You might vaguely remember your psychology teacher talking about Maslow. He pointed at a picture of a triangle as you nodded off in the back of the school room.

But that triangle might mean more than you think. Today, I’ll give you a refresher course on Maslow’s Hierarchy of Needs and tell you how this applies to your money. If you’re missing a rung in this ladder, this might be the “aha” moment you’ve been seeking.

Maslow developed his needs theory in the 1940s and 50s. Psychologists, teachers, businessmen, and others have used his theories to help motivate people ever since.

The theory is often portrayed as a pyramid with a wide base. The bottom needs should be fulfilled first. Without basic needs being met, it will be harder to motivate someone to care about the needs in the next layer of the pyramid.

Maslow’s Hierarchy of Needs

Let’s take a quick look at the hierarchy.

Biological & Physiological Needs

Have you heard the quote “If you have your health, you have everything”? No matter how much wealth you build, there are some health problems that money can never cure. We’ve had enough celebrity deaths lately to illustrate that.

The base of the pyramid is your most basic needs. Air, water, food, shelter, sleep, health, and more. If you are missing any of these items for long, nothing else will matter until you can get it back.

Safety Needs

Law, order, protection, security, and employment are examples of this layer. Living in chaos or constant danger would cause you to search for these things.

Belongingness and Love Needs

Family, relationships, and work groups belong at this level. We need “our people”. If you don’t have close family, at this level you’d need to build relationships with others to create a support group.

Esteem Needs

Achievement, status, reputation, and responsibility. Once you have confidence in the other layers of your needs, you can move on to doing things that build your sense of accomplishment.

Self Actualization

Now that you’ve achieved all layers of the needs hierarchy, you’re ready for some personal growth and fulfillment.

What About Money?

Maslow mentions employment at the safety level. We need to know we have an income to support ourselves. Beyond that, we move on to other motivators.

A few years ago, a study was released that said once your salary hits $75,000, having extra won’t buy you any more happiness. I found an interesting article that breaks happiness salary levels down by state. But no matter where you live, the point is that salary isn’t everything.

Once you are making the income that supports your basic needs, you’ll want a job that helps you fulfill your higher needs as well. Even if you’re paid handsomely at a job that offers no growth or recognition for improving your workplace, you aren’t likely to be satisfied there for long.

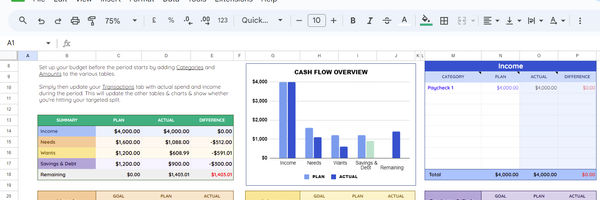

Your Budget

Now take a look at how your budget lines up with the hierarchy. Are you meeting your basic needs first? If you’ve ever spent so much of your paycheck on “stuff” that you had trouble covering basic bills, you’ve got your priorities out of line.

Your tax dollars cover some of the needs at the safety and security level. Job security fits in here, as well. If you are often anxious about keeping your job, it might be time to look for a new one.

Another thing at the safety level is insurance. Unless you’re independently wealthy, you’ll want good health, home, car, and term life insurance.

Family and love require a certain amount of money. You’ll need to cover the basic needs of your children and anyone dependent on you. But keep in mind that fulfilling this level is more about giving your time than your money.

Maybe you feel like something is missing in life, and if you just chase that dollar, you can fill the emptiness. But what if that emptiness can only be filled by spending time with loved ones? Quality time comes from eating a meal together or playing a board game. It doesn’t have to mean an outing with a high price tag.

Ideally, your esteem needs would be met both at home and on the job. If your boss doesn’t respect you or give you the recognition you feel you deserve, try working a little harder. Sometimes we think we are doing more than we really are.

If you still can’t catch their attention, update your resume and see what else is out there. It never hurts to keep your eye out for a better job that fulfills these needs.

Self-actualization is highly personalized. What do you want the most? Would you like to be head of the company one day? Are you only on the job so you can collect enough money for early retirement?

While esteem is more about the way others view and treat you, self-actualization belongs to you alone.

Need help with budgeting?

The 50/30/20 rule ensures you meet your basic needs while also allocating some income to your wants (further up the pyramid) and your savings/investments (for achieving self-actualization). Get your finances in check by downloading our 50/30/20 budget template!

Examine Your Money

Does the way you use money as a tool reflect the hierarchy of needs? If you spend money taking the family on elaborate vacations, but struggle to cover your mortgage bills, you need to take another look at your priorities.

Buying vegetables is a biological need. Dining out is social (family and love). Be sure you aren’t justifying purchases under the wrong category.

If you find something is holding you down to a lower level, make that your goal. Do what you can to fix the problem so you can advance to the next level. For us, that’s credit card debt. For you, it might be creating a budget and sticking to it. Or leaving a dead-end job.

Remember the hierarchy of needs when you make decisions about your money and your life.

Keeping your priorities in order will help you reach your best self. With or without independent wealth.

.jpg)

.jpg)