This debt reduction calculator can be used to estimate how much money you can save, as well as the number of months saved, by increasing the amount of money paid toward reducing your debt. This debt reduction calculator uses the debt owed, annual interest rate on debt, and the additional debt payment, to calculate the dollars, as well as time, saved by adding money to each payment.

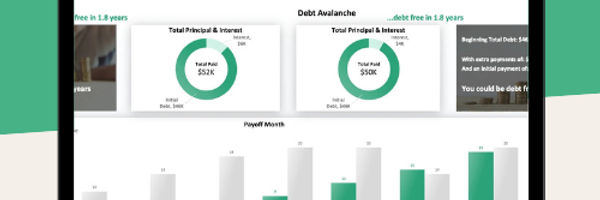

Need to tackle your debt but unsure where to start? Check out our debt snowball vs debt avalanche template below 👇 Both are proven methods to repaying debt, and you can compare which one works for you:

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!

Calculator Definitions

The variables used in our online calculator are defined in detail below, including how to interpret the results.

Debt Owed ($)

Additional Resources |

Credit Card Payoff Calculator Family Budget Calculator Debt Ratio Calculator Lump Sum Debt Reduction Calculator |

This is how much debt you might be carrying on a credit card or another line of revolving credit.

Annual Interest Rate (%)

This is the annual interest rate on the debt, or the interest rate your credit card company is charging you on the outstanding balance on your card.

Current Monthly Debt Payment ($ / Month)

This is how much you're currently paying each month to pay down this particular debt you owe.

Extra Monthly Debt Payment ($ / Month)

This is the extra dollars you'd like to add to your payment each month to try and pay down the debt faster.

Time to Pay Off Debt - Current Payment (Months)

This is how long it would take to pay off the debt using the current payment you're making each month.

Time to Pay Off Debt - Extra Payment (Months)

This is how long it would take to pay off the debt if you were to start to add extra money to your debt payment each month.

Time Saved by Extra Payment (Months)

This is how many months, or payments, you would save by making the extra debt payment each month.

Dollars to be Paid with Current Debt Payments ($)

This is the total dollars that you need to pay to your lender or credit card company, using your current monthly payment.

Dollars to be Paid with Extra Debt Payment ($)

This is the total dollars that you need to pay to your lender or credit card company, if you were to add the extra payment to your current payment each month.

Dollars Saved by Making Extra Debt Payment ($)

This is how much money you'd save in interest expense by making the extra debt payment each month.

Debt Reduction Calculator

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.

.jpg)