High interest rates and a flat wage growth are making things difficult for those repaying their student loans. The high cost of borrowing, rising living expenses, and job market uncertainty make the student loan payoff calculator a really valuable resource. Using this strategy means faster debt repayment while saving money on interest payments.

Missing out on student loan payments also has severe consequences. Defaulters could face legal proceedings, having their wages withheld by employers, the outstanding balance becoming due all at once, blocking federal benefits and tax refunds, and a drop in credit scores.

Avoid these pitfalls with a solid debt repayment plan.

This guide offers a step-by-step walkthrough on leveraging one of the most popular debt reduction strategies to repay your student loans wisely.

Key takeaways

Prepayments on your student loan might not help unless you direct your bill collector to apply it to the principal amount.

Do not refinance federal student debt with a private lender to avoid losing access to federal benefits like forgiveness programs and income-driven repayment (IDR) options.

Repaying debt is a mental game, so employing strategies like the Debt Snowball method could help you repay faster and encourage you to stay on track consistently.

Get a student loan repayment plan in minutes

Head over to the shop and download our student debt snowball spreadsheet for Excel or Google Sheets.

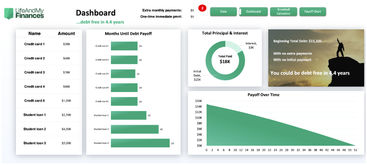

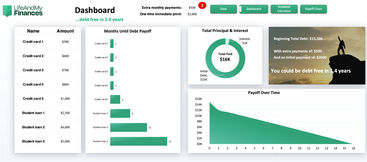

Just fill in your loan details and how much you can pay. The calculator will show you exactly how long until you're debt-free! Experiment with different payment amounts and see visualizations of your progress to keep you motivated!

Check out our other resources and tools:

Debt Snowball Method (to learn even more about the debt snowball)

What You Need to Know About Our Student Loan Payoff Calculator

While debt reduction strategies could sound complicated, this is far from the truth. All you need is an easy way to track your student loans and repayment progress in one place.

Our Student Loan Snowball Spreadsheet on Etsy can help you manage up to 32 student loans on a single Excel or Google Sheets template.

For $9.99, you can download the template and enter your debt details and monthly repayment amount to see how fast you can become debt-free while saving money 👇

Ready to tackle your student debt? This student debt snowball spreadsheet is what you need!

A few key features of this template:

Proven method tailored to student loans

Customizable to YOUR needs

Works with Excel and Google Sheets

Can handle up to 32 debts!

Using the Snowball reduction strategy, our algorithm populates the template with calculations showing how your debt reduces over time.

Let’s Understand The Snowball Strategy

It’s simple. Focus on repaying the smallest debt first while making the monthly minimum payments for the rest. Debt can be directly linked to stress, so seeing the number of loans go down fast can boost your commitment to becoming debt-free and free up more cash you can apply to the next smallest loan.

How to Get The Ball Rolling

Identify the smallest loan and apply the extra money you have to it.

Make the minimum payments for the remaining student loans.

Repeat the steps until the targeted debt is repaid.

Once repaid, you can route the extra money you saved from the previous loan to the next smallest debt.

Keep snowballing until all debt is repaid.

A Deep Dive Into The Debt Spreadsheet

Users love the simplicity of the debt snowball spreadsheet. It is intuitive, fast, and specifically designed for users without any prior experience in managing finances.

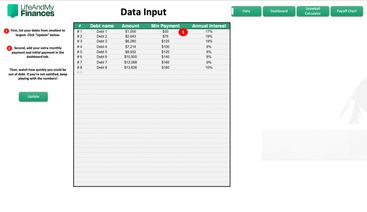

After downloading the spreadsheet, follow these steps:

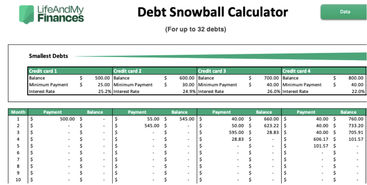

Open the sheet and click the “Data” tab.

List all debt details on the spreadsheet, including loan type, outstanding balance, minimum payments, and rates, as shown in the screenshot below.

When you click the “update” icon, the sheet will visualize a breakdown of how your debt shrinks each month and the estimated time to go debt-free for each loan.

Let’s say you had $2,000 and used it to make a lump-sum payment alongside contributing an extra $500 from a side hustle each month on top of the minimums.

As you can see, an extra $500 monthly and the lump sum amount drastically lowers the debt repayment time from 4.4 years to 1.4 years. You can play around with the numbers to find a balance between your budget and when you want to go debt-free.

The spreadsheet paints a vivid picture of all your debt details in one place, making it super easy to track progress throughout your loan repayment journey.

How Long Will It Take to Pay Off Your Student Loans?

Sadly, many who graduated long ago are still paying their student loans. The thing is, monthly minimum payments just don’t help your finances since you end up paying much more than you borrowed over a long time.

Let’s take an example:

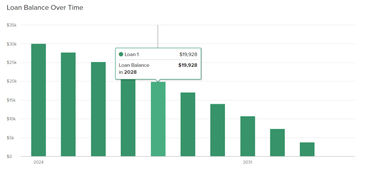

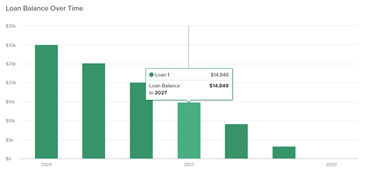

Assume your student loan repayment for a $30,000 debt at an interest rate of 5.5% under a 10-year standard repayment plan starts in 2024. You will be required to pay $326 in monthly minimums to avoid becoming a defaulter.

By 2034, or the end of your loan repayment tenure, you would have paid $39,069.

Adding $200 to the monthly minimum of $326 reduces your repayment tenure to six years, for which you pay $34,979. And how much do you save? A solid $4,090.

Clearly, clearing student loans as early as possible is more fruitful than managing them late as liabilities increase over time. As you age, you are likely to take on more debt, such as a car loan or a mortgage, while your daily expenses for health and lifestyle ramp up.

How Extra Student Loan Payments Work

To understand how your prepayments towards your student loans work, let’s check this screenshot:

As you can see, we have already input multiple debt details on the Excel spreadsheet, with the assumption that you make extra monthly payments of $500.

When you click the “Snowball Calculator” tab, you can see the snowball strategy in action. Per the screenshot, your first $500 clears the smallest loan with a monthly minimum of $25.

Once cleared, you can route that extra money, plus interest saved to the next smallest debt, thus speeding up the repayment process like a chain reaction.

The snowball debt reduction method saves you time and money and shows progress from day one. The immediate results could lift your morale and encourage you to explore other avenues of saving extra money like via passive income streams or trimming your monthly budget.

Applying Extra Student Loan Payments Toward the Principal

This is very important. Student loan servicers or your bill collectors could use prepayments to advance the due date. This means applying the extra amount to next month’s dues. Hence, the extra amount you pay on top of the minimum payments doesn’t reduce your principal, rendering your efforts in vain.

This is because the prepayment goes towards any late fees and accrued interest before hitting the principal loan amount. To avoid this, simply tell your loan servicer to apply the prepayments to your principal balance without changing the due date for next month.

How Do Student Loans Work?

Student loans fund higher education in accredited colleges or universities. They cover tuition fees, the cost of books and study materials, living expenses, and other education-related expenditures.

While you don’t repay until you graduate or until the end of the loan grace period, interest on the debt might accrue while you are studying, depending on the type of loan. The interest rate and the loan repayment tenure vary based on your loan provider.

Before we dive into the types of student loans, here’s a sneak peek into the different repayment plans, which we will discuss in detail below.

Repayment Plans | Loan Tenure | Monthly Payment Amount | Eligibility |

|---|---|---|---|

Standard | 10 years | Fixed | All |

Graduated | 10 years | Increase every two years | All |

Revised Pay As You Earn (PAYE) | 20-25 years | 10% of discretionary income | Any Direct Loan borrower |

Income-Based Repayment | 20-25 years | 10%-15% of discretionary income, never more than under Standard plan | Partial standard loan payments exceed 10% of discretionary income |

Income-Contingent Repayment | 25 years | The lesser of 20% of discretionary income or the amount on a 12-year fixed payment plan | Any Direct Loan Borrower |

Types of Student Loans

Student loans can be broadly classified into federal and private loans. Private loan rates are generally higher than federal government student loans. Meanwhile, federal loans could be subsidized, meaning that the US government pays the interest on the loan that accrues while you are in college.

If not subsidized, interest will accrue when you are studying or in your grace period. Ultimately, you start repaying on a bigger outstanding balance as the accrued interest capitalizes when your repayment starts. To avoid capitalization, make the effort to make monthly interest payments while the interest accrues or a lump-sum payment before the grace period ends.

Let’s check out the different Federal student loans available today:

Stafford Loans

Stafford loans are popular as they offer undergrad students low origination fees and interest rates. The interest rate for the 2023-24 academic year was fixed at 5.50%. There are two different types of Stafford loans:

Direct Subsidized Loans

This option can be chosen by undergrads who require financial support. The loan application also checks if you are financially independent from your parents. Know that the amount sanctioned will vary based on your year in school with a ceiling of $23,000. Since it is subsidized, the US government will take care of the interest accrued when you are in school. Remember, interest will rack up if you drop below half-time status.

Direct Unsubsidized Loans

If you are ineligible for a subsidized loan, the US government offers direct unsubsidized federal student loans, which are available to undergrads, graduates, and professional students irrespective of their financial requirements. Being unsubsidized, interest on the principal amount will accrue right from the moment the loan is approved. The interest rate for the 2023-2024 academic year is 7.05%.

Direct PLUS Loan

This federal student loan is designed for graduate and professional students. It also allows parents of dependent undergrads to pay for educational expenses not covered by other financial aid. If your federal loan amount isn’t sufficient to meet costs, a direct PLUS loan could bridge that gap. Keep in mind that you need a decent credit score for this option. Although there is no borrowing limit, the interest rate for PLUS loans is comparatively higher at 8.05% with an origination fee of around 4.3% for 2023-24.

Direct Consolidation Loans

As the name suggests, this option allows you to consolidate several federal student loans into one loan with a single loan servicer. This way, you could prolong your repayment term and reduce your monthly payment. That also means you could pay more in interest payments over time.

Perkins Loans

The Perkins Loan Program was discontinued in 2017. However, those who enrolled in the program before that still have to repay them. It was a low-interest federal loan option provided directly via participating colleges and institutions. The interest rate was fixed at 5% for 10 years.

Private Loans

Many people who are ineligible or have exhausted the limits of their federal student loans opt for funding from private lenders. The process is often similar to applying for a traditional loan. Interest rates are generally higher, and your credit score matters. Some private loans come with no deferment options.

State Student Loans

US states offer diverse student loan options unique to each state. These loans are provided by state agencies or state-chartered non-profit organizations. If you are taking this route, consult your state's department of post-secondary education for financial student aid details.

Some state student loans include forgiveness provisions, as long as the student stays in the state after graduation. To be eligible, students also must be state residents or out-of-state students enrolled in a college within that particular state.

Tip:

Prepayments aren’t subject to penalties under any federal student loan repayment plan.

Applying for Federal Financial Aid

The application for federal financial aid is the first step to acquiring student loans. Most colleges and universities use the FAFSA application to determine your eligibility for federal, state, and college-financed student support.

If you are a US citizen, a legal permanent resident, or an individual with an Arrival-Departure Record from US Citizenship and Immigration Services showing particular designations, you can apply for federal student aid. The FAFSA 2024-25 form submission deadline is June 30, 2025.

Apply for aid with these simple steps:

Create an account on StudentAid.gov.

Click “Start New Form” and log in to your newly-created account on the next page.

Select “Student” as the applicable role when filling out the FAFSA form.

After completing the form, send it to your college for review.

If selected, review the offer terms and costs before accepting.

When you opt in, your financial aid department will apply the funding to the amount you owe your school.

Any remaining balance will be sent to you for miscellaneous college expenses.

Remember to complete your FAFSA form every year.

Student Loan Payoff Programs & Repayment Options

There are many student debt forgiveness and discharge programs you can check to lower your monthly loan payments or seek complete forgiveness of your outstanding debt. These programs were designed to help people dealing with diverse financial and health problems, across multiple industries. We’ve outlined some of the most popular programs below.

Standard Repayment Plan

This is the default student loan repayment plan that stretches over 10 years with 120 payments. The amount you pay each month is fixed, and payments can’t be less than $50. This plan is a good option for you if you can afford it. The monthly payments are not lower than programs that extend loan repayment duration. However, you repay the loan faster and save on interest payments.

Income-Driven Repayment Plan

If you feel you might not be able to keep up with your monthly student loan repayments or have a large outstanding debt, IDR plans are best suited for you. These plans cap your monthly debt payments at a percentage of your monthly income. There are four IDRs, and when you enroll in any of them, your remaining loan balance becomes eligible for forgiveness after 20-25 years.

Saving on a Valuable Education (SAVE)

You could be eligible for this new program if your annual income is less than $32,800, or $67,500 for a family of four. In this income range, you could see your monthly repayment bill shrink to $0. If you have an undergraduate student loan, your monthly payment will be set at 5% of discretionary income from the current 10% in July 2024, meaning you pay less every month. Borrowers at risk of default would also be automatically enrolled in the program. Do recertify income-based repayment every year to retain your IDR status.

Income-Based Repayment (IBR) Plan

If your loans were sanctioned before July 1, 2014, the IBR plan would cap your monthly payments at 10%-15% of your discretionary income and pardon any balance after 25 years of payments. Those who took loans after July 1, could qualify under the new IBR plans that reduce your loan repayment duration to 20 years.

Pay As You Earn (PAYE) Plan

The PAYE program is best if you think your income levels won’t change much in the foreseeable future. It could also work if you have undergraduate debt, or are married with two sources of income. The PAYE plan limits student loan repayments to 10% of your discretionary income. The remaining balance after 20 years is forgiven.

Income-Contingent Repayment (ICR) Plan

The ICR plan is a good option for those with parent PLUS debt. Parents use this debt to pay for their children’s education. However, parent PLUS borrowers must consolidate the student loan into a federal direct loan to be eligible for the program. The monthly payments are capped at 20% of your income for a duration of 25 years before any remaining debt is forgiven. You could also benefit from slightly lower monthly payments.

Graduated Repayment Plan

The graduated repayment plan for student loans could initially minimize monthly payments to the extent that you pay only the interest accrued on your debt. However, the amount you pay each month starts to increase every two years for 10 years. This plan could work for those seeking smaller payments but earning too much for an IDR plan.

Public Service Loan Forgiveness (PSLF) Plan

Full-time workers in public service under the US government or a non-profit can benefit from the PSLF program. This program could eliminate your remaining debt after you make 10 years’ worth of monthly payments under an IDR plan. You must have direct or refinanced federal student loans to be eligible.

Teacher Loan Forgiveness

If you are a teacher working full-time at a low-income public elementary or secondary school and have taken out a student loan after Oct. 1, 1998, you could be eligible for this loan forgiveness program after working for five straight years. The program could forgive up to $17,500 in federal direct or Stafford loans.

Total and Permanent Disability Discharge

Those who are unable to work due to total and permanent disabilities, both physical or mental, could be eligible to have their outstanding debt canceled. Remember that you must submit relevant documents to authenticate your medical condition. If your loans are discharged, the federal government could keep track of your finances and disability for up to three years. If you don’t meet the requirements in the duration, authorities might reinstate your loans.

Tip:

IDRs can reduce your monthly bills to nil if you are not working or earning below 150% or 225% of the poverty threshold, depending on your plan.

Benefits of Paying Off Your Student Loans Faster

Not just a mental relief, paying off your student debt faster could have a real, visible impact on your finances, professional and personal life. We have listed some of the top benefits of going debt-free as early as possible:

Lowers Debt-to-Income (DTI) Ratio

A high DTI ratio doesn’t show on your credit report but could signal high credit utilization, for instance, high credit card debt. This could impact the limit of how much you can borrow and increase the cost of any future loans. Lenders could see you as a high-risk borrower. Try consolidating your loans or the debt snowball method to lower your DTI.

Saving Money on Interest Payments

Increasing prepayments shortens your loan tenure and reduces the amount you would have paid otherwise. The money saved improves your monthly cashflows.

Allows You To Plan Future Financial Goals

Freeing up more cash allows you to put that money to better use like building an emergency fund or contributing to your child’s 529 tax-advantaged savings plan for future education.

Ways to Pay Off Student Loans Faster

Paying off your loan faster can be achieved in many ways. These simple strategies are suitable for beginners. You can even use multiple strategies at once to see faster results.

Direct Windfall Money Into Your Debt Principal

Windfall payments like a gift or from winning a cash prize could come as a relief for those struggling with their debts. At the same time, if you are managing your debt well, pouring that money into repayments still makes sense to reduce your principal amount faster.

Refinance Your Debts To Lower Interest Rates

If you have multiple student loans, you could refinance them into one at a lower interest rate. Your chances of securing better rates improve with a steady income and a good credit history. Beware though, you could lose federal benefits if you refinance a federal student loan with a private loan provider.

Repay Higher Amounts As Income Rises

Your income could grow due to promotions, side hustles, or growing business revenue if you are a business owner. When a portion of that extra money is used to repay debt, it helps you save time and money on interest payments.

Enroll in Autopay

Federal student loan services lower your interest rate by 0.25% if you sign up for the autopay option. With this option, bill collectors deduct the monthly loan repayment directly from your bank account. Many private lenders also offer to enroll in autopay. This is also a good way to lower your principal balance.

Can You Refinance Student Loans?

You can refinance both federal and private student loans. Refinancing is combining your current loans into one monthly payment.

What’s In It For You?

The advantage is that factors like a good credit score, low DTI, and/or steady income levels could help you fetch a lower interest rate and possibly even a better loan term when you refinance.

Do Your Own Research

If you think refinancing your debt is the right choice, do your due diligence on lenders, check your credit report, and patiently research better rates to save considerable money long term. Check if lenders offer variable or fixed rates, fees, and flexible due dates, among other loan terms.

Don’t Lose Federal Benefits

Refinancing federal student loans with a private lender could mean losing benefits like IDRs and loan discharge programs. However, refinancing private debt at better terms makes more sense. Refinancing also stamps a hard inquiry on your credit report, which could drag down your score by a few points and stay on the report for up to 2 years.

Key Student Loan Terms to Know

Here are some important loan terms that every current and future student loan borrower must know.

Principal Balance: It is the amount you initially borrowed, based on which interest payments are calculated.

Outstanding Balance: As you pay off your debt subject to interest payments and fees if any, it declines. This is your outstanding principal balance.

Interest Rate Fixing: Federal student loan rates are fixed using the 10-year Treasury note auction in May every year. It includes a fixed hike with a limit in place.

Minimum Monthly Payments: The minimum monthly payment is the lowest amount you must pay to stay in good standing with your lender. Factors like loan type, interest rate, and repayment terms affect monthly payments.

Prepayments: This is simply repaying your loan ahead of schedule in parts or in full.

Loan Repayment Term: This is essentially the amount of time you are permitted to repay what you owe.

.jpg)