You can use this simple monthly loan calculator to figure out your monthly loan payment. The results of the calculator also include the total of all payments, and the interest paid over the life of the loan.

Ready to tackle your loan? Consider using one of our debt repayment templates. You can find our favorite one below 👇

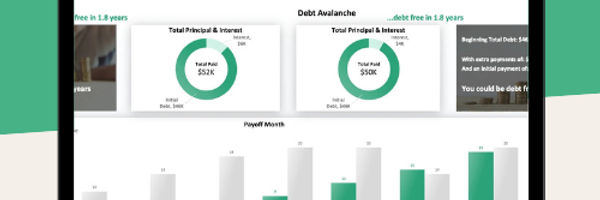

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!

Calculator Definitions

The variables used in our online calculator are defined in detail below, including how to interpret the results.

Total Loan Amount ($)

Additional Resources |

Simple Monthly Loan Calculator Loan Comparison Calculator Debt to Income Ratio Calculator Loan APR Calculator Loan Cost Calculator |

The total amount of money borrowed for this loan, also referred to as the principal on the loan.

Annual Interest Rate (%)

This is the annual interest rate on the loan. This is not the APR, which takes into account other costs associated with the loan.

Term of the Loan (Years)

This is the original term or length of the personal loan, stated in years. The most common terms for personal loans range from 3 to 10 years.

Monthly Payment ($ / Month)

This is the monthly payment necessary to repay the loan over its lifetime.

Total Payments ($)

The total amount paid to the bank or lending institution over the life of the loan.

Total Interest Paid ($)

The total amount of interest charges over the term of the loan. This is the cost of borrowing money from the lending institution.

Simple Monthly Loan Calculator

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.

.jpg)