When it comes to debt, the Great Recession will be remembered for the turmoil created in the housing market. But the news doesn't always have to be bad. In fact, the time has never been better to reflect on past spending habits and start a plan to get out of debt.

We’re not going to mess around here. I’ll tell you what I did to ditch my debt and detail 40+ tips to get you out of debt as quickly as possible.

And that’s not all yet. I’ll also provide helpful tools and warn you what services to avoid.

This article will show you:

The “Get Out of Debt Fast” course.

More than 40 top tips to get out of debt fast.

Other ways to get out of debt you could consider.

Read more:

What’s The Best Way to Get Out of Debt?

If you want to get out of debt and do it fast, what’s the best way to do it?

I’ve studied numerous courses, listened to the plans and logic of many experts, and I’ve noted my own experiences while plowing through my own debt.

In the last decade, I have—

Paid off $18,000 in 14 months while working a meager temp job.

Annihilated $21,000 of divorce debt in six months.

And paid off my remaining $54,500 mortgage in just 11 months.

I’ve discovered that the best way to get out of debt is with the below process:

Sell everything you can.

Create a small $2,000–$3,000 emergency fund.

Start knocking out debts using the debt snowball method.

Make a goal, have a “why,” and create milestones to celebrate your wins.

Cut way back on expenses and boost your income.

Keep moving fast until all the debt is gone.

Sure, the above bullets are overly simplified. But if that’s enough direction for you, go with it.

Run the get-out-of-debt race, and don’t look back.

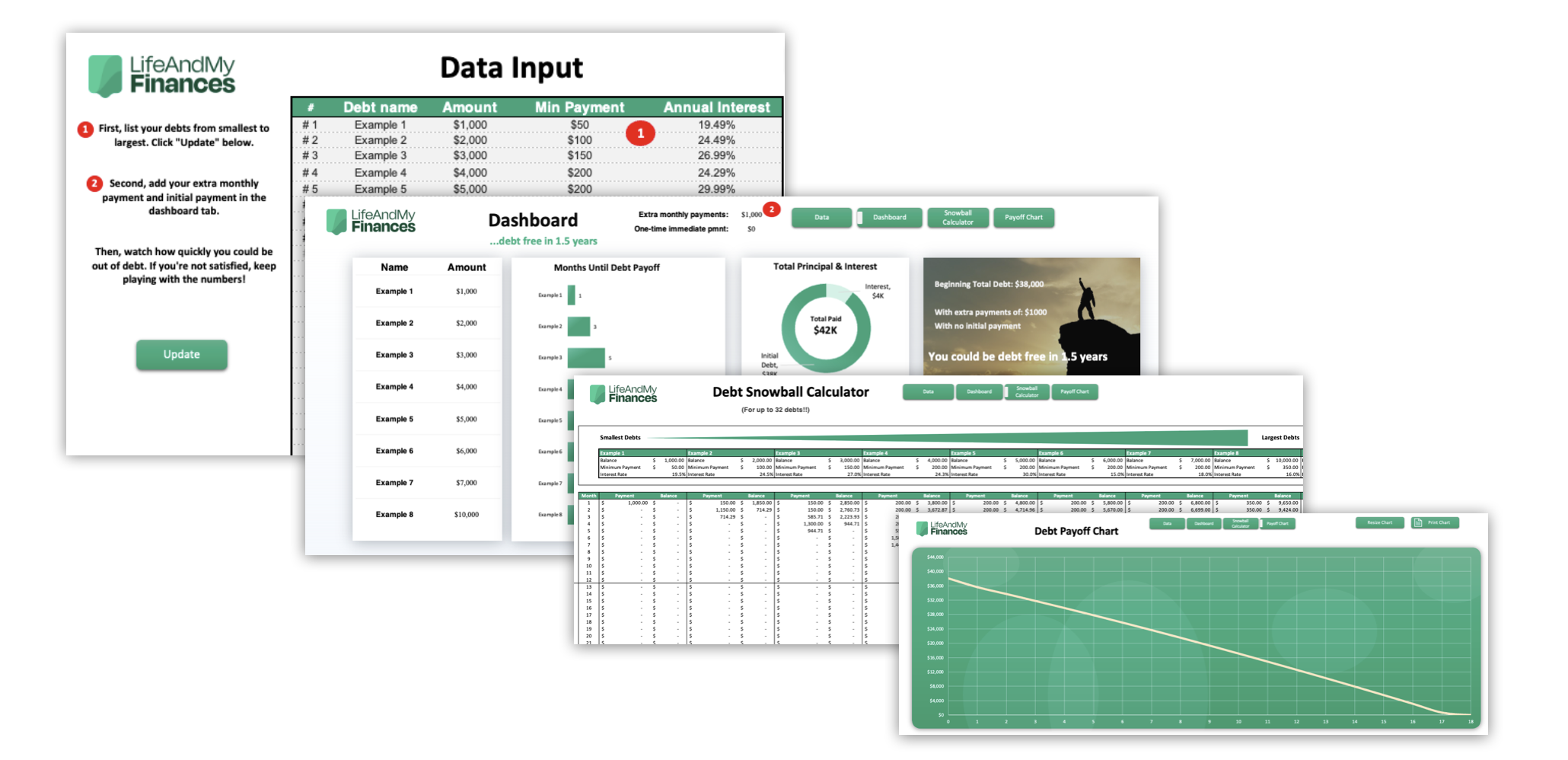

Time to get out of debt with this debt snowball worksheet! 💪

As seen on CNBC and Business Insider, this is the best debt snowball spreadsheet template for Microsoft Excel and Google Sheets that is out there!

A few key features of this template:

It will show you when you can pay off your debt

Detailed but super easy and suitable for beginners

Can handle up to 32 debts!

The How to Get Out Of Debt Fast Course

Now, most of you guys expect a bit more than just a few bullet points of information—which is why we created the Get Out of Debt Fast course.

This course walks you through everything you’ll need to know to get out of debt faster than you ever thought possible, and includes:

80+ minutes of video instruction.

A full course presentation and workbook.

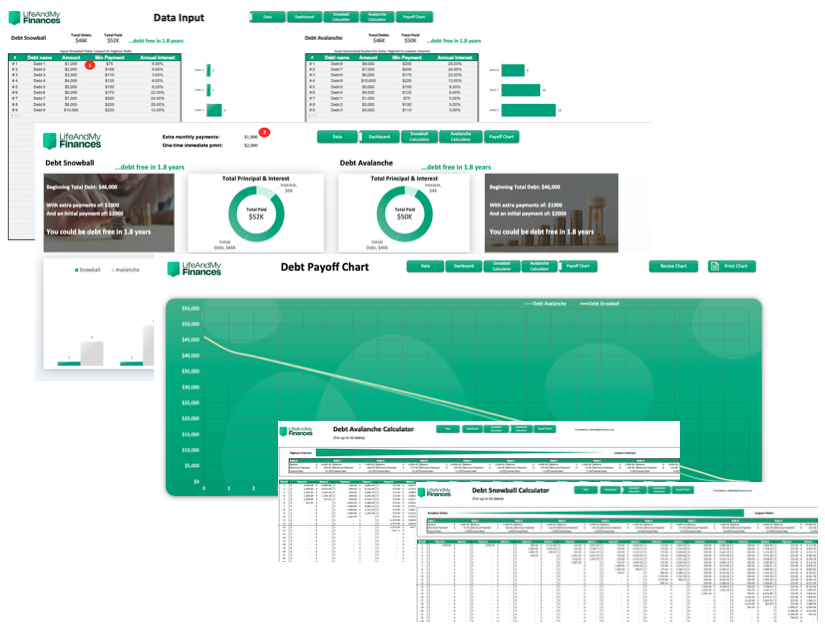

The debt snowball vs. debt avalanche spreadsheet.

The monthly budget template and weekly budget template.

A Q&A session with me.

I’ve seen the other courses out there. This one is cheaper, better, includes more tools, and you can actually talk live with me.

This is the absolute best equation for you to ditch your debt—and do it for good.

If you’re serious about getting out of debt and want to do it in two years or less, look no further: You’ve found your program.

Oh, and did I mention there’s a 30-day money-back guarantee?

If you don’t like the course for any reason, shoot me an email, and I’ll reimburse you—no questions asked.

80+ minutes of video instruction

The debt snowball vs. debt avalanche calculator

The weekly and monthly budget templates

The Q&A session with me

Early mortgage payoff calculator

Get Out of Debt Fast With The Debt Snowball

If (for some unearthly reason) you’re still not interested in the get out of debt course, there’s a simpler option: It’s our debt snowball spreadsheet.

With the debt snowball spreadsheet, you can:

Input all your debts (up to 32 of them).

See when the debts would pay off with minimum payments.

See right away how quickly you could get out of debt with an initial lump sum amount and additional monthly payments.

Most people enter their debts and see that it’ll take them eight to ten years to get out of debt with minimum payments.

But then by adding just a few hundred dollars a month, their debt payoff timeframe is often cut down to two years or less.

It’s an empowering experience that often motivates people to start paying off their debt straight away.

Types of Debt

Let's take a look at some of the most common types of debt and how you can deal with them.

Good Debt vs Bad Debt

There is the misconception that all debt is bad, and that's simply not true. For many Americans, borrowing money is the only way to buy a home or pay for college. As long as the household has the financial resources to pay back outstanding loans, borrowing money serves a very useful purpose.

Good Debt

The term good debt is usually associated with the purchase of an appreciating asset. That is to say, money borrowed to pay for things like a new home or to pay for college. This is an investment in the home or an education, which is expected to be more valuable in the future.

To a lesser extent, good debt can be characterized as secured loans. These loans are associated with something tangible such as a car. Admittedly, most cars depreciate over time, but loans on the vehicle are paid off too. With a collateralize loan, the home or car can be sold to help pay back the money owed if the owner ever runs into financial trouble.

Finally, another good rule of thumb is that good debt is usually associated with a low interest loan that is tax deductible.

Bad Debt

On the other hand, bad debt is usually associated with credit cards or other forms of unsecured loans. An unsecured loan is one that is not directly backed by an asset, or something tangible that can be quickly sold to pay off the money owed. Credit card balances are a great example of unsecured loans, and the most economically worrisome source of debt.

With very few exceptions, there is no good reason to carry a credit card balance each month. If overspending turns into a long-term habit, then it defies the most fundamental of all home economic rules:

Household Expenses must be equal to, or less than, Household Income

Credit Card Bills

The convenience of credit cards oftentimes results in their abuse. Interest paid on balances is not tax deductible. Card-issuing companies offer low introductory interest rates, and accountholders may find themselves switching between companies to keep their rates low.

Paying off Bills

It takes discipline to pay off credit card debt, but it's done all the time. Obviously it's going to mean paying more than the minimum monthly payment. The below list contains five steps that everyone can take to start that process:

Practice Self Discipline: either stop using credit cards altogether, or start limiting purchases to emergencies or necessities - such as groceries. Anyone that's tempted to overspend at the shopping mall should cut up their cards and start paying with cash or a debit card.

Minimum Payments: lowering outstanding balances means paying more than the minimum payments each month. In fact, this website has several loan calculators that can help figure out how long it will take to pay back the money owed.

Organize Debt: it might be disheartening, but it's important to understand how much is owed to creditors. That means evaluating interest rates charged, as well as the outstanding balance on each card.

Prioritize Payments: the most financially-sound approach is to first pay off credit cards that charge the highest interest rates. However, people can also get a big motivational boost by first paying off a card or two with relatively low balances.

Lower Interest Rates: finally, sometimes all it takes is a call to the card issuing company to obtain a lower interest rate. If introductory offers are in the 0 to 8% range, and the company is charging 18 or 20%, then it's time to start negotiating.

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

Home Equity Loans

Perhaps the single most valuable asset Americans own is their home. In a robust housing market, many families find themselves with a home worth much more than they paid for it only a short time ago. They are simply awash in home equity.

Unfortunately, many homeowners begin pulling the equity back out of their homes as quickly as it accumulates. The outcome is additional debt load, and increased risk of losing the asset backing those loans: the home. This is especially worrisome if the housing market slows down.

Negative Equity

A downturn in the housing market can suddenly result in a negative equity situation. This occurs when the loans using the home as collateral are greater than the home's market value.

Normally, lenders will limit the total of all loans to around 80% of the equity in the home. But a sharp downturn in values can leave families with very little, or even a negative equity situation.

Floating Interest Rates

Anyone that has floating interest rates (as in the case of adjustable rate mortgages) on their home equity loans might want to consider insulating themselves from future interest rate increases. This can be accomplished by converting the variable rate loan to a fixed rate mortgage.

Adjustable rate mortgages can be risky in turbulent times. Locking in a fixed rate mortgage is just another way of demonstrating a commitment to paying off outstanding loans.

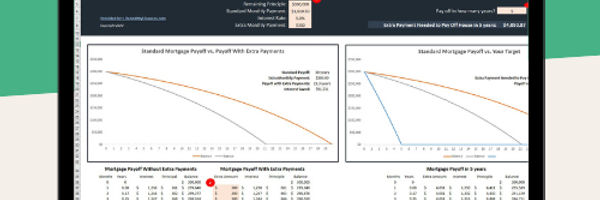

Biweekly Mortgage Payments

One way to accelerate the pay down of a loan is by requesting a biweekly payment plan. With a biweekly mortgage, the borrower will be making the equivalent of 13 monthly payments each year.

A 30-year mortgage, carrying an interest rate of 7%, can be paid off 20% faster with a biweekly loan. This website has a biweekly mortgage payment calculator than can help the end user run through a series of "what-if" scenarios.

Alternatively, we also have a template for early mortgage repayments 👇

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

40+ Tips to Get Out Of Debt Fast

Want to know what we cover in the How to Get Out of Debt Fast course?

Everything below and more. Plus, you get a bunch of free tools with it.

Without further ado, here are a hefty 40+ tips to get out of debt fast—

1. Commit to going fast

What would you rather do?

Get out of debt slowly over the course eight years? Or work it hard and get out in eighteen months?

If you voted for the eight-year option, you won’t like this list.

In fact, you might just want to stop reading and go back to sitting on your boat with your buddies. Have fun being mediocre for life.

If, however, you think the rip-the-band-aid approach is best, I totally agree—and that’s the mentality I had when making this list.

Remember

Commit to going fast early on, and you’ll absolutely do it (probably faster than you ever thought possible).

2. Choose the best get-out-of-debt option for you

If you love the debt snowball like I do—use it and run with it.

Remember

If you’re more of a math nerd and can’t stand leaving those high-interest debts till later in your payoff journey, then use the debt avalanche method (where you pay the high-interest debts first and leave the low-interest debts for later).

Either way, just commit to a method and pay off that debt as fast as possible.

Need some help with your debt avalanche? Here’s our free debt avalanche spreadsheet.

Still not sure which debt payoff option to choose? Use our debt snowball vs debt avalanche payoff sheet.

With this tool, you can actually see each debt payoff method, tweak your extra monthly payment, and then choose the best one.

3. Get yourself in a stable spot financially

Remember

If you constantly find yourself behind on your bills and making late payments, it’s not yet time to pay off your debts.

You first need to get yourself on stable ground:

List out your upcoming bills for the month.

Write down when you get paid each week (or every other week).

Ask yourself, “Will I have enough money between each paycheck to pay the bills?”

If not, you’ve got to figure out how to cut down on or rearrange your expenses. (Either that or start making more money.)

Likely though, it’s probably just you being disorganized. Once you get a grip on yourself and make peace with your finances, you can start tackling the debt with a vengeance.

4. Sell everything that you’re not using

The first “money step” is to look at everything in your house and ask yourself if you’ll use them in the next year:

Fans

Cars

Tents

Tools

Bikes

Books

Movies

Clothes

Weights

Furniture

Pots/pans

Treadmills

Appliances

Sleeping bags

Building materials

If not, sell them.

Sure, you might need them in three years, but you need the cash now. Sell them and start paying off your debt.

Remember

You can afford something nicer in three years when you’re totally debt-free and on your way to millionaire status.

5. Save up a quick $2,000–$3,000 emergency fund

After you sell a bunch of stuff, you’ll probably get close to having your mini-emergency fund in place.

If you have a bit more to go, work some side jobs with your friend that’s always asking you for help. That should close the gap on your emergency fund goal pretty quickly.

Once you have your emergency fund, it’ll be tempting to put that money straight toward the debt—don’t do it.

You’ll need it for any unknown expenses that might come your way.

You don’t know what it will be (or when it will hit) but let me assure you—an emergency will come. (It always does.)

And you don’t want to go backwards on your debt journey when it happens.

Remember

Save up the fund, put it in a separate savings account, and forget about it until an emergency happens.

Not sure where to put it? Consider the top high-yield saving options below:

CIT Bank | UFB | SoFi |

|---|---|---|

APY 4.5% | APY 4.81% | APY 4.20% |

Minimum Deposit $100 | Minimum Deposit $0 | Minimum deposit $0 |

Promotion None | Promotion None | Promotion Up to $250 Get paid up to 2 days early, pay no account fees or overdraft fees, and cash in on up to $250 when you sign up and set up direct deposit. Click "Learn more" for more details on the SoFi website. |

6. Cut out any expenses you don’t need

You know how you sold a bunch of stuff in step four? That was for your emergency fund.

Now the moment has arrived to get yourself out of debt: Time to cut your spending that you really don’t need.

Download your checking account, credit card, and digital wallet detail. Then sift through it to find anything that’s not a need, and you can do without.

(Not sure how to do this? The How to Get Out of Debt Fast course shows you the step-by-step instructions, so you don’t need to go into it blindly.)

Look for spending items like:

Subscriptions

Coffee shops

Amazon (some of these might be a need, but are they all?)

Recreation

Decor

Clothing

Vacation

Weddings travel/gifts

Concerts

Drinks at the bar/club

You might be getting ticked right about now.

Am I trying to tell you not to have any fun?

Of course not.

Remember

You can still have all the fun you want—just do it at the park, your friend’s house, or a free concert downtown.

You want to get out of debt fast, right? Cut way back on spending this year, and you can literally do anything you want once all your debt is gone and you have a heap of cash at your disposal.

Believe me, it’s totally worth the short-term sacrifice.

7. Negotiate the monthly expenses you need to keep

There are some expenses you just can’t do away with:

Insurance

Utilities

Trash service

Taxes

Cell phone service

But some of these expenses can be negotiated.

First, call your current provider. Let them know that your budget is tight and you’re looking for expenses to cut.

Tell them you’re looking around at other services, but you first wanted to call them to see if there’s any way they could reduce your bill. They’ll likely find something.

Remember

Once they give you a discount, keep checking around to see if you can get a better deal.

If you don’t feel like you’re getting anywhere, try my friends at BillCutterz. They can negotiate on your behalf.

If they find savings, you just pay them half of what they saved you in that first year. (If they find you nothing, you owe them nothing.)

8. Stop using credit cards

No, credit cards aren’t evil (we actually recommend a list of the top credit cards on our site). But it doesn’t make sense to pay off debt on one side and then borrow from the other.

That’s like trying to fill a bucket with a hole in the bottom. It’s just pointless.

Remember

While you’re paying off your debt, push pause on using those credit cards.

9. Work some side jobs with a friend that needs your help

If you want to start paying down your debt immediately but don’t have a quick source of additional income, check around with your friends.

I have plenty of buddies with side gigs that could use an extra hand from time to time—and I bet you do too.

Remember

Come up with a fair price for your assistance, and get to work.

10. Set your goal

Quite a few “personal finance experts” would tell you to budget and set your goals as your step one.

Not me—and that’s not how I start the How to Get Out of Debt Fast course either.

Remember

Take action from the get-go: sell a bunch of stuff, build up a quick emergency fund, and start paying down debt. And then we can go back and set up a structured plan after starting the process.

At this point, it’s time to tweak and solidify what you’ve probably already got in your head.

Pop open the Debt Snowball Spreadsheet (or—if you bought the course already—use the Debt Snowball vs. Avalanche Spreadsheet Calculator that came with it) and think about how quickly you’d like to get out of debt.

Then figure out the additional monthly payments that you’ll need to crush it.

And presto, there’s your goal.

Now it’s up to your brain to figure out how to make it happen.

11. Set up milestones

Remember

The best way to help your brain process what’s needed to hit your overall goal is to make some milestones (some checkpoints to hit along the way to your grandiose goal).

Let’s say you have $100k in student loan debt, and you want it completely gone in two years.

When you put that in the calculator, you discover that you’ll need an extra $4,000 a month to make that happen.

Well, there you go, now you’ve got your milestone goals: $4,000 each month.

12. Reward yourself along the way

Want to add some motivation to your debt payoff journey?

Allow yourself little splurges when you hit certain milestones (like buying yourself a $20 gift after paying off $10,000 in debt).

Mine was a Detroit Tigers hat. It’s nothing special, but I still have it today and love to wear it because of what it represents.

That hat is proof that I can win—even during the absolute lowest of lows in my life.

Remember

Your little victory splurges should (and will) be meaningful to you too.

13. Commit any extra money toward your debt

You might think you never earn extra money, but you do:

Overtime

Bonuses

Tax refunds

Gift money

And if you get paid bi-weekly, there are two months a year where you actually get paid three times.

Remember

Don’t just spend this money on a whim. Commit yourself right now to put it toward your debts.

14. Know your “why”

This point is super important.

In terms of your longevity in this debt payoff game, I’d say it’s actually the most important.

Why do you want to get out of debt? Because it sounded fun? I don’t think so.

Get down to the meat and potatoes of your heart here—

What is the real reason you want to get out of debt?

Do you want to provide a better future for your kids?

Are you sick of that pit in your stomach at the end of every month when you’re not sure if you’ll have enough money?

Or maybe you just want to prove everyone wrong that said you’re a loser and that you’re going nowhere in life.

Remember

Your “why” is going to keep you moving.

When life gets tough, you’re going to think about your kids, that sick financial feeling, or that schmuck that dared to say you’re worthless.

Then you’ll picture yourself winning against all odds, no matter what anyone says or thinks about you.

You have your reason. And you will not fail.

15. Make a monthly budget

If you want to maximize your debt payoff efforts, you’ve got to know what you’re spending each day, week, and month.

Remember

Set monthly budget goals, track your spending, and put all excess funds toward your debt each month.

When creating a household budget, it's important to distinguish between wants and needs.

Discretionary vs Mandatory Expense

Not sure where to start with your budget? Check out our top free monthly and weekly budget planners.

Want something more automated? We have some great options for that too:

16. Make a goal chart and keep it visible

Life is busy. It’s easy to forget about your goals after a while.

And I probably don’t need to tell you, but if you’re not thinking about your goals, that means you’re not hitting them.

To combat this, make a goal chart and put it where you can see it.

It can be a thermometer that you color in. Or maybe you want to make it more fun (more personal): an image of stacked-up credit cards, a diploma, a car, or maybe all of them combined.

Remember

Update your goal chart each day to keep your mind actively thinking about what you want to achieve and when you want to be totally debt-free.

17. Get your partner on board (like, for real)

This one is key.

If you and your significant other aren’t fully on board with getting out of debt, the race to the finish will be extremely difficult.

It’s the difference between running a marathon with a buddy that’s encouraging you every step of the way, and one that you’re dragging in a sled while he ignores you and chats with all the other runners as they whiz by (or worse, he’s shouting at you, telling you how slow you are and how you’ll never finish the race).

Remember

If you’re married and your spouse doesn’t want to get out of debt, don’t try to pay off a bunch of it without them. It just doesn’t work.

Either get them on board or take small, slow steps toward progress. If you try to push them, you will have a perpetually rocky marriage (or a completely broken one).

18. Involve the kids

Kids can be great motivators, and they could even make your debt payoff journey fun.

Remember

Be real with your kids about your situation—about how you want to get out of debt to make a better life for them in the future.

Then include them in your efforts to cut costs and make more money. To them, it turns into a game.

But be warned: If you try to cheat and spend money that you shouldn’t, they will call you out on it—

19. Downsize your house

Cutting out your $9 Netflix subscription is great, but it’s not going to move the needle on your debt.

If you want to become debt-free (and do it in this lifetime), you’ve got to find those big expenses and bring them way down.

Remember

Everyone’s biggest expense is their mortgage or rent.

Save money on rent

If you’re renting right now, that’s perfect.

You likely have a one-year lease and can find something cheaper to reduce your monthly spending.

Here are some great ways to save money on rent:

Find an above-garage apartment.

Rent a room instead of an entire place to yourself.

Rent a space that’s smaller or outside the city limits.

Another great hack is to find a home that’s vacant.

It may have belonged to an elderly couple, and now the kids own it and don’t quite know what to do with it.

If you assure them you’ll take care of the property while they figure it out, you’ll likely get an insane deal.

This scenario doesn’t come up often, but it does happen, so be sure to keep your eyes open—

Save on your mortgage

If you own a home, saving on your monthly mortgage payment is a bit more difficult, but here are some ideas:

Rent out a room.

And if you’re going to move soon anyway, it might be worth selling your house and finding a cheap rental.

Selling your home

One of the easiest ways to get out of debt is by selling your home and using the equity to pay off all your loans. You could clear all your debts in a matter of days.

But do I often recommend it?

Nope.

Why not?

For two reasons:

First, you don’t learn anything since you really didn’t feel the pain of getting yourself out of debt. (You’ll likely just get yourself back into debt and have the same problems all over again.)

Second, you’re putting yourself farther behind financially. (You’re selling your largest asset that was appreciating in value, and now you’re likely going to rent while housing prices continue to go up. Not smart.)

Selling your house is an option, but it’s not one I recommend (unless you’re planning on moving soon anyway).

20. Sell your car(s)

Your car is another costly item in your monthly budget.

Consider these:

Car payments

Insurance payments

Maintenance costs

Fuel costs

Just those four bullet points could easily cost you $1,000 a month.

Remember

If you’re trying to figure out how to get out of debt with no money, getting rid of your four wheels is your ticket.

If you can do without a car entirely, sell it.

But how do you get around?

Walk.

Bike.

Take the bus.

Hop on your city train.

Get an Uber once in a while.

Or maybe you could regularly hitch a ride with someone (like a work buddy).

And if you truly can’t live without your car, then at least get something cheaper.

Believe it or not, there are still plenty of dependable rides out there for under $5,000.

21. Stop with the expensive toys

“Big boy toys,” as my Dad calls them—boats, quads, snowmobiles, wave runners, dune buggies, and even those top-of-the-line super unnecessary zero-turn lawnmowers—are complete money pits.

Not only do they cost quite a lot of money to buy, but they also:

Go down in value.

Cost money in insurance.

Need repairs.

And they suck gas like nobody’s business.

Remember

Recreational toys will suck your wallet dry—and if you want to save money and pay off debt, I say get rid of them.

They’ll earn you cash (to put toward your debts) and will severely reduce your expenses each month.

22. Find free fun

If you sell all your toys, and you’re not going out to eat, and you’re not going to the coffee shop—what are you going to do for fun?

C’mon.

Remember when you were in college and had no money?

Did you have fun? Absolutely.

What did you do?

You hung out with friends at their place and ate pizza.

Played video games.

Had a bonfire.

Played frisbee.

Went on hikes.

Went to the beach.

Attended city events.

Walked around downtown.

Went to the mall and tried on random hats.

And if you were nerdy like I was, you went to Barnes and Noble with your friends and looked at books for hours (that was just me, wasn’t it?).

Remember

Having fun isn’t about spending money—it’s about getting creative and enjoying who you’re with.

23. Stop eating out (it all adds up)

I already spilled the beans (excuse the pun) on this one in the last get-out-of-debt tip.

Going out to eat is expensive.

Even Mcdonald’s is about twice what you’d pay if you just made a meal and ate it at home.

Remember

Simply stop eating out—and you’ll likely save hundreds of dollars a month.

24. Stop with the lattes

While Ramit Sethi may disagree, saving money on lattes is a real thing.

If you get a $7 latte every weekday, that equates to $140 every month. That’s $1,680 a year—

Yikes.

Instead of mindlessly swinging through the coffee shop drive-thru, why not save that money and get out of debt even faster?

Remember

What would you rather have? A steady flow of expensive caffeine or a wealthy lifestyle?

Me? I’m brewing my coffee at home and enjoying complete debt freedom.

25. Learn to say no

We live in a society that almost forces you to say yes to everything.

It’s somehow a travesty to say, “No, thank you.”

You don’t need to go to every concert, every family vacation, or even every wedding (especially if it’s for your great step-niece).

Remember

If it’s not in the budget, kindly say, “I’d love to, but I’m really trying to get a handle on my finances. I just don’t have the money right now.”

Don’t be ashamed that you’re watching your pennies. (You’ll probably get a lot of kudos, actually.)

And, of course, you’ll save a bunch of money in the process and can load it toward your debts.

26. Give more

Okay, I know. This one sounds counterintuitive, right?

Save money by giving it away. Great idea, Derek (eye roll).

But it is an absolutely great idea.

Why?

Let me ask you this: What got you into debt in the first place?

You like stuff, you wanted stuff, and you thought you deserved stuff. So you went into debt for it.

Remember

When you start to give, you begin to understand the needs out there in the world.

Suddenly, you become much more appreciative of what you already have.

And when you’re more content, you want less, and you’ll therefore buy less.

So give more, want less—and get out of debt faster.

27. Cut back on tax payments if you get a refund each year

The average tax return in 2023 was $2,827 (source). That means the average person paid $235 too much for taxes each month.

Remember

Want to pay off your debts faster? Stop paying too much for taxes.

Instead, put that $235 toward your debt every month.

How can you do this? Simply adjust the number of withholding allowances you’re claiming on your W4.

Not sure how? The IRS website is actually a pretty good resource and will help you choose the right number for your situation.

28. Stop investing beyond the match

Remember

Investing is important—but if you want to pay down debt fast, you’ll need to pull back the reigns on investing for a bit.

Unlike Mr. Ramsey, I’m fine with you investing some money into your retirement, but only put in what’s required to get the match from your company.

Beyond that, it makes more sense to put any additional money straight toward your debt.

29. Reduce insurance costs by raising the deductibles

Before you started paying off your debts, you set up your small emergency fund (the $2,000–$3,000 I suggested).

With that buffer, you can increase your insurance deductibles, which will save you money every month in insurance premiums. (This applies to all your insurance items: home, car, medical, and others.)

Remember

If you agree to pay a deductible of $1,000 instead of $100 in the event of an accident, you’ll owe less per month in insurance costs.

With those monthly savings, you can just put that much more money toward your debts.

30. Stop paying for expensive life insurance

Whole life insurance is almost always a rip-off—your contributions go toward insuring your life, but also toward savings and investments (which often underperform the general stock market).

Remember

In most cases, you’re better off investing in a 10-year or 20-year term life insurance policy for $20–$30 a month.

Sure, the policy will end when you’re 50 or 60 years old, and you may receive zero benefits (because you’re still alive), but at that point you’ll be debt-free and extremely wealthy (which means you don’t need a life insurance policy, anyway).

If you die late in life, your surviving relatives will get your monster estate (instead of your crappy whole life insurance policy that kept you broke while you were alive).

Stop paying for expensive life insurance and put that money toward your debt instead.

31. Work overtime

What’s the fastest way to pay off debt? Make a bunch of money.

And what’s the best way to make a bunch of money?

Work a bunch of overtime.

First off, overtime is the easiest option to increase your income if it’s available to you. Second, you’re probably making 1.5x your regular wage (or more) by doing it.

Remember

If you want to be debt-free in six months (or something quick like that), start working 10, 20, or 30 hours of overtime each week. Your paychecks will be massive.

Seem like a bit much? Remember that it’s only temporary.

32. Ask for a raise

Has it been a while since you got a raise?

Or maybe you’ve been constantly over-performing at work, and it’s time you get compensated for your efforts?

Then ask for a raise.

Go to your boss with all the info:

What you’ve done in the past year.

What your job pays elsewhere.

And what value you’re bringing to your corporation.

Remember

Make it impossible for them to say no.

And you know what? If they say no, it’s not the end of the world. But you’ll never know unless you try.

33. Put in for a promotion

There’s always going to be a churn of people at work. New folks will come in while others leave.

And that’s great news for you if you’re looking for a promotion.

Remember

If a position becomes available that you’d like and it offers more pay, put your name in the hat for it.

I mean, why not?

You’ll get more experience, more pay, and likely get you closer to an even better-paying position in the future.

If there aren’t any positions available, you could get creative and try to manufacture one.

Find a need around your work, start working extra to fulfill it, prove its worth—and then let your boss know you’d like a promotion based on your increased responsibilities.

It’s not the easiest way to get a promotion, but I’ve seen it done many times.

34. Get a better job somewhere else

Remember

One of the easiest ways to make more money (and pay off your debt faster) is by simply getting a job somewhere else.

I’ve known quite a few people that have job-hopped every couple of years and earned an extra $20,000 with each move.

And, if you’re lucky, you have a job that’s remote, which means you can job-hop to anywhere in the world.

When your work options span the globe, and you never have to move—that, my friend, is a fantastic way to boost your income and pay off your debt.

35. Get a part-time job

Remember

One of the better strategies for paying off debt is to get a high-paying part-time job.

Examples of this are:

Bartending

Waiting tables

Delivery

Security

Personal trainer

Tutoring

Web developer

And I’m sure there’s plenty more.

36. Start your own side gig

If you can’t find a good, high-paying part-time job to pay down your debt, then maybe it’s time to find a side gig.

But, just like I tell you in the "How to Get Out of Debt Fast" course, this side gig isn’t your dream business that you’d like to make a reality someday.

Remember

This side gig is for generating income now so you can be debt-free ASAP.

Here are some great side gigs that can start earning you money immediately:

Fixing cars

Cutting hair

Dog sitting

Dog walking

Making crafts

Mowing lawns

Detailing cars

Cleaning yards

Power washing

Painting houses

Staining decks

Cutting down trees

And there are a ton of other options, just like the ones above.

Just think about what people need and how you can fill that need right away. There’s money to be made there.

37. Keep moving fast

Don’t take your foot off the gas when you’re paying off your debt.

You will be tempted to deviate from your budget from time to time—maybe by taking a mini-vacation or splurging on yourself because of a “great deal” at the store.

Don’t do it.

Remember

Once you pause, you’ll likely never get started again.

It’s best to keep your eye on the prize: Don’t look left, don’t look right, just keep moving forward until all that debt is gone.

38. Find a cheerleader or an accountability partner

It can be difficult to stay motivated if you’re battling your debt on your own.

Remember

Find someone that has either already run this get-out-of-debt race, or is in the midst of trying to get out of debt themselves.

You can empathize with each other during life’s challenges and motivate one another as you go.

There’s nothing quite like having a friend in battle.

Extra Tips For Getting Out of Credit Card Debt

Looking for credit card debt relief?

Here are a few additional tips just for you (along with some more below this section that you should almost certainly avoid)—

39. Credit card balance transfer

Do you have a big credit card balance with a high interest rate?

Remember

It might be worth getting a better card with a 0% intro APR.

Our favorite is the

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.2 | Visitcapitalone.com |

This isn’t going to change your life, but it might save you a few hundred bucks. And you get a solid rewards credit card in the process.

If you're looking for a credit card with great cashback, check out our full review on the Capital One SavorOne card.

40. Debt settlement

If you have credit card debt that you’ve been paying sporadically (or debt that’s already in collections), these could be great candidates for paying off your debt by “settling it.”

What is this?

Remember

It’s you and the credit company agreeing to clear your debt for an amount that’s less than you owe.

Let’s say you owe $5,000 on your credit card.

You’ve managed to save up $3,000, so you call up the credit card company and let them know you have three thousand bucks in cash, and you’d love to give it all to them if they agree to clear your entire $5,000 loan balance.

If you reach an agreement, get it in writing before sending the money.

They might agree, they might not—but it’s definitely worth a shot if you can save yourself $2,000 with a single phone call.

This tends to work best with credit cards since much of your balance is likely accumulated interest over the years.

Collections companies go for this because they bought your debt for ten cents on the dollar. If they can make fifty or sixty cents on the dollars—they’re still winning.

Alternative Options

The absolute best way to get out of debt is what I’ve outlined in my “How to Get Out of Debt Fast” course (and mostly described above):

Build up a mini-emergency fund.

Use the debt snowball tools to make a goal.

Make a plan and get better as you begin tackling your debt.

Spend less, make more, and don’t stop until all your debt is gone.

For those that don’t want to put in the work but want to feel all warm and fuzzy about doing something (even though it’s not nearly as effective), there are the additional debt payoff options below—

Debt consolidation

Let’s say you have 20 debts with 20 individual payments each month.

That can be a little daunting, especially if you’re getting behind.

There are debt consolidation companies out there that will manage all these debt payments so you can just make one payment each month.

They may even be able to reduce your overall payment.

Sounds too good to be true, right? Most of the time, it is.

Remember

While there are a handful of good debt consolidation companies out there that will negotiate on your behalf and truly get your debt total down (thus getting your payment down), there are hundreds more that negotiate illegally (or simply extend the terms of your debts to reduce your payments).

And that won’t help you. In fact, it’ll hurt you tremendously.

This is why I say it’s often best to tackle your debts on your own. You made the mess. You clean it up.

Stop wasting all your time and effort conjuring up ways to get someone else to do it for you.

Refinancing

Refinancing your debt won’t solve all your problems, but it might bring your payments down and make it easier to get out of debt (and do it faster).

However, interest rates aren’t exactly low right now.

Chances are that if you got yourself into debt a few years ago, your rates from that time are lower than they are today, so I doubt this is a great option for you.

Remember

It’s best to just make a plan to get yourself out of debt, drive straight forward, and tackle it to the ground yourself.

Filing for bankruptcy

This is the absolute last resort.

Before you file for bankruptcy, you should:

Write out all your debts. You don’t know if you’re really in trouble unless you get organized and look at the full picture.

Call each creditor. Ask them for help—perhaps with a reduction in your interest rate, loan deferment, or an option to settle your debt for less than you owe.

Cut your budget severely. Don’t just cut out lattes—look at cutting your rent/mortgage, car expenses, and food costs.

Earn more. Try to earn more at your job, look for a better-paying job, get part-time work at night, or start a side gig that will produce income immediately.

Remember

By doing all of the above, you should be able to get yourself out of debt. It won’t be easy, but it’s possible—and it’s better than ruining your financial life for the next ten years of your life.

Debt Payoff Traps to Avoid

If you’re asking yourself how to pay off debt with no money—be careful.

You can’t just look up some magical program and, poof!, have your debt all disappear.

Sorry—life just doesn’t work that way.

If you need to pay off debt but have no money, you’re going to find some: either by limiting your expenses or earning more money.

I’d suggest using all the ideas I laid out in the sections above.

You might be interested in the below options, but I’m going to give you a word of caution for each one:

Debt settlement companies

We already discussed debt settlement, but that was you making the phone calls.

What about hiring a debt settlement company to settle those loans on your behalf?

Watch out for this—

Remember

Some debt settlement companies can be legit, but most are expensive and end up helping you very little in the process.

These companies typically aren’t in the game for you—they’re in it for themselves.

Debt counselors

In my opinion, there’s not a whole lot of value here, either.

A debt counselor might be able to help you figure out where to start (with various programs or organizations that you can work with), but that’s where the benefits end.

Remember

You’ve still got to roll up your sleeves and get out of debt yourself.

If you win, it’ll be due to your effort, not theirs.

Government loans to get out of debt

I don’t know about you, but the government would be the last entity that I’d want to owe money to.

They’re massive, they certainly don’t have a heart for you, and they’re all-powerful (they can literally just take money out of your bank account if they want to).

Remember

If you’re going to borrow money from anyone, make the government your last option.

And don’t forget perhaps your best choice: the “How to Get Out of Debt Fast” course.

There’s no risk to sign up with our 30-day money-back guarantee. You’ve got nothing to lose (and everything to gain).

Key Takeaways

If you want to get out of debt fast, build up a $2,000–$3,000 emergency fund, pay off your debts using the debt snowball, and never take your foot off the gas.

Use the “How to Get Out of Debt Fast” course to get direct video instruction, free tools, and a proven roadmap to debt freedom.

Be leery of easy get-out-of-debt programs. They often don’t work and leave you more broke than when you started.

.jpg)