How much of your income should go toward your mortgage payment? How much for food? What about your car? Everyone has a different opinion, but what are the wise numbers? How much should you spend on that?? Nobody wants to barely scrape by each month and end up with very little in retirement, so let's dig into these numbers and figure out what amounts are best for you!

Similar articles on budgeting:

How Much Should You Spend on That?

The single biggest purchase for nearly everyone in America is......that's right, a house. We all start out our lives living in a crummy apartment, dreaming of home ownership.

After a couple years at a full-time job, we decide to take the plunge and head to the bank to see how much house we can afford (which is typically our first HUGE mistake in life...).

The bank tells us that our mortgage loan can be 28% of our pre-tax income and our total monthly debt payments can be as high as 36% of our pre-tax income. Without thinking about it, many of us smile excitedly because that means we can buy a wicked nice house!

But do you realize what this equates to in after-tax dollars? 40% mortgage payments and 51% debt payments.... Well that sucks. You earn $3,000 a month and immediately over $1,500 goes toward your debt.

Then you still have to pay for utilities, food, clothing, car insurance, gas, and if you have any money left...about $13 worth of fun. Yup, sounds pretty terrible.

Read more on getting out of debt:

Instead of groveling to the bank, asking how much money you can borrow, why not use your brain and think for a minute?

Questions You Might Want to Ask Yourself:

First, what's your current rent? Can you even afford to pay more than that on a new mortgage?

Second, what's the optimal percentage for your mortgage payment? Instead of using the bank's ridiculous 40% number, I like to target 25%. If your take-home pay is $3,000 a month, target a house that only costs $750 a month. This lets you have some breathing room in your budget and it still allows you to afford a decent house.

So what about all the other areas of your spending? How much money should you be allocating toward your food? Toward your clothing? Toward everything else? How much should you spend on that?

How Much Do Normal People Spend?

Before we dive into what you should spend, let's take a look at the Joneses. I want you to understand that yes, they look good with that monster house, that Mercedes Benz, and the yacht, but they are absolutely BROKE.

All their money is going toward debt and they are SHACKLED to it. They have very little money for spontaneous fun, and they NEVER build up any money for their retirement.

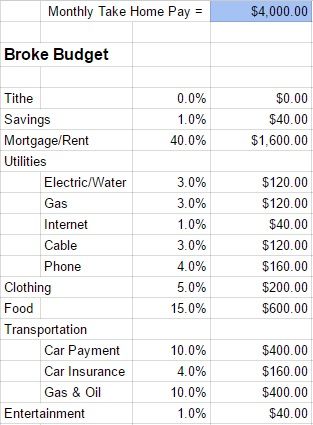

Here are their typical spend percentages:

They take home $4,000 each month, which is pretty dang good! Unfortunately for them, they listened to the bank's advice and loaded up on mortgage debt. They live in a $300,000 home, drive a couple of decent cars (thankfully one of them is paid for), and dine out every Friday.

They look like they're doing pretty good from the outside. I mean, their house is huge, their cars are sparkly, and they always seem to be eating out at the next new restaurant.

BUT, take a look at their savings rate....1%. And the amount of money they give away? Is none. These people are looking good, but are living paycheck to paycheck and miserable.

Do NOT aspire to be this family.

Read more:

What About You? How Much Should You Spend?

So if the above budget was too lavish, what's a better approach?

If you've poked around on this blog for more than 2 minutes, you already know that's I'm a no debt kind of guy. I believe in fully paid-for cars and a tight grocery budget. But, I also believe in saving money and giving some of it away. It's simply the best way to live.

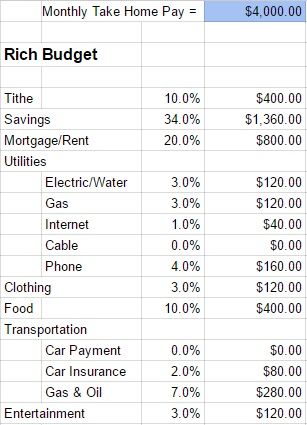

In my opinion, here's a much better method for allocating your spending:

First of all, take a look at the house payment. Instead of a massive payment of $1,600. Shoot for $800 (or 20%-25% of your take-home pay). Think that's impossible? My first home mortgage payment was $700 a month, and that was on a 15 year note!

Second, since you drive modest paid-for cars, you have no car payment (my wife and I had a combined car value of $4,000, which made it really easy to pay cash for them!).

With just those two actions, you've already reduced your monthly payments by $1,200!!

And you know where that money goes if you're not spending it on your house or your cars? Into your savings and investments! Dang, this is easy isn't it?? ;)

Are you serious about getting rich someday? Here's a guideline for your spending:

Savings = 20%

Tithe = 10%

House = 25%

Food = 10%

Utilities (including phone and cable) = 15%

Transportation = 10%

Clothing = 5%

Other = 5%

Read more:

Your Turn - How Much Should You Spend?

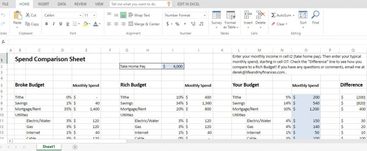

So what about for you? Whatare you spending your money on each month? I wanted to make it as simple as possible, so I created an easy Excel tool for you to use. This will show you how broke people would spend your money, how rich people would spend your money, and how you're currently spending your money.

Wonder how you compare??

Check it out! Spending Comparison Spreadsheet

Download the spending comparison sheet and take the following steps:

Enter your monthly take-home pay in the upper-middle cell (highlighted in blue)

Enter your current payment amounts for each of the categories

Add any additional funds that you spend money on into the "other" bucket (ie. medical bills, dance classes, etc.)

Make sure all the categories total up to your take-home pay

Study your numbers - where could you improve? How do you compare to the broke and the rich??

If you're house heavy, it might be time to sell the house. If you have a whack load of car payments, then you're probably going to want to sell your car and get something super cheap.

Granted, none of these options are going to make you look super cool, but at least you'll be able to breathe again! AND, you'll be able to save for your future!!

I always advise that you consciously spend less, earn more, and invest heavily. I absolutely love Wealthsimple. It's cheap, super simple, and the tool pretty much does the investing for you!

.jpg)

.jpg)