Art isn’t just something pretty to hang on your wall. It also represents a unique investment opportunity. Not only is it an impressive and low-correlated asset to add to your portfolio, but artworks can sometimes sell for many times their original value.

But I’m sure I don’t need to tell you that. You’ve probably seen the headlines about record-breaking art sales. Remember the unattributed Da Vinci bought for just over a grand in 2005 that sold for an eye-watering $450 million just 12 years later?

Perhaps you thought that profiting from paintings was just for art aficionados and billionaires. But you don’t have to sit on the sidelines.

Okay, so you’re probably not going to lay your hands on a lost Leonardo. But today’s art market still provides ample opportunities for the average investor.

Even if you don’t know your Monet from your Manet, you could still reap the rewards if you build some knowledge of the art market. So, discover the key art investing trends and how you can take advantage of them in 2026!

How to invest in art

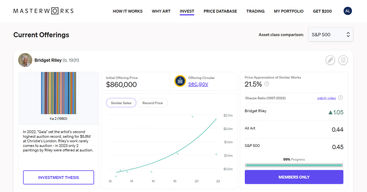

It's actually a lot easier than you might think. Masterworks lets you buy shares in top contemporary artworks. They do all the legwork of analyzing the market and acquiring paintings. You can just sit back until they find a good opportunity to sell and reap your share of any profits.

Picture-Perfect Profits: A Trend in Price Appreciation

Trading in art is a multi-billion dollar industry. Although the pandemic saw a sharp decrease in the size of the art market, 2022 saw a year-on-year increase of 3%. This brought its value to $67.8 billion—the second-highest value in the last 15 years—suggesting the art market has recovered well from its coronavirus correction.

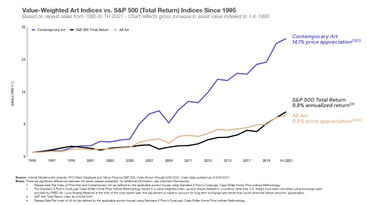

As investors buy art for capital appreciation, the most important trend to consider is that of prices. Repeat sales of artworks have demonstrated, overall, a consistent increase in value.

In fact, when looking just at contemporary art, price appreciation since 1995 has far outstripped the annualized returns of the S&P 500 (according to research by Masterworks).

Artful Investors: Who’s Purchasing Paintings?

The art market is broader today than ever. Gone are the days when the only people to buy masterpieces were the Medici and other noble families of their ilk. Now, demand for art comes from many places.

The Rich and Famous

Okay, so this one is no surprise. Given some of the sums involved, it’s no wonder that those with the most money are some of the biggest art buyers.

The list of art-loving celebs is expansive and diverse. Here are a few notable examples:

Jeff Bezos - The Amazon founder has a thing for modern art and reportedly spent $52.5 million on Ed Ruscha's Hurting the Word Radio #2.

Oprah Winfrey - The talk show host has an extensive art collection and made a tidy $62 million flipping a Klimt in 2016.

Elton John - The singer has been collecting paintings, photographs, and sculptures since the 90s by artists including Picasso, Warhol, Basquiat, and Man Ray.

Jay-Z - Though not best known as an art aficionado, the rapper has amassed an array of blue-chip art by Damien Hirst, George Condo, Jean-Michel Basquiat, and others.

New Money

Last year, for the first time, Gen Xers overtook baby boomers as the biggest demographic in the market for $1M+ artworks, according to bidder data from Sotheby’s. Perhaps surprisingly, millennials are now making their presence felt in the high-end art market, with their share of bidding activity rising from 6% in 2018 to 30% in 2023.

These younger generations are showing enthusiasm for emerging and contemporary artists, such as Banksy and KAWS. But they’re also active at the highest end of the market, bidding on Picassos and Basquiats.

Asian Market Growth

Although the US and UK are still the leading markets for art investments, Asia has been a rising star, coming in third. China and Hong Kong are the main drivers, accounting for $11.2 billion in sales in 2022. The continent is actually the largest market in terms of just auction sales.

Asian collectors also represented 28.6% of Sotheby’s bidders in the $1M+ market last year. They were particularly interested in the works of Asian artists, such as Yoshitomo Nara and Yayoi Kusama.

Korea is becoming a hotspot for world-class art, too. It saw the debut of the Frieze Seoul art fair in 2022. In the same year, Singapore played host to a Sotheby’s live auction.

The Man in the Street

A distinctive trend across many asset classes in recent years has been the rise of fractional investing. The securitization of high-priced assets once only accessible to the wealthy means that anyone can gain exposure to these markets by buying fractional shares.

This is as true in the art market as in the stock market. Shares in valuable artworks are made accessible to everyday investors through user-friendly platforms like Masterworks and Yieldstreet.

Ready to join the art investment trend?

You can buy shares in some of the best contemporary artworks with Masterworks. There are no upfront fees and experts are on hand to give you free investment advice.

From Sotheby’s To Online Sales: Where Are They Buying?

Art dealers represent the most common sales channel, with auction houses coming in second. Art fairs have also seen increasing sales since the pandemic. Online sales have been decreasing but proved to be a vital medium during the pandemic.

Old Masters or Modern Artists: What Are They Buying?

To some extent, this depends on the demographics of the buyers. As we’ve already seen, younger collectors are leaning toward newer artists while Asian buyers are enthusiastic about Asian artists.

At the very highest end of the market, Modern Art is leading the way. It accounted for all of the top 10 most expensive artworks auctioned in 2023, including a Picasso and a Klimt that each went for over $100 million!

In particular, Post-war and Contemporary artworks have been taking up an increasing share of seven-figure transactions over recent years. These categories actually accounted for more than half of Sotheby’s bidders last year.

The share of Old Masters in the high-end art market has been decreasing as they’re becoming more rare. They shouldn’t be discounted altogether, however, as Sotheby’s saw Old Masters bidders double between 2022 and the first half of 2023.

Ultimately, though, the global admiration of Old Masters and the length of time they’ve been on the secondary market means that their value is already priced in. This means they may be less attractive as investments than contemporary works, which will likely go for less on the primary market. As the market and recognition of contemporary art are still growing, they may have greater price potential.

The Value Proposition: Why Are They Buying?

So what’s the big deal with art? Why are so many investors adding it to their portfolios? Well, there are a couple of good reasons.

Price Appreciation

This is the obvious one. Clearly, investors want to generate returns by buying something that will increase in value.

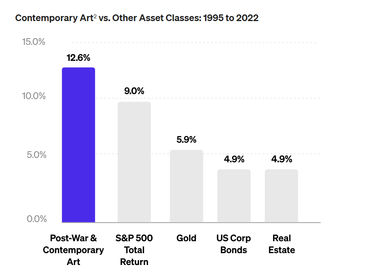

According to Masterworks, Contemporary Art appreciated at a compound annual growth rate of 12.6% between 1995 and 2022. This is significantly higher than traditional assets like real estate, gold, and even the S&P 500.

Masterworks claims that a 15-25% Contemporary Art allocation has historically been capable of improving the risk-adjusted appreciation rate and driving higher returns than a stocks and bonds portfolio.

Diversification

There are those who think that diversification simply means holding a 60/40 portfolio (60% stocks and 40% bonds). And sure, that kind of portfolio might have held up well in the 80s and 90s.

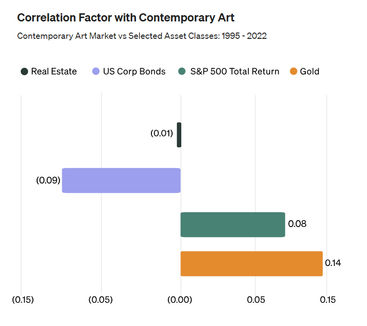

The problem is that turbulent markets since then have put both asset classes at risk. So if you want to achieve true diversification, you’ll need to look beyond the two main players. Contemporary Art is a good option as it has a low correlation with other popular asset classes.

It’s also resilient. The major participants in the art market are ultra-high-net-worth individuals who aren’t as affected by economic changes as ordinary investors. This means that art can weather the storm in periods of recession or inflation when other markets struggle. So, art could be a good investment for hedging purposes.

Macro Drivers

To really understand the value of the art market, we need to take a look at the big picture. This means considering changes in demand and supply.

As we’ve already discussed, there are new and growing sources of demand from younger generations, the Asian market, and fractional investors. However, the wealthiest remain an important source of demand.

Given the steady increase in the number of billionaires in recent years—and the fact that the ultra-high-net-worth population is projected to grow 28.5% between 2022 and 2027—things are looking pretty good for the demand side of the art market.

As for supply—well, 11% of dealers’ sales in 2022 were to museums and institutions. The movement of artworks into these permanent collections effectively removes them from the supply. This scarcity is another good sign for our value proposition.

A Blank Canvas: How To Start Your Art Investment Journey

So, you’re interested in investing in art, but how do you do it? Well, the good news is that you don’t need to travel to auction houses, pay expensive buyers’ fees, and organize storage, conservation, etc.

Actually, anyone can gain exposure to art through fractional investing with Masterworks. This user-friendly platform lets you buy shares in contemporary artworks they’ve purchased. After some years, they’ll sell the work and distribute profits to shareholders.

You don’t need to be an art connoisseur. Masterworks has a team of art and finance experts on hand to give you advice—and they’re only a phone call away.

Masterworks has offered its members works by big names and rising stars including Monet, Banksy, Jean-Michel Basquiat, George Condo, Ed Ruscha, Andy Warhol, and Yayoi Kusama. Some of the paintings Masterworks sold generated annualized net returns of over 30%.

So if you’re ready to unlock the potential of paintings and hold a piece of the next masterpiece, create a free account with Masterworks today!

.jpg)