This emergency fund calculator is used to estimate how much money should be set aside to pay for financial emergencies. The calculator takes the total of all essential living expenses, and uses this information to determine the size of a minimum and optimum emergency fund. From this value, the calculator subtracts any money already set aside for this purpose to determine the additional savings required to meet this need.

Ready to build your emergency fund? Check out our favorite debt payoff template 👇

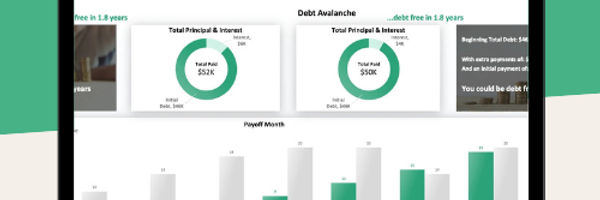

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!

Calculator Definitions

The variables used in our online calculator are defined in detail below, including how to interpret the results.

Current Savings ($)

Additional Resources |

Loan Payoff Calculator Loan Amortization Table Refinancing a Loan Calculator Wage Garnishment Calculator |

These are assets that can be turned into cash in 30 to 90 days, and then used to pay for essential expenses. This would include money market accounts, money market funds, as well as certificates of deposit.

Living Expenses ($ / Month)

These are essential living expenses including mortgage and / or monthly rent, real estate taxes, homeowner insurance policies, and monthly home repair bills.

Travel Expenses ($ / Month)

These are essential travel-related expenses including car loans, automobile insurance payments, gasoline, and / or monthly maintenance and repair bills.

Personal Expenses ($ / Month)

This category of essential expenses includes any personal loans, life insurance premiums, medical and / or dental insurance premiums. An emergency fund can be used to pay these premiums if you lose your job. Keep in mind that employers typically share in the cost of healthcare premiums. Individual or family premiums may be higher than the group premiums you're paying each month through your employer.

Household Expenses ($ / Month)

These are expenses associated with running a household. Essential expenses include monthly electricity, natural gas, heating fuel, water, telephone, cellular service, and internet access. This category of expenses also includes food and credit card payments.

Total Essential Expenses ($ / Month)

This is the total of all of the individual essential monthly expenses entered earlier into this calculator.

Minimum Emergency Fund ($)

The Minimum Emergency Fund is calculated as three months of the Total Essential Expenses. From this value, Current Savings is subtracted to determine the Minimum Additional Savings Needed.

Optimum Emergency Fund ($)

The Optimum Emergency Fund is calculated as six months of the Total Essential Expenses. From this value, Current Savings is subtracted to determine the Optimum Additional Savings Needed.

Emergency Fund Calculator

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.

.jpg)