Paying off credit card debt can help boost your credit score, opening doors to better rates, more rewards, and those all-important bragging rights. But think twice before using another credit card to pay off your existing balance.

If you’re not careful, using a credit card to pay another can slam those doors before you even get a foot in. But if there’s a will, there’s a way—so let’s uncover the smartest strategies to avoid any debt disasters.

This article will show you:

If you can pay off a credit card with another card.

What the best ways are to pay off your credit.

What should you do if you can’t pay off your credit card.

Check out more relevant articles:

Can You Pay a Credit Card With a Credit Card?

Paying off one credit card with another credit card is technically possible—but it’s not as simple as you think.

To answer the question—you can’t directly pay off your credit card with another. But there are other ways to “cheat” the system, with many opting for alternative methods like balance transfers or cash advances.

Before we dig deeper into how you can pay off your credit card, remember that making a credit card payment with another isn’t a long-term debt solution, and you could risk getting caught up in the never-ending cycle of debt.

So, while you can find ways to pay off a credit card with another—it’s always better to work on a plan to pay off your debt responsibly and sustainably.

How to Pay a Credit Card With a Credit Card?

Don’t expect paying off a credit card with another to be smooth sailing—there could be high fees and interest rates on the horizon.

But here are some options to try:

Balance transfers: Many credit card issuers offer balance transfer promotions that let you move your balance from one credit card to another. These promotions can come with a low or 0% interest rate for a limited time, making it easier to pay off any debt.

Personal loans: While not directly using your card, you could take out a personal loan to pay off your balance. Finding a loan with low-interest rates makes it a good option to help pay off high-interest credit card debt.

Cash advances: This is a risky strategy, but it’s possible to use a cash advance from one card to pay off another credit card. However, this can come with high-interest rates and fees.

Before diving in, weigh the different methods and choose the one that works best for your financial situation and goals.

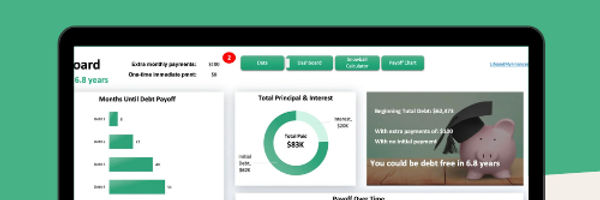

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

Balance Transfers

Out of all the methods, balance transfers come out on top in ways you can use credit cards to pay off other credit cards.

Let’s find out how well this method could work for you—

What is a balance transfer?

A balance transfer is a handy financial tool that lets you transfer your outstanding balance from one card to another (ideally with a lower interest rate) to save money on interest and pay off your debt faster.

What are the key things to know about balance transfers?

Balance transfers typically come with an introductory period of low or 0% interest for a specific amount of time (usually between 6 to 18 months).

After the introductory period ends, the interest rate on the balance transfer card usually rises. The trick is to pay off the balance before that happens to dodge those higher rates.

And it’s not just interest rates you have to keep an eye on. Balance transfers also come with fees (usually around 2% to 3% of the transfer amount). So don’t forget to do your calculations before making the transfer.

Last but not least, not all credit cards allow balance transfers—some might have restrictions or limits on the amount you can transfer. So double-check with your issuer before walking headfirst into a closed door.

All in all, balance transfers can help, but you’ll need a good dose of discipline and careful planning to successfully pay everything off.

Make a solid plan to pay the transferred balance before the introductory period ends and to avoid racking up new debt on the old card.

How to do a balance transfer?

To go ahead with the balance transfer, follow these steps:

Find a credit card that offers a balance transfer promotion. Keep an eye out for cards with a low or 0% introductory interest rate and low balance transfer fees.

Apply for the new credit card and provide all the right information. You might need to give details about your current credit card (like the account number and balance).

Once you’re approved, contact the issuer to discuss the balance you want to transfer. Be ready to give details on the name of the credit card company, the account number, and the balance amount.

Time to play the waiting game—the balance transfer typically takes between a few days to a few weeks, depending on the credit card issuer.

Once the balance transfer is complete, start making payments on the new card to pay off the transferred balance before the introductory period ends.

And try to avoid making new purchases on the old card—it’ll only add to your debt and make it harder to pay off the transferred balance.

Still unsure if this is the right method for you? Time for the classic pros and cons list to help you out—

Pros

- Lower interest rates: Balance transfers often come with a lower interest rate than your current credit card, helping you save money on pesky interest charges.

- Introductory offers: Many balance transfer offers come with introductory 0% interest rates for a set period, which can help you pay down your debt faster.

- Consolidate debt: Balance transfers let you consolidate multiple credit card balances into one payment, making it easier to manage your debt.

- Flexible payment options: Balance transfers can offer more flexible payment options than your current credit card. For example, some balance transfer cards let you make smaller minimum payments or offer other payment plans to help you pay off your debt.

Cons

- Fees: Most balance transfers come with the dreaded fees, usually ranging from 3% to 5% of the transferred balance. These fees can easily build up and make the transfer more expensive than you first thought.

- Short-term offer: Introductory offers on balance transfers typically only last for 6–18 months. So, if you can’t pay off all the transferred balance before the introductory period ends, you’ll end up paying more interest charges.

- Credit score impact: Applying for a new credit card can knock your credit score, especially if you’re denied (which is a possibility if you have a low score).

Should you do a balance transfer to pay off a credit card?

Balance transfers can unlock lower interest rates and usually come with a promotional 0% rate for a limited time.

Some balance transfer credit cards even offer waived balance transfer fees or other incentives to help you save money.

But on the flip side, the promotional 0% interest rate on balance transfer credit cards usually only lasts 6 to 18 months.

So the clock is ticking—and if you can’t pay off your balance before the promotional period ends, you’ll be stuck with a higher interest rate than your original credit card.

Before going down this route, note all the potential balance transfer fees, promotional interest rates, and the length of the promotional period.

Don’t skimp on the fine print, and do your research to figure out whether a balance transfer is the right choice for you.

Alternatives to Paying Off Your Credit Card

While doing a balance transfer is a fairly common option—it’s not the only one.

Here are some alternative ways to pay off a credit card:

Take out a personal loan

If you find a personal loan with lower interest rates than your credit card, you could save money on interest charges over time.

Many personal loans also come with fixed repayment terms, making it easier to budget and manage payments.

But you guessed it—there are always fees lurking around. Many personal loans come with extra charges, such as origination fees or prepayment penalties, which can bump up the cost of the loan.

Personal loans can work if you get one with low-interest rates and you’re able to pay it off. But if you're not careful, taking out a loan to pay off a credit card can lead to even more debt—especially if you keep using your cards after paying them off.

Try a cash advance

Using a cash advance to pay off a credit card can be tempting when you’re in a pinch, but this method can lead you down a bumpy road.

Starting with the (few) positives—cash advances let you get your hands on funds quickly and easily without a credit check. So those with poor credit scores are in luck.

So why do so many warn against cash advances?

Well, cash advances typically come with interest rates, usually between 3% and 5% with no grace period—so you’ll be paying interest right from the get-go.

And then, there are the extra fees, such as monthly payments and ATM fees.

Cash advances also usually come with short repayment terms, so you’ll need to pay off the advance quickly or risk getting dumped with those additional fees and interest charges.

Moral of the story—if you’re unable to pay off the cash advance pronto, it can quickly become very expensive, and add to your debt load.

If you still want to go ahead with a cash advance, take a look at the best apps for the job.

Use a mobile payment service

There’s more to cell phones than scrolling through endless dog videos.

Using a mobile payment app—like PayPal or Venmo—can act as an intermediary to pay off one credit card with another.

Essentially, you could use a credit card to transfer funds to a friend or family member through the mobile apps, who could then use the transferred funds to pay off your credit card balance or give you the funds to do so yourself.

This approach can come with rewards from the apps, but there are also fees to consider.

Some peer-to-peer credit card transactions on Venmo may also be seen as cash advances on Mastercard and Visa credit cards—which, as we know, come with high fees and APRs.

Purchase a money order

If you don’t have access to other payment methods—you could buy a money order, which is available at banks, post offices, and other retail locations.

Companies like Western Union and MoneyGram also let you send money to a phone number or email address.

Money orders are more secure than sending cash through the mail, as they’re usually traceable. They also don’t require a credit check, so your poor credit score won’t be a problem.

But money orders come with fees, with some banks and retailers charging extra for just purchasing the money order.

And then there’s the small matter that not all credit card issuers accept money orders as payment, with many viewing it as a type of cash advance—so make sure you double-check with your card issuer first.

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

What’s the Best Way to Pay Off Your Credit Card?

We’ve given you several methods—but if we had to choose a winner, balance transfers come out on top for paying off your credit card with another.

Using a balance transfer can be a smart option—especially if you’re looking to save money on interest charges.

Just pay close attention to potential fees and have a plan to pay off your debt during the introductory period to avoid high-interest rates in the future.

Is it better to pay off one credit card at a time?

If you’ve landed in debt, paying off one credit card at a time is a wise approach.

Here are some reasons why:

Focus: Tackling multiple debts at once can be stressful. Focusing on one card at a time lets you focus your efforts and resources on one debt, which is much more manageable and less overwhelming.

Motivation: Paying off one credit card at a time can give you a sense of accomplishment and keep you motivated as you see your debt go down while your credit score climbs up.

Debt snowball method: Consider the debt snowball method, which involves paying off your debts in order of smallest to largest balance. Try our snowball debt spreadsheet to take the stress away from juggling your debts.

Mind you, if you have high-interest rates on your other credit cards, you could end up paying more in interest charges over time, even if you make progress on one debt.

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

When Should You Avoid Paying One Credit Card With Another?

While using one credit card to pay off another can be tempting, there are also situations where it’s best to avoid this strategy.

If the credit card you’re using to pay off another has a high-interest rate, you could end up paying more interest over time.

For example, if you use a cash advance from one credit card to pay off another with a lower balance, you may have to cough up higher rates and fees on the cash advance.

And it’s not just interest charges you have to worry about.

Some credit card issuers charge fees for balance transfers, cash advances, or other forms of credit card payments. These charges can add to the cost of your debt and make it harder to pay off your balance.

Paying your credit card with another can also affect your credit score, especially if you’re using a high percentage of your available credit. This could mean saying goodbye to certain loans, credit cards, and other financial products in the future.

Long story short—using a credit card to pay off another is a sign of poor financial habits.

Before the situation spirals, try to address the issues that led to your debt in the first place, rather than simply transferring your debt to another card.

What Happens if You Don’t Pay Your Credit Card?

We get it—sometimes you get into financial trouble, and one thing leads to another. But if you can’t pay off your credit card, be prepared to face the consequences.

Here’s what can happen if you fail to make payments:

Late fees: If you miss a payment or don’t pay the full amount on time, you could be lumped with a late fee—which can range from $30 to $41.

Interest charges: It’s simple—if you carry a balance on your credit card, you’ll be charged interest on that balance. And the longer you carry a balance, the more interest will build up, making it more difficult to pay off your debt.

Credit score impact: Not paying your credit card means your score will take a hit. Late payments, high credit utilization, and other factors can lower your credit score, and it’ll be tricky to qualify for loans, credit cards, and other financial products.

Debt collectors: Phone calls and letters—nobody likes them, especially when they’re from the debt collector. This will only add to your stress and can have a knock-on effect on your mental health and well-being.

Legal action: If you continue to avoid paying off your credit card, the issuer or debt collector could take legal action. This could include filing a lawsuit or getting a court judgment against you, leading to serious financial and legal consequences.

So, what can you do if you can’t pay off your card?

Keep reading to avoid a fee fiasco—

What Should You Do if You Can’t Pay Off Your Credit Card?

If you’re struggling to make payments, here are some tips for paying off debt with a credit card:

Contact your credit card issuer

Calling up the bank (or even the dreaded in-person visit) isn’t at the top of everyone’s to-do list. But there’s no harm in reaching out to the credit card issuer and explaining your situation.

You could get lucky and they might even offer you a payment plan or other options to help you manage your debt.

Create a budget plan

Nobody likes to admit exactly how much they spend on takeout every month—but creating a budget with our monthly template will force you to face your pizza demons and help you get to grips with expenses while pinpointing areas to cut back.

By prioritizing your payments, cutting back on unnecessary expenses, and focusing on your most important payments, you’ll quickly free up more money toward your credit card debt.

Boost your income

As well as saving up, you can also find ways to fill your pockets, like taking up a side hustle or selling unused items.

And if you’re braver than me—you could also ask for a raise at work (just make sure you have enough to back yourself).

Consider debt consolidation

Debt consolidation involves taking out a loan or credit card with a lower interest rate to pay off your existing debt.

This can make it easier to manage your payments and pay off your debt quickly (try using our debt avalanche spreadsheet).

Just keep in mind that loans often come with credit inquiries to check if you’ll be able to pay the money back—which can hurt your credit score. But this is usually temporary, and you’ll soon see that score finding its way back up when you make full and on-time payments.

Seek professional help

No, we don’t mean to get therapy (although that’s not a bad idea). If you’re struggling alone, you could get help from an agency or financial advisor.

Nowadays, advice doesn’t come cheap, so you’ll have to cough up initial costs. But professionals can help you develop a debt management plan, negotiate with your creditors, and keep you on track in the long run.

Use available tools

There are plenty of free tools out there—so it makes sense to take advantage of them.

Get a free credit report from Credit Karma to stay up-to-date with your finances and score. Setting up account alerts for payment due dates can also keep you up to speed with debt repayment.

Take action

If you can’t pay off your credit card, don’t just let it simmer until it spills over.

Take action to improve your financial situation and manage your debt before it reaches boiling point.

Ian Wright, Managing Director at Business Financing, also gave some advice on staying out of debt,

If possible, set up auto payments for your recurring bills as close to your pay period as possible. This can seem daunting as it’s normal to want that money in your account for as long as possible—but doing it sooner rather than later gives you a more accurate idea of what you have left to work with.

Ian Wright Managing Director at Business Financing

What other ways can you use your credit card?

Enough about debts. Let’s find out how else you can make the most out of your shiny hard plastic—

Can you pay rent with a credit card?

Yes, in most cases, you can pay rent with a credit card.

But here are a few things to keep in mind:

Check with your landlord or property management company to see if they allow rent payments with a credit card.

Make sure you have a credit card with a high enough credit limit to cover your rent payment without maxing out your card.

Consider any fees that come with paying the rent with a credit card, including processing fees and interest charges if you carry a balance on the card.

Keep in mind that paying rent with a credit card can affect your credit utilization ratio, which is a factor in determining your credit score. Your credit utilization should be below 30% to maintain a good score.

That being said, paying rent with a credit card can also boost your credit score if you pay in full and on time, as it shows positive and trustworthy financial habits.

Can you pay taxes with a credit card?

Yes, you can pay taxes with a credit card. Start with checking the IRS and see if your state tax agency allows tax payments with a credit card.

If they do, you’ll want to consider any fees, including processing and interest charges.

You should also make sure you have the funds to pay off your credit card balance in full when it’s due.

If you carry a balance, you’ll gather interest charges that can quickly bounce back any rewards or cashback benefits you might earn by using your credit card to pay taxes.

If you can pay off the balance in full, using your credit card to pay taxes could be a smart move.

But if you’re already carrying a balance on your card or can’t afford to pay in full, it may be better to explore other payment methods.

Can you pay bills with a credit card?

You can definitely pay bills with a credit card.

Here are some must-know tips:

Check with your biller to see if they accept credit card payments. Some billers may only accept certain types of credit cards or charge extra fees for credit card payments.

Consider any fees associated with paying bills with a credit card. Depending on your credit card issuer and the biller, you may face processing fees or other charges that can add up quickly.

Take advantage of rewards programs. Many credit cards offer cashback or rewards for certain types of purchases, including bill payments.

Keep your credit utilization in check. Paying bills with a credit card can increase your overall credit utilization, which is the percentage of your available credit that you're using at any given time.

Paying bills on time can also improve your credit score by showing a history of timely payments. Your payment history is the most important factor in making up your credit score (up to 35%). By paying your bills on time, you can boost your score and qualify for better credit terms in the future.

Can you pay student loans with a credit card?

It can be difficult to pay student loans with a credit card as many federal student loans and private lenders don’t accept them as a form of payment.

But there are a couple of exceptions to consider:

Third-party payment services: There are third-party payment services, such as Plastiq, that let you pay your student loans with a credit card. These services usually charge a fee, so you'll need to weigh the cost against any rewards or benefits you might earn from your credit card.

Balance transfer: If you have a credit card with a 0% introductory APR on balance transfers, you could transfer your student loan balance to the card. This can be a good option if you're struggling to make payments on your student loans.

But paying your student loans with a credit card also comes with drawbacks. For one, you could end up paying more in interest if you don’t pay off your credit card balance in full each month. And if you’re not careful, you could end up building more debt on your credit card.

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

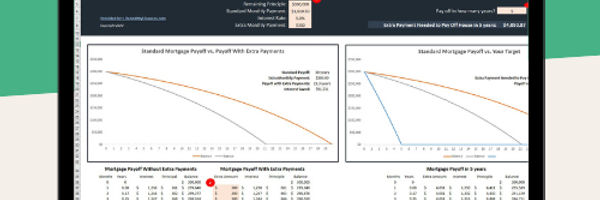

Can you pay your mortgage with a credit card?

While it may be possible to pay your mortgage with a credit card, it’s generally not recommended.

Many mortgage lenders don’t accept credit card payments because of the high fees that come along with processing them.

So you might need to use a third-party service to make the payment with a credit card (which certainly isn’t cheap).

If you decide to use a third-party service to pay your mortgage with a credit card, you’ll probably be charged a fee. This can range from 2% to 4% of the transaction amount, which can add up quickly if you’ve got a large mortgage payment.

We know it’s tempting to try to earn rewards or cashback by paying your mortgage with a credit card—but keep in mind that the fees and interest charges can quickly outweigh any benefits.

If you want to pay off your mortgage fast, check out our mortgage payoff tool 👇

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

Key Takeaways

Paying off your credit card with another is a risky strategy that could land you in more debt if not managed responsibly.

Balance transfers are the best way to pay off your credit card—just be aware of extra interest charges.

Alternative ways to pay your credit card include getting a loan, cash advance, or using a money order or mobile payment service.

You can avoid getting into credit card debt by creating a budget and seeking advice from a financial advisor.

.jpg)