Debt is agonizing. A study by Northwestern Mutual points out that out of the Americans burdened with debt:

29% delayed making significant purchases

18% delayed saving for retirement

14% delayed buying a home

8% delayed having children

7% delayed marriage

These staggering stats make us wonder: are we in control of our debt, or are we being controlled by debt? That’s why if you’re dealing with debts, you should look for ways to get rid of them—for good.

What if we told you that a simple debt repayment strategy is the answer to your problems? We’re talking about the debt snowball method—a technique that lets you build momentum or “snowball” your payments as you pay off your debts, from smallest to largest.

If you want to try it out yourself, click the button below 👇

Time to get out of debt with this debt snowball worksheet! 💪

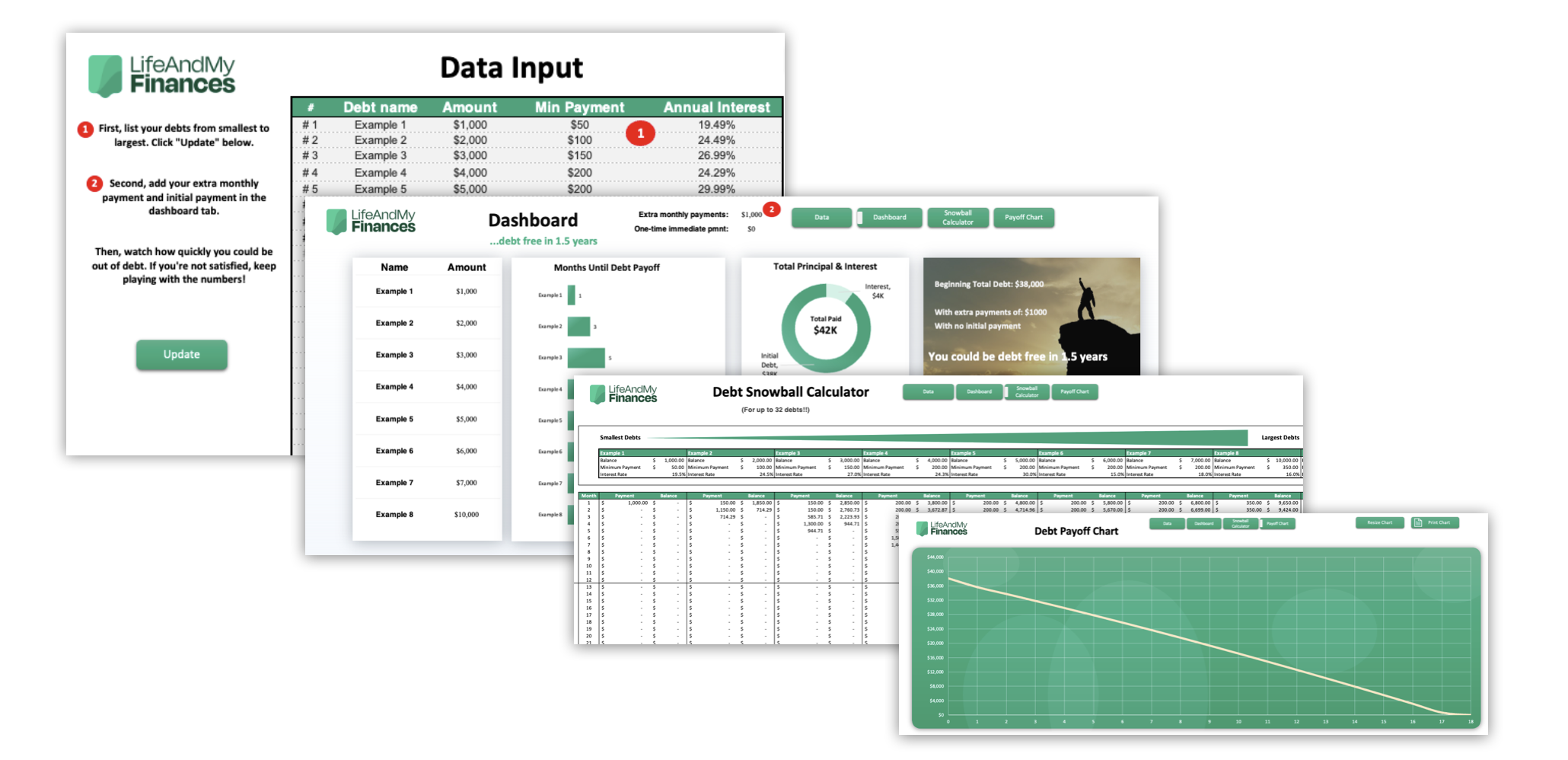

As seen on CNBC and Business Insider, this is the best debt snowball spreadsheet template for Microsoft Excel and Google Sheets that is out there!

A few key features of this template:

It will show you when you can pay off your debt

Detailed but super easy and suitable for beginners

Can handle up to 32 debts!

Else, keep reading to learn what it is and how it works.

In this article, you'll learn:

What is the Debt Snowball Method?

How Does Debt Snowball Work?

An Example of the Debt Snowball

The Debt Avalanche Method

A Brief Look at Debt Snowball vs Avalanche Method

4 Important Advantages of the Debt Snowball Method

2 Limitations of the Debt Snowball Method

5 Tips to Speed Up Your Debt Repayment

Key FAQs on Paying Off Credit Card Debt And Loans

What is the Debt Snowball Method?

The debt snowball method is an effective debt-reduction strategy that involves paying off your debts from smallest to largest. Once you’re done paying down your smallest debt, you roll over the minimum payment you made into the next-smallest debt—like rolling a snowball down the hill.

This Harvard-approved debt repayment method capitalizes on small victories to build momentum. This momentum helps you pay off your bigger debts, it’s that simple!

Derek Sall, financial expert and founder of Life And My Finances, says this about the debt snowball effect and the impactful spreadsheet he created: “I erased $116,000 of debt before turning 30 solely through the help of the debt snowball method. I created my debt snowball spreadsheet, which empowered me to repay my debts in record time. Over the past few years, I’ve refined the sheet, made it more robust, and now present it to you. Exploit the snowball tool and get out of debt now.”

Note: For more inspirational quotes on becoming and leading a debt-free life, visit our collection.

Want to dive straight into setting up your debt snowball spreadsheet? We’ve got you covered.

Head over to our shop, make the small investment, get your instant download, and create a plan to become debt-free today.

One of our users, Redd, had this to say:

“Great product! I can actually breathe a little better after entering all of my information and seeing a light at the end of the tunnel! Great customer service as well! Highly recommend.”

If you’re not quite ready to pull the trigger on the all-inclusive spreadsheet, you could always test out the small FREE Debt Snowball Spreadsheet as well. Either way, start tackling your debts today! You’ll never regret it.

How to Get Out of Debt Fast—Our New Course!

Want to get out of debt even faster?

What if we gave you...

The debt snowball vs. debt avalanche calculator ($15 value)

The weekly and monthly budget template ($10 value)

An early mortgage payoff calculator ($10 value)

80 minutes of video instruction

A complete slide deck of the video

A full workbook

And a live Q&A session with me in the next few weeks...

...all for just $39? Yeah, we’re doing that! It’s a complete steal, but it’s only available at this price until May 7th.

If you’re serious about getting out of debt, take the course. You won’t regret it. I can’t wait to meet you and hear your questions in the live Q&A!

How Does Debt Snowball Work?

Let’s break down the debt snowball method into five easy steps.

First, budget enough to cover the minimum payments for every single debt.

Now, arrange your debts from smallest to largest. Remember, you’re disregarding the interest rates on your debts.

Put any extra money you have toward your smallest debt each month.

Once you’ve successfully repaid the smallest debt, redirect the amount you were paying on it and target the next smallest debt.

Repeat until all of your debt is paid in full.

An Example of the Debt Snowball

To fully understand how powerful the debt snowball effect is, you must see it in action. But to do that, you’ll need an automated debt snowball calculator. Our debt snowball Excel spreadsheet is an impactful tool to help you lay out your debts and keep you motivated. The best part?

We have a small FREE debt snowball spreadsheet you can try today. If this free tool doesn’t have enough columns for all your debts, you can check out our bigger templates.

One of our templates can hold up to 16 debts and is available in our store.

The largest debt snowball tool has room for 32 debts and is available in our store for just $9.99.

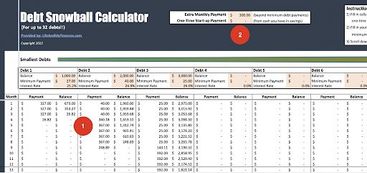

(P.S. You can make a spreadsheet yourself. But be warned that it can be super time-consuming and will cause emotional suffering.) Here’s a screenshot of the debt snowball spreadsheet below:

We’ve populated the snowball tool with three debt entries of $1,000, $2,000, and $3,000. And these are listed from the smallest to the largest debt. In mere seconds, the tool will show you how each debt will pay off over time (Marked #1 in the screenshot).

But that’s not all! (This is probably sounding like a QVC commercial. Sorry, we’re just really excited about this tool!) The top of the sheet (Marked #2 in the screenshot) lets you enter a larger monthly payment (the default is set at $300) to see how much more quickly you could pay off your debts if you put some extra dollars toward them each month.

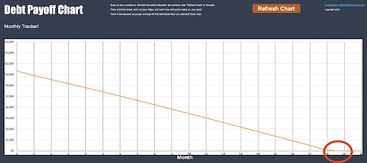

This section also gives you a spot for a one-time lump-sum payment. Let’s say you’ve saved up an additional $1,000 somewhere. You can enter this one-time lump-sum payment to see what impact it has on your debt repayment timeframe. Our debt snowball tool also comes with a chart that will help you visualize your debt payoff journey.

One of our users, Darcie Velez, says, “It was as well worth the money to get a great Excel file! Saved me lots of time (and better than I could have done anyway!) Thank you!” Not convinced about the debt snowball spreadsheet? There are alternatives, we’ll walk you through them now—

The Debt Avalanche Method

The debt avalanche method is a strategy that focuses on paying off debts with the highest interest rates first. After paying off the debt with the highest interest rate, you move on to the debt with the second-highest interest rate. You repeat the process until all your debt is paid off.

Here’s an example: Suppose you had a personal loan of $10,000 at an 18% interest rate, a credit card debt of $5,000 at a 16% interest rate, and a student loan debt of $4,000 at a 7% interest rate. You’d be paying the personal loan first, the credit card debt second, and then the student loan last. But with the debt snowball method, you’d be paying off the student loan first, then the credit card debt, and lastly, the personal loan. Want to try the debt avalanche strategy?

Check out the best avalanche Excel template on our shop for just $9.99. Or, click below.

We’ve populated the tool with the three debt entries from our previous examples. And these are listed from the highest interest debt to the lowest. The tool will immediately show you how each debt will pay off over time.

And just like the debt snowball spreadsheet, the top of the avalanche sheet lets you enter extra monthly payments and a one-time lump-sum payment. The debt avalanche Excel template is priced at $9.99 in our shop and can accommodate up to 32 debts!

You can check out the 16-debt option for just $3.99 on our shop. There’s also a FREE debt avalanche spreadsheet that can fit up to 8 debts.

A Brief Look at Debt Snowball vs Avalanche Method

We hear you say, “If the debt snowball method is the best debt-pay-off method, why do I need alternatives?” The debt avalanche method can save hundreds of dollars in interest payments and help you pay off your debts faster.

So, why does Harvard (source) think the debt snowball method is the best debt repayment method? It’s because the debt avalanche method takes a lot of discipline to stick to, and doesn’t offer you any motivation in return.

Let’s get real. Your biggest and highest-interest debt will take ages to pay off. For the debt avalanche method to work, you’ll have to stay disciplined throughout this period and not miss any strategic monthly payments. The debt snowball method, on the other hand, gives you early momentum and a sense of success every time you pay off debt.

So, it’s a bit like when you decide to improve your physique:

You can pick up a workout you enjoy enough to come back for more, or

You can sign up for a multi-year intense CrossFit program.

The latter is tempting, sure, but how about you keep it real and simply show up at the gym first? Still curious about how both these methods stack up against each other? Try our debt snowball vs avalanche Excel spreadsheet, which can accommodate 32 debts, for $14.99 in our shop. With this tool, you get:

the full debt snowball spreadsheet

the full debt avalanche spreadsheet

AND, you get the main page and chart that will show how quickly each method pays off against each other

One of our recent users, Leonard, had this to say:

“Exactly what I needed and if I stick to it I’ll be debt free again in about 18 months!! Derek is a great inspiration, as well as takes the time to make sure things are working for those of us who are Excel illiterate. I messed up on mine and he was kind enough to take the time and effort to fix it for me…above and beyond customer service much appreciated! Thank you Derek!!”

We’ve got an in-depth analysis of the differences with real-life scenarios to help you understand which method is best for you. Read Debt Snowball vs Avalanche Excel Spreadsheet Calculator. Again, there is a small free option that only holds 8 debts if you want to test it out!

4 Important Advantages of the Debt Snowball Method

A team of researchers at Kellogg School of Management (source) found that people with large credit card debts are more likely to pay off their entire debt if they focus first on paying off the smallest balances. Let’s dig a little deeper and see exactly why the debt snowball method works for people.

1. Quick wins

The Northwestern Mutual Study (source) we talked about in the beginning of the article points out that at least 9% of Americans believe they’ll be in debt for the rest of their lives! It’s scary to think that any one of us could end up feeling that hopeless. But thankfully, the debt snowball method can help in such situations.

The method’s greatest advantage is the psychological boost it can give you. Since you end up paying off your smallest debts first, you get to see separate debts paid off sooner. This psychological boost can help you tremendously if you’re going into your debt payoff journey with little hope or have lost sight of how to pay off your debts.

2. Better money management

Implementing the snowball debt effect lets you gain early momentum. Your money habits will likely change as you keep paying off smaller debts and snowballing your payments to pay off bigger debts. The more you see your debt pile decrease, the more you’ll be motivated to save and pay off debts.

3. Focus on one debt at a time

The snowball method also helps you focus all your energy on a single debt instead of worrying about all your debts simultaneously. This can help ease your stress and boost your morale.

4. Can boost your credit score

Implementing the debt snowball method can boost your credit score. Here’s how:

With this method, you can choose to pay just the minimum payments. This means you’re more likely to make your payments on time. Making 2–3 on-time monthly payments can boost your credit score.

Your debt utilization percentage should ideally be 10–30% of your total available credit. The American average was 31% (source) as of April 2022. With the debt snowball method, you’ll likely gain early motivation, which can prompt you to pay off your debts faster. This way, you can quickly reduce your debt utilization percentage and improve your credit score.

Limitations of the Debt Snowball Method

The debt snowball method has its cons. Let’s take a look at the most important ones.

1. Ignores interest costs

The debt snowball method fails to consider the amount of money you’d save by paying high-interest balances first. Mathematically, it makes more sense to pay off high-interest debts first, so they don’t continue accruing interest.

2. Extended repayment period

Since you could end up paying more interest over time, the debt snowball plan can also extend the length of your debt repayment process. If you have high interest rates on your largest balances, it may make more sense to implement the debt avalanche method.

5 Tips to Speed Up Your Debt Repayment

Here are some ways to ensure you’re on top of your debt repayment game:

1. Create a realistic budget

Track your spending carefully to understand what’s draining your money month after month. This process will help you spot where to cut expenses and redirect the saved-up money toward debt repayment. Use a spreadsheet or a budget-tracking app for efficiency.

2. Find a side hustle

Side hustles are a fantastic way to make more money. Plus, they add some much-needed breathing space to your monthly budget. There are lots of ways to earn extra dough. You can try your hand at anything from tutoring online to taking surveys.

Consider drop-shipping with Shopify and Spocket. This dropshipping marketplace works with vetted US and EU suppliers so your customers can receive their orders fast. You can set up any projects on your Shopify page with Spocket. And when customers order the Spocket product, it simply drop-ships straight from the manufacturer to the customer. All you have to do is get customers to check out your store. And your earnings depend entirely on you and your marketing skills.

Get started today by signing up for FREE and begin drop-shipping Spocket products! Selling products not your thing? Consider taking up gigs like food delivery. For instance, DoorDash has a very simple sign-up process, and their Dasher program lets you work at your convenience. The opportunities are truly endless.

3. Automate your payments

Do yourself a favor and automate your debt repayments. It’s smart to set up automatic payments that cover the minimum payments on your debts. If you can afford to pay more, set up auto payments for an amount higher than the minimum amount due. For instance, if your minimum payment is $150, try setting up automatic payments of $200 or $250.

4. Build an emergency fund

According to the Consumer Financial Protection Bureau (source), nearly 24% of consumer have no savings set aside for emergencies, while 39% have less than a month of income saved up. These are alarming numbers.

And here’s the thing: once you’re used to conquering small debts, you’ll be tempted to use every bit of extra money to pay off your debt. That’s great, but only if you have an emergency fund saved up in case you run into an unexpected expense. Having this financial cushion will allow you to focus on paying down your debts quickly.

5. Look for lower rates

In a scenario where your largest debts are also the ones with the highest interest, find opportunities to lower your rates. Consider a debt consolidation loan or transferring your credit card balance to a lower-rate card, especially if you have a good credit score.

Key FAQs on Paying Off Credit Card Debt And Loans

See below for answers to common questions you may have on eliminating credit card debt and loans.

1. Which debts to pay first?

Pay off your smallest debts first. In fact, throw as much money as possible toward the smallest debt until it’s paid off. Your quick wins will help you build momentum and become debt-free. But if you’re looking for a mathematical approach to save on interest, try the avalanche or the high-rate method and pay off high-interest debts first.

2. How to pay off credit card debt fast?

If you’re wondering how to pay down credit card debt, you can implement either the debt snowball method or the debt avalanche method. Apart from choosing a strategy, you can also try these tips to pay off credit card debt:

Check if you qualify for a 0% APR balance transfer offer with a good balance transfer credit card. The 0% introductory offer lasts anywhere from 12 to 21 months. You can transfer your higher-interest balances to this new card. You’ll then save on interest for the introductory offer period. This can help you get out of debt faster.

Look for a debt consolidation loan that has a lower interest rate than the interest rates of your credit cards. This can help you save on interest rates and can sometimes be the fastest way to pay off credit card debt. Plus, if you make monthly payments on time, your credit score could see a positive impact. Trust us and the 57.6% (source) of American borrowers who take out a personal loan to consolidate debt or refinance credit cards.

3. What are the other strategies for paying off credit card debt?

The debt snowball and avalanche methods aren’t the only strategies out there. There are lots of other debt repayment methods, including:

Debt snowflaking: Immediately captures small savings to pay off outstanding bills. This means every small, micro-saving you make—gas money and Starbucks included—goes toward paying off debt.

Equal distribution method: Involves making equal payments towards all your debts each month.

Cash flow method: Essentially the opposite of the debt snowball method. Concentrates on paying off your largest debt first

4. How to pay off a high-interest loan?

Your debt repayment method will help you pay off a loan. But to pay it off faster, you can:

Use your existing equity to pay off loans. This includes all non-liquid assets, such as stocks and real estate.

Refinance your loans can get you a lower interest rate.

Make higher payments and do it more frequently.

Look for debt relief options.

Key Takeaways

The debt snowball method is an effective debt-reduction strategy that involves paying off your debts from smallest to largest.

The snowball method of paying off debt gives you quick wins that will help build momentum and conquer your other debts.

The debt avalanche method focuses on paying off debts with the highest interest rates first. This one is for those who are motivated by interest-savings.

Consider tips like finding a side hustle, automating your payments, and looking for lower interest rates to pay off your debts quickly.

.jpg)