A man reached out to me a few years ago—looking for help with his finances. I shot him an email back, asking for all the usual stuff:

Credit card and bank statements

Monthly income

And the $150 fee I charged (which I felt guilty about until I got his email back)

He sent all the info, and my eyes couldn’t get past his monthly income. This dude was making—get this—$600,000 a year!

And he was struggling to pay the bills? Sure, he lived in a high-cost-of-living area. But beyond that, he just wasn’t paying attention.

He fell into the trap that we all do. We make money, we spend it, and we put that process on repeat the next month. Most of us don’t stop to make a plan for our money.

Well, this is your chance. Stop. Take a moment, make a budget, and create wealth. You won’t regret it.

Or, you can get the one we created (below)

Simple, quick, and easy monthly budget template for Google Sheets and Excel.

With this template, you will get:

Pre-set expense categories

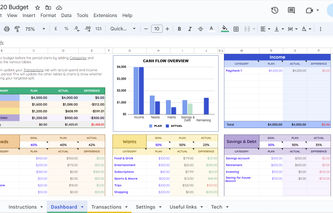

Simplified dashboard and day-by-day monthly tracker

Automated charts for comparison

Day-by-day views for budgets and actual spend

Similar articles on budgeting:

Monthly Budget Template—What We’re Offering In This Post

Most people save nothing (like my client in need). They spend everything they have every month and put no money away for the future. Others save as much as they can, amass millions of dollars, and then die. Which of these people need to get on a budget? Both.

While we’re alive, we shouldn’t only spend—and we shouldn’t only save. We should do both every month. We should enjoy our money now, and we should earmark some for the future to enjoy then, too. So how do you do this? Enter the monthly budget template—

Monthly Budget Template For Excel and Google Sheets

A monthly budget template is basically a budget tracker. It’s meant to plan your income and expenses, and then show what actually happened.

With this DIY budget planner of sorts, you can see if you’re on track with your spending goals each month. And you don’t need to involve anyone else in the process if you don’t want to. Here’s a sneak peek at our monthly budget template—available in Excel and Google Sheets.

Katlin recently purchased this budget sheet and rated it 5 stars out of 5:

"Awesome! So excited! Thank you!"

Can’t wait to check it out and use it for yourself? Make a small investment and download the full version from our shop.

(To use the file in Google Sheets, download the Excel budget planner from Etsy and save it to your computer. Then hop into Google Sheets and upload the file.)

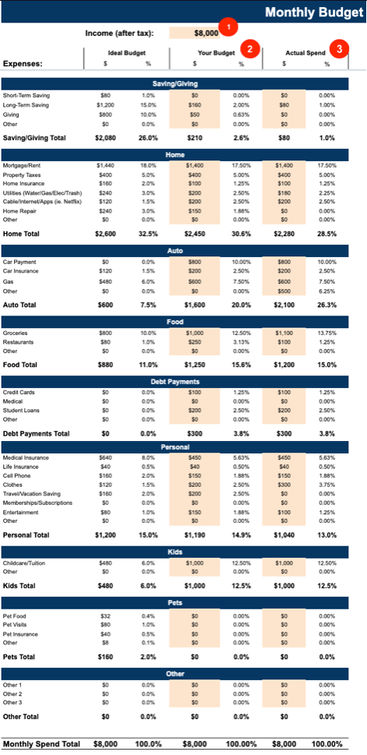

This monthly budget sheet includes:

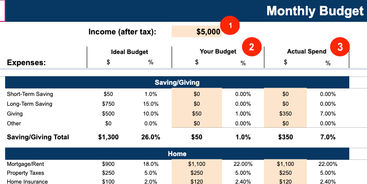

An estimate of what your budget should look like.

A space for you to enter your budget by category.

A column for you to enter your actual monthly spend.

And, of course, there are budget charts so you can quickly analyze how you’re doing.

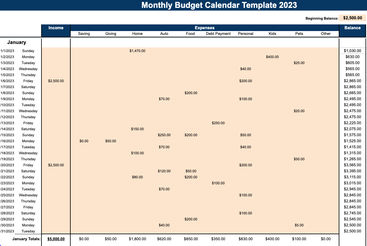

There is also a calendar view if you want to budget and track your spending each day:

Free Monthly Budget Template

Not looking to spend money right now? We also offer a free monthly expenses template.

It’s a printable monthly budget template, so you can easily write in your budget and track your actual spending (vs how much you should really spend).

It’s more tedious to fill out and calculate vs. the full monthly budget tracker version since you’ll be using pen and paper. And you won’t get all the nifty charts and graphs of your progress. But if this is your style for budget tracking, go for it!

Here’s a sneak peek of the printable monthly budget sheet:

Here’s the free budget spreadsheet download if you’d like to start here.

Why Use Our Monthly Budget Sheet

We offer a monthly household budget template. Why should you use it? How will it actually help you? Read on, my friend.

It gets your mind thinking long-term

Without a budget, you’re sitting shotgun, leaving it up to everyone else to direct your financial life. Start budgeting, and you’re in the driver’s seat. You’re thinking about your budget, which means you’re ready to plan your future.

If you’re already strapping on your driving gloves, you may also want to check out our free investment calculator and our free retirement calculator.

See what a monthly budget should look like

This personal monthly budget template has a cool feature that no one else has. When you enter your monthly income at the top of the sheet, you’ll immediately see an “ideal budget” populate on the left side of the template.

It shows you:

How much your house payment should be.

How much you should save and give.

What you should spend on your car each month.

How much you should spend on food.

And more—

With these auto-populated fields, you might immediately see trouble spots in your spending. And this “ideal budget” should also help you create your monthly budget.

React to your budget

A few years back, I paid off $21,000 of debt in just six months . There were two main reasons I accomplished such a feat:

Writing out my budget.

Using the debt snowball method.

Here’s the play-by-play of what happened when I wrote out my budget:

I looked at my bank and credit card statements to see what I was spending each month.

I put all those expenses into a simple monthly budget template.

Within seconds, I found expenses that were just too much for what they were. It made no sense.

I immediately called my cell phone provider, insurance agent, and cable company. I told them I was looking at my budget, and the rates they were charging me were too high. I needed them lowered, or I was going to look elsewhere.

Most lowered their rates. If they didn’t, I found cheaper rates with other providers.

In the end, I cut my budget to just $460 a month (excluding property taxes and insurance, which I paid once a year). Making a budget flips the script. It makes you the master of your money instead of a slave to it. It’s your choice.

You’ll finally see what you actually do with money

You’ve got a bow and arrow. You shoot it aimlessly into the woods. “Dang, that was a nice shot,” you say as you pat yourself on the back. But how do you know? You were aiming at nothing. This is how it works when you spend money.

If you never write down what your money should be doing for you, how do you ever know if you’re doing a good job with it?

With our monthly budget template for budgeting, you’ll finally have something to compare to. Scary, yes.

When you first aim at that bullseye, you’ll likely make a discovery—you’re as good a marksman as Elmer Fudd.

But, if you never try to sight in that target, you won’t ever become a world-class archer.

In the same way, if you never start budgeting, you’ll continue to spend terribly and leave your future at risk.

What Will Happen When You Make a Budget

For most, budgeting is a bit of an earth-shattering, eye-opening experience.

You’ll set your budget, and you’ll be feeling good. You’re going to spend exactly what you wrote down that month.

On day two, your furnace goes out. You need to get it fixed—the cost is $400. You already blew your budget.

Oh, and in your monthly budget template, you forgot about your cable bill and water bill, and you waaay underestimated your grocery bill (since when did food get so expensive?).

This will happen to you, but don’t worry. It happens to everyone.

You’ll learn, you’ll get better, and you’ll really start to own your money after the first few months. Not to mention, you’ll begin to save more because you’ll cut out all the ridiculous spending you never even thought about before this budgeting exercise.

Monthly Budget Examples

When I budgeted to pay off that $21,000, I knew I wanted that debt gone in 6 months. I had no clue how I would do that, but I made it happen thanks to the budget exercise.

You can make big things happen, too. I know it. To familiarize you with this home budget template, let’s walk through some examples of monthly budgets.

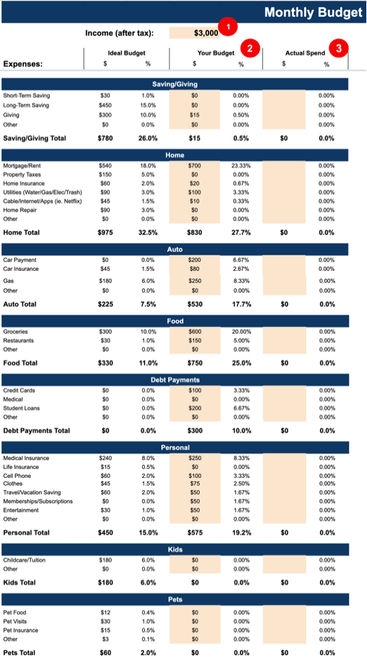

Monthly budget example #1: the single guy

First up, the single guy with some pretty straightforward income and expenses:

Income = $3,000 a month.

Rents a room for $700 a month.

Has a car with a $200 payment.

He spends roughly $150 a month on groceries and goes out to eat once in a while.

He has some debt:

$200/mo for student loans

$100/mo for credit cards

He has other pretty standard expenses (medical, cell phone, gas, etc.) and gives a few bucks to charity here and there.

Here’s what this monthly budget example looks like:

He has no kids or pets, so we have zeroed out those sections. Take a look at the ideal budget vs. the monthly budget for this single guy.

Where is he falling short? Where is he spending too much money?

First, he’s not saving any money and he’s not giving either (which I believe is important for a human—to do less for ourselves occasionally and instead do good for others in need).

Second, it looks like he’s overspending in the following categories:

Auto—he’s got a car payment that’s weighing him down.

Debt payments—he’s got student loans and credit card debt.

Personal—he’s spending more on himself than he can afford given his income.

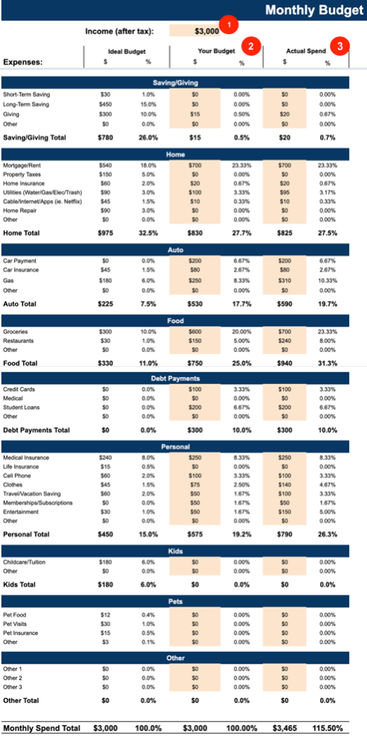

Monthly budget example with actuals: the single guy

Let’s say Steve (yes, I’m finally naming this guy) gets through one month of tracking his expenses. What does that look like? And how did he do?

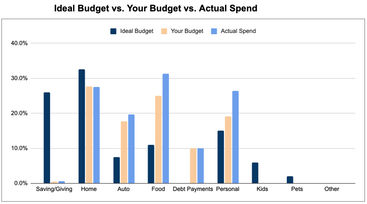

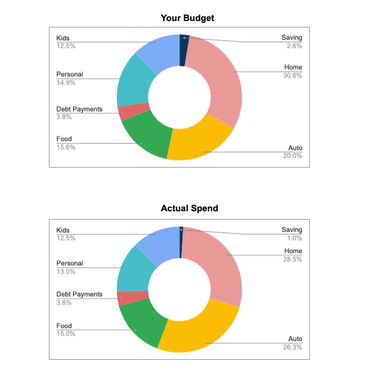

By viewing the budget chart, it’s pretty clear Steve overspent in “Auto”, and he blew it in “Food” and “Personal” as well.

By looking at the table, you’ll see that he overspent specifically in:

Gas

Groceries

Restaurants

Clothes

Entertainment

Steve made $3,000 and spent $3,465 that month. Not good. His credit card balance is going up, so his minimum payment is likely going up—making it even harder for him to stick to his $3,000 budget next month.

Monthly budget example #2: married couple with two kids

What if you’re married with kids? What might your family budget template look like?

Here are the stats of our example couple, Samantha and David:

Both work and earn a combined monthly income of $8,000.

They have two young children—one in school, the other in daycare.

Their home mortgage is relatively modest at $1,400/month.

They have two car payments and a student loan.

They have no pets.

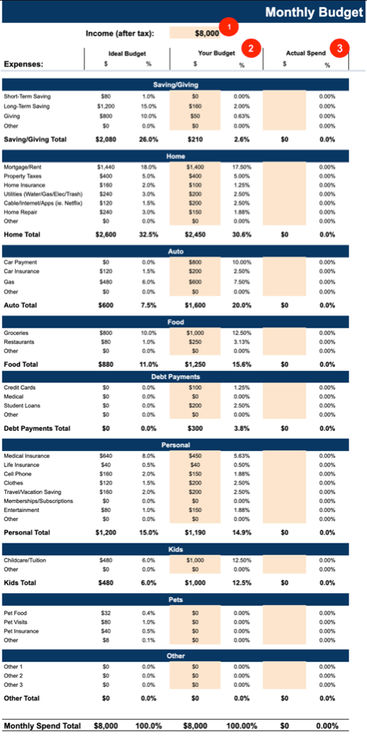

See below for their ideal budget and their proposed budget:

Right off the bat, you can see that they’re not saving or giving nearly enough.

So what are they over-budgeted on?

Auto—they have two car payments that total $800. This is killing their monthly budget.

Food—they spend more on groceries and restaurants than they should.

Debt payments—they have credit card debt and student loan debt that’s eating into their budget.

Kids—their daycare costs are $1,000 a month.

Monthly budget example with actuals: married couple with two kids

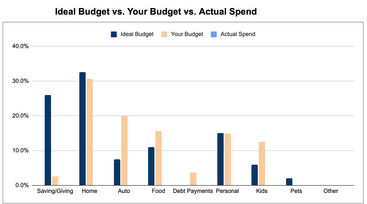

So how did Samantha and David fare with their first month of budgeting?

Unfortunately, winter showed up, and David lost control of his car on the ice. He hit his front bumper on the guardrail, which needed immediate repair. This cost Samantha and David $500, which wasn't in the budget.

To counter this unexpected expense, they pulled back on:

Home repair (nothing happened to the house during this time, thankfully)

Eating out

Entertainment

You can see this clearly in the circle budget charts above. Actual spending on "Auto" was 26.3% of their budget vs. the 20% they had budgeted for. Then you can see their pull-back in “Home”, “Food”, “Personal”, and “Savings”.

Pretty cool.

Samantha and David didn’t match their budget perfectly, but they did a great job battling back from an unforeseen expense! And they were still able to put some money into long-term savings. It wasn’t perfectly to budget, but they made it work!

How to Create Your Personal Budget Template

If you’re wondering how to make a monthly budget template on your own, you can—but it’s going to take some time, and it probably won’t come out as pretty or as functional as our tool (I’m allowed to brag a bit, right?).

And, our monthly budget excel template is less than $5. Well worth the purchase. (Plus, you haven’t even seen everything it can do yet!)

So instead of making a budget template, let’s use this section to explain how to use your budget template.

How to fill out the main budget template

You’ve probably gathered how to do the first steps by now with our previous monthly budget examples, so we’ll walk through this quickly.

First, type in your total income after tax for the current month. The ideal budget will populate immediately after you hit “enter”.

Second, fill in your proposed budget for the month. If you have expense items that aren’t listed, include them in the appropriate category and in the “Other” row.

Your total budget should equal your total income. If you have extra dollars to spend, put them in your long-term savings line. If you have too many dollars budgeted, you’ll have to find something to cut out (otherwise, you’ll continually be going backward financially).

Finally, track your monthly spending in the “Actual Spend” column.

How to fill out the budget calendar and actual spend calendar

Click the “Budget Calendar View” tab to get more granular with your budget. Below is an example of a $5,000 budget. It looks daunting at first, but it’s pretty simple.

First, enter your beginning bank account balance in the upper right-hand cell (the amount you have when the month begins). Then start filling in your expenses as you expect them to hit.

For instance:

The mortgage might always hit on the 1st, so enter it in the first line and under the category “Home”.

Then, on the 2nd, you might have your son’s daycare bill due, so plug that into January 2nd under “Kids”.

Start with all the items that regularly hit on the same date each month—the credit card bill, car payment, student loan bill, medical insurance, life insurance, subscriptions, and so forth.

Then fill in the other expenses with your best estimates. Your actual spend calendar tab will work precisely the same way, except you’ll enter each daily spend as it hits. You won’t need to guess.

The 50/30/20 budgeting rule

You may have heard of this rule while searching for a budgeting worksheet. Our template is actually built on this premise.

The rule states that:

50% of your after-tax income should be spent on needs and obligations (dwelling, utilities, transportation, and clothing).

30% should be spent on anything else you might want (entertainment, eating out, private education vs. free public schooling, etc.).

And that leaves 20% for saving, giving, and debt repayment.

Use this as a guide when you put your budget together.

What Should The Monthly Budget Template Do For You Long-Term?

Whew! If that seemed like a lot, remember what Archimedes once said: “Give me a spreadsheet long enough and a computer on which to place it, and I shall move the cash flow.”

With the right tools, anything is possible. And trust me, these are some of the best monthly budget tools out there.

So how does a monthly budget spreadsheet help you?

We already stated a few budgeting benefits early in this post:

Budgets get you thinking about the long-term (i.e., investing for retirement).

You’ll see what a budget should look like.

When you put your numbers into the cells, you immediately start reacting to them (and work toward reducing the expenses).

You’ll finally see what you’re doing with your money when you record what you're actually spending.

Are there other long-term benefits of budgeting?

You might be surprised, but there are more.

You’ll learn cash flow analysis

When you fill out the calendar view of your budget and actual spend, you’re actually performing a cash flow analysis. Sounds fancy, but it’s pretty simple.

By recording your daily spending and tracking how much is in your account, you’re ensuring you’ll always have cash in the bank on any given day.

You’ll have a constant point of reference

By filling out the main budget and the daily calendar budget view, you’ll always know if you’re on track with your budgeting goals and if you need to redirect your course (like if your car costs you $500 early in the month).

Get you and your partner on the same page

Talking about money gets you nowhere. Seeing a plan for money makes sense.

If you and your partner can sit down and put a budget together, your relationship will get 10x better almost immediately. There’s nothing better than being on the same page as your spouse.

Tips to Win With This Budget Tracker

If you want to win with budgeting, here’s what I suggest you do:

Download the monthly budget spreadsheet.

Enter your income, your proposed budget, and your actual spend—both on the main page and in the daily calendar.

Track your expenses vs. your budget at the end of each day for three months.

Once you get the hang of budgeting, begin to ask yourself where you want to be financially and why.

Transform your budget monthly. Inch yourself toward where you want to be.

If you want to retire wealthy, you’ll likely need to put at least 15% of your income into long-term investments. To do that, you’ll probably need to get rid of some debts to free up the cash to invest. Do what you can to make this transformation sooner rather than later.

Need help getting out of debt? Check out our debt snowball spreadsheet post. Or, if you’re looking for a template, visit our Etsy page for the debt snowball spreadsheet.

Other Monthly Budget Templates and Apps You Might Like

If you’re not in love with our monthly budget worksheet, there must be something wrong with you. Joking, only joking. Seriously though, if you’re looking for alternatives, there are two great ones that I can think of off the top of my head.

Tiller is a budget template that’s built into Excel. It might initially sound ordinary, but they took it one massive step further.

They set it up so you can link your Excel sheet directly to your bank accounts. Yes, you can get your detailed transactions directly into Excel (or Google Sheets) and then build your budget from there. It’s pretty incredible.

The look isn’t super pretty, and it takes a few steps to get the bank linking to work, but once you get it all set up, this budget tool is pretty slick. Try it for free for the first 30 days. If you still love the tool, there’s an annual fee of $79.

.jpg)

.jpg)