| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 7.6 | Visittractorsupply.com | $0 | 30.99% | $50 | fair or above |

The Tractor Supply Co. credit card has no annual fee and a dizzyingly high APR—but offers a pretty nifty rewards structure. That is if you shop at Tractor Supply Co. regularly.

Does this card make the cut?

Let’s find out—

This article will show you:

What the Tractor Supply Card is.

Its pros, cons, and rewards system.

How it compares to other credit cards for fair credit.

Read more:

Tractor Supply Credit Card at a Glance

Full name: Tractor Supply Company Visa Card

Best for: Rewards for buying stuff at Tractor Supply Company

Issuer: Citibank, N.A.

Credit score needed: Fair or above

The Difference Between Tractor Supply Visa Credit Card and Tractor Supply Store Card

Alright, let’s break this down.

The Tractor Supply Store Card is like a VIP pass—it only works at Tractor Supply Co. online, in-store, or catalog.

It doesn’t offer rewards, but it can give you cool financing options when you buy big stuff.

On the flip side, the Tractor Supply Co. Visa Credit Card is all that and more. It works everywhere Visa is accepted, not just in Tractor Supply Co. shops. Plus, it showers you with rewards for every buck you spend. How cool is that?

But this card will usually check your credit score more strictly—so be aware of that.

Now, if you clicked here on a whim and need first to find out what the Tractor Supply Company does—

Tractor Supply is your go-to local store for rural living essentials. It offers everything from animal feed to power tools and even rugged clothing suitable for the great outdoors.

Now, let’s get into the nitty-gritty of the Tractor Supply Credit Card.

Tractor Supply Credit Card: Overall Card Review

| |

APR | 30.99% |

Annual fee | $0 |

Intro offer | $20 |

Rewards | 5 points per $1 spent at Tractor Supply Co. 3 points per $1 at gas stations and grocery stores 1 point per $1 on other purchases |

Overall credit card rating | 3.8/5 |

Tractor Supply Credit Card Pros & Cons

Pros

- Pretty generous rewards structure.

- No annual fee.

- Special financing options on larger purchases.

- Zero fraud liability for unauthorized transactions.

- Built-in Visa cardholder benefits.

Cons

- Limited use of rewards, as they’re redeemable only at Tractor Supply Co.

- Not ideal for those who don’t frequently shop at Tractor Supply Co.

- High APR, making it costly for those unable to pay the balance in full each month.

- Rewards points expire if not used within a year.

Pros—Why We Like It

Pretty generous rewards structure

With five points per $1 spent at Tractor Supply Co., your regular purchases could pile up rewards quickly.

That's like earning 5% back on your spending, to be used on TSC purchases again. So if you’re a regular there, it should be a no-brainer.

Earning three points per dollar at gas stations and grocery stores means everyday essentials also contribute to your rewards.

With the flexibility to earn one point per $1 on other purchases, you aren’t limited to specific categories or retailers.

Read more:

No annual fee

The absence of an annual fee reduces your cost of owning the card.

And if you don’t use it for a while, it’s not a big deal.

Intro APR

You get a 3.99% intro APR for 36 months for select purchases eligible for a Major Purchase Plan.

Special financing options on larger purchases

Special financing options for larger purchases could help manage outlays better.

Financing options with TSC Credit Cards mean no interest if paid in full within the respective promotional period. You’ll get:

Six months of interest-free financing for purchases of $199 or more.

Twelve months of interest-free financing for purchases of $399 or more.

Keep in mind, though, that interest will accrue from the purchase date and will be charged if unpaid within the promotional period.

Additionally, they offer:

A 36-month plan with a 3.99% APR for purchases of $1,599 or more.

Remember

These promotions are for those whose accounts are in good shape and have gotten the green light on credit checks. Other offers can’t be used together with these, and the total purchase amount should reach the necessary amount before considering taxes, fees, or discounts in a single purchase.

Zero fraud liability for unauthorized transactions

Zero fraud liability shields you from costs incurred due to unauthorized charges.

And let’s be honest—in today’s world, it can come in handy sometimes.

Built-in Visa cardholder benefits

Additional Visa cardholder benefits, including car rental insurance and emergency assistance, can be just what you need in unexpected situations.

Cons—Things to Think About

Limited use of rewards

Rewards can be redeemed only at Tractor Supply Co., limiting their versatility quite a bit. And you won’t get the 5% rewards rate if you don't shop there regularly.

You need to ask yourself—is it worth it, then?

Check out more flexible options:

High APR

The card’s high APR could make carrying balances expensive. With over 30% rate, it’s basically only good for those who can clear their balance each month.

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

Rewards points expire

If you can’t use your reward points within a year, they’ll expire. It’s extra important to plan spending and rewards redemption efficiently.

Key Tractor Supply Credit Card Fees & Rates

FEE | DETAIL |

|---|---|

Annual fee | $0 |

APR | 30.99% |

APR for cash advances | 29.99% |

APR for balance transfers | 30.99% |

Balance transfer fee | Either $10 or 5% of the amount of each transfer (whichever is greater) |

Cash advance fee | Either $10 or 5% of the amount of each cash advance (whichever is greater) |

Foreign transaction fee | 3% of each transaction (in US dollars) |

Late fee | Up to $41 |

Minimum interest charge fee | $2 |

Things to Know About the Tractor Supply Company Visa Card

Tractor Supply Company Visa rewards & benefits

The Tractor Supply Co. Visa Credit Card rewards its users with points for every dollar spent.

Here’s how the point system works:

You earn five points per $1 spent on purchases at Tractor Supply Co. (whether in-store or online).

Gas station and grocery store purchases are rewarded at three points per $1 spent.

All other purchases where Visa is accepted bag one point per dollar spent.

Once you accumulate 2,500 points, you’re in for a treat: These points convert into a $25 Tractor Supply Co. Rewards Certificate, which you can use on your next Tractor Supply Co. purchase.

Hence, for every 2,500 points earned, you’re essentially earning back $25, making each point worth about a penny.

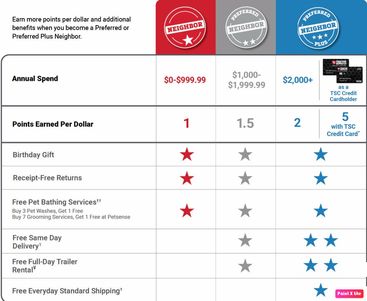

If you want even more benefits, join their Neighbor program. All the details are below:

Source: Tractor Supply Company

The Preferred Plus Neighbor Membership of the Tractor Supply Co.’s Neighbor’s Club offers several premium benefits:

Free Same-Day Delivery: You get two complimentary same-day deliveries per quarter on eligible Tractor Supply purchases. Each certificate has a maximum value of $25. (Conditions and exclusions apply.)

Full-day Trailer Rentals: This membership level includes two free full-day trailer rentals per quarter, subject to availability and vary by location.

Free Everyday Standard Shipping: Enjoy complimentary standard shipping on eligible Tractor Supply purchases with a minimum spend of $29.

These benefits aim to make shopping with Tractor Supply more convenient and cost-effective for frequent customers.

What’s the credit limit on the Tractor Supply credit card?

The credit limit on the Tractor Supply Co. Visa Credit Card isn’t set in stone, as it largely depends on the cardholder’s creditworthiness.

Here’s how it works: Your credit limit is based on things like your credit score, how much you make, and the debts you already have. During your application, these factors are checked to assign your credit limit. So it can be different for everyone.

The surest way to know your limit? Wait for the info from your issuer once they approve your application.

Remember

If you want to apply, beware of the hard pull Citibank performs to check if you’re eligible for the credit card.

Alternatives: How Tractor Supply Card Compares to Other Credit Cards for Fair Credit?

We ranked the Tractor Supply card against two other credit cards that require only a fair credit score:

TRACTOR SUPPLY CREDIT CARD 3.8 | CAPITAL ONE QUICKSILVERONE CASH REWARDS CREDIT CARD 3.6 | PETAL 2 "CASH BACK, NO FEES" VISA CREDIT CARD 4.4 |

|---|---|---|

Annual fee $0 | Annual fee $39 | Annual fee $0 |

Rewards 1%–5% | Rewards 1.5%–5% | Rewards 1%–10% |

Promotion $50 | Promotion N/A | Promotion N/A |

Learn more | Learn more |

Useful Links

Download the Tractor Supply app here.

Download our credit card payoff calculator.

Read more about the smart way to get and manage a credit card at the Consumer Financial Protection Bureau’s website.

Actual Consumer Reviews of the Tractor Supply Card

There weren’t many reviews on the Tractor Supply Visa, but we managed to find a couple that could be useful for you. For example, about the rewards program—

“I’ve got 5% points from the card and just looked in the app… 4,700 spent this year for over $200 reward certificates. Last year, I used one of the quarterly free trailer rentals because it was easier than running back to the farm. They also have my tax-exempt attached to the phone number/credit card, so it makes that easy too.”

“We used to get a % off coupon, but now they don’t even do that. We get a coupon once a corner for a small trailer rental for a day, but that isn’t something we would ever use. I now fully support a locally owned feed store, and they load everything for me.”

And then about the card itself—

“I would get a Citibank Double Cash Card instead.”

Is Tractor Supply Credit Card Good for Me?

If you’re a regular at Tractor Supply Co., grabbing tools, pet stuff, or farm gear, then the Tractor Supply Co. Visa Card could be your ticket to some neat rewards—five points for each buck you spend there.

But if spending every dollar there is foreign to you—look for a better credit card. The APR over 30% is just too high.

.jpg)