Definition

The term bank charges and fees refers to the costs applied to an account balance for services such as bank checks, non-sufficient-funds (NSF) check processing, safe deposit box rentals, and overdraft protection. Bank charges and fees are typically identified as part of the bank account reconciliation process.

Explanation

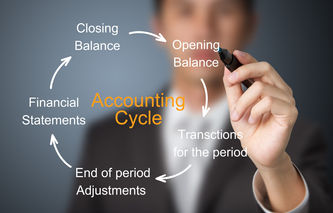

At the end of each accounting period, companies go through a bank statement reconciliation process to understand any differences between the company's record of the account balance and that appearing on the statement issued by the bank.

The reconciliation process involves comparing the company's account balance per the statement received from the bank versus the company's record of cash in the account. Oftentimes the company will not be aware of bank charges and fees until a statement is received each month. Companies have the ability to predict recurring monthly charges, such as account maintenance fees. However, they may not be fully aware of specific charges such as fees associated with providing overdraft protection and checks deposited with non-sufficient-funds.

This reconciliation process is part of the accounting cycle, allowing the company to accurately report cash, a current asset, on its balance sheet.

Example

Company A recorded $90,000 in cash deposits made to its general checking account in the month of June, and withdrawals of $80,000. When the June bank statement was received, it indicated $300 in bank charges and fees associated with checks with insufficient funds. Company A's ending bank balance is calculated as follows:

Bank Account Balance (Starting Balance) | $102,000 |

Add: Deposits | $90,000 |

Less: Withdrawals | $80,000 |

Less: Bank Charges and Fees | $300 |

Bank Account Balance (Ending Balance) | $111,700 |