You're out of consumer debt, you've got your emergency fund, you're investing for your retirement, and now you're finally ready to tackle the behemoth - the mother of all debts...the house! Congrats!

Just think about the future you'll have here - use the tool below to pay off the mortgage fast, bump up your retirement savings yet again, and then still have so much extra money that you won't even know what to do with it all! These are good problems to have, so let's get you there and pay off the mortgage fast!

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

More articles on mortgage:

How to Pay Off the Mortgage Fast (Like Us!)

We were completely out of debt, owned two rentals that we paid cash for, and our retirement funds were soaring...but somehow, we just weren't content. Life wasn't what we expected it to be.

Maybe it was the fact that our house was originally mine and my ex's,

Or that our kitchen window was only about 15 feet from our neighbor's living room,

Or maybe it had something to do with the busy road that hosted a multitude of police cars, fire trucks, ambulances, and even the occasional drag race.

We were entering our mid-30's and everything about our place just screamed, "starter house". It worked, it fulfilled our needs, but sometimes life's not all about living as cheaply as possible while building up millions of dollars for your decrepit self later in life.

It was time to make the move that we had been considering for years - to a place in the country with room to roam and that we could call our own. So, we sold one of our rentals along with our primary home and nearly paid cash for a solid 1970's two-story home on 6 acres.

After all the smoke cleared on the house sales, we still owed $24,000 to the bank.Womp wommmm.

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

Why I Built This 'Pay Off the Mortgage Fast' Tool

If you know anything about me, you know that I can't stand debt - mainly because it always comes up as a hindrance (source) to everything we want to do in life...

"We should take that amazing vacation we've been talking about!" ...Oh wait a second, we have a huge debt already...maybe we shouldn't go...

"Let's build a barn on our property and have horses!" ...But no...we should probably pay off the mortgage first...

"The kids really want to go on a mission trip through church." ...Well, we don't really have the cash right now because of that honkin' mortgage payment each month...

Yeah, all these conversations typically just happen in my head, but it's enough to drive me batty! Now that Liz and I officially have a mortgage again, I had to make sure we were on the same page about paying it off.

So, I built this tool originally to see how fast we could actually do it (while funding everything else we're saving up for). And also, I wanted her to be able to look at the results in 20 seconds, say, "Yup, let's do it", and have the conversation be as painless as possible (she's not big on planning, spreadsheets, and budgets).

After having the quick conversation (Yup, it worked just like I'd hoped), I figured quite a few of my readers might benefit from the "Pay Off the Mortgage Fast" tool as well! So, I modified it a bit and added some robustness so that nearly everyone could enter their information, share the plan with their spouse, and get out of the gates faster than they could have ever imagined!

Check out the beautiful results!

Then, simply follow the steps in the tool and see how quickly you could ditch that mortgage debt!

Getting Started with the Basics

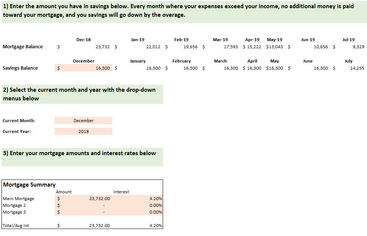

The first inputs of the tool are simple:

Enter the amount that you currently have in savings

Enter the month and the year

Then, enter your total mortgage amount(s) and interest rate(s) (if you have a second or third mortgage, you'll have to enter multiple entries)

I originally built this tool assuming that we'd always have more income than expenses each month...which unfortunately was not true (good to know, right??). Some months are heavy in property tax or home insurance and tip our expenses a bit higher than our income.

This is why I added the "Savings Balance" line to the tool.

Whenever we make a house payment, but we're actually spending more than we earned that month, I wanted to see how much my savings account would dive and how often.

The last thing I would want is to aggressively pay my mortgage with my savings. Hopefully this portion of the "Pay Off the Mortgage Fast" tool helps you too.

Map Out Your Expenses Each Month

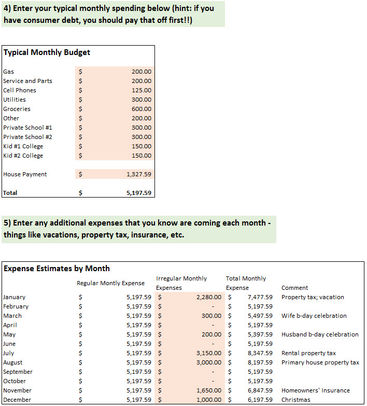

Steps #4 and #5 will help you put your budget together for the year. As I eluded to earlier, not all your months will have the same number of expenses. Some will have birthday celebrations, Christmas shopping, insurance bills, and property taxes! So, here's how I tackled those phenomenons.

I first entered all of our typical expenses each month. Things like:

Gas

Car service and parts (my car transmission is starting to slip, so I bumped this number up a bit)

Cell phones

Private school savings

College investments

The house payment of course

...and anything else you can think of!

For us, that all totaled about $5,200 a month (I tweaked some numbers here so you don't know everything about our budget, but this is pretty close).

So, as long as nothing else pops up in the normal months, we can expect to spend, invest, and save about $5,200.

Next, we figured out what our irregular expenses might be.

I don't sit down and think about irregular expenses very often, but I was quite surprised when I finally did! When it was all said and done, 7 out of the 12 months had additional expenses that were above and beyond our main budget.

Sometimes it was a few hundred bucks for a birthday trip and other times it was $3,000+ for taxes, but I definitely wanted to make sure I included every dollar so I wouldn't be surprised later!

Enter your best estimates for your main budget and your irregular expenses. It will definitely help you understand how much extra you'll have at the end of each month to throw at the mortgage!

Read more on budgeting:

Map Out Your Income Each Month

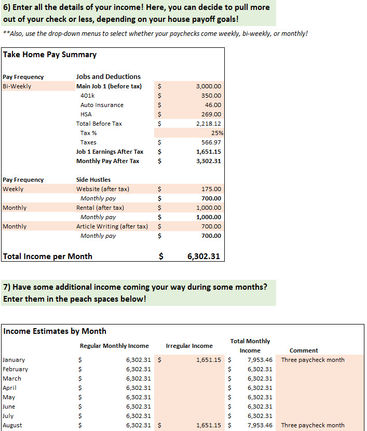

Just like we did for our expenses, I mapped out how much our income would typically be each month (again, I changed the numbers a bit, but they're close).

With my bi-weekly paycheck, Liz's photography income, the website income, my writing gigs, and our rental property, our average income is somewhere around $6,300 a month. Not too shabby.

Then (as you can see in step #7), there are a couple of months that earn us some extra cash! Can anyone say "triple paycheck month??" This is the phenomenon where, two months a year, bi-weekly paychecks actually amount to three payments a month! This gives us a little extra to put toward the mortgage in January and August.

Do you have any additional income coming your way?

Maybe you have bonuses every quarter,

Maybe you get paid weekly and actually get five paychecks a month sometimes,

Or, it could be that you have some kind of settlement coming your way soon!

Whatever it is, put it in your plan, even if it's not regular income. You'll be amazed at how much it'll help you pay off your mortgage fast!!

It's Time to See the Results!

How quickly do you think you could pay off your mortgage?

Less than one year?

Five years?

Ten years?

Whatever your number is, remember that it's probably way better than the 30-year mortgage most people are subscribing to nowadays. But also, don't ever become complacent in your payoff time-frame. The more you think about the possibility of paying it off sooner, the more your mind will find a way to make it happen.

As of right now, it looks like we'll pay off our $24,000 mortgage in less than a year, but I bet that with some bonuses, extra writing gigs, and with a potential pay increase at work, we'll probably make that final payment in 8-9 months. I can't wait to report our success and I also can't wait to hear about yours! Fill out the free mortgage payoff calculator and pay off the mortgage fast!

Check out our personal finance products for more solutions.

.jpg)

.jpg)