Are you ready to level up your credit card game and boost your investing efforts? The M1 Owners Rewards Card comes with zero annual fees and competitive cashback rewards—saving you some serious dough.

And the cherry on top? You can feed all your rewards straight into your investment portfolio.

But is it worth it? Let’s find out if the M1 Owners Rewards Card truly delivers or if it’s hiding behind some sneaky high fees.

This article will show you:

All you need to know about the M1 Owners Rewards Card.

The complete breakdown of M1 fees and cashback.

M1 Plus benefits and drawbacks.

Read more:

M1 Credit Card at a Glance

Full name: The Owner’s Rewards Card

Best for: Those looking for high cashback rates.

Issuer: Celtic Bank

Required credit score: 670 or over

What’s the M1 Credit Card?

The M1 Owner’s Reward Card is a cashback credit card powered by Deserve and issued by Celtic Bank.

M1 aims to be a one-stop shop for financial needs by offering investments, lines of credit against investments, personal banking, and more.

The M1 Owners Rewards Card offers a variety of rewards and benefits to M1 Finance account holders.

To start, you’ll earn 1.5% cashback on all purchases, which are automatically put into your M1 Finance account.

And if you’re an M1 Plus member, you can even snag up to 10% cashback when you make purchases from eligible M1 partners with the Owner’s Reward Card:

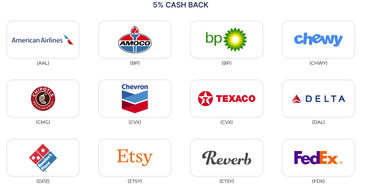

And (again, as an M1 Plus member) you can earn 5% cashback when you spend with these partners:

Overall, the M1 Owners Rewards Card is a great option for those looking to earn cashback rewards without paying annual fees. But if you want to become a member, you could save even more.

Plus, you can use it to build credit, as the card reports to all three credit bureaus.

Check out more of the top cashback credit cards.

How does the M1 Owner’s Rewards Credit Card work?

The M1 Owners Rewards Card is a cashback credit card that lets M1 Finance account holders earn rewards on everyday purchases.

You’ll see your M1 credit card limit after opening your account, which can vary depending on your financial situation.

Here’s how the M1 credit card works:

Apply for the card: First, you’ll need to apply for the M1 Owners Rewards Card through the M1 Finance website. You’ll need a FICO score of 670 or more, but the application process is quick and easy.

Make purchases: Once you’ve got your M1 card, you can earn 1.5% cashback on all eligible purchases, which are automatically put into your M1 Portfolio or M1 Checking Account (you decide).

Redeem rewards: You can then withdraw the rewards from your M1 account as cash or invest them in your M1 Finance portfolio.

Enjoy extra benefits: The M1 Owners Rewards Card also has price protection, extended warranties, and travel and emergency assistance services. These benefits can save you money and give you peace of mind while on the go.

Want to boost those rewards?

As an M1 Plus member, you can earn 1.5% cashback on standard purchases, with the opportunity to earn between 2.5% and 10% cashback at eligible brands.

There’s a catch, though: You’ll have to fork out $95 annually or $10 a month for membership fees.

M1 Credit Card Review: Quick Summary

| |

APR | 20.24%–30.24% |

Annual fee | $0 |

Intro offer | N/A |

Standard rewards rate | 1.5% cashback |

Maximum rewards rate | 2.5–10% cashback |

Overall rating | 4.4/5 |

M1 Credit Card Fees

The zero annual fee and generous rewards are more than enough to catch your eye. But are the extra fees enough to send that eye wandering?

Let’s find out:

FEES | DETAILS |

|---|---|

Annual fee | $0 |

Processing fee | $0 |

Monthly maintenance fee | $0 |

APR | 20.24%–30.24% variable |

APR for cash advances | N/A |

Balance transfer fee | N/A |

Cash advance fee | N/A |

Foreign transaction fee | $0 |

Late fee | Up to $25 |

Minimum interest charge fee | $1 |

Returned payment fee | Up to $37 |

Over limit fee | N/A |

Additional card fee | N/A |

M1 Credit Card: Pros & Cons

But let’s not let the fees hog all the limelight.

Here are the benefits and drawbacks of the M1 Owner’s Rewards Card:

Pros

- No annual fee necessary.

- Added benefits.

- No foreign transaction fee.

- Integrated with M1 investment account.

- High cashback rewards across well-known brands.

Cons

- Extra fees.

- No cash advances or balance transfers.

- Maximum rewards require an M1 membership.

What We Like

No annual fee necessary

The M1 Owners Reward Card comes with no annual fees, which means you can save up your dollars over time.

But this does limit your rewards rate to just 1.5%.

Instead of forking over your hard-earned cash just to have a credit card, you can use those funds to invest or treat yourself to something special.

Added benefits

The M1 credit card benefits stretch further than just cashback.

You can enjoy added perks like extended warranties, price protection, and travel and emergency support services.

With the M1 credit card, you’ll be ready to take on the world (or just your daily errands) with a little more security and peace of mind.

No foreign transaction fee

Time to say “bon voyage” to foreign transaction fees weighing you down.

With other cards, charges for buying from foreign merchants or exploring the world can add up and suck the fun out of traveling.

But the M1 Credit Card makes sure you’re not spending your hard-earned cash on unnecessary fees.

Integrated with M1 investment account

The M1 Owners Rewards Card integrates seamlessly with the M1 platform.

That means you can manage your finances and invest your rewards without all the hassle of switching between accounts.

Curious about M1 as an investment option? We’ve reviewed them there too.

Check it out on our top investment apps page.

High cashback rewards across well-known brands

Earning 1.5% cashback on all purchases is a great deal, but the fact that the rewards apply across well-known brands makes it even better.

This means that you can earn cashback rewards on a wide variety of everyday purchases, from groceries to gas to online shopping.

Popular brands in the rewards program include:

Walmart

Amazon

Uber

Target

Apple

Starbucks

Nike

Spotify

Things to Keep in Mind

Extra fees

The M1 Owners Rewards Card may not have an annual fee, but there are a few other charges to keep in mind.

Late payment? That’ll be up to $25. Returned payment? That’s another $37.

No cash advances or balance transfers

While this isn’t necessarily a dealbreaker, not having these options comes with its own set of drawbacks and restrictions.

For example, if you need to borrow money quickly and don’t have another source of funds available, not having a cash advance feature could leave you high and dry.

And if you’re looking to transfer a balance from a high-interest credit card to a lower-interest credit card, not having the balance transfer feature could cost you more in interest charges.

Remember

Cash advances and balance transfers often come with high fees and interest rates, so they’re usually not the best way to borrow money.

Maximum rewards require an M1 membership

If you’re dreaming of raking in the maximum cashback rewards of 10%, get ready to shell out some extra dough.

You’ll need to be an M1 Plus member to unlock this golden opportunity, which comes with a $95 annual fee.

Otherwise, you’ll be stuck with just 1.5% cashback on all purchases (which isn’t bad but not as sweet as those membership rewards).

M1 Credit Card: Things to Know

How can I use the rewards for M1 investing?

With the M1 Owners Rewards Card, you can easily use your cashback rewards to invest in your M1 Finance account.

Here’s how it works:

Earn rewards: Every time you use your M1 Owners Rewards Card on eligible purchases, you’ll earn 1.5% cashback. As an M1 Plus member, you can earn 1.5%–10% cashback on purchases.

Deposit rewards: Your cashback will be automatically deposited into your M1 Finance account. From there, you can withdraw the rewards from your account as cash or invest them in a portfolio.

Invest your rewards: If you choose to invest your rewards, you can allocate them to any of your M1 Finance account portfolios. This can help you to grow your investments over time and potentially earn even more rewards.

Reinvest your earnings: As your investments grow, you may earn dividends or see capital gains. You can then choose to reinvest these earnings back into your portfolio or withdraw them as cash.

Find out more about the best ways to invest.

What’s the M1 credit card credit score requirement?

If you’re looking to score those rewards with the M1 Owners Rewards Card, you better make sure your credit score is up to snuff.

What credit score do you need for the M1 card?

While there’s no specific credit score requirement on the M1 Finance website, you’ll probably need a FICO score of 670 or higher to qualify.

But credit scores are just one piece of the pie. Other factors like income, employment history, and debt-to-income ratio can also make or break your M1 credit card application.

So, if you’re feeling nervous about your credit score—there’s still hope.

And you can always take steps to improve your score, like paying your bills on time, keeping your credit utilization low, and resolving any errors on your credit report.

Read more:

Who is eligible for the M1 credit card?

Anyone with a good to excellent credit score can apply for the M1 Owners Rewards credit card.

You also need to have an M1 Finance account (which is free) and to be a resident of the US.

If you’re eligible for the card, it’s worth considering how you can maximize your cashback rewards—for example, you can use the card for everyday expenses like groceries, gas, and online shopping.

And just a heads up: There isn’t an M1 credit card pre-approval option. So make sure you fit all the criteria and ensure it’s the right fit for you before applying.

How can I contact M1 Finance support?

If you want to get in touch with M1 Finance customer service, there are plenty of ways to lasso some help.

First, you can head to the M1 Finance website and use the chat feature to connect with a representative. This is a quick and hassle-free way to get help with any questions or issues.

If you prefer the old-fashioned way, here is the M1 phone number: 312-600-2883. They’re available Monday through Friday, from 9 a.m. to 4 p.m. ET (unless there’s a market holiday).

And if you’ve got questions about your Owner’s Rewards Card by M1, you can call (833) 978-3351. They’re free to chat Monday–Friday from 9 a.m. to 9 p.m. ET and Saturday from 10 a.m. to 3 p.m. ET.

You can also log in to your account and send a message through their messaging system.

What’s the M1 Finance referral bonus?

Want to share the wealth while earning rewards? While there’s no referral bonus for the Owner’s Rewards Card, you can take advantage of M1 Finance’s other services.

You can invite your friends to open and fund an M1 High-Yield Savings Account with your code—and you’ll both earn 5.00% APY on savings.

If your friend uses your code to open an account, you’ll earn six months of free M1 Plus. And you can keep sharing your link to earn an additional six months per qualified referral.

But what about your friend? As a new client, they can try M1 Plus for free for three months. This way, they can get a good taste before committing to the full experience.

Is M1 Plus worth it?

M1 Plus is a premium membership program offered by M1 Finance.

For an annual fee of $95, you’ll get your hands on a range of benefits and features.

But whether M1 Plus is worth it for you depends on your financial goals and situation.

The membership comes with a wide range of features—such as $0 trading commissions, digital checking with a 1% APY, and special rates on borrowing.

If you’re a regular money borrower, M1 Plus can save you some serious cash. M1 Plus members receive a lower margin rate, which can save you money on interest charges if you borrow on margin.

And let’s not forget the high cashback rates the M1 Plus membership can get you with the Owner’s Rewards Card.

But remember to weigh the cost of the membership against the benefits you’ll receive.

For example: Let’s say you spend $5,000 a year at Stitchfix—that’s $50 earned with the 10% rewards.

Then you spend $10,000 a year on gas and eating out at the qualifying stations or restaurants listed—that’s $50 with the 5% rewards.

Right there, you’ve already made the $95 fee worth it.

How Does the M1 Credit Card Compare?

M1 Finance vs. Fidelity vs. Charles Schwab: The battle of the investment platforms is nothing new.

But they also have their own credit cards to add to the mix.

Let’s see how they compare:

M1 Credit Card 4.4 |  Fidelity® Rewards Visa Signature® Credit Card 4.2 |  Schwab Investor Card® from American Express 4.6 |

Annual fee $0 | Annual fee $0 | Annual fee $0 |

Rewards 1.5% to 10% cashback 1.5%–10% cashback on eligible purchases to a maximum of $200 cashback per month. Cashback rates of 2.5%–10% require an active M1 Plus subscription. | Rewards 2% cashback Earn unlimited 2% cash back on everyday spending. | Rewards 1.5% cashback Earn an unlimited 1.5% cashback for eligible purchases made with your card. |

Intro offer N/A | Intro offer N/A | Intro offer $200 statement credit. Earn a $200 Card Statement Credit after spending $1,000 in the first 3 months of Card Membership. |

Struggling to choose the right card for you? Here are some final words of wisdom:

If possible, find a card with no or low fees, that gives you additional perks for everyday expenses. This could look like travel miles, cashback rewards, or loyalty points for a favorite retailer.Colin Palfrey, Crediful

M1 Credit Card: Useful Links

Apply for the M1 Owner’s Rewards Card online.

Check out the M1 Finance website.

Take a look at our free investment calculator.

Learn more about owning a credit card at the Consumer Financial Protection Bureau’s website.

Is the M1 Credit Card Good For Me?

The M1 Owner’s Rewards Credit Card is best suited for:

M1 Finance users who want to earn cashback rewards.

People who often use their credit cards for everyday purchases.

Those who want to invest their rewards in an M1 Finance account.

Overall, the M1 Finance Credit Card can be a great option for those looking to earn cashback rewards and invest them in a customizable portfolio.

Remember

Always consider the card’s features and fees to make sure it’s the right fit for your financial goals and spending habits.

.jpg)