs are absurd. Also, their kids and food are more expensive than what’s recommended. When their actuals landed, they had absolutely nothing to give or invest.

To truly get ahead, they will have to tighten their budget, get their cars paid off, and put money away for their future. If they don’t, they’ll be broke for life. And that’s no one’s aspiration.

How to Make a Budget Sheet

To create a weekly budget template, follow the steps below:

Get out a blank piece of paper (or open a blank excel sheet).

Write down your weekly after-tax income, then multiply by four to get your monthly income.

Next, write down all the expenses that you incur each month (names and amounts—your home, car, food, debt, personal, kids, pets, etc).

Do you have a surplus of money left? Add categories for saving and giving.

Then stare at your expenses and decide if you’re happy with them or not. If not, make changes. Either spend less or—if you need to—call your providers to get a reduced rate.

Finally, track your spending vs. your proposed budget. Are you spending according to your wishes? If not, what can you do to change that?

Keep tweaking and changing your budget until you’re satisfied.

You could do all that—or you could just download the weekly budgeting worksheet I already created. It’s a tool with suggestions and templates for budgeting and spend tracking (both in a simple view and a calendar view). Or—if you don’t mind the trimmed-down version—you could use the free downloadable weekly budget spreadsheet in Excel. If it were me, I’d gladly use what already exists vs. building something from scratch.

How to Use This Weekly Budget Sheet

You’ve already seen a few example scenarios. Now let’s whip out the manual—

Start on the “Weekly Income Monthly Budget” tab

In this tab:

Enter your weekly income at the top of the sheet.

Review the ideal budget column that automatically populates.

Take a look at your recent bank and credit card transactions to gain an understanding of your spending.

Create your proposed budget in the middle column.

When the month starts, keep track of your actual spending, and record it in the far right column.

Fill out the budget calendar tabs

One of the calendar tabs is for your budget. Start here. First things first, enter your account balance at the top right of the sheet. While looking at your proposed budget from the main tab, fill out how you think your spending will take place on the monthly calendar (do this just one month at a time).

Your mortgage should be an easy one. That’s due on the same date every month. The same is probably true for your car payment, credit card bills, student loans, and utility bills. Then take your best guess at the amounts and dates for your other expenses.

When you’re done with that, ensure your total spend (including the amount you put into your saving account) equals your total income. Finally, track your actual spending in the final tab. See how well you’re matching up to your proposed budget as you go. And always watch how much cash you have on hand. If heavy spending is coming in future weeks, be sure you’ll have enough to cover it.

What happens when you get paid five times in a month? Then what do you do?

You may have been wondering, “If I assume every month has four weeks, and there are 12 months in a year, that only equates to 48 weeks. What happens to my other four weeks of paychecks?”

Your total income will obviously happen, but it’s going to appear like bonus money in this template. In other words, you’ll plan your main budget with just four weeks of paychecks, but when you enter your income into the calendar view, you’ll realize that you’ll actually get paid five times in the month.

What do you do with the extra paycheck?

You essentially have two choices:

Go back into the main sheet and override the formula that multiplies your weekly income by four. Instead, multiply by five and then budget accordingly.

You can treat it as bonus money. Either put it all toward your investments, decide to use it for a vacation, or do some combination of both. Your call—after all, it is your money!

What Should The Weekly Budget Template Do For You Long-Term?

First, the weekly budget spreadsheet should ease some tension between you and your spouse. You’ll both agree on the budget, you’ll be working toward the same goals, and you’ll be winning together! It’s a great feeling when you and your partner are on the same page.

Second, this budget tracker will make you question everything you spend money on (in a good way). Before writing down your expenses, you would have assumed you lived a pretty frugal life. After writing down your expenses, you’ll likely find hundreds of dollars in savings each month. Sounds crazy, but it’s true.

Finally, this template should make your future 80-year-old self smile from ear to ear. With this exercise, you will think about your retirement years more than you ever have. You’ll reduce your spending, get rid of your debts, and start investing heavily in your retirement. I’d say this ~$5 budget template purchase is well worth the money. Wouldn’t you?

Tips to Win With Weekly Budgeting

I’ll close out here with some final tips. My main tip: Be like Nike and just do it.

My second tip: When you first do it, you won’t enjoy it. You’ll realize how little you know about your own finances. But from week to week, you’ll tweak and tweak, and create a proper budget. Find the simple weekly budget template on our Etsy page.

.jpg)

.jpg)