Navigating the stormy seas of job loss? You're not alone.

The recent wave of layoffs across various industries, including Nike's cut of over 1,500 jobs, reflects a broader trend. 2024 is shaping up to be a challenging year, with major companies like Microsoft, Lloyds Banking Group, Valeo, eBay, Corning Inc., and Salesforce announcing significant job cuts.

This global trend shows why it's important to really check out how we spend money and take a new look at our finances.

In this guide, we'll go through the important money steps to take after losing your job, to help you get back on track and feel more in control during these uncertain and difficult times.

Redesign Your Spending Habits

Just lost your job? Take a deep breath – it’s time to get smart with your spending. Managing Director of Investments at Wells Fargo Brad Hindman advises, “Losing your job can feel like the end of the world... Take a deep breath and conduct a thorough review of your finances to determine where to trim expenses.”

Budget expert Andrea Woroch agrees. It's all about reassessing and reshaping your budget. Hit by job loss? She says, “the first step you really need to take is to assess your spending.” Time to scrutinize your expenses and find areas to cut back.

To streamline this, the Monthly Budgeting Planner is a game-changer. It makes it easy to track and trim your monthly expenses. Prefer more detail? There’s a great weekly budgeting tool that gives you an even closer look for tighter control.

Work on Your Emergency Fund

Your emergency fund isn’t just a backup; it’s your financial superhero right now.

Financial planner Oliver Levey puts it perfectly: “Aim for at least three to six months' worth of living expenses, factoring in rent or mortgage payments, utility bills, groceries, transportation, and any other regular financial commitments.” This strategy isn't just smart; it’s essential for keeping you afloat during these choppy job-hunting seas.

Taking stock of your emergency fund is like getting a reality check on your financial health. How long can you last without steady income?

Be honest with yourself. If your savings aren’t quite up to the mark, remember to prioritize beefing up this fund when you’re back in the income game.

Chase Your Unemployment Benefits

.jpg)

Unemployment benefits are here to throw you a financial lifeline.

HR Consultant and recruitment expert Colin Wolf stresses the importance of looking into your benefits. “Understanding your rights and options regarding unemployment benefits can provide essential financial support during this challenging time.”

Remember, you're not at the mercy of your ex-employer here. Your eligibility for these benefits is decided by state laws.

You've been contributing to this through taxes, and so has your employer. It's absolutely your right to claim this support when you need it.

Wolf’s top tip? “Start by contacting your state's unemployment office as soon as possible,” because processing times can be a bit of a wildcard.

Cut Non-Essential Spending

Tough times call for smart spending cuts. Rick Kahler, the financial brain behind Kahler Financial Group, once shared with CNBC, “Most spending issues are not about the money. They are about the behaviors, the thoughts, feelings and beliefs that drive the behavior.”

That’s a golden nugget of wisdom – managing your finances is as much about your mindset as it is about the numbers.

Start with a deep dive into where your money's going. We're talking about those extra splurges. For example, fancy dinners out, sneaky subscription services, or late-night online shopping sprees.

This is where our Monthly Budget Planner steps in as your financial sidekick. It will help get a full financial picture and help you make smart cuts in your spending.

Discover how one spreadsheet can help you keep track of your finances and save more every month.

Learn to Manage Your Debt

Sharpening your debt management skills is crucial for regaining your financial footing.

Forbes throws in an interesting twist: "Research found the 'snowball effect' led to paying off debt faster on average. The psychological motivation seems to spur people to put more effort into debt repayment." In short, start small, gain momentum, and watch those debts disappear one by one.

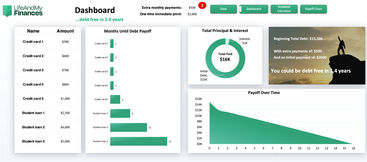

Want to put this theory into action? Our Debt Snowball Spreadsheet is your go-to tool. It breaks down the process, helping you visualize each victory against debt. It also maps out a clear path to a debt-free life.

Look into Side Hustles

Chris Guillebeau, the side hustle guru, nails it with, "good things happen to those who hustle."

In his hit book, “Side Hustle: From Idea to Income in 27 Days,” he drives home the message: “Your side hustle could be your ticket to financial freedom.” That’s some serious inspiration for finding your perfect side gig.

Fast forward to 2024. The side hustle scene is buzzing with more opportunities than ever, all doable from your living room couch!

Think of freelance writing, virtual assistance, e-commerce, or online tutoring. The list is endless. To kickstart your journey, we’ve put together a killer guide on the hottest side hustle apps in 2026.

Revamp Your Resume (Now!)

Your resume is your career billboard. Like the experts at Amber K Boyd Attorney at Law say, “You want any employer or connection viewing your credentials to see your best and most up-to-date self."

"An outdated or sparse resume or LinkedIn could cause hiring managers or colleagues to make unfair assumptions about your ambition, abilities, or work ethic.”

So, keep polishing that resume and LinkedIn profile – they’re your ticket to your next big break.

And here's a golden nugget: “Even if you are not actively job hunting at the moment, optimizing these career tools positions you for future growth.”

“You never know when an exciting new position may become available or when an unforeseen layoff might leave you urgently needing a polished, interview-ready resume.” Staying ahead means being ready for anything, anytime.

Thinking of a career pivot? Check out options that don’t demand a degree but still offer attractive pay. At Moneyzine, we’ve got a list of jobs that pull in $60K or even $200K a year without a college degree.

These insights might be just what you need to reshape your career path after losing your job. They could be a game-changer.

Onward and Upward: Rebuilding Financially After Job Loss

As we've seen, losing a job can be a daunting experience, but it also presents an opportunity to reassess and rebuild your financial foundation. The key is to act swiftly and strategically.

From tightening your budget to exploring new career opportunities, each step you take can lead to greater financial security and peace of mind.

Remember, you're not alone in this journey. With the right approach and mindset, you can navigate through these tough times and emerge stronger on the other side.

.jpg)