In 2010, a Nobel Prize-winning study found that earning more money only boosts happiness up to a point; once you hit $75,000, more money doesn’t mean more satisfaction. Fast-forward more than a decade and one world-economy-altering pandemic later, and we wanted to know: is that still true?

To find out, moneyzine.com asked 1,200 Americans not only about their income, but also about how satisfied they are with what they earn and how much more they needed to earn for the work they did to hit that income-happiness sweet spot. And the results…well, they’re a little alarming.

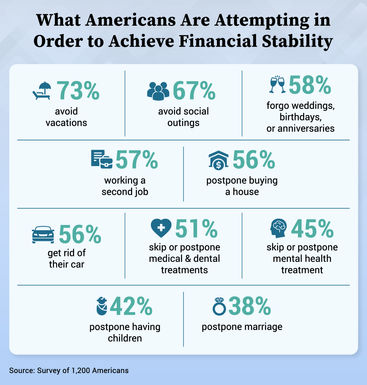

Key takeaways:

Nearly all U.S. residents report needing a salary of $100,000/year to be happy

Retail workers need 407% more income to be satisfied

Americans are avoiding vacations (73%), social outings (67%), and more due to financial unrest

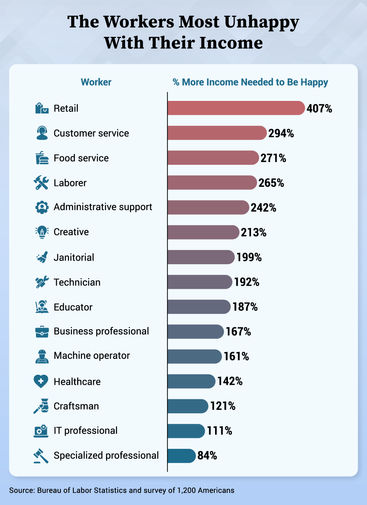

Retail Workers Are the Most Dissatisfied

For anyone who has worked in retail, it should come as no surprise that this is the industry with the largest disconnect between actual income and the income workers believe would keep them happy at work.

Get this: the difference for retail employees is just over 400%! That means people working in retail earn a quarter of what they need to be happy. No wonder the employee turnover rate is over 60%...

On the other end of the spectrum, specialized professionals—think doctors, lawyers, or engineers—actually reported they could earn 84% of what they currently do and still be satisfied.

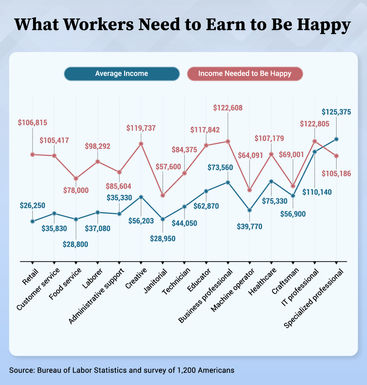

Nearly Everyone Reports Needing $100k/Year to Be Happy

The average income workers across fifteen industries reported they needed to be satisfied with their jobs was $96,303.

From retail workers and customer service representatives to IT professionals and surgeons, $100,000 per year seems to be the magic number.

Just keep in mind that the average income in America is just under a third of that at around $31,000. That means most people earn about a third of what they think they should be paid.

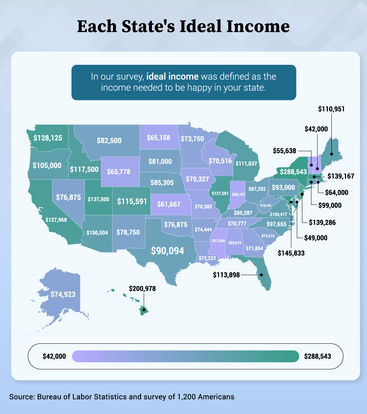

The Elusive Sweet Spot: What Income Is Considered Ideal in Each State?

Keeping with the $100k/year income goals across industries, the average income across all 50 states that respondents reported needing to be happy was $94,696, just under $100,000 per year.

Alabama: $69,615

Alaska: $74,923

Arizona: $100,504

Arkansas: $74,444

California: $127,968

Colorado: $115,591

Connecticut: $99,000

Delaware: $49,000

Florida: $113,898

Georgia: $71,854

Hawaii: $200,978

Idaho: $117,500

Illinois: $127,581

Indiana: $58,167

Iowa: $70,327

Kansas: $61,667

Kentucky: $85,287

Louisiana: $72,222

Maine: $110,951

Maryland: $145,833

Massachusetts: $139,167

Michigan: $111,037

Minnesota: $73,750

Mississippi: $57,500

Missouri: $70,385

Montana: $82,500

Nebraska: $85,305

Nevada: $76,875

New Hampshire: $42,000

New Jersey: $139,286

New Mexico: $78,750

New York: $288,543

North Carolina: $97,655

North Dakota: $65,158

Ohio: $87,292

Oklahoma: $76,875

Oregon: $105,000

Pennsylvania: $93,000

Rhode Island: $64,000

South Carolina: $81,000

South Dakota: $75,215

Tennessee: $70,777

Texas: $90,094

Utah: $137,500

Vermont: $55,638

Virginia: $100,417

Washington: $128,125

West Virginia: $78,342

Wisconsin: $70,516

Wyoming: $65,778

Interestingly, the reported necessary income to be happy and satisfied isn’t directly correlated with the local cost of living. Hawaii and New York—two of the most expensive states—also had the highest desired incomes and were the only two states needing over $200,000.

However, California and Massachusetts—both of which have higher costs of living than NY—came in just a little over average at $130,000 desired per year.

Delaware and New Hampshire were the two least needy states, both with incomes below $50,000 being required for workers to be satisfied with their paychecks.

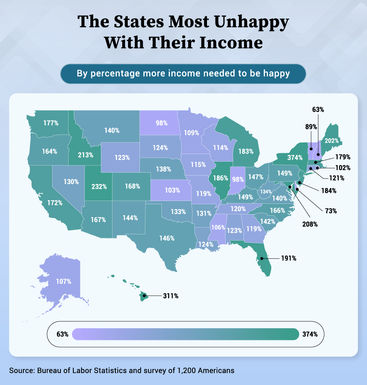

The Salary Struggle: Which States Are the Least Satisfied With Their Income?

With those $200,000+ annual income goals, it’s no surprise that New Yorkers and Hawaiians reported the largest discrepancies between actual income and reported yearly pay to be satisfied. In both states, workers require an average of over 300% more per year to be happy.

Alabama: 123%

Alaska: 107%

Arizona: 167%

Arkansas: 131%

California: 172%

Colorado: 168%

Connecticut: 121%

Delaware: 73%

Florida: 191%

Georgia: 119%

Hawaii: 311%

Idaho: 213%

Illinois: 186%

Indiana: 98%

Iowa: 115%

Kansas: 103%

Kentucky: 149%

Louisiana: 124%

Maine: 202%

Maryland: 208%

Massachusetts: 179%

Michigan: 183%

Minnesota: 109%

Mississippi: 106%

Missouri: 119%

Montana: 140%

Nebraska: 138%

Nevada: 130%

New Hampshire: 63%

New Jersey: 184%

New Mexico: 144%

New York: 374%

North Carolina: 166%

North Dakota: 98%

Ohio: 147%

Oklahoma: 133%

Oregon: 164%

Pennsylvania: 149%

Rhode Island: 102%

South Carolina: 142%

South Dakota: 124%

Tennessee: 120%

Texas: 146%

Utah: 232%

Vermont: 89%

Virginia: 140%

Washington: 177%

West Virginia: 134%

Wisconsin: 114%

Wyoming: 123%

Five states in total are fully satisfied with what they currently earn, and they actually report that they could earn less and still be happy:

Delaware

Indiana

New Hampshire

North Dakota

Vermont

Based on all of this data, the average American requires 150% of their current income in order to be content with their annual salary…a pretty staggering statistic, if you ask us.

What Americans Give Up to Improve Their Financial Situation

More than two-thirds of Americans skip social outings in an effort to save money and improve their lot in life. And things only get more depressing when you ask what else U.S. residents are abstaining from…

Nearly three-quarters of all workers in the U.S. skip vacations to save, 58% miss important events with family and friends—like birthdays and weddings—and 45% forgo seeking needed mental health treatment.

So…not only is the income in most states not good enough for most to consider themselves “happy,” but a huge subsection of the population is actively sacrificing social and physical health to get more out of the money they do earn.

More Money, More Problems?

It’s pretty clear that this saying doesn’t ring true for most Americans. The average U.S. resident must earn more than twice as much as they currently earn to be happy with their income. Even more disconcerting is that most U.S. workers are willing to make massive sacrifices in other areas of their lives to make their paychecks go further.

Methodology

We surveyed 1,200 people across America about what income they would need to be satisfied and the things they sacrifice to make their money go further. The average age of respondents was 40 years old. 61% of the participants were male, 36% were female, and 3% identified as non-binary or other.

We also used publicly available wage data from the Bureau of Labor Statistics to make comparisons between desired income and actual income across 15 different industries.

Fair Use

Interested in using our data or infographics? Feel free! Please just link back to this page to credit moneyzine.com.

Contributors