Getting out of debt can be hard to do alone as it requires organization. But one proven and efficient method for achieving a debt-free life is the debt snowball strategy.

To succeed with this technique, you’ll need motivation, determination, and some way of keeping track of all your debts and payments. This is where the debt snowball spreadsheet comes in handy.

By entering all the details of your debts and inputting the right formulae, the spreadsheet will do the math for you. It can also show you how much progress you’ve made towards achieving your goal, which should motivate you to stick with it.

So what exactly is the debt snowball method and how do you track it with a spreadsheet? We’ll be answering these questions and much more below.

If you’d prefer to build your own from scratch, just keep reading to discover how.

Alternatively, start your snowball right now, you can head over to our shop page and purchase a ready-made debt snowball spreadsheet (or click the button below 👇).

Time to get out of debt with this debt snowball worksheet! 💪

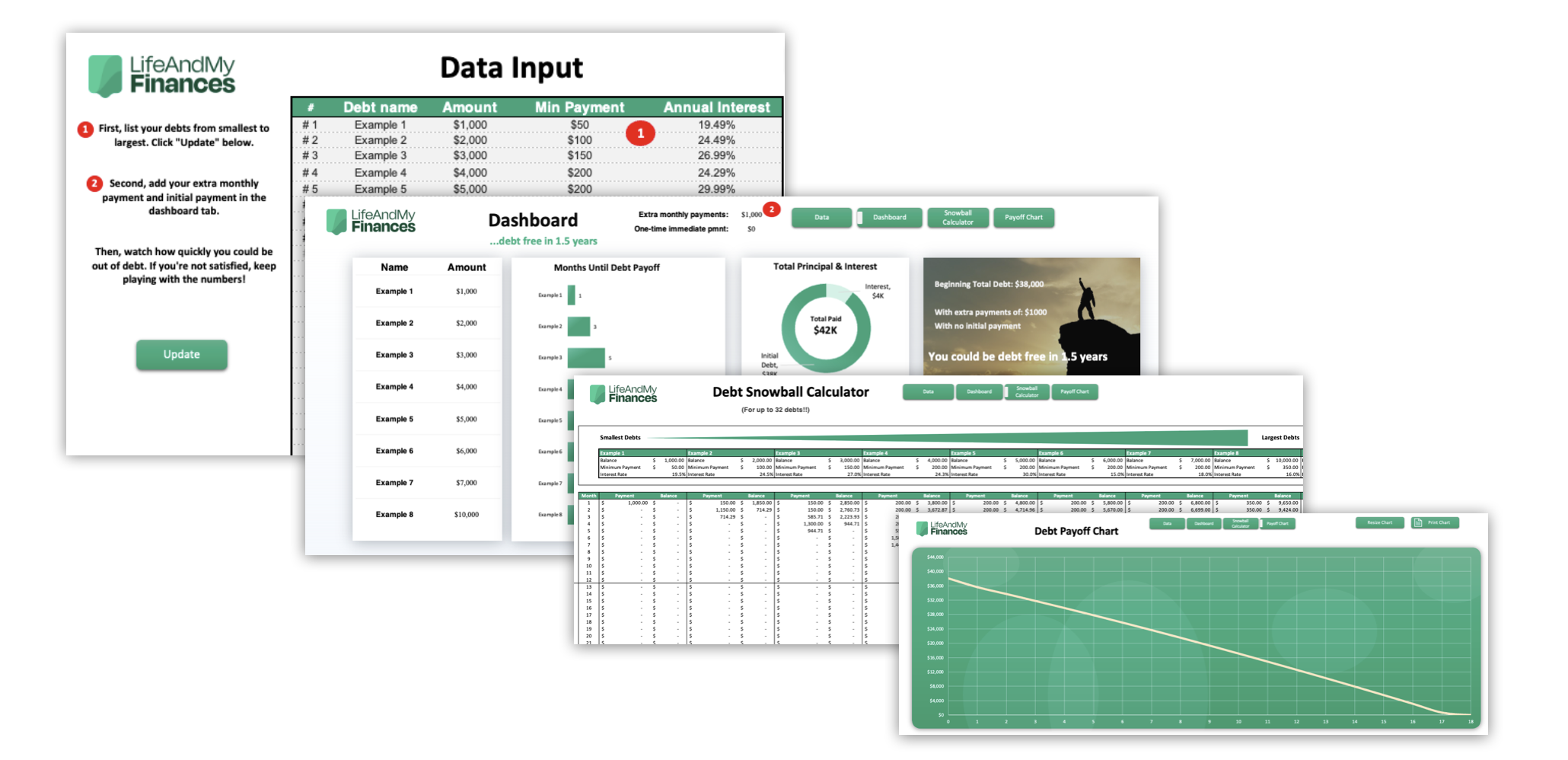

As seen on CNBC and Business Insider, this is the best debt snowball spreadsheet template for Microsoft Excel and Google Sheets that is out there!

A few key features of this template:

It will show you when you can pay off your debt

Detailed but super easy and suitable for beginners

Can handle up to 32 debts!

Understanding the Debt Snowball Method

The Debt Snowball Method is a debt reduction strategy designed for you to pay off your debts efficiently. It centers on the psychological win of clearing small balances. This motivates you to keep going.

As you roll the payments on your cleared debts into larger debts, your debt reduction will gain momentum—like a snowball rolling down a hill. Here's how it works:

List Your Debts: Start by organizing your debts from the smallest balance to the largest, regardless of the interest rate.

Minimum Payments: Keep making the minimum payments on all your debts.

Extra Payments: Focus any extra money available on the smallest debt until it's completely paid off.

Once you've paid off the first debt, you redirect the money you were paying on that first debt to the next smallest balance, creating a "snowball effect".

Example:

You have two credit card debts and a loan to repay. You order them by size and work out that after the minimum payments and your day-to-day expenses, you would have an extra $75 a month to put toward your debts. You allocate this to your smallest debt:

(There’s no interest in this example to keep things simple).

Debt | Balance | Minimum Payment | Extra Payment |

|---|---|---|---|

CC1 | $500 | $25 | $75 |

CC2 | $1000 | $50 | $0 |

Loan | $2000 | $100 | $0 |

After five months, CC1 will be cleared and you can apply the $100 (previously allocated to CC1) to CC2's payment. Now your payments would look like this:

Debt | Balance | Minimum Payment | Extra Payment |

|---|---|---|---|

|

|

|

|

CC2 | $750 | $50 | $100 |

Loan | $1500 | $100 | $0 |

After another five months, CC2 will also be paid off and you can reallocate the $150 from CC2 to your outstanding loan:

Debt | Balance | Minimum Payment | Extra Payment |

|---|---|---|---|

|

|

|

|

|

|

|

|

Loan | $1000 | $100 | $150 |

It’ll just be another four months until you’re totally debt free!

If you’d split your extra $75 equally between your outstanding debts, it would have taken a bit longer to pay off all your debts. The debt snowball method also meant paying off the first debt in half the time, which provides great psychological encouragement!

Preparing Your Free Debt Snowball Spreadsheet

Before you can start snowballing your own debts, there are just a couple of steps that you’ll need to take first.

Choosing the Right Tool (Excel and Google Sheets)

First things first—you need somewhere to build your spreadsheet. The two main options are Microsoft Excel and Google Sheets. Ultimately, it’s a personal choice which you want to use.

You might prefer Excel because it:

Can handle large datasets

Has more powerful tools

Has a faster processing speed

Is secure

Alternatively, you might prefer Google Sheets because it’s:

Easier to use

Ideal for sharing and collaboration

Free to use

Both should provide everything you need to build a debt snowball spreadsheet or download a template.

Input Your Debt Info

The second step is to list out all your debts. For clarity, make a table with columns for:

Creditor Name (e.g., credit card company, bank)

Balance Owed

Interest Rate

Minimum Monthly Payment

Ensure every debt you owe is included in this list, as missing any can affect the efficiency of your debt snowball strategy.

Organizing the Debt List

After you have listed your debts, organize them from the smallest balance to the largest—this is the essence of the debt snowball method. In your spreadsheet, you might configure it as follows:

Creditor Name | Balance Owed | Interest Rate | Minimum Payment |

|---|---|---|---|

Debt A | $500 | 10% | $25 |

Debt B | $1,000 | 12% | $50 |

Debt C | $2,000 | 9% | $75 |

Paying off smaller debts first can create psychological wins that motivate you to continue with your repayment plan. As each debt is paid off, you direct the freed-up funds to the next smallest balance, hence the 'snowball' effect.

Skip the Hard Part with our Debt Snowball Spreadsheet Template

Building your own debt snowball spreadsheet is free, but it’s not without difficulties. It’s pretty time-consuming, and if you're not a whizz with spreadsheets you could find it challenging and frustrating.

We’ve built one for you to save you the hassle. You can download it now, plug in your figures, and start your journey towards freedom from debt.

Our debt snowball spreadsheet can be downloaded for Excel or Google Sheets. All the complex formulae are already set up for you. What’s more, graphs and charts will help you visualize your progress and timeline. You can even see projections of how tweaks to your repayment plan would affect how long it takes to pay off your debts.

Key Features of the Template:

Capacity for Multiple Debts: Manage up to 32 debts seamlessly.

Payment Timeline: Visualize the expected date for complete debt freedom based on your chosen repayment strategy.

Structured Repayment Guidance: Receive a methodical, payment-by-payment guide to simplify your journey out of debt.

Calculating Minimum Payments and Interest

The minimum payments and interest rates for your debts are two of the most important figures you’ll need to include in your debt snowball spreadsheet. These factors could have a big impact on how long it takes you to pay off your debts.

Determining Your Minimum Payments

Your minimum payment is the least amount you can pay on your debt each month without incurring penalties. It may be given as a flat amount, a percentage of your outstanding balance, or a percentage that factors in interest and other fees.

Your lender should tell you what the minimum payment is. For example, if you’re repaying a credit card debt, you should find the minimum payment on your credit card statement. Remember to check your statements and keep the spreadsheet updated as minimum payments can change.

Inputting Interest Rates

The interest rate determines how much extra you will pay on top of your borrowed amount. This will also be provided on your statement, usually as an annual percentage rate (APR). If you want to calculate the amount of your payment that goes towards interest each month, you can use the following formula:

You can input this data into your spreadsheet as follows:

Creditor's Name | Total Balance | Interest Rate | Monthly Interest |

|---|---|---|---|

Credit Card A | $5,000 | 15% | $62.50 |

Credit Card B | $3,000 | 18% | $45.00 |

Remember that the balance you owe will be affected by the monthly interest as well as the amount you repay. So the balance each month will be the balance from last month minus repayments plus monthly interest.

Customizing the Debt Snowball Worksheet

It helps to personalize your debt snowball spreadsheet to fit your specific financial situation. By adding extra payments, creating a tailored payment schedule, and visualizing your progress, you can maintain motivation and keep a clear view of your path to becoming debt-free.

Adding Extra Payments

To accelerate debt repayment, it's important to incorporate any additional funds you can into your debt snowball spreadsheet. For each debt listed, you should:

Specify the amount in an 'Extra Payments' column next to the minimum payment.

Update your snowball calculator to reflect any changes in how much you repay each month.

Example:

Debt Name | Minimum Payment | Extra Payments | Interest Rate | Due Date |

|---|---|---|---|---|

Credit Card 1 | $50 | $100 | 15% | 1st |

Car Loan | $250 | $0 | 6% | 14th |

Student Loan | $350 | $0 | 3% | 22nd |

Creating a Payment Schedule

Your payment schedule is the backbone of the debt snowball method:

List each debt with the corresponding due dates and minimum payment amounts.

Sequence your debts from the smallest balance to the largest, regardless of interest rate, making it easier to see which debt to target first.

Example payment schedule:

Credit Card 1 - $300 balance - Minimum payment: $50

Car Loan - $6,000 balance - Minimum payment: $250

Student Loan - $20,000 balance - Minimum payment: $350

Visualizing Progress

A visual representation of your debt reduction can be a powerful motivator:

Use a chart in your spreadsheet to graphically display your total debt over time.

Create a debt snowball tracker, marking off when a debt is paid off, to visualize your journey towards being debt-free.

For example:

Month | Total Balance | Payment | Monthly Interest | Debt Paid Off |

|---|---|---|---|---|

Jan | $26,300 | $750 | $83.75 | |

Feb | $25,633.75 | $750 | $80.07 | |

Mar | $24,963.82 | $750 | $76.36 | Credit Card 1 |

By customizing your debt snowball spreadsheet in these ways, you create a personalized and actionable plan that charts a clear course for eliminating your debts, one by one.

Paying Off Debts: Snowball vs. Avalanche

The debt snowball isn’t the only debt repayment strategy. There’s another popular method called the debt avalanche method. So what’s the difference and which one is better?

Debt Snowball Strategy

The Debt Snowball Strategy involves listing your debts from smallest to largest, regardless of interest rates. Focus on paying the smallest debt first while making minimum payments on the rest. Once the smallest debt is paid off, you roll the payment amount into the next smallest debt. This process creates a "snowball effect" where your payments toward debts become larger as each debt is eliminated.

List debts from smallest to largest.

Pay extra on the smallest debt.

Roll over payments as each debt is paid off.

Debt Avalanche Comparison

In contrast, the Debt Avalanche Method focuses on paying off debts that incur the most interest first. Say you have the following debts:

$10,000 loan with 5% interest

$5,000 loan with 8% interest

$5,000 loan with 20% interest

Loan 1 incurs $500 in interest each year, loan 2 incurs $400, and loan 3 incurs $1,000. Using the debt avalanche method, you would therefore pay off the debts in the order 3, 1, 2. The aim of this method is to save you money on interest over time.

List debts from highest to lowest amount of interest.

Pay extra on the debt that incurs the most interest.

Roll over payments as each debt is paid off.

If you would prefer to pay off your debts using the debt avalanche method, you can download our debt avalanche Excel template.

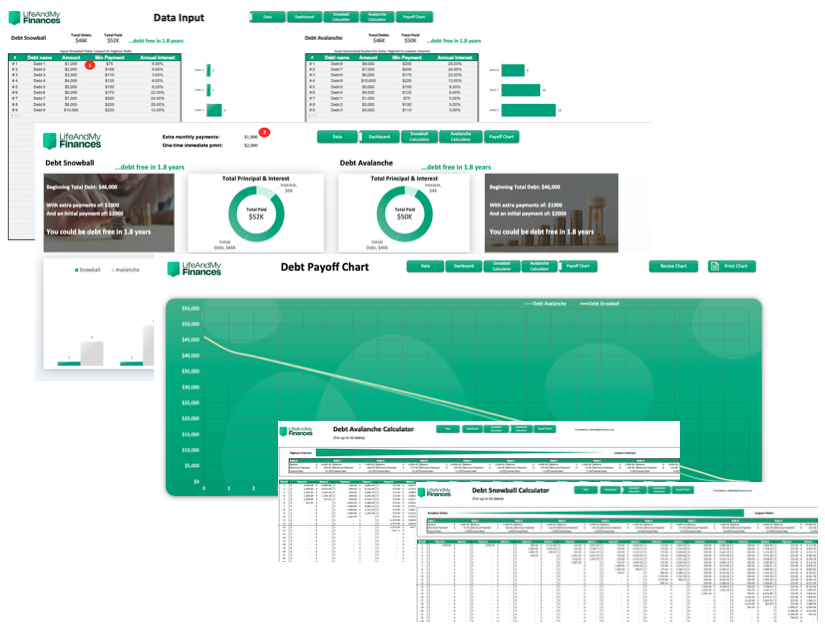

Snowball vs Avalanche Calculator for Excel and Google Sheets

So which is better, the debt snowball or debt avalanche method? Well, this is a personal choice. If you do the math, you’ll find that the debt avalanche method means paying less interest and becoming debt-free faster.

However, there often isn’t that much difference between how long the two methods take. The benefit of the debt snowball method is that you’ll start clearing some of your debts sooner. This can be a huge boost psychologically and give you the motivation and momentum you need to see the strategy through.

If you want to know how long each method would take to pay off your debts and what the differences are, we created a debt snowball vs avalanche calculator.

Just plug in your figures to see projections of how long each method will take and how much you’ll pay overall. Once you’ve decided which strategy you prefer, just open the tab for your choice and start tracking your debt repayment.

To download the debt snowball vs avalanche calculator for Excel or Google Sheets, just head over to our Etsy page.

Achieving Milestones and Maintaining Motivation

When you embark on debt repayment, your psychological journey is as important as your financial one. Quick wins are essential—seeing progress early on can greatly reinforce your motivation. By tackling the smallest debt first, regardless of interest rate, you create an immediate sense of achievement which acts as a stepping stone towards larger goals.

Celebrate Small Victories: Each time you pay off a debt, it's a victory worth recognizing. This not only boosts your morale but also reaffirms your commitment to financial freedom.

Track Your Progress: Use a spreadsheet to visually track your payments and shrinking balances. This allows you to witness the tangible reduction of debt, reinforcing a sense of progress.

Remember, the snowball method is as much about maintaining momentum as it is about paying off debt. Each small balance cleared can inject a renewed energy into your repayment strategy, pushing you to continue until all debts are settled. Keep your focus on the sequential milestones, and let each success propel you to the next until your debt is just a memory!

Advanced Techniques and Tips

If you really want to speed up debt reduction, there are a couple of extra things you can try.

Negotiating Interest Rates

You have the ability to potentially lower your interest rates through negotiation with creditors. This could lead to substantial savings. Here’s what you’ll need to do:

Research Your Position: Understand your current interest rates and compare them with what's offered by competitors.

Contact Creditors: Reach out to your lenders and ask if there's an option to reduce your current rates.

Be Persistent: If initially denied, don't hesitate to call again or escalate to a manager.

Consider using a debt tracker spreadsheet to record creditor responses, current versus negotiated rates, and estimated savings.

Increasing Your Payments

Naturally, the more money you can allocate to repaying your debts, the faster you’ll pay them off. Here are a few things you can try to increase your income and get hold of some extra cash:

Ask for a pay rise

Look for a higher-paying job

Get a side hustle

Be more frugal in your spending

Sell things you don’t use

Cancel subscriptions you don’t need

Using Debt Reduction Spreadsheets

Implementing debt reduction spreadsheets can streamline your approach to paying off debts. If you don’t have the time or skills to make your own, you can download ours and get started straight away.

A small investment now will start you on your journey to becoming debt-free!

.jpg)