Definition

The term deposits in transit refers to cash that has been recorded as received by a company, sent to their bank account, but not yet posted to the account's statement by the bank. Deposits in transit are typically identified as part of the bank account reconciliation process.

Explanation

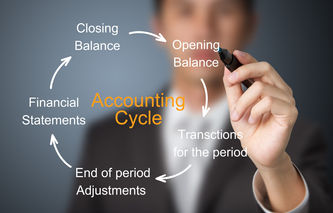

At the end of each accounting period, companies go through a bank statement reconciliation process to understand any differences between the company's record of cash deposits and withdrawals, and the account statement issued by the bank. Oftentimes, cash will be received by a company, recorded in the general ledger, but not yet shown on the company's bank statement.

For example, cash may have been received and recorded by a company on December 31. However, due to the time necessary to process the deposit by the bank, this cash will not appear on the company's December bank statement. The reconciliation process will identify this difference as a deposit in transit.

This reconciliation process is part of the accounting cycle, allowing the company to accurately report cash, a current asset, on its balance sheet.

Example

Company A recorded $100,000 in cash deposits made to its general checking account in the month of June. During the May bank statement reconciliation process, Company A determined it had a balance of $6,000 in deposits in transit. The bank statement received by Company A showed total deposits of $102,000 in June. Company A's deposits in transit at the end of June would be calculated as:

Deposits in Transit (Starting Balance) | $6,000 |

Add: Cash Deposits | $100,000 |

Total Deposits | $106,000 |

Less: Total Deposits (Per Bank Statement) | $102,000 |

Deposits in Transit (Ending Balance) | $4,000 |