Investing in mutual funds, index funds, stocks, bonds, or real estate is sometimes so convoluted, many people give up. Even if you already know how to invest, where and how much can leave you second guessing yourself in the middle of the night.

Your finances should help you relax, not cause you more stress. So here is our clear, step-by-step guide on how to buy VTSAX and how to start your investment portfolio. This post was written by our staff writer, Lindsey Smith.

Similar articles:

What is VTSAX?

VTSAX stands for Vanguard Total Stock Market Index Fund Admiral Shares. It’s a passively managed indexed mutual fund through Vanguard that was founded in 1992, but became part of their Admiral shares in 2000.

That’s a mouthful, so let’s break it down into its individual parts. At its core it’s two things: a mutual fund and an index fund.

What is a Mutual Fund?

A mutual fund is a group of stocks put together into one portfolio item. Rather than going out and buying one share of Apple, thus only investing in Apple, a mutual fund will take stocks from all over the stock market and put them together into one specific group.

So instead of saying “I own Apple” with your one Apple stock, you can say “I own over 3,500 companies”, which is diversified across the entire market. VTSAX is “total stock market” fund, so it groups shares from every company across the stock market at different percentages to make up its mutual fund.

If you're buying VTSAX, that means you're quite diversified in the market, even if you contribute a relatively small amount.

What is an Index Fund?

An index fund is a group of stocks, like a mutual fund, but that follow a certain trend like the S&P 500 or NASDAQ. So, VTSAX groups all the companies across the stock market into a mutual fund, and that mutual fund tracks the entire stock market as an index fund. What this does is return to you a certain percentage that matches the growth of the total stock market.

If you had an S&P 500 index fund, the fund from that company would track the growth or decline of the S&P 500. Whatever percentage the S&P 500 went up that year, that’s how much the company’s mutual fund would return to you as well. VTSAX does the same thing, but across the entire stock market over time.

What Makes VTSAX Different from Other Mutual Index Funds?

There are some little things that make them different from other funds. First, they have different percentages of each company inside the portfolio.

Sticking with Apple as our example, VTSAX might have 4% Apple and another company might have 3.6% Apple, which means they’ll have different returns. Another reason people love VTSAX is because Vanguard has a great reputation, especially for newer investors or people wanting an easier approach to investing.

They are a client-owned company, not publicly traded, and

they operate at-cost.

So the investors with Vanguard, ie. you and me, are the only investors they have to impress. You can feel secure knowing that they want you to do well, because when you do well, they do well. Operating at-cost means they are able to offer some of the lowest fees over the long term than any other investing platform.

They have more money in their fund, about $1.2 trillion, a far cry from one of their competitors' $62 billion fund, which means they pay out bigger dividends, even if that competitor has a lower expense-ratio. If and when you figure out how to buy VTSAX, rest assured that it will likely be a solid investment for many years to come.

Read more:

How To Buy VTSAX?

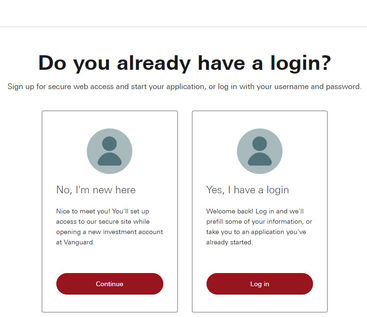

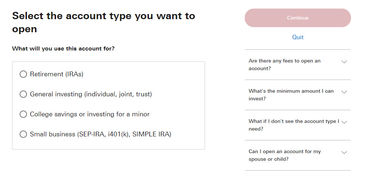

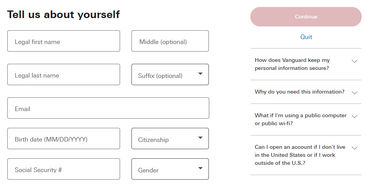

Buying VTSAX stock is pretty simple. Start by opening a free account on Vanguard by providing your personal identification information and choosing an account type.

After identifying your money goals, you can then fund your account through an electronic transfer and begin the investment process. For more details, follow these steps to learn how to buy VTSAX—

1. Open a Vanguard account

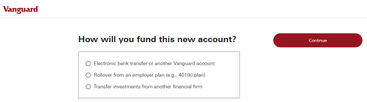

2. Select the funding method

3. Choose your account type

4. Identify your money goal

5. Wait for the deposits

6. Start the investment process

7. Add your money

8. Transfer to VTSAX

9. Complete the final steps

10. Review and submit

Why would you choose to put it in the settlement fund?

Settlement accounts can be used as a sort of hub where you put all the money you’re investing, and then from there you can distribute it to each investment portfolio you have.

Another reason to use a settlement fund might be that you’re not ready to invest in something particular, but you want to invest that money when you are better prepared. Yet another reason might be that you aren’t quite to the minimum investment yet, so you’re just parking the money there to grow until you reach it.

More articles on investing:

Is VTSAX a Good Investment?

Overall VTSAX is a great investment, and though there are some drawbacks, they have their solutions too. Here are the pros and cons on VTSAX for you to use to make the best decision for you.

Pros of Buying VTSAX

1) It’s Passively Managed

As we talked about above, it’s a mutual fund and an index fund, and not only that, but a total stock market index fund, meaning it follows the entire market.

When the market goes up, VTSAX goes up. When the market goes down, VTSAX goes down. Over time we know that the stock market will likely go up. So what this tells us is that, over time, VTSAX will go up as well.

Actively Managed Funds vs. Passively Managed Funds

Now, an actively managed fund has one fund manager, and their job is to pick the things that go inside the fund, as well as the percentages of each. They bring companies into the fund, they get stocks out of the fund, and try to get you the most growth possible.

They also have huge fees to pay these fund managers. Passively managed, on the other hand, doesn’t need to do this, because the amount of the stock that’s in the fund is just a representation of how big the company is.

The bigger the company, the greater the impact it will have on the index fund. Now, history has shown us that over time, the actively managed funds don’t actually outperform the index. There are a few outliers, but on the whole this is true. So you go with the index because over time, the index will almost certainly beat the actively managed funds.

Like in gambling, the house always wins. So, if weknow over the long term that VTSAX will likely go up, and we know passively managed funds outperform actively managed funds, AND we know VTSAX is the biggest fund - it makes sense that this is the best option.

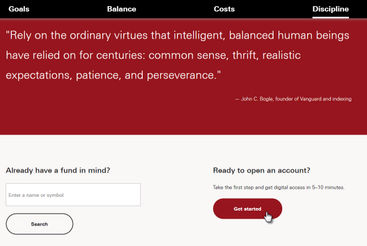

2) Vanguard is a Reputable Company

Vanguard is a company with a great reputation, especially among “regular people” investors, and is popular in the FIRE (Financial Independence Retire Early) community. It’s not publicly traded, so there are no outside investors they need to please.

In fact it’s owned by its own funds, and who invests in those funds? Us, the investors. As Vanguards’ funds go up, they benefit and we benefit. You can feel comfortable because when they make decisions about their fees, or funds, or just make changes, you know it’s strictly for our benefit. This is also how they keep their fees so low.

3) No Worrying About Volatility

The top ten companies in VTSAX change very little. They may jockey for position within the top 10, but they’re pretty much just doing their thing. When one falls off, another one is usually on the rise, and takes their spot. With individual stocks, you have to worry about the volatility of the stocks going up and down. You also are at the mercy of that particular company’s behavior. They could be performing extremely well for some years, and then something could happen, there could be a scandal or some other major problem, and the stock drops to 0 and you’re out of luck.

A mutual index fund has tons of stocks in the basket. As we’ve said, VTSAX has over 3,500 companies in its fund, so one company isn’t really going to have any big impact on the fund itself. When one company plummets, another is on their way up. The constant balance of companies going up and down allows consistent growth over time.

Cons of Buying VTSAX

VTSAX is Not Very Diversified

Diversification of stocks means that you have some kind of stock from all the different sectors of the market. You want a little bit of...

international exposure,

real estate,

stocks, and

bonds.

VTSAX is strictly a stock index fund, there is no direct exposure to international markets and bonds (though it does have some real estate exposure). However, because VTSAX is so big, and some of the companies are the largest in the world, you get something called “indirect exposure” to international markets.

If you look at the top 10 companies in VTSAX, you might see Apple, Amazon, Facebook, Google, and VISA. These companies all make money in the international markets. Of course, you need to decide for yourself whether that’s enough exposure to make you feel comfortable. In addition to VTSAX, you can pick up an international index fund, and Vanguard also offers a Total Bond Index if you want to invest there as well.

You Need a Minimum Amount to Invest in VTSAX

In order to invest in VTSAX, you need an initial minimum amount of $3,000. Once you have that, you can invest any amount you want. But the first transaction needs to be $3,000. This is where you might start putting money into the settlement account inside Vanguard to save up to this amount, or use the alternative option they have provided for people who don’t have that much.

Vanguard created an ETF, or exchange traded fund, called VTI that trades like a stock, so you can buy shares in it. It’s identical to VTSAX, just in an ETF form, and you can get into it for whatever the share price is, right now it’s around $219 per share. And once you reach the $3,000 minimum threshold, Vanguard will convert your VTI to VTSAX.

How to Buy VTSAX - Now You Know...But Will You Invest?

So, now it’s time for you to set up your account and start investing in VTSAX. The only question now is...will you? Many won't, but I'm hopeful that you do. Very few people have regrets about investing, but MANY have deep regrets about not investing earlier in life. Live your life without regrets, start investing for the long term now. VTSAX is a great place to start putting your money.

Check out:

Our free investment calculator, free debt snowball spreadsheet, and more personal finance tools.

Was this post helpful on the topic of buying VTSAX? Or do you have more questions? Let us know in the comments!

.jpg)