This free lump sum debt reduction calculator can be used to figure out how much money you might be able to save, and the number of months that are eliminated, by making a one-time, lump sum payment. The calculator uses the current debt owed, annual interest rate on debt, monthly payment, and the lump sum, to calculate both the dollars and time saved by making this one-time payment.

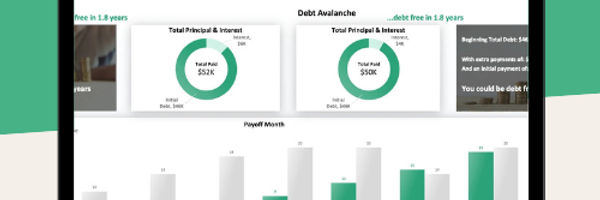

Want to see how lump sum payments will affect your debt? We've created a template that will show you just that, using two proven methods (debt snowball and avalanche) 👇

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!

Calculator Definitions

The variables used in our online calculator are defined in detail below, including how to interpret the results.

Debt Owed ($)

Additional Resources |

Credit Card Payoff Calculator Family Budget Calculator Debt Ratio Calculator Debt Reduction Calculator |

This is how much debt you might be carrying on a credit card or another line of revolving credit.

Annual Interest Rate (%)

This is the annual interest rate on the debt, or the interest rate your credit card company is charging you on the outstanding balance on your card.

Monthly Debt Payment ($ / Month)

This is how much you're currently paying each month to pay down this particular debt you owe.

Lump Sum Payment ($)

This is the one-time, lump sum, dollars you'd like to make towards paying off a portion of the debt you owe.

Time to Pay Off Debt (Months)

This is how long it would take to pay off the debt, using the payment you're currently making each month.

Time to Pay Off Debt - Lump Sum (Months)

This is how long it would take to pay off the debt, if you were to make a one-time, lump sum payment.

Time Saved by Lump Sum Payment (Months)

This is how many months, or payments, you would save by making this special lump sum debt payment.

Dollars to be Paid with Existing Debt Payment ($)

This is the total dollars that you need to pay to your lender or credit card company, using your current monthly payment.

Dollars to be Paid with Extra Debt Payment ($)

This is the total dollars that you need to pay to your lender or credit card company if you make a one time, lump sum extra payment to help pay down your debt.

Dollars Saved by Making Lump Sum Payment ($)

This is how much money you'd save in interest expense by making this one-time, lump sum debt payment.

Lump Sum Debt Reduction Calculator

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.

.jpg)