Definition

The term accounting cycle refers to the framework and processes followed in each accounting period. The accounting cycle begins with the identification of events and transactions, and ends with the after-close trial balance.

Explanation

The accounting cycle is a conceptual framework that describes the process a company goes through each accounting period. While the exact number and description of the steps in the cycle is somewhat subjective, the core processes include:

Journalization of Transactions: identification of events and transactions as they occur and recording them using the proper journal entry.

Posting to Ledger: transferring the journal debits and credits to the proper ledger accounts.

Trial Balance and Adjustments: includes the preparation of various worksheets to prove debits equal credits, and perform adjusting entries such as accruals.

Preparing Financial Statements: assembly of accounting information to construct the company's balance sheet, income statement, and statement of owner's equity.

Closing Accounts: reducing the balance of temporary accounts to zero in preparation for the journalization of transactions associated with the next accounting period.

After-Close Trial Balance: following the closing of accounts and adjustments, this step proves that debits are still equal to credits.

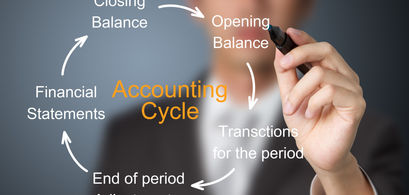

An illustration of the accounting cycle appears below:

.png)

.jpg)