Credit scores have a big impact on your life. They decide if you get a loan or a credit card, the interest rate you’ll be stuck with, or if you’ll snag your dream apartment.

In fact, a score above 750 will leave you spoilt for choice. You can qualify for 0% financing on cars, great mortgage rates while buying a house, and credit cards with 0% introductory APR.

It’s safe to say this little three-digit score holds a ton of sway over your financial situation. That’s why it’s important to understand how it works.

This article will show you:

What the different credit score ranges are.

How the FICO® score and VantageScore credit scoring models work.

What does and doesn’t affect your credit score.

Read more:

What is Credit?

A credit score is a three-digit number that shows how likely you are to repay what you borrow and how you handle your bills. It usually ranges from 300 to 850.

Your credit score is calculated based on information about your credit accounts. This data comes from credit bureaus who gather and present this information in your credit reports.

The big players here are Equifax, Experian, and TransUnion.

Here’s the interesting bit: You don’t have just one credit score—you’ve got a bunch of them.

That’s because different companies like FICO®, TransUnion, and VantageScore crunch the numbers to come up with scores.

Wondering which credit score is the most important?

The FICO score is one of the most popular credit scoring models in the US, with almost 90% of top lenders using it to make credit decisions.

What Are the Different Credit Score Ranges? Credit Score Tiers Explained

Like we said, a credit score chart usually ranges from 300 to 850.

The scores within that range are categorized using scoring models by companies like FICO® and VantageScore®.

Here’s a detailed breakdown of the different credit score ranges:

FICO credit score range

CREDIT RATING | FICO® CREDIT SCORE RANGES |

Poor credit | 300–579 |

Fair credit | 580–669 |

Good credit | 670–739 |

Very good credit | 740–799 |

Excellent credit | 800–850 |

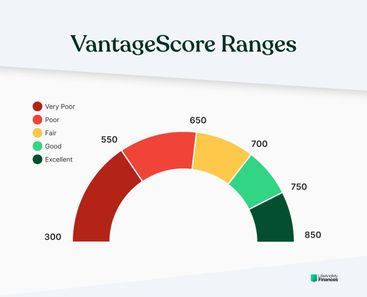

VantageScore 3.0 credit score range

CREDIT RATING | VANTAGESCORE 3.0 CREDIT SCORE RANGES |

Very poor credit | 300–499 |

Poor credit | 500–600 |

Fair credit | 601–660 |

Good credit | 661–780 |

Excellent credit | 781–850 |

What is an excellent credit score range?

FICO: Excellent credit score is 800–850.

VantageScore: Excellent credit score is 781–850.

When you have excellent credit, you can get the best terms and interest rates on the best credit cards, loans, mortgages, and more.

Folks with stellar credit scores usually keep their credit utilization ratio low and never miss a payment.

What is a good credit score?

FICO: Very good credit score is 740–799 and good credit score is 670–739.

VantageScore: Good credit score is 661–780.

Having good credit scores is a comfortable place to be, as you can qualify for more financial products. This includes home and auto loans, and credit cards with better interest rates.

For instance, applying for a credit card with a good score could land you a higher credit limit and a lower interest rate.

What is a fair credit score?

FICO: Fair credit score is 580–669.

VantageScore: Fair credit score is 601–660.

Having a fair credit score means you’re in the middle of the credit score spectrum. You aren’t necessarily in trouble, but you don’t have anything to write home about.

A fair credit score gives you relatively more credit opportunities than folks with poor credit—meaning you can still get the green light for credit or loans.

But here’s the catch: You might have to cough up more money in interest or settle for not-so-great terms.

Picture this: You’re getting a new credit card with a fair credit score. You may get the card, but brace yourself for higher interest rates compared to people with better scores—we’re talking a difference of thousands of dollars over time.

What is a poor credit score?

FICO: Poor credit score is 300–500.

VantageScore: Poor credit is 500–600, and very poor credit is 300–499.

Landing in the bad credit territory can make getting approval for credit cards or loans pretty tricky.

And even if you manage to get approval, brace yourself for much higher interest rates.

But don’t lose hope just yet. A bad credit score doesn’t have to mean utter doom. There are many ways to improve your score and turn things around.

Paying off your credit card debt and steering clear of new credit accounts are some of the most effective tips to try.

How Does Credit Score Work?

Several factors can affect all your credit scores, and we usually divide them into five categories:

Payment history: Making your credit account payments on time can help build your scores. However, missing payments, having an account sent to collections, or filing for bankruptcy could harm your scores.

Credit usage: The number of accounts with balances, the amount you owe, and your credit utilization rate (the percentage of available credit you’re using) all play a role here.

Length of credit history: This category tracks the average age of all your credit accounts, as well as the age of your oldest and newest accounts.

Types of accounts: Also known as “credit mix,” this category looks at whether you’re handling both installment accounts (like car loans, personal loans, or mortgages) and revolving accounts (such as credit cards and other lines of credit). Showing responsible management across both types of accounts can benefit your scores.

Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO and VantageScore take different approaches to explaining the relative importance of these categories.

Here’s the full breakdown:

FICO® score factors

FICO uses percentages to represent how important each category is.

But the exact percentage breakdown FICO uses to figure out your credit score will depend on your unique credit report.

FICO considers scoring factors in the following order:

Payment history: 35%

Amounts owed: 30%

Length of credit history: 15%

Credit mix: 10%

New credit: 10%

VantageScore factors

VantageScore lists the factors by how influential they typically are in assigning a credit score.

VantageScore looks at the factors this way:

Total credit usage, amounts owed, and available credit: Extremely influential

Credit mix and experience: Highly influential

Payment history: Moderately influential

Length of credit history: Less influential

New credit: Less influential

What Doesn’t Affect Your Credit Scores?

FICO and VantageScore don’t care about the following when they calculate your credit score:

Your race, color, religion, national origin, sex, or marital status. (They can’t use this information because it’s against the law. The law also protects you from being penalized for receiving public assistance or exercising your consumer rights under the Consumer Credit Protection Act.)

Your age.

Your salary, job, title, employer, and work history. (But lenders might consider this when deciding whether to approve you.)

Where you live.

Soft inquiries. These happen when companies offering credit deals or your lender checks on your existing accounts take a peek at your credit report. Soft inquiries don’t affect your credit scores. You can also check your own credit report or use credit monitoring services without it affecting your scores.

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

What is the Average Credit Score?

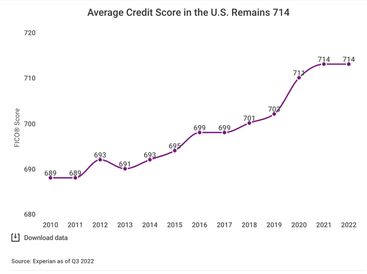

The average FICO score in the US was 714 in 2022 (consistent with the average in 2021), according to data by Experian.

The data also suggests that consumers effectively managed their credit despite the economic turbulences of the last few years.

Average FICO score across all generations

Wondering what the average credit score looks like across different age groups in the US?

Here’s a quick breakdown of average scores in 2021 and 2022:

GENERATION | 2021 | 2022 |

Silent Generation (77+) | 760 | 760 |

Baby boomers (58–76) | 740 | 742 |

Generation X (42–57) | 705 | 706 |

Millennials (26–41) | 686 | 687 |

Generation Z (18–25) | 679 | 679 |

Source: Experian data

What Is a Good Credit Score Range to Buy a House?

If you want a better shot at getting a sweet deal from a mortgage lender, you have to aim for a credit score in the “good” zone (a FICO score of 670 or higher).

When it comes to the minimum credit score needed to buy a house, it’s a bit of a mixed bag.

The score can range from 500 to 700—but it all boils down to the type of mortgage loan you’re after and the lender you choose.

Here’s a quick look at your top loan options for buying a house:

If you’re eyeing an FHA home loan, they’ll usually cut you some slack with a credit score of at least 500 if you put down 10%, or 580 if you can scrape together 3.5%.

USDA loans don’t have a fixed credit score requirement, but most lenders will give you the nod if your score is at least 580.

And if you’re going for a VA loan, they’re not too strict on the minimum credit score either. Generally, they like to see a score of 620 or higher.

Lenders look at your credit score to size you up and decide how much risk you bring to the table.

You can swing a mortgage with bad credit, but it’s way smarter to boost your score before jumping into the mortgage game.

This way, you’ll land better mortgage terms and a happier wallet.

What Is a Good Credit Score to Buy a Car?

There’s no specific credit score you need to buy a car, but it’s best to aim for a score of 670 or higher.

Having a higher credit score will get you better loan terms for your car.

Lenders see low credit as risky, so if your credit is poor or fair, you’ll end up paying more interest on your car loan.

If your FICO® Score is below 670, it’s a good idea to work on improving your credit before getting a car.

Once you reach the “good” credit range, you’ll have a better chance of qualifying for lower interest rates and better loan conditions.

But Andrew Boyd, co-founder and managing director at Finty, points out that credit scores aren’t everything, “Remember that your credit score isn’t the only factor lenders consider. They also look at your income, employment history, and debt-to-income ratio. So it’s always a great idea to aim for a healthy financial profile overall, not just a good credit score.”

How Can I Improve My Credit Scores?

Rebuilding your credit score can feel like an overwhelming task. It doesn’t have to be.

Here are some practical tips to boost your credit:

Pay at least the minimum and be on time with all your debt repayments. A single payment that’s 30 days late can mess up your credit scores and stick around on your credit report for a whopping seven years. If you think you might miss a payment, reach out to your creditors ASAP and see if they can cut you some slack or offer any hardship options.

Keep your credit card balances low. Your credit utilization rate is a big deal—it’s the percentage of total available credit you’re currently using. Having a low utilization rate (less than 30%) can do wonders for your credit scores.

Open accounts that get reported to the credit bureaus. If you don’t have many credit accounts, make sure the ones you do open show up on your credit report. These can be installment accounts like student, auto, home, or personal loans, or revolving accounts like credit cards and lines of credit.

Only apply for credit when you really need it. Applying for new credit can trigger a hard inquiry, which might ding your credit scores a bit. Usually, it’s not a huge deal, but applying for tons of different loans or credit cards in a short time can lead to a bigger drop in your scores.

Keep an eye on your credit report. Regularly check it for mistakes. You can grab a free credit report from each of the three major credit bureaus for free at Credit Karma. You can also go to the MyFico website to get your FICO Score for free.

Start building a credit history if you don’t have one. It can be tough getting good credit scores without a solid history. One way to start is by getting a secured credit card or a credit builder loan.

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

Read more:

Key Takeaways

A credit score is a three-digit number that tells you how likely you are to repay what you borrow and handle your bills. It usually ranges from 300 to 850.

The FICO credit score scale ranges from 300 to 850, including categories such as poor credit (300–579), fair credit (580–669), good credit (670–739), very good credit (740–799), and excellent credit (800–850).

The VantageScore scale ranges from very poor credit (300–499), poor credit (500–600), fair credit (601–660), good credit (661–780), and excellent credit (781–850).

Payment history, credit usage, and the length of credit history are all factors that can affect your credit score.

You can boost your credit score by paying off all your credit card bills on time, maintaining a low balance, and applying for credit only when you need it.

.jpg)