Top 10 Credit Cards for 2023:

Capital One Venture Rewards Credit Card—best credit card overall

Chase Freedom Unlimited Credit Card®—best credit card for travel

American Express® Blue Business Cash Card—best credit card for business

Upgrade Triple Cash Rewards Visa®—best credit card for beginners

Blue Cash Preferred® from American Express—best credit card for groceries

Hilton Honors Card from American Express—best hotel credit card

Wells Fargo Autograph℠ Card—best credit card for gas

Synchrony Premier World Mastercard—best cash back credit card

Discover it® Secured Credit Card—best credit building credit card

Discover it® Student chrome—best credit card for students

All credit cards are different—so what should you look into when deciding on one? Mainly four categories:

APR% (the annual interest rate)

Annual fee

The introductory offer (usually cash for signing up and using the card)

Cash back (either as points or a percentage of spend that you get back)

We’ve made this into a rating system where any total score of 4.5 or more is excellent.

Want to Know More? Best Credit Cards: Detailed Reviews

Below you’ll find a detailed breakdown of each top card—why we picked it, what the pros and cons are, and what other cards you may want to consider (if you’re not sold on our top pick).

Best Overall—Capital One Venture Rewards Credit Card

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.2 | Visitcapitalone.com/credit-cards/venture | $95 | 19.99% - 29.99% (Variable) | Enjoy a one-time bonus of 75,000 Miles | Good–Excellent (690–850) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 19.99% - 29.99% (Variable) |

Intro APR | N/A |

Balance transfer rate | N/A |

Balance transfer intro APR | N/A |

Cash advance APR | 29.99% (Variable) |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $95 |

Balance transfer fees | $0 at the Transfer APR, 3% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you |

Cash advance fees | 3% of the amount of the cash advance, but not less than $3 |

Foreign transaction fees | None |

Late payment fees | Up to $40 |

Why we like it

My third credit card in life is still my favorite—it’s the Capital One Venture Rewards Credit Card.

It comes with a nice early spend bonus of 75,000 bonus miles (worth $750 when redeemed for travel), the APR% is reasonable, and the rewards of 2x–5x bonus miles (2 miles per dollar on every purchase, every day, 5 miles per dollar on hotels and rental cars booked through Capital One Travel) are excellent (equivalent to 2%–5% when used for travel).

It has also been my most secure credit card—it notifies me of strange charges, large spend items, or duplicate transactions. This card has everything you might want—with one of the most reputable card issuers in the business.

Pros

- Earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months of account opening.

- Earn unlimited 2 miles per dollar on every purchase—plus 5 miles per dollar on hotels and rental cars booked through Capital One Travel.

- Redeem miles for any airline, hotel, rental car, and more.

- Receive up to a $100 credit for Global Entry or TSA PreCheck®.

Cons

- $95 annual fee.

- You need good/excellent credit.

Best Credit Card For Travel—Chase Freedom Unlimited Credit Card®

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.6 | Visitcreditcards.chase.com | $0 | 20.49% - 29.24% Variable | SPECIAL OFFER: Unlimited Matched Cash Back | Good to excellent (700–850) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 20.49% - 29.24% Variable |

Intro APR | 0% Intro APR on Purchases 15 months |

Balance transfer rate | 0% Intro APR on Balance Transfers |

Balance transfer intro APR | 0% Intro APR on Balance Transfers 15 months |

Cash advance APR | 29.99% Variable |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | Either $5 or 5% of the amount of each transfer, whichever is greater. |

Cash advance fees | Either $10 or 5% of the amount of each transaction, whichever is greater. |

Foreign transaction fees | 3% of each transaction in U.S. dollars |

Late payment fees | Up to $40 |

Why we like it

Chase has many appealing credit cards as of late—and Chase Freedom Unlimited Credit Card® is the most impressive.

There’s no annual fee, and you could earn an extra $300 with the additional 1.5% cash back in the first year (up to $20,000 of spend) on top of the already stunning rewards offering. Earn 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% on drugstore purchases and restaurant dining, and 1.5% on everything else.

Pros

- 0% intro APR for 15 months from account opening.

- No minimum to redeem for cash back.

- Cash back rewards don’t expire as long as your account is open.

Cons

- You need good/excellent credit.

Other Considerations

Chase Sapphire Preferred® Card (intro offer of 60,000 points, 1x–5x rewards, but has a $95 annual fee)

The Platinum Card® from American Express (high $695 annual fee—see rates & fees—but comes with amazing travel benefits)

Best Credit Card For Business—American Express® Blue Business Cash Card

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.4 | Visitamericanexpress.com | $0 | 18.49% - 26.49% Variable | Earn a $250 statement credit |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 18.49% - 26.49% Variable |

Intro APR | 0% on purchases 12 months from date of account opening |

Balance transfer rate | N/A |

Balance transfer intro APR | N/A |

Cash advance APR | N/A |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | N/A |

Cash advance fees | N/A |

Foreign transaction fees | 2.7% of each transaction after conversion to US dollars. |

Late payment fees | Up to $39 |

Why we like it

The American Express® Blue Business Cash Card is powerful but pleasantly simple.

There’s no annual fee—and you get a flat 2% cash back on all eligible purchases up to $50,000 in yearly spending (1% afterward). On top of that, there’s an intro offer of $250 (earned in the form of a statement credit) if you make $3,000 of purchases in your first 3 months. (Terms apply.)

Pros

- 0% intro APR for 12 months.

- $0 annual fee (table of rates & fees).

- High rewards rate.

- You can spend beyond your credit limit with Expanded Buying Power.

Cons

- Spending cap on 2% cash back bonus.

- You need good/excellent credit.

Other Considerations

Ink Business Unlimited® Credit Card ($750 intro offer, 1.5% cashback)

Ink Business Premier Credit Card ($1,000 intro offer, 2.5% cash back on purchases of $5,000 or more, 2% cash back on all other business purchases)

Capital One Spark Cash Select for Excellent Credit ($500 cash back after spending $4,500 in the first 3 months, 1.5% cashback)

Best For Beginners—Upgrade Triple Cash Rewards Visa®

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 8.8 | Visitupgrade.com | $0 | 200 | Fair-Excellent (600 or more) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 14.99% - 29.99% Variable |

Intro APR | N/A |

Balance transfer rate | N/A |

Balance transfer intro APR | N/A |

Cash advance APR | N/A |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | Up to 5% |

Cash advance fees | N/A |

Foreign transaction fees | Up to 3% |

Late payment fees | $0 |

Why we like it

Shopping for the best credit card can be easy if you have excellent credit—but what if you don’t?

Enter the Upgrade Triple Cash Rewards Visa®, the best credit card for beginners—

It's more attainable than others (with a recommended credit score of 580–740)—and it still comes with an impressive $200 intro offer, great rewards, and a reasonably low APR. With 3% rewards on home, auto, or health purchases (and 1% on everything else), it’s not a bad offer for a card more targeted toward beginner users.

Pros

- $0 annual fees.

- No late fees or penalty APR fees.

Cons

- No introductory APR offer.

- High interest rate possible.

- You’ll need a Rewards Checking account and 3 debit card transactions to get the $200 intro offer.

Other Considerations

Upgrade Triple Cash Rewards Visa® ($0 annual fee, 1.5% flat cashback)

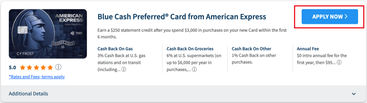

Best Credit Card For Groceries—Blue Cash Preferred® from American Express

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

.svg) | 9.2 | Visitamericanexpress.com | 95 | 19.24% - 29.99% Variable | Earn a $250 statement credit | Excellent (690–850) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 19.24% - 29.99% Variable |

Intro APR | 0% on purchases 12 months |

Balance transfer rate | 0% on balance transfers |

Balance transfer intro APR | 0% on balance transfers 12 months |

Cash advance APR | 29.99% Variable |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 intro annual fee for the first year, then $95. |

Balance transfer fees | Either $5 or 3% of the amount of each transfer, whichever is greater. |

Cash advance fees | Either $10 or 5% of the amount of each cash advance, whichever is greater. |

Foreign transaction fees | 2.7% of each transaction after conversion to US dollars. |

Late payment fees | Up to $40 |

Why we like it

Groceries are getting unbelievably expensive—with the $250+ grocery bill we encounter each week, my family is seriously considering the Blue Cash Preferred® from American Express.

It has a$0intro annual fee for the first year, then $95 (see rates & fees)—but also an unbelievable 6% cashback reward rate for groceries in the US. Sure, they cap this reward at $6,000 in supermarket spending, but that reward alone is worth $360—which is more than enough to cover the annual fee.

Other rewards include:

6% cash back on select streaming subscriptions in the US.

3% cash back at US gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses, and more).

1% cash back on other purchases.

(Terms apply.)

Pros

- $0 intro annual fee for the first year ($95 after that).

- $250 intro offer (earned in the form of a statement credit) when you spend $3,000 within the first 6 months.

Cons

- You can’t redeem cash back through direct deposit or check.

- The 6% cashback reward doesn't include purchases at wholesale stores, superstores, and specialty stores.

Other Considerations

Capital One SavorOne Cash Rewards Credit Card (Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening; 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases)

Best Credit Card For Hotels—Hilton Honors Card from American Express

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 8.8 | Visitamericanexpress.com | $0 | 20.99% - 29.99% Variable | Earn 100,000 Hilton Honors Bonus Points | Good–Excellent (690–850) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 20.99% - 29.99% Variable |

Intro APR | N/A |

Balance transfer rate | N/A |

Balance transfer intro APR | N/A |

Cash advance APR | 29.99% Variable |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | N/A |

Cash advance fees | Either $10 or 5% of the amount of each cash advance, whichever is greater. |

Foreign transaction fees | None |

Late payment fees | Up to $40 |

Why we like it

It’s the Paris Hilton of hotel rewards cards.

The Hilton Honors American Express® Card has an excellent intro offer: Earn 100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership.. Also, earn 7x bonus points on eligible purchases at participating hotels or resorts within the Hilton portfolio—5x points on eligible purchases at U.S. restaurants, U.S. supermarkets, and at U.S. gas stations—and 3x points on all eligible purchases.

A moment for the paparazzi, please.

Each point is valued at about 0.5 cents, which means the intro offer is worth hundreds of dollars. You’ll get roughly 2.5% rewards on gas, restaurant, and supermarket purchases—and 1.5% on everything else.

Pros

- 10 complimentary Priority Pass Lounge visits each anniversary year.

- Enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card.

- No foreign transaction fees.

Cons

- $0 annual fee.

Other Considerations

Chase Sapphire Preferred® Card (Intro offer of 60,000 points, 5x rewards on travel through Chase Ultimate Rewards)

Best Credit Card For Gas—Wells Fargo Autograph℠ Card

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.2 | Visitcreditcards.wellsfargo.com | $0 | 20.24%, 25.24%, or 29.99% Variable APR | Limited Time Offer: Earn 30,000 bonus points | Good–Excellent (690–850) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 20.24%, 25.24%, or 29.99% Variable APR |

Intro APR | 0% intro APR 12 months from account opening |

Balance transfer rate | N/A |

Balance transfer intro APR | N/A |

Cash advance APR | Refer to Important Credit Terms |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | 3% for 120 days from account opening, then up to 5%, min: $5 |

Cash advance fees | Refer to Important Credit Terms |

Foreign transaction fees | None |

Late payment fees | N/A |

Why we like it

Do you know what else is expensive besides groceries? Gas. It would be great to save some extra money at the pump.

Thankfully, the Wells Fargo Autograph℠ Card can help us here.

With this card, you’ll earn 3x points on restaurants, travel, gas stations, transit, select streaming services, and phone plans (and 1x points on everything else). If you spend $1,500 in the first three months, you’ll earn 30,000 points—equivalent to $300.

Pros

- $0 annual fee.

- 0% intro APR for 12 months.

Cons

- Can’t transfer rewards to airline or hotel loyalty programs.

Other Considerations

PenFed Platinum Rewards Visa Signature Card (15,000 points for intro offer, 5x points on gas purchases)

Blue Cash Preferred® from American Express ($250 intro offer, 3% cashback on gas in the US—terms apply)

Best Cash Back Credit Card—Synchrony Premier World Mastercard®

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.2 | Visitsynchronybank.com | $0 | 18.74%–31.74% | N/A | Excellent (750–850) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 18.74%–31.74% |

Intro APR | N/A |

Balance transfer rate | 18.74%–31.74% |

Balance transfer intro APR | N/A |

Cash advance APR | 29.99% |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | 4% or $10, whichever is larger. |

Cash advance fees | 5% or $10, whichever is larger. |

Foreign transaction fees | 3% |

Late payment fees | Up to $41 |

Why we like it

There’s no introductory offer with this card—but at 2% cash back and no annual fee, this one takes the cake in the “cash back” category. The Synchrony Premier World Mastercard® also makes life easy by automatically applying your 2% cash back to your credit card balance.

Pros

- 2% cash back on every purchase (no categories, tiers, or limits—no kidding).

- No annual fee.

Cons

- No intro APR or welcome bonus.

- Charges a foreign transaction fee.

Other Considerations

Want more flexibility with your rewards? The Citi® Double Cash Cardearns an unlimited 2% cash back—and you can redeem rewards for cash, gift cards, travel, or at Amazon.com. Other top cash back cards are:

Wells Fargo Active Cash® Card (2% cash back with a $200 cash rewards bonus)

Capital One SavorOne Cash Rewards Credit Card (1%–3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases; earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening)

Best Credit Card For Bad Credit—Discover it® Secured Credit Card

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 7.6 | Visitdiscover.com | $0 | 28.24% Variable APR | N/A | Poor (300–629) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 28.24% Variable APR |

Intro APR | N/A |

Balance transfer rate | 10.99% Intro APR |

Balance transfer intro APR | 10.99% Intro APR 6 months |

Cash advance APR | 29.99% Variable APR |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)* |

Cash advance fees | Either $10 or 5% of the amount of each cash advance, whichever is greater. |

Foreign transaction fees | None |

Late payment fees | None the first time you pay late. After that, up to $41. |

Why we like it

Want to rebuild your bad credit? Discover it® Secured Credit Card is the top option in our opinion.

Most secured credit cards offer nothing, while the Discover it® Secured card has 2% cashback rewards on gas and restaurants (1% on everything else), a first-year cashback match offer—and no annual fee. The interest rate is 26.74%—pretty good for those with bad credit.

Pros

- 10.99% intro APR on balance transfers for 6 months.

- No credit score needed to apply.

- Reports to three major credit bureaus.

Cons

- Needs a $200 deposit.

Other Considerations

Chime Credit Builder Visa Credit Card ($200 deposit needed, but 0% APR since you’re borrowing from yourself while building credit)

Best Credit Card For Students—Discover it® Student chrome

| Name | Score | Visit | Annual Fee | Regular APR | Intro Offer | Credit Needed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.2 | Visitdiscover.com | $0 | 18.24% - 27.24% Variable APR | Cashback match | Average (630–689) |

Rates/APR

TYPE | DESCRIPTION |

|---|---|

Regular APR | 18.24% - 27.24% Variable APR |

Intro APR | 0% Intro APR 6 months |

Balance transfer rate | 10.99% Intro APR |

Balance transfer intro APR | 10.99% Intro APR 6 months |

Cash advance APR | 29.99% Variable APR |

Fees

TYPE | DESCRIPTION |

|---|---|

Annual fees | $0 |

Balance transfer fees | 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)* |

Cash advance fees | Either $10 or 5% of the amount of each cash advance, whichever is greater. |

Foreign transaction fees | None |

Late payment fees | None the first time you pay late. After that, up to $41. |

Why we like it

I believe there’s no better time to get your first credit card than when you’re a student—your credit score will be low, but card issuers are okay with that, because they’d like to form a partnership with you early in life (that’s why there are so many credit cards designed for students).

Our top credit card pick for students is the Discover it® Student chrome card. This was my second credit card in life, and it was great—a reputable card accepted nearly everywhere, which helped me build my credit while I was a student (and earn some cash back in the process).

You also get a great APR and 2% cash back rewards on gas and restaurants (perfect for a college student)—and whatever you earn in cash back rewards in your first year will double with the cashback match offer.

Pros

- 0% intro APR on purchases for 6 months.

- You don’t need a credit score to apply.

- No annual fee—and you build your credit with responsible use.

Cons

- Complicated rewards.

Other Considerations

Capital One SavorOne Student Cash Rewards (one-time $50 cash bonus once you spend $100 on purchases within 3 months from account opening; 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases)

Chase Freedom® Student Credit Card ($50 Intro offer, 1% cash back on all purchases)

Note: The content on our site is not provided or commissioned by any credit card issuers. Likewise, opinions expressed are the author's alone. We strive to maintain accurate information; however, all credit card offer details (including information about rewards, signup bonuses, introductory offers, and other terms and conditions) is presented without warranty. If you click on any offer on our site, you'll be directed to the issuer's website, where you can review the current terms and conditions of the offer.

Other Category Winners

Here are some more top picks if you're looking for something more specific, like the best store credit card or metal credit card.

Amazon Prime Rewards Visa Signature Card—best store card

Chase Sapphire Preferred® Card—best metal card

Blue Cash Preferred® from American Express—everyday use

Citi® Double Cash Card—high limits

Capital One SavorOne Cash Rewards Credit Card—excellent credit

Wells Fargo Active Cash® Card—good credit

Upgrade Triple Cash Rewards Visa®—fair credit

Chase Sapphire Preferred® Card—military

Credit Card Reviews

If these credit cards don't float your boat, we've evaluated dozens of others. Check out our in-depth reviews below.

The Best Credit Cards of 2023—The More You Know

“Sign up for a credit card, get a free T-shirt!” called the vendor from behind the table. I was twenty-one—and it was my first baseball game as an adult. My buddies started filling out the application form—so I followed suit. “What fake name did you use?” said my friend after we grabbed our shirts. I froze. “Fake name? Crap!” That’s how I got my first credit card.

That first card screwed up my credit score for a while. I don’t want you to make the same mistake. You came here looking for a credit card—so I want to be sure you find the card that’s exactly right for you.

That’s why I personally sifted through and graded over 50 of the most recommended cards to come up with this top 10 list of the absolute best credit cards for 2023.

A Beginner’s Guide to Credit Cards

Now that you know all the top credit cards, it’s time to learn how they work.

How do credit cards work?

If you charge money on a credit card, you’re essentially asking the credit card issuer to cover the tab for you until later—you’re borrowing money and agreeing to pay it back once it’s due.

Credit card balances are tallied for one month. Then the credit card issuer sends you a bill in the mail—typically asking you to pay within three weeks of the end of the monthly term (the statement date).

There are two main ways to pay your bill—via check or a bank transfer. If you pay your bill on time, you are charged no interest—and your timely payment is recorded to the credit bureaus. Then this monthly cycle repeats.

How do credit rewards work?

Most credit cards have a rewards program—if you use them to spend money, they’ll reward you with points or a percentage of your spending (usually 1%–3%).

Let’s say this month you spend $1,000 on your credit card this month with a 2% rewards program—you’ll earn $20 (many cards automatically apply rewards and reduce your monthly bill). You’ll likely have more options if your card offers you rewards points. You could either get the points back as cash, use them for gift cards and travel, or buy something through your online credit card store.

Points often show on your monthly statement—you can use them anytime. They rarely expire and are usually unlimited.

How does credit card interest work?

When you get a home or car loan, interest starts accumulating immediately. Not so with a credit card. You won’t owe any interest if you repay your borrowed money by the set date each month.

If you can’t pay back your balance by the due date, interest will begin accruing on your debt—daily.

How does daily interest work on a credit card?

We’ll stick with the $1,000 example. Say you couldn’t pay any of it—and this is now the balance on your account, while your interest rate is 20%.

How much interest will accumulate per day?

The 20% rate is the annual percentage rate (APR)—let’s divide it by 365 days to get that down to a daily rate.

20% / 365 = 0.055%

Then apply that daily percentage rate to the $1,000 balance.

0.055% * $1,000 = $0.55

So—on day two, your balance becomes $1,000.55. This doesn’t seem like a big deal—but that’s because it’s only one day.

Monthly interest on a credit card

What if we let this balance grow for a whole month? What do we owe at the end of it? Drum roll—$1016.63!

How does annual interest actually work on a credit card?

And what if we left this balance untouched for an entire year? (We’re not counting in any penalties you’d owe for not making the minimum payments.) Think you’d owe $1,200 with a 20% interest rate?

It’s just simple math, right?

Wrong.

The interest that builds up daily will accrue more interest throughout the year—think snowball effect—so you'll be more in debt than you might think. After 365 days of interest accumulation on $1,000, your new balance would be $1,222.25.

Credit card interest—the takeaway

I’m a numbers geek, so this exercise was fun for me—likely not as much for you. So here’s your takeaway—don’t let money sit on your credit card.

Pay off whatever you charge on it every month—then you won’t have to worry about being smacked in the face with an interest snowball one day.

The best use of credit cards

Don’t use credit cards for emergencies (that’s what emergency funds are for). Use them for convenience, to earn rewards, and for security.

You should have the money in the bank to pay for the expense before you swipe your card—take this best practice from the master. I use my credit cards for two main reasons:

When there’s a chance of theft (I’m reading my credit card info over the phone to pay a bill, using it at a restaurant where the server takes my card to the back and does who-knows-what with it, or buying stuff online).

When I make a big buy and want to get rewards points (to make myself feel a bit better after a splurge).

(Soon I’ll get the Blue Cash Preferred® from American Express that I learned about while writing this piece. I’ll use it to buy my gas and groceries—and earn some pretty sweet rewards!)

How to Apply For a Credit Card

The application process for a credit card isn’t complicated—but there are a few steps you can learn in advance.

Check your credit

Before you do anything, check your credit score. Once you understand your score (excellent, good, fair, and bad credit), you’ll know what types of credit cards you should be going for.

Delve into your credit report to see if everything is accurate—all the lines of credit are yours and without any wrong records of late payments. Look for anything that might hurt your credit—and get it corrected immediately.

How to improve your credit score

Apart from reviewing your credit and dealing with any inaccuracies, carry on making payments on time. If your credit is good enough to get accepted for a credit card, this is a great way to continue boosting your credit. Use it sparingly, make consistent payments, and your credit score should climb over time.

Choose the card that’s best for you

How will you most use your credit card—on gas and groceries, travel, business expenses? Be honest with yourself—and choose the credit card that makes the most sense for you.

How to get pre-approved for a credit card

Once you decide on your card, use the link in the article above, and simply click the “Apply Now” button.

Some card issuers may still have a pre-approval option (if you see one, click it to see if you’re pre-approved for the card you chose), but most have built it into the application process.

For example, when you land on the American Express page, click “Apply Now” again, and start filling out the application. Once you finish, they’ll let you know if you’re approved first (without hurting your credit score).

If you’re approved (and accept the card), your information will be sent over to the credit bureaus.

Fill out the credit card application

You may cover this step in the pre-approval process—but let’s hit it here just in case the pre-approval was truly separate from the application.

When you click “Apply now,” the issuer will need some information from you, like—

Name

Email

Date of birth

Phone number

Home address

Social Security number

Annual income

Income source

Pretty simple.

Wait for a response from the credit card issuer

Then it’s up to them if they decide to accept you as one of their new customers. Most (like American Express) will likely approve or deny your application immediately. If they’re on the fence about you, they’ll ask some guy in a suit to decide—in this case, it could take a few days.

Receive your credit card and activate it

Once you’re approved, you’ll get your card in the mail after a week or two.

What Are the Different Types of Credit Cards?

In case you missed it, we’ve already gone through many different types of credit cards in this post:

Rewards credit cards

Cashback

Travel

Airline

Hotel

Balance transfer credit cards

Low-interest and 0% credit cards

College student credit cards

Business credit cards

Cards for building credit

Rewards Credit Cards

A rewards card means you get something back for spending money on your card—it could be cash, travel points, airline credits, or even money toward a future hotel stay.

Cash back credit cards

Spend a thousand dollars on your credit card, and you’ll likely earn between 1% and 2% from a cash back credit card (that’s between $10 and $20). It’s not going to make you rich—but it’s nice to get money back for essentially doing nothing (other than borrowing someone else’s money for a few days).

Travel credit cards

Travel rewards cards give you points toward hotel stays, car rentals, and airline tickets.

Airline credit cards

All the major airlines (United, Delta, Southwest, and others) have their own credit cards. For being a cardholder, they’ll offer added perks (like getting on that claustrophobic metal box first) and points toward your next ticket. If you often fly with the same airline, their airline credit card might be worth a look.

Hotel credit cards

The major hotels have their own credit cards too—they’ll often offer elite status or even a free night’s stay if you’re a cardholder. (And then they’ll, of course, offer a slew of points if you book with their hotel chain.) Love a particular hotel? It’s probably worth getting their credit card.

Balance transfer credit cards

Balance transfer credit cards are for transferring your current credit card balance to the new card. They often have a 3%–5% transfer fee—but likely also a 0% introductory APR for 12+ months.

If you have a 20% interest rate on your current card, it probably makes a ton of sense to transfer that balance to a new balance transfer credit card—especially if its regular APR is less than 20% for the long term.

Low-interest and 0% APR credit cards

You already know that some credit cards start with a 0% interest introductory rate—they’re 0% APR credit cards, or low-interest credit cards.

College student credit cards

These credit cards are obviously for college students. They often have rewards for gas and groceries since college students love to drive and eat—it’s a perfect marriage.

Business credit cards

Again, a no-brainer—business credit cards are for businesses. They often offer the most money back if you buy office supplies or spend more than $5,000 at a time. Using a business credit card can be a great way to house all your business expenses in one place—you can earn an easy 1%–2% back on your business buys.

Cards for building credit

These are for folks with low credit scores.

They often have a higher interest rate (to protect the issuer from default), but they may still come with cash rewards—and offer you a way to rebuild your credit.

If you can’t qualify for a regular credit card, try building your credit with secured credit cards. You’ll need to make a deposit upfront before you can swipe with these cards—not ideal, but will help you build credit if you’ve made financial mistakes in the past.

What Credit Card Should I Get?

So what’s the best credit card in the world? Let me break it to you—quite like the perfect partner, it doesn’t exist.

Why not?

We all have different needs and spending patterns—you might have an 850 credit score and travel around the world every month, while I primarily use my credit card for gas and groceries. Picking the right credit card for you is like choosing a romantic partner—we’ll all have our own preferences.

So here’s the correct question to ask—

Which credit card is best for me?

Scroll up to those “best of” categories again—which one suits you?

Best credit card for cashback?

For travel?

For groceries?

For hotels?

Before you sign up for your next credit card (no matter if it’s your first, second, or third), study your bank statements. See where you spend the bulk of your money. Then answer the question, “What is the best credit card for me?”

Other things to keep in mind:

Annual fee

Interest rate

Reputability and acceptance of the card

How Many Credit Cards Should You Have?

We recently asked ourselves the same question: ”How Many Credit Cards Should I Have?” So we did the research and discovered that the optimal number of credit cards for many people is roughly three. You can have more, but this is what’s typical.

If you apply for more than five in two years, some credit card issuers see that as too many—and will red-flag you. So don’t get too crazy with your applications—choose the best credit cards for you and make the most of them.

What Are The Major Credit Cards?

Want to know if the credit card you want is one of the top credit card companies? You’ll first need to learn the difference between an issuer, a network, and a co-brand partner.

Issuer

A credit card issuer is a bank where you have your credit card account—say Capital One, Wells Fargo, or Chase. But this could also be your local credit union.

Network

The payment networks are the ones that almost everyone knows—like Visa, Mastercard, American Express, or Discover. They get to decide where you can use your card. (Fun fact: American Express and Discover are both the payment network and the issuer.)

When you charge something on your credit card, it’s up to the network to let the issuer know about it, and to make sure they pay the merchant. They also often give you perks and protections, like rental car coverage and travel insurance.

Co-brand partner

Stores, airlines, hotels, and other companies with branded credit cards are called co-brand partners—Costco, Hilton hotels, and Allegiant to name just a few.

Note: The content on our site is not provided or commissioned by any credit card issuers. Likewise, opinions expressed are the author's alone. We strive to maintain accurate information; however, all credit card offer details (including information about rewards, signup bonuses, introductory offers, and other terms and conditions) is presented without warranty. If you click on any offer on our site, you'll be directed to the issuer's website, where you can review the current terms and conditions of the offer.

Top credit card companies

When people ask about the top credit card companies, they often mean either the leading payment network or the top issuer.

Top credit card payment networks: Visa, Mastercard, American Express, Discover

Top credit card issuers: Wells Fargo, Capital One, Citi, Chase, Bank of America, Discover, American Express, US Bank, USAA, PNC

FAQ

What are the best second credit cards?

What are the best credit cards for 18-year-olds?

What are the best unsecured credit cards for bad credit?

What are the best business cards for start-ups?

What are the coolest looking credit cards?

What are the best credit cards for Disney?

What are the best credit cards for a wedding?

Note:

For rates and fees of The Platinum Card® from American Express, please see the table of rates & fees.

For rates and fees of the American Express Blue Business Cash™ Card, please see the table of rates & fees.

For rates and fees of the Blue Cash Preferred® Card from American Express, please see the table of rates & fees.

Editorial Disclosure: Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

.jpg)