Creating a budget is arguably the first line of defense against runaway debt. It provides the end user with a clear picture of both sources of income and household expenses.

In this article, we describe how to go about putting together a household budget. In this first of a two-part series, we discuss getting started with a worksheet, including a sample to download. Next we explain the importance of balancing a budget. Finally, we talk about the first half of a budget: sources of income.

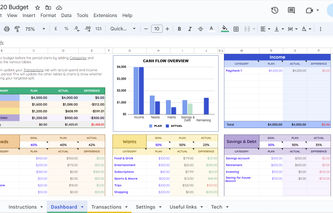

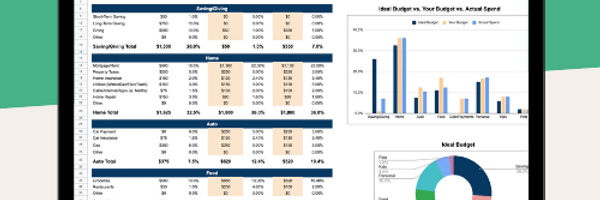

Simple, quick, and easy monthly budget template for Google Sheets and Excel.

With this template, you will get:

Pre-set expense categories

Simplified dashboard and day-by-day monthly tracker

Automated charts for comparison

Day-by-day views for budgets and actual spend

Getting Started with an Annual Budget

The only requirement needed to get started is a spreadsheet application. Microsoft Excel, LibreOffice (Calc) are all great productivity tools. Everyone with an internet connection has access to a spreadsheet application. In our article, Resume Builder, we describe how to obtain a copy of OpenOffice. Most individuals do not need any specialized budget software to create a simple family budget.

Family Budget Basics

There are only two variables that need to be in balance to keep everyone out of debt: income and expenses. In the same way a profitable business operates, the goal of a personal or family budget should be to have Income that is greater than Expenses. This must be true for the entire year (in aggregate), not just a month or two.

This last point is important because individuals often have large expenses, such as life insurance payments or holiday gift purchases, that can result in monthly expenses that are sometimes much greater than that month's income. But over the course of a year, income needs to be greater than expenses.

Sources of Family Income

Most people have a very good understanding of their income sources. It's the expenses that tend to be harder to track. On Row 5 of the budget worksheet, the term Wages appears. These are after-tax wages that are deposited into a banking account, or the value appearing on a paycheck. This is the money that someone can actually spend, after deductions such as taxes and medical insurance have already been removed.

On this line the end user needs to enter their total household wages for each month. If paid weekly, then for some months this will be five paychecks. If paid bi-weekly, then for some months this will be three paychecks. The worksheet takes the wages in January and populates the other months.

Example

Since there are 52 weeks in a year, if someone is paid weekly, they need to take their paycheck and multiply it by 4.33. If someone is paid bi-weekly, they need to take their paycheck and multiply it by 2.17. Below is an example of an Excel formula used when a person receives a $750 paycheck weekly:

=750*4.33

Other Sources of Income

On Row 6 of the worksheet, the user should enter any interest or dividends paid each month. Individuals having problems balancing their budget will likely enter zero. However, anyone with money in the bank earning interest should take a look at their latest bank statement and enter a value for each month. Don't worry about the number being exactly right; just enter a value that is in the right range.

Row 7 of the budget worksheet is labeled Miscellaneous. If someone has another steady source of monthly income, then enter that value on this row. This is not the place to get creative, just stick to reliable sources of income.

Now that we've finished the income portion of the budget worksheet, this is a good place to stop. In the next installment in this series, we'll be covering the expense portion of an annual budget.

.jpg)

.jpg)