I’m a personal finance expert. I’m supposed to be super smart about money. These were our expenses in the last two weeks:

Half-cow (beef): $1,700

Flight tickets for our February vacation: $1,500

Vet bill for our dog (abscessed tooth): $1,500

Home insurance: $1,150

Car insurance: $1,100

Medical insurance: $700

Dining out: $150

My wife just called an emergency budget meeting. Oops. Our savings accounts are dwindling, and I didn’t see it coming. I was not paying attention to the budget—time to refocus and get back into it. I’m certain I’m not alone.

Other helpful articles on budgeting:

And if you are interested in beefing up your savings, check out these posts for the best saving accounts:

Budgeting Statistics (and How to Improve Them)

I’m a money nerd, and even I don’t love budgeting. What are the odds that the average person is deeply enamored with their highly detailed Excel spreadsheet of income and expense transactions? Not great.

According to a recent survey, just 27% of US households prepare and follow a monthly budget. Why so few? First, budgeting can get complex if you don’t have the right personal finance tools. Second, it can get incredibly dull if you’re stuck sitting in front of your computer for hours on the weekend.

Why is budgeting important?

Who better to ask this question than the man himself—J. Money, founder of BudgetsAreSexy.com:

Budgets are awesome. They make you more confident, which in turn makes you sexier! By giving each of your dollars a mission you stay in control and write your story vs. the other way around. Even when you fail, you win, because you are actively working on it and can pinpoint what went wrong!J. Money, founder of BudgetsAreSexy.com

So what’s the solution to get more people into budgeting? (including myself)

Make it simple.

Make it quick.

Boom. I cracked the code.

Best Budget Templates for 2026 (Sneak Peek)

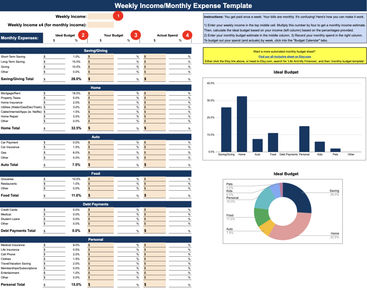

I recently put together an Excel template for budgeting that’s easy to understand, fill out, and download, so you can look at it whenever you want. It works in Excel, Google Sheets, and Numbers. And I created two of them: one for a monthly budget, and the other for a weekly budget (if you get paid weekly).

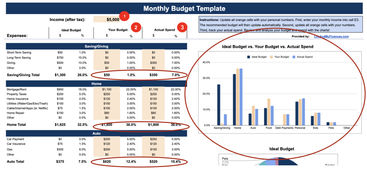

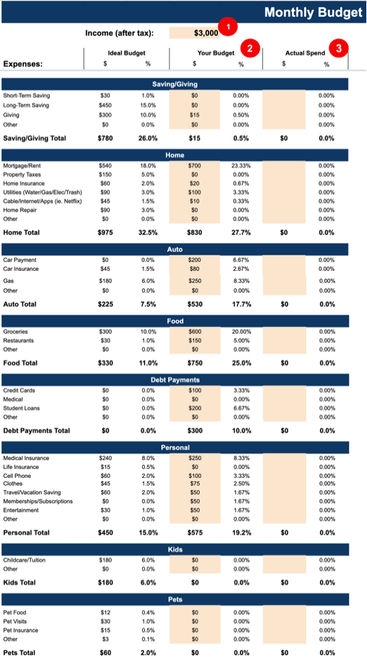

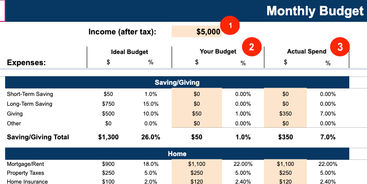

Monthly budget template

Here’s the main page of the monthly budget planner. I don’t want to give too much away, but within this one tab, you can enter your income and then immediately get a proposed budget that you can follow. All the main expense categories are already pre-populated, and it’s plug-and-play. There are some wicked-sweet comparison charts, too.

Click the button below—it’ll take you to our shop page. With a small investment, you’ll get a digital download sent to your email to start planning your budget right away.

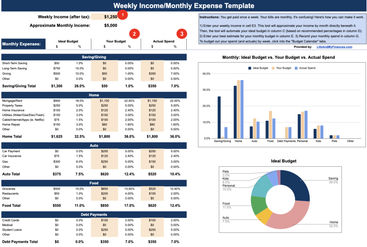

Weekly budget template

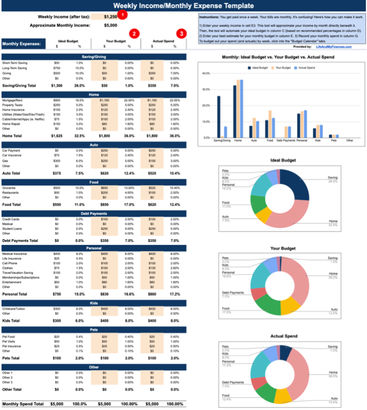

If you get paid weekly, you’ll be more interested in our weekly budget Excel template. Just enter your weekly income in this file, and the sheet automatically turns that into a monthly figure and then fills out the ideal budget based on your weekly paycheck. Then use the ideal budget figures to form your personal budget. Finally, track your actual expenses in the far right column. Use the charts and graphs to see where you can improve.

Click the “Start now” button to download the weekly budget spreadsheet from our shop.

Who Are These Personal Budgets Best For?

These customizable monthly budget templates are really for anyone—but they work great for the following:

Single person monthly budget template

Couple budget template

Family household worksheet

High school student budget template

College budget template

If you want to keep your budget super basic—or get more complex and expand or track it by the day—you can do that with this tool. It works best for those who want to get started quickly, get guidance on creating their budget, and have an easy tracker.

How Does Our Budget Worksheet Help You?

Here are the many reasons why our template might be the best budget sheet out there—

Monthly view

The most popular budget tracker we offer is the monthly budget spreadsheet. The monthly view lets you create your tracker for the current month, update your calendar, and move on to the next month when you’re ready. It’s simple, quick, and feels great once you have a solid budget plan.

Weekly view

Some people get a paycheck weekly, which makes it challenging to plan monthly. For instance, they’d have to translate their income into a monthly format. Thankfully, this tool calculates that automatically.

Daily budget planner

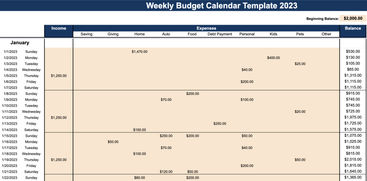

Our budget templates have dedicated tabs if you’re hardcore and want to plan and track your money by the day. There’s a full calendar for 2026, leading us to our next point.

Calendar budget template

Most budget worksheets give you a monthly view, and that’s it. That’s really not helpful since life constantly changes and often in an instant. One month is never like the next, so we offer you a calendar view where you can plan and track actuals each day, all in one place.

365 budget planner

If you’re more into planning for the year, our calendar includes the entire 2026 calendar year (with both days and dates). You could budget out each day for the whole year if you wanted. (If you actually do this, I want to know. You might become my new hero.)

Here’s a look at the budget calendar starting in January:

Budget vs actual variance analysis template

This one is super important. What’s the point of budgeting if you’re never going to track how you’re spending against it?

We set up the main budget view right next to the actuals, so you can compare and contrast how much you spent vs. how much you budgeted in each category. (And, spoiler alert to an upcoming benefit, we also offer charts that will help you analyze your spending.)

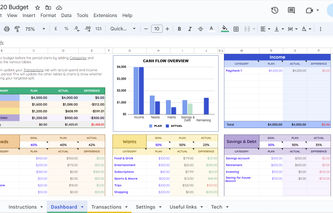

Cash flow budget template

The talking heads on TV often make finance sound so complicated. It doesn’t have to be. Case and point—cash flow analysis. It sounds fancy, but it’s pretty simple, and our templates make it even easier.

Cash flow analysis is simply reviewing how much cash you have in your account. With the calendar budget view, you can get a daily look at your cash and make sure there’s enough money there for those big upcoming bills.

Zero-sum budget template

A zero-based budget means you plan out every dollar of your income (and not just the dollars you’re going to spend).

Plan your mortgage and car payments, but also make a budget for how much you will save and invest. No surprise, our budget spreadsheet does all of that—so yes, it’s a zero-sum budget template.

Read more:

Charts

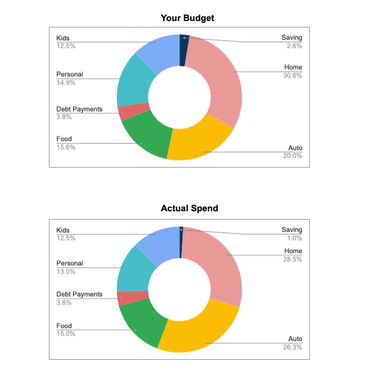

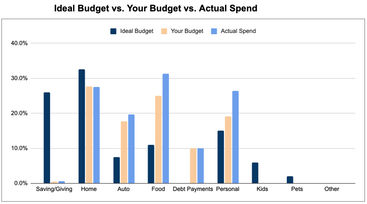

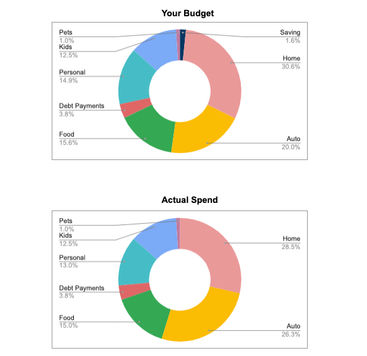

Finally, we’ve got some nifty charts and graphs to help you better understand your numbers. One chart shows the “Ideal budget” vs. “Your budget” vs. “Your actual spend,” and the others show the percentage of spending by category.

Sample Budget Examples

We’ve nearly shown you the Excel budget template in its entirety, but it’s always helpful to see a few examples to get a feel for how to use the tool.

Single person monthly budget template

First up, the single guy (we’ll call him Reggie) with some pretty straightforward income and expenses:

His income is $3,000 a month.

Rents a room for $700 a month.

Has a hatchback with a $200 payment.

He spends about $150 a month on groceries and rarely goes out to eat.

He has just a couple of debts:

$100/mo for credit cards

His other expenses are pretty common and straightforward.

Here’s what this monthly budget example looks like:

He has no kids or pets, so we have zeroed out those sections. Look at the ideal budget vs. the monthly budget for this single guy.

First, he’s not saving any money and not giving either (not good for his future or his personal well-being).

Second, it looks like he’s overspending in the following categories:

Auto—his car payment is weighing him down.

Debt payments—ideally, he shouldn’t have any. He’s got student loans and credit card debt.

Personal—he’s spending more on himself than he can afford, considering his income.

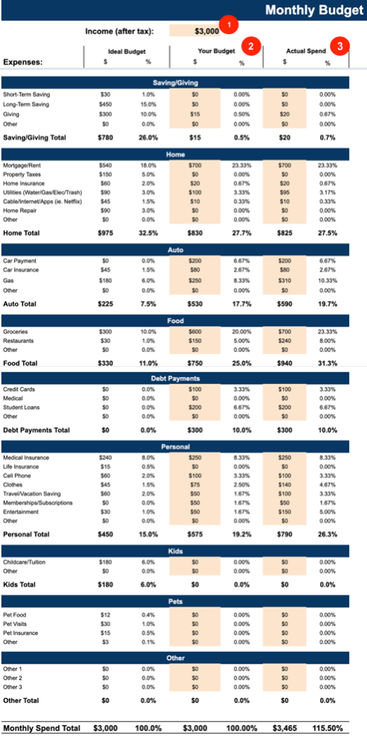

Monthly budget example with actuals: The single guy

Let’s say Reggie gets through one month of recording his actual spending.

What does that look like?

And how did he do?

By viewing the budget chart, it’s pretty clear Reggie overspent in “Auto,” and he blew it in “Food” and “Personal” as well (see the mountains of light-blue bars).

By looking at the table, you can quickly see he overspent in the following categories:

Gas

Groceries

Restaurants

Clothes

Entertainment

He made $3,000 and spent $3,465 that month. Not good, Reggie.

By overspending in the month, his credit card balance went up, so his minimum payments will likely jump as well, making it even harder for him to stick to his $3,000 budget next month. (Sidebar—We also offer debt snowball tools if you want to get out of debt.)

Family Budget Plan

The single-male budget was pretty simple, but perhaps you’re interested in an example of a household budget with kids and pets. We heard you. Here you go.

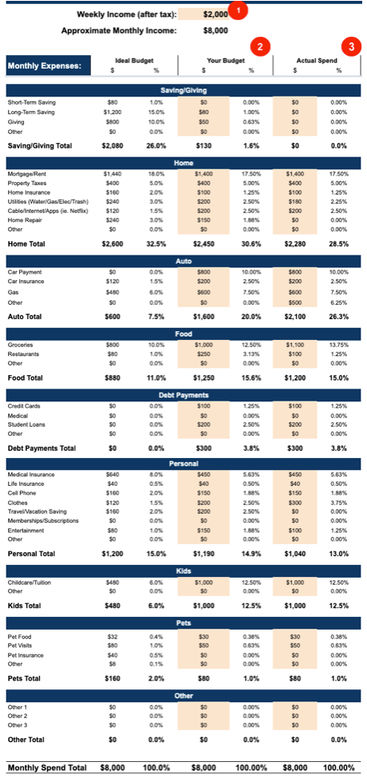

Our sample couple is Jon and Jessie. Between the two of them, they earn $2,000 a week. They have two kids—one’s in school, and one’s in daycare. They own a house, and both have car payments.

Let’s have a look at their ideal budget, their actual budget, and their monthly spending—all lined up on the first tab of the weekly budget template:

Looking at the table or the budget charts, you can see their house payment is in line, but their car costs are killing them. Also, their kids’ and food costs are higher than recommended. When their actuals landed, they had absolutely nothing to give or invest.

To truly get ahead, they will have to tighten their budget, get their cars paid off (or sold), and put money away for their future. If they don’t, they’ll be broke for life.

And let’s be honest, even the most carefree among us don’t want to run out of money later in life.

Read more:

How to Make a Budget in Excel

To make your own budget sheet, follow these steps:

Get a blank piece of paper (or open a blank Excel sheet).

Write down your weekly after-tax income. Then multiply by four to get your monthly earnings.

Next, write out all the expenses that you incur each month (names and amounts)—for your home, car, food, debt, personal, kids, pets, etc.

Do you have a surplus of money left over? Add categories for saving and giving.

Then review your expenses and decide whether you’re happy with them. If not, make changes. Either spend less or, if you need to, call your providers to get a reduced rate.

Track your spending vs. your proposed budget. Are you spending according to your wishes? If not, what can you do to change that?

Keep tweaking and changing your budget until you’re satisfied.

You could do all that—or download the monthly budget template I already created (currently priced at $4.99).

Or, if you’re interested in the weekly budget template download, we’ve also got you covered.

If you don’t mind the basic (mostly blank) version, you could use the free monthly budget template or the free downloadable weekly budget spreadsheet in Excel. (Click the link, and the download will appear at the bottom of your screen.) I’d rather use what already exists vs. building something from scratch.

How to fill out the main budget template

Let’s say you download the budget worksheet. How do you fill it out?

You’ve probably gathered how to do the first steps by now with our sneak peeks and budget examples, so we’ll walk through this quickly.

First, enter your total income after tax for the current month. The ideal budget will populate right after you hit enter.

Second, fill in your estimated budget for the month. If you have expense items that aren’t listed, include them in the most relevant category in the “Other” line. Your total budget should equal your total income. If you have extra dollars to spend, put them in your long-term savings line.

If you have more spending than income, you’ll have to find something to cut out—otherwise, you’ll continually be going backward financially. Finally, track your monthly spending in the “Actual Spend” column.

How to fill out the budget calendar and actual spend calendar

The budgeting calendar is one of the most powerful tools out there. In this view, you plan and spend every dollar and can quickly see if you’re heading toward trouble. How do you fill it out?

Click the “Budget Calendar View” tab.

Below is an example of a $5,000 budget. It looks daunting at first, but it’s pretty simple.

First, enter your beginning bank account balance in the upper right-hand cell (i.e., the amount you have at the beginning of the month). Then start filling in your expenses on the day you expect them to hit.

For instance:

The mortgage might always hit on the 1st, so enter it in the first line and under the category “Home.”

Then, on the 2nd, you might have your son’s daycare bill due, so enter that on the 2nd under “Kids.”

Start with all the items that consistently land on the same date each month—the credit card bill, car payment, student loan bill, medical insurance, life insurance, subscriptions, and so forth.

Then, take your best guess on when the other expense items will hit. Your actual spend calendar tab will work the same way, except you’ll enter each daily expense when it happens. You won’t need to guess.

Read more:

Tips For Making the Most of Your Spreadsheet

If you want to use your budget template to the fullest, here’s what I’d advise you do—

My main tip: Start now. Stop thinking about doing it, and do it. Download the template for budgeting. It’s not that hard, and I can almost guarantee it will be life-changing.

My second tip: Realize that it’s going to suck. You think you know what you spend each month. You don’t. Your first budget is going to be way off. Be ready for that.

My third tip: Follow the steps above, and don’t quit. Quitting is easy but often yields regret. Financial awakening starts with budgeting. Financial success arrives on the mountain of old budget sheets.

Free Printable Budget Spreadsheets

Not yet sold on the spreadsheet? Want to get a feel for the budget template with a freebie version first? That’s totally fine.

Monthly budget worksheet

Click this link for the free downloadable monthly budget template. The download will appear in the lower left of your screen. Just click it and open it up in Excel (or Numbers for Mac users).

Or, if you prefer Google Sheets, then click into a blank Sheet, click File, Open, then Upload, and upload your recent budget template download.

Weekly budget spreadsheet

Click this link for the free downloadable weekly budget template.

Again, this file is best for those who get paid weekly and want to budget expenses monthly. The download will appear in the lower left of your screen. Click it to open it up in Excel (or Numbers for Mac users).

Or, if you use Google Sheets, then click into a blank Sheet, click File, Open, then Upload, and upload your recent budget template download.

Top Budget Template Alternatives

Is this budget worksheet missing something? First of all, tell us! (It’s my nerdy pleasure to hang out in Excel all day and tweak spreadsheets, so I won’t complain.) But if you want to look elsewhere, we’d recommend Tiller or Mint.

Tiller is a budget template that’s built in Excel.

It might initially sound like an ordinary template, but they took it one massive step further. They set it up so you can link your Excel budget sheet directly to your bank accounts. Yes, you can get your detailed transactions directly into Excel (or Google Sheets) and then build your budget from there. It’s pretty incredible.

The look isn’t super pretty, and it takes a few steps to get the bank linking to work, but once you get it all set up, this budget tool is pretty slick. Try it for free for the first 30 days. If you still love the tool and want to continue with it, there’s an annual fee of $79.

I started using Mint over a decade ago. This free service/app lets you enter your budget, link to your bank and investment accounts, and get daily updates about your transactions. It even automatically categorizes your spending.

Mint has become quite commercialized over the years, but it’s still a powerful tool that I recommend.

.jpg)

.jpg)